- APT development activity has declined as its price has skyrocketed, setting off alarms across the market.

- The analysis indicates that the APT is currently at a crossroads, awaiting the emergence of a definitive trend.

After days of notable decline, Aptos (APT) showed signs of recovery, rising 5.48% and providing a brief respite to the market.

The question remains, however: is this rally sustainable or is it just a temporary relief for tired sellers before the price drops again? AMBCrypto explores this question in even more detail.

The bears are knocking at the door

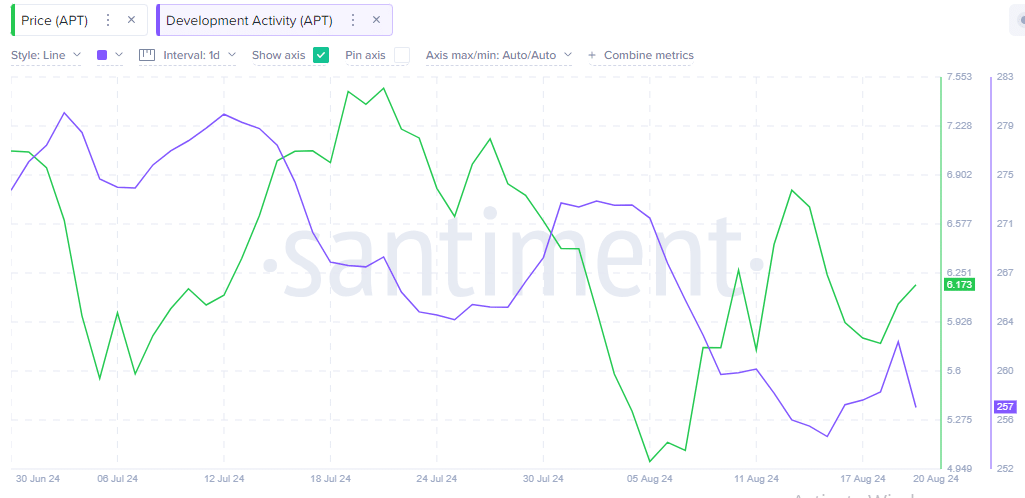

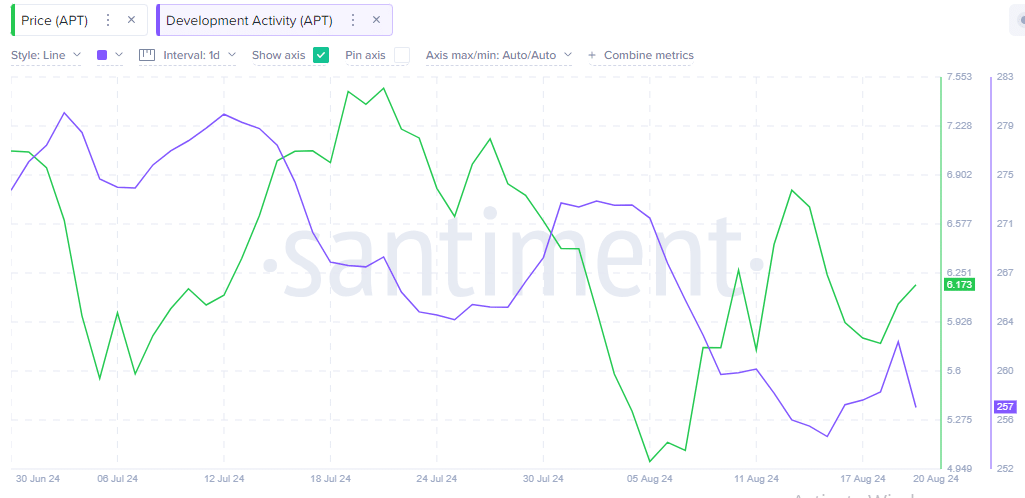

Low development activity suggests that bears are dominating the market. A divergence between an asset’s price and its development activity indicates a market imbalance that often requires correction.

In simpler terms, this means that the price (green line) could soon adjust to align with the current level of development activity (blue line), or conversely, development could accelerate to match the price movement.

Source: Santiment

However, in this scenario, a price retracement is more likely. A similar divergence on July 16th saw price initially rise as development activity fell, only to eventually decline, realigning with the decline in development activity.

The downward movement intensifies

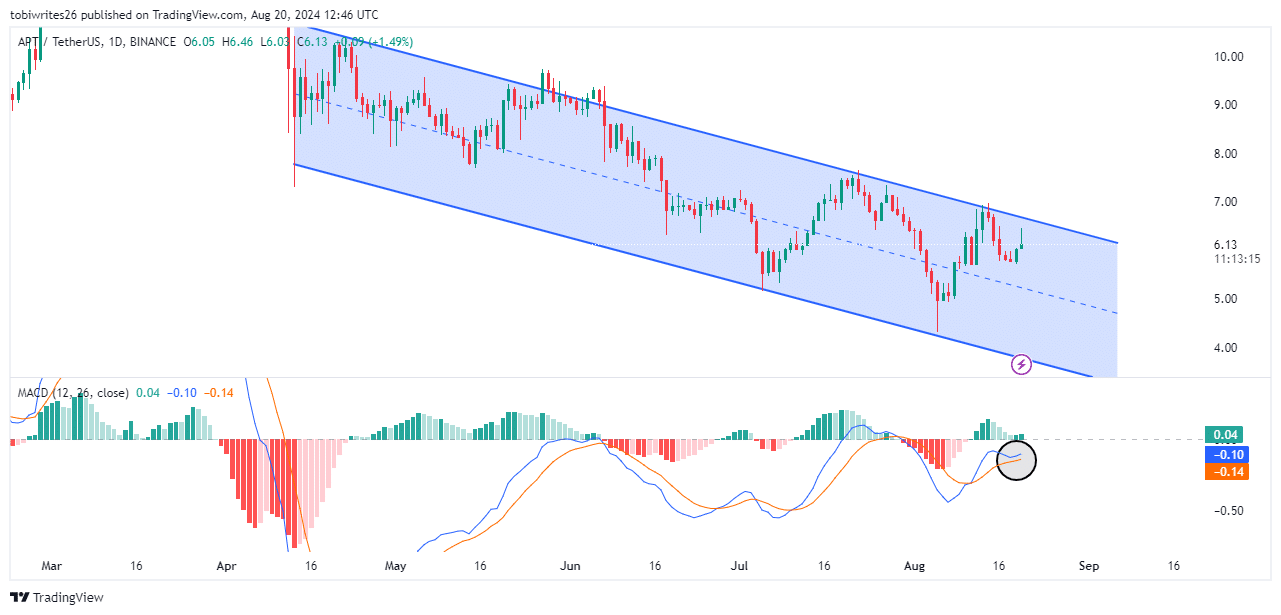

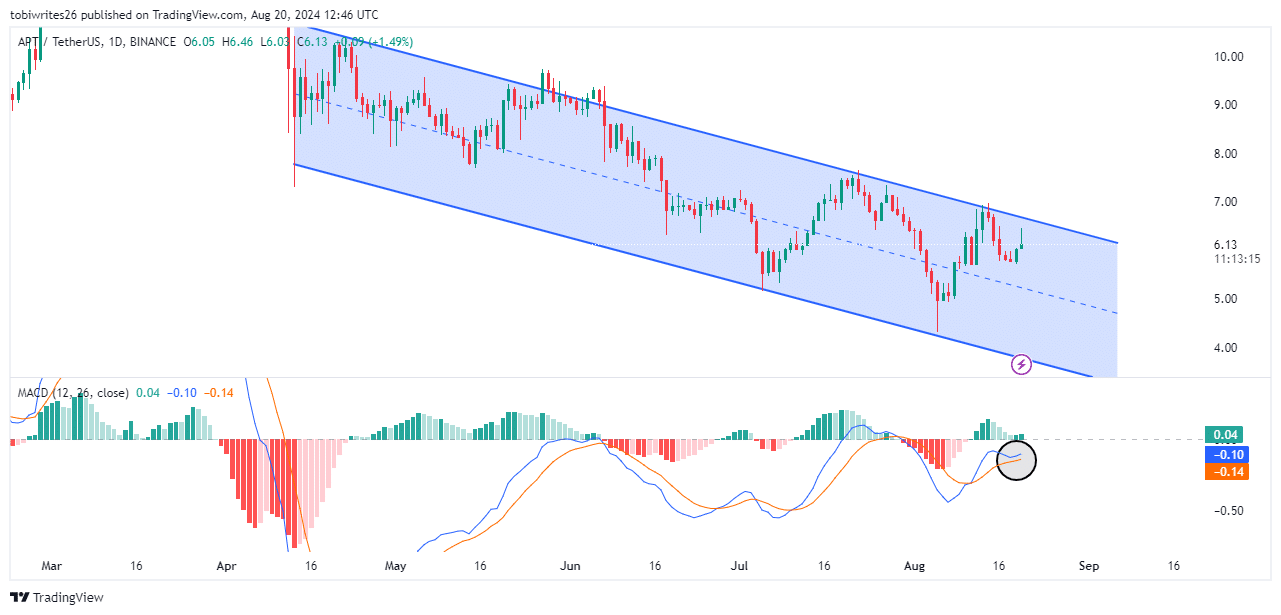

APT has been moving in a descending channel for the past month, presenting mixed signals on the technical side. In such a channel, the price of an asset can either break through the upper boundary, suggesting an upward breakout, or break through the lower boundary, indicating a potential decline.

Currently, the upper boundary is acting as resistance; APT has bounced from this level but has only gained partial upward momentum, which, according to AMBCrypto’s analysis, may not be sustainable.

Source: TradingView

This analysis used Moving Average Convergence-Divergence (MACD), a momentum indicator that illustrates the relationship between two moving averages of a security’s price.

It signals buying opportunities when the MACD line (blue) crosses above the signal line (orange) and indicates selling signals when it crosses below.

Currently, the MACD line is in a negative zone with decreasing volume and is about to cross the signal line. Considering the current APT price of $6.15, it is likely to see further declines.

A slight hope: APT remains optimistic among retail investors

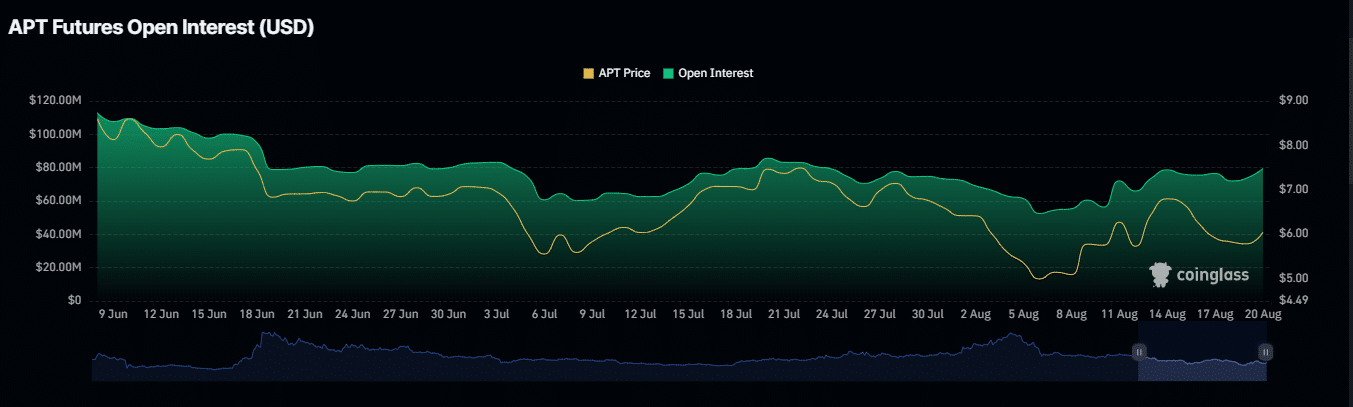

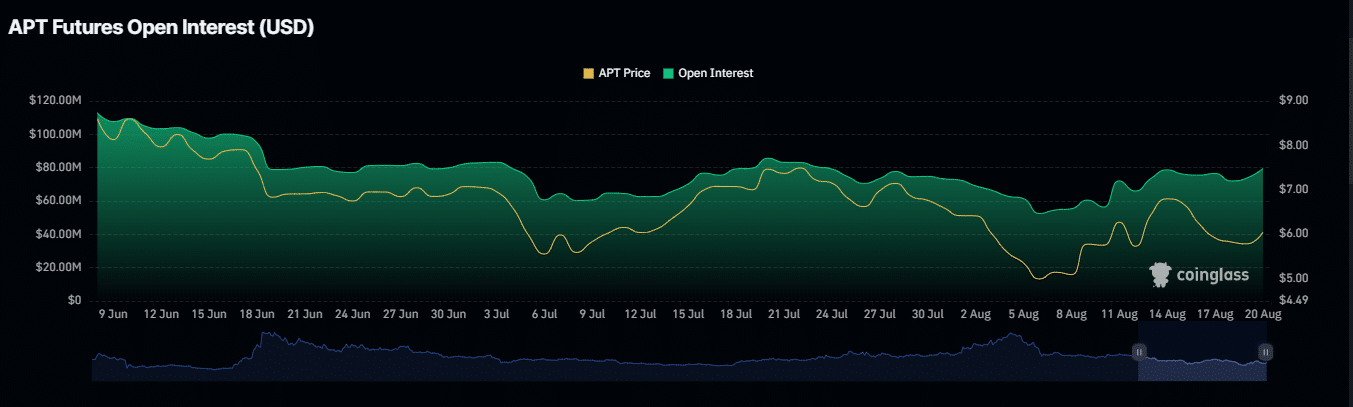

Open interest, which represents the total number of unsettled derivative contracts such as options or futures, has been rising significantly since August 6. according to Coinglasssignaling strong market participation.

As open interest increases, it indicates that new contracts are being opened and existing contracts are being closed or executed, indicating that APT has a bullish outlook.

Source: Coinglass

Additionally, APT net flow on exchanges was negative on both the 24-hour and 7-day time frames, a sign generally interpreted as bullish.

Read Aptos (APT) Price Predictions for 2024-25

This suggests that market participants are choosing to store their APTs in wallets or other offline storage, reflecting confidence in the asset’s growth potential.

In conclusion, despite mixed signals, it is important to give the market time to reveal clearer buy or sell indications.