- APT bulls show strength as prices move away from local lows.

- Will the burgeoning utility and demand for Aptos mitigate the potential withdrawal of APT?

Aptos (APT) managed to hit a new 5-month high in the last 24 hours. This is due to its prolonged bullish momentum, building on its September rally.

APT rose above $10 on Sunday for the first time since April. This performance highlights further efforts to move beyond the lower range, where it has been stuck for months.

This follows the crash that occurred between March and July, eliminating the gains made during the previous rally.

Is APT about to experience another decline? Although its recent rise highlights strong demand, a decline is likely.

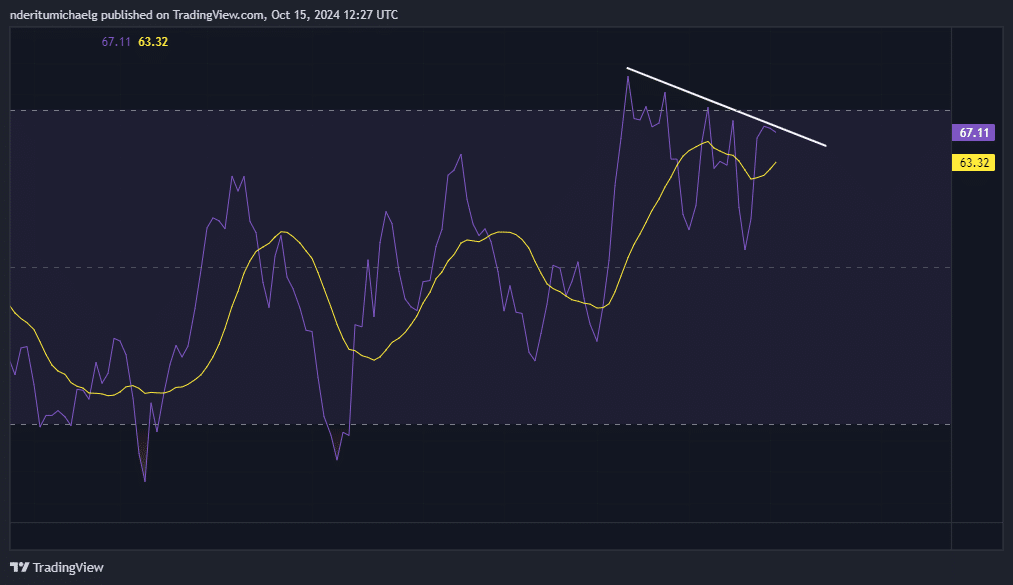

Although it hit a new 5-month high at $10.68 in the past 24 hours, it has since demonstrated a resurgence of resistance in the face of further upside.

APT was trading at $10.08 at press time, highlighting the risk of sliding below $10 again.

Source: TradingView

The cryptocurrency has already seen resistance around the $10 level, raising the possibility that it could experience a mid-week retracement near the same level.

Although a short-term retracement could be on the cards, the cryptocurrency could be poised for more upside before the end of the year.

APT Bears are ready to take over

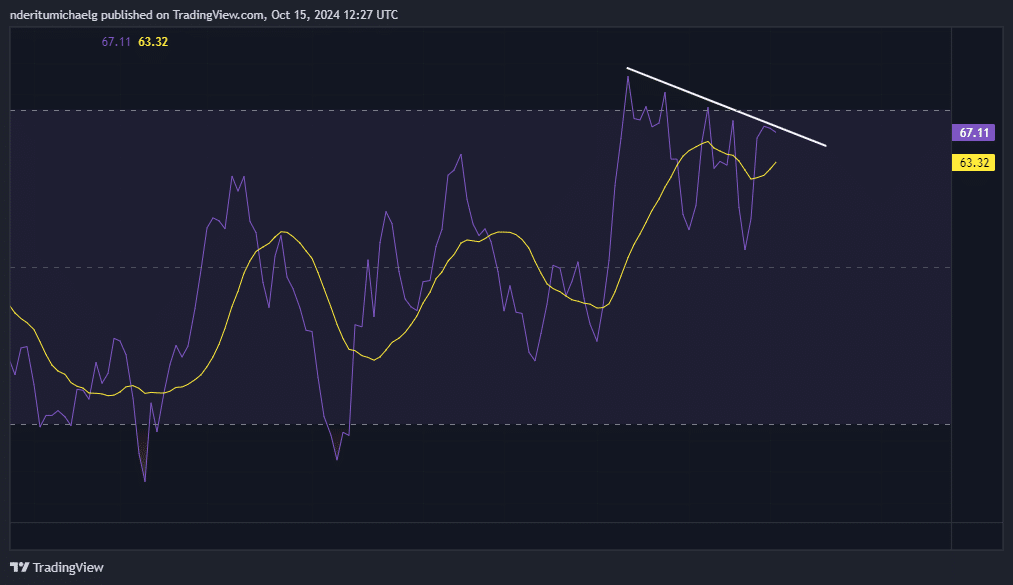

Although APT has pushed higher, there have been signs of a potential pivot. For example, the RSI has been making lower highs over the past three weeks, forming a bearish price-RSI divergence trend.

This suggests that the bulls may be losing momentum.

Source: TradingView

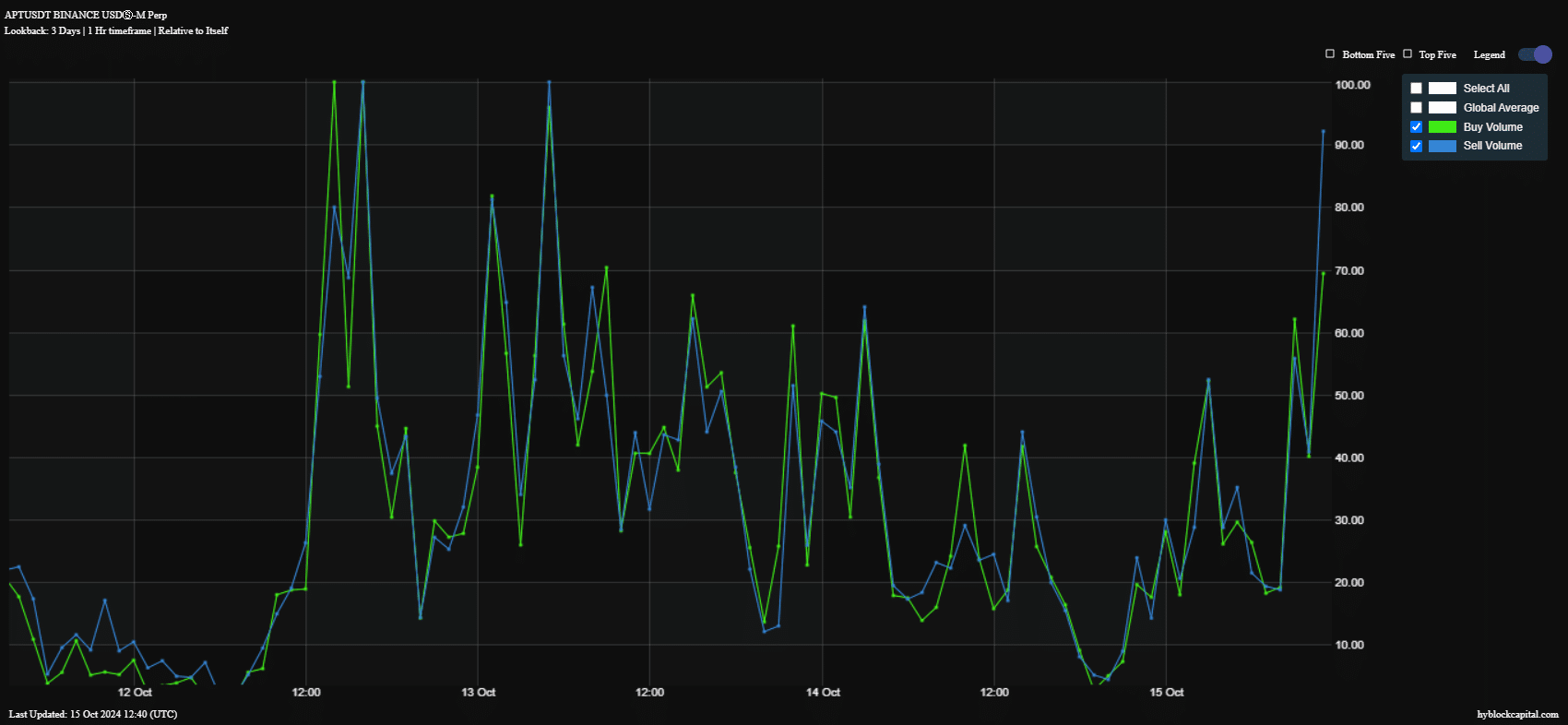

The bearish divergence suggests that selling pressure is likely to increase. An assessment of APT’s buying and selling volume revealed that such an outcome was already occurring.

The latest on-chain data revealed an increase in sales volume over the past 24 hours. It was significantly higher than the prevailing buying volume, which could be due to increased profit-taking.

Source: HyblockCapital

While these observations suggest a high likelihood that APT will experience some selling pressure, a retracement may be limited.

Indeed, a significant portion of APT’s demand comes from the budding network utility Aptos.

Read Aptos (APT) Price Prediction 2024-2025

Aptos TVL recorded a new ATH of $730.71 million in the last 24 hours. The network’s stable market capitalization also reached new territories during the same period after surpassing $256 million.

These observations highlight the rise in network utility, supported by greater trust in the network. These factors can protect APT from a strong decline.