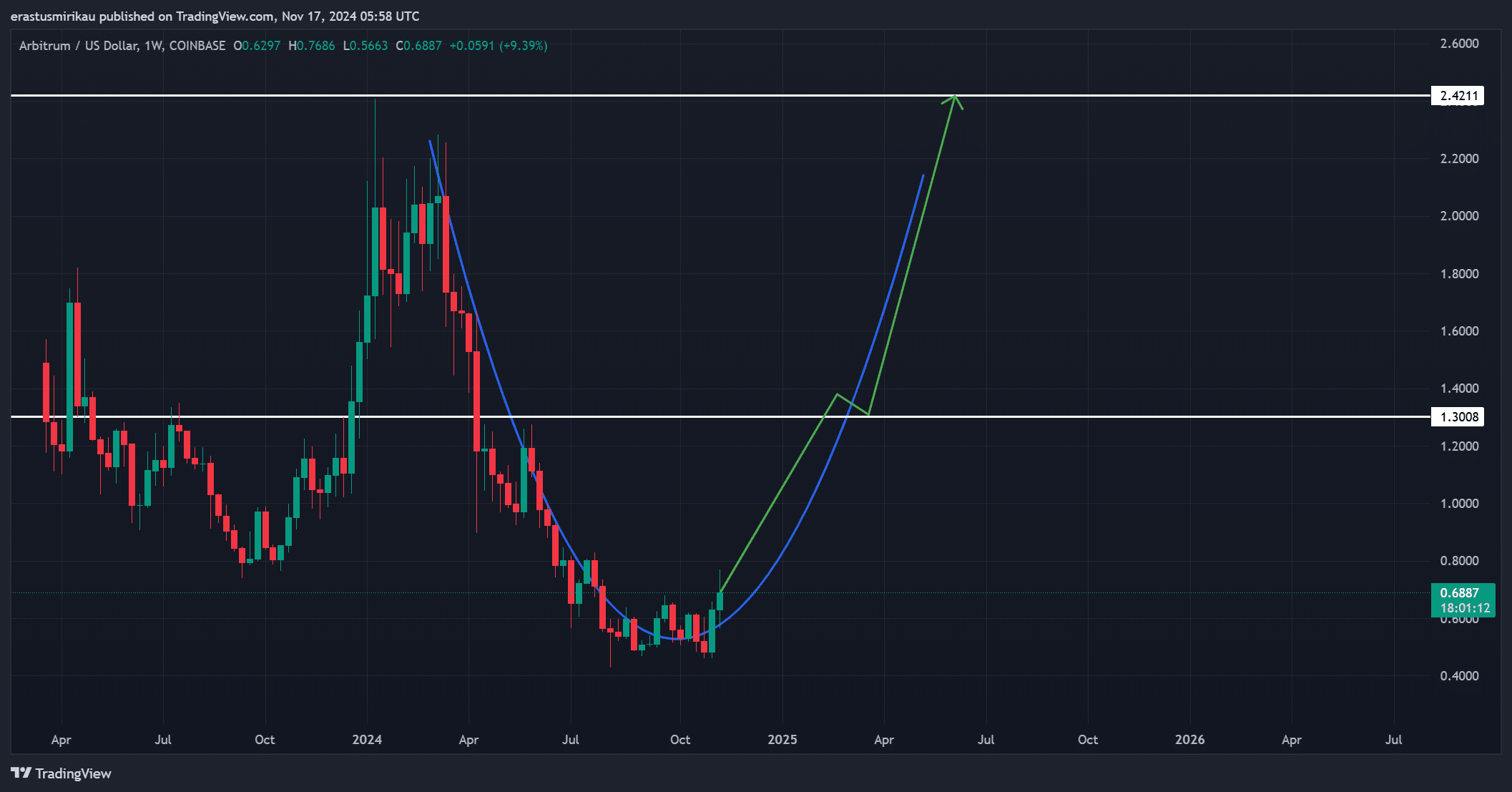

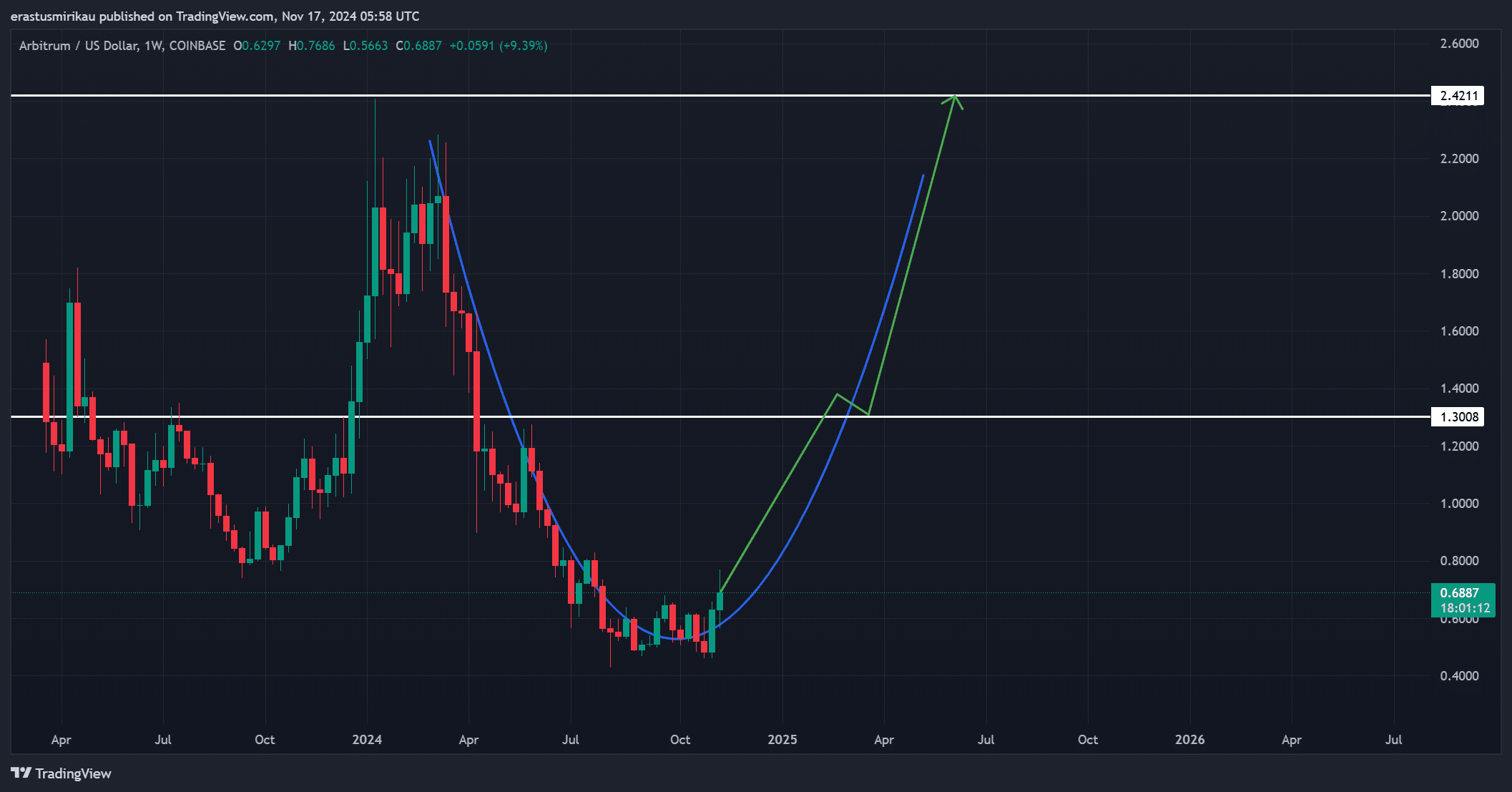

- A rounded bottom pattern has emerged with ARB targeting $2.42 after breaking resistance at $1.30.

- Market sentiment supported ARB’s bullish outlook, signaling sustained momentum.

Arbitration (ARB) has attracted considerable attention in the crypto market, fueled by its impressive price performance and growing trading activity.

At press time, ARB is trading at $0.6947, an increase of 11.29% in the last 24 hours. Its trading volume also soared 200% to $1.10 billion, reflecting strong interest from market participants.

However, the crucial question remains: can ARB maintain its bullish momentum and break above the $1.30 resistance, paving the way for a rise to $2.42?

The rounded bottom suggests a potential rebound

The weekly chart paints an optimistic picture with the appearance of a rounded bottom pattern, a strong indicator of a bullish reversal.

This trend suggests that ARB could continue its upward trajectory, provided it breaks through immediate resistance at $1.30.

A decisive break above this level would likely attract additional buyers, propelling ARB towards its ambitious target of $2.42. Conversely, failing to exceed $1.30 could signal a potential consolidation phase.

Source: TradingView

Arbitrum: strengthening the dynamic

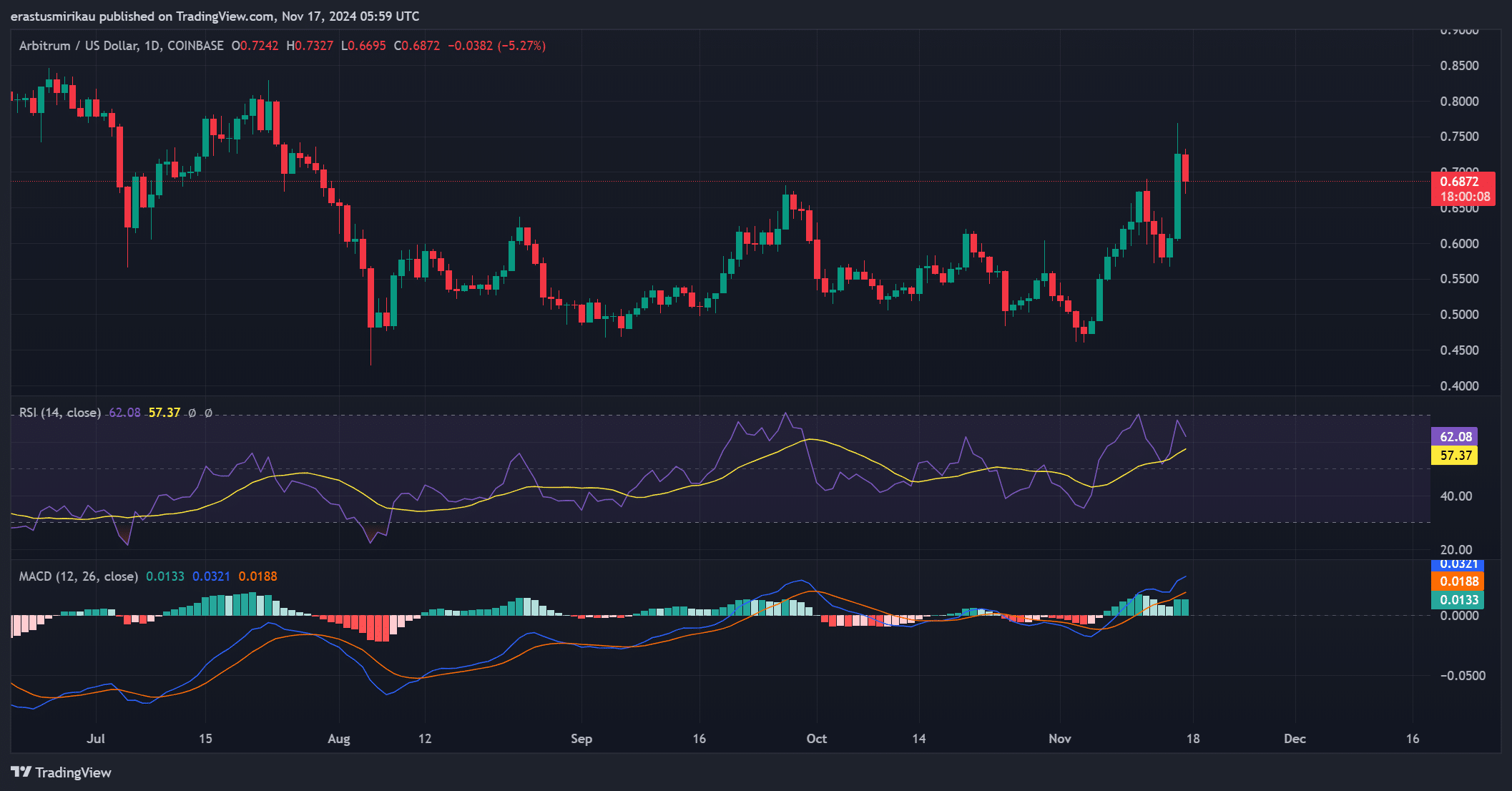

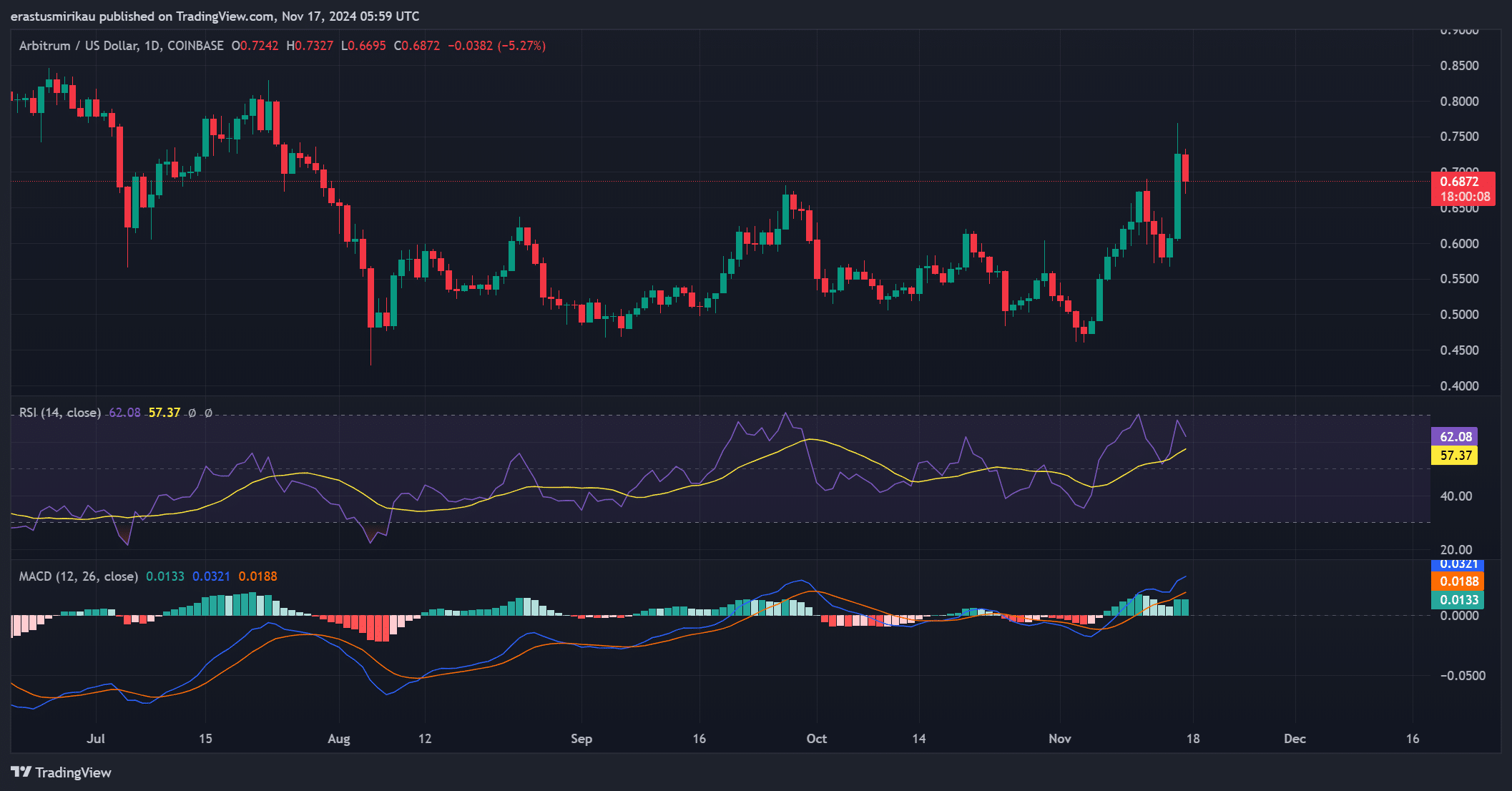

Momentum indicators further reinforced ARB’s bullish outlook.

The RSI on the daily chart was 57.37 at press time, which while indicating bullish momentum, leaves room for further upward movement before reaching overbought territory.

Likewise, the MACD showed a bullish crossover, with the MACD line firmly above the signal line. These moves highlighted growing market optimism and suggest buyers are taking control.

However, any signs of weakening could lead to a short-term pullback.

Source: TradingView

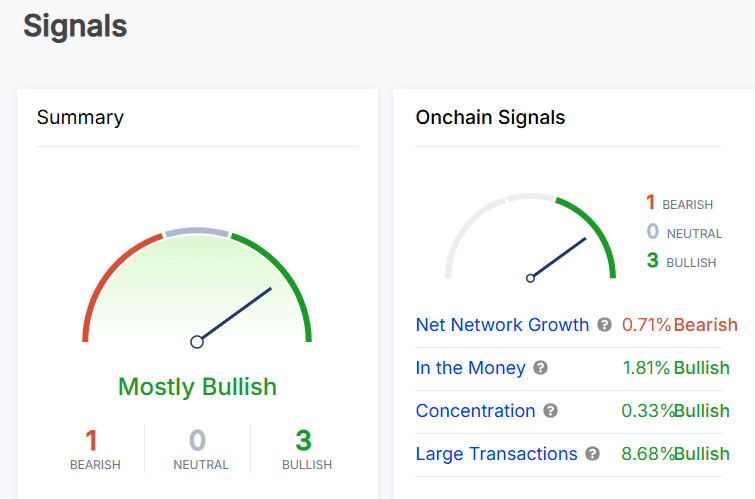

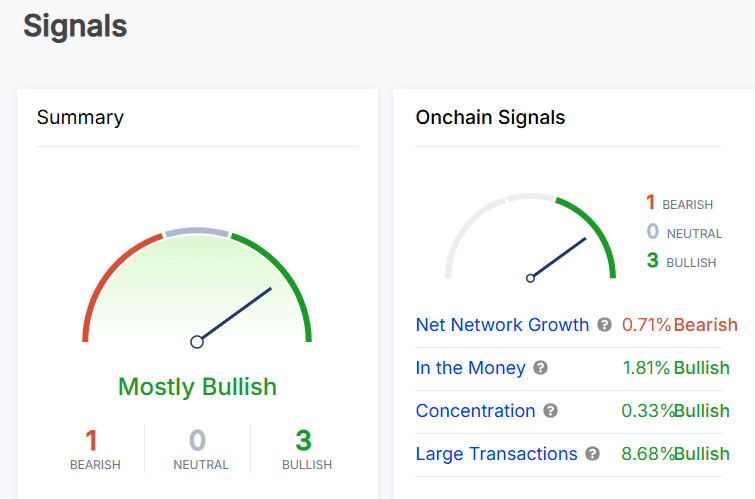

On-Chain ARB Signals Strengthen Bullish Sentiment

On-chain signals largely support ARB’s bullish case.

The ‘in the money’ indicator, up 1.81%, reflects increasing profitability for holders, while the 8.68% increase in large transactions indicates increased activity from institutional investors or whales.

However, the 0.71% decline in net network growth revealed some hesitance to onboard new participants, which could pose a challenge to sustainable growth.

Additionally, the 0.33% bullish concentration measure suggests continued accumulation by long-term holders, a positive sign of stability.

Source: In the block

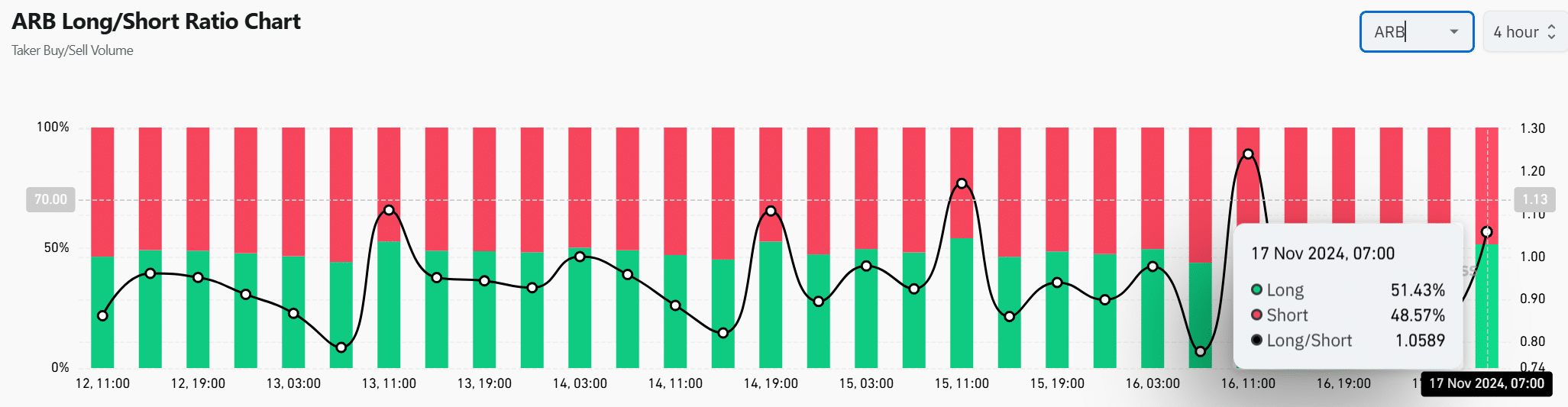

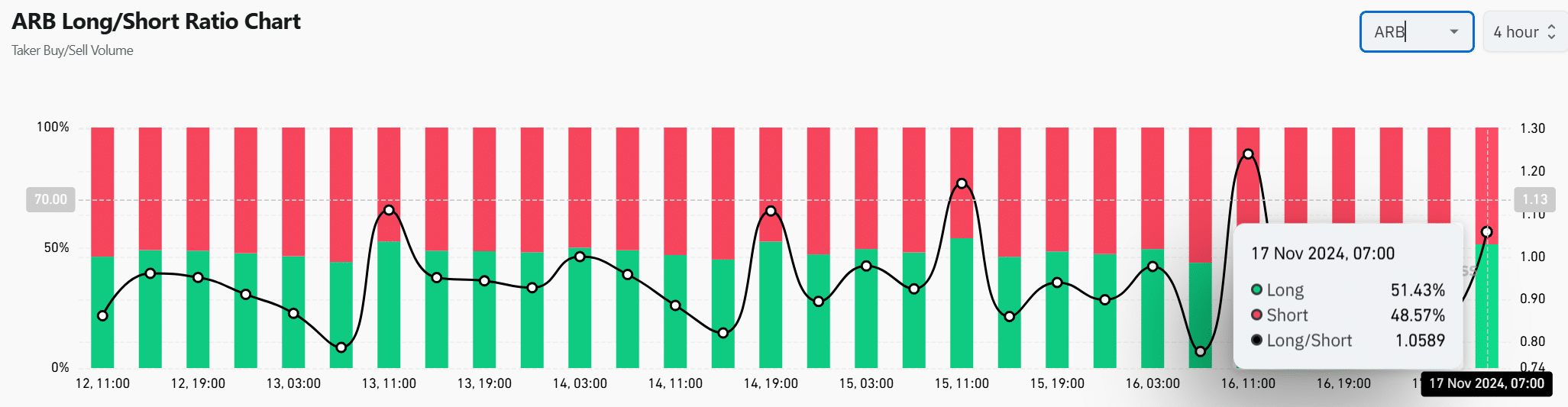

Will traders push ARB higher?

Sentiment data further highlighted cautious optimism. The Long/Short ratio showed that 51.43% of traders took long positions at press time, signaling a slightly bullish tilt.

This suggests growing confidence in ARB’s ability to overcome resistance at $1.30.

Source: Coinglass

Read Arbitrum (ARB) Price Forecast 2024-2025

Ultimately, ARB is well positioned for further gains, supported by a rounded bottom setup, bullish technical indicators and mostly positive on-chain metrics.

However, breaking the $1.30 resistance is essential to confirm its bullish momentum. If ARB can reach this level, the $2.42 target could become a reality in the near future.