- Arbitrum had the third highest DEX volume at press time.

- ARB has continued to decline over the past three months.

Arbitrum (ARB) has maintained its position as the dominant decentralized exchange (DEX) platform and has the largest Layer 2 (L2) total value locked (TVL) in the ecosystem.

Despite the platform’s strong performance in terms of TVL and its dominance in the DeFi space, the native token, ARB, has been trending less favorably in recent months.

Data indicates that nearly 100% of ARB holders were holding shares at a loss at press time, reflecting the token’s decline in value.

Arbitrum continues its downward trend

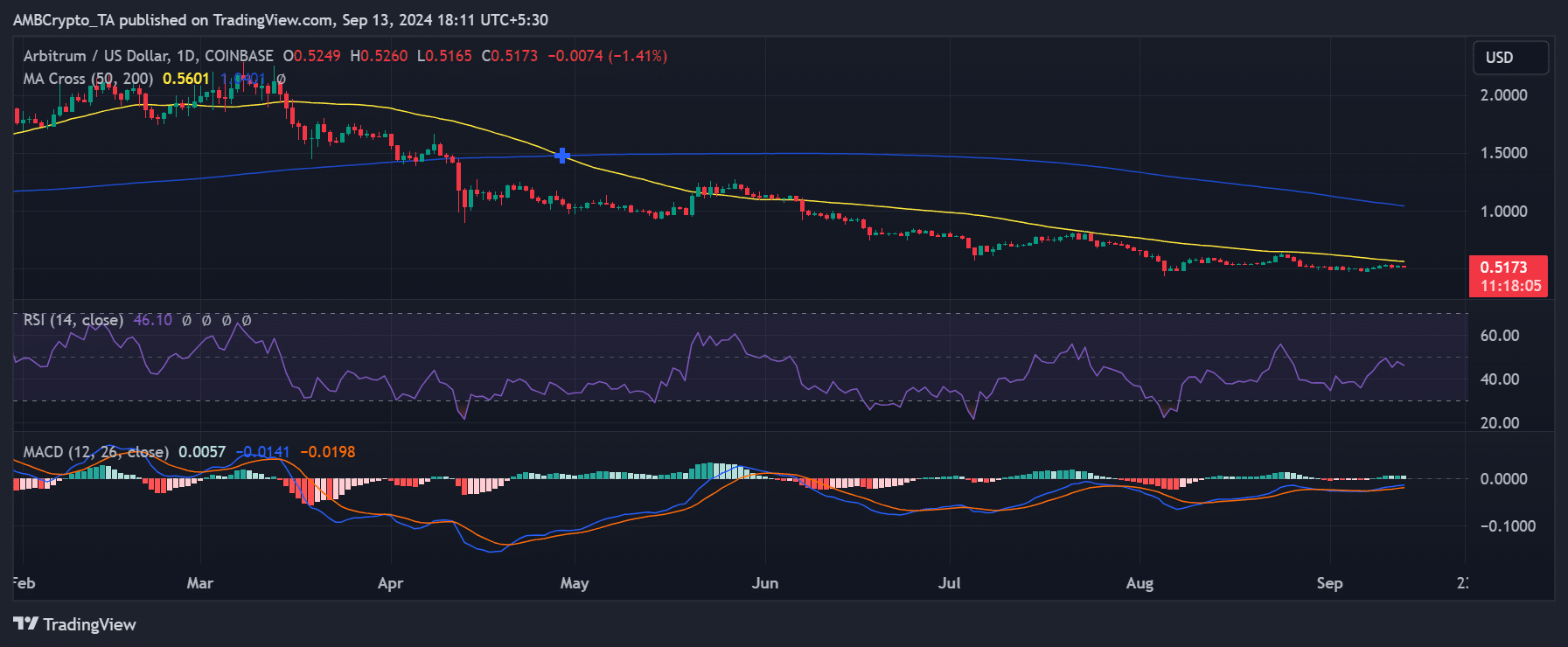

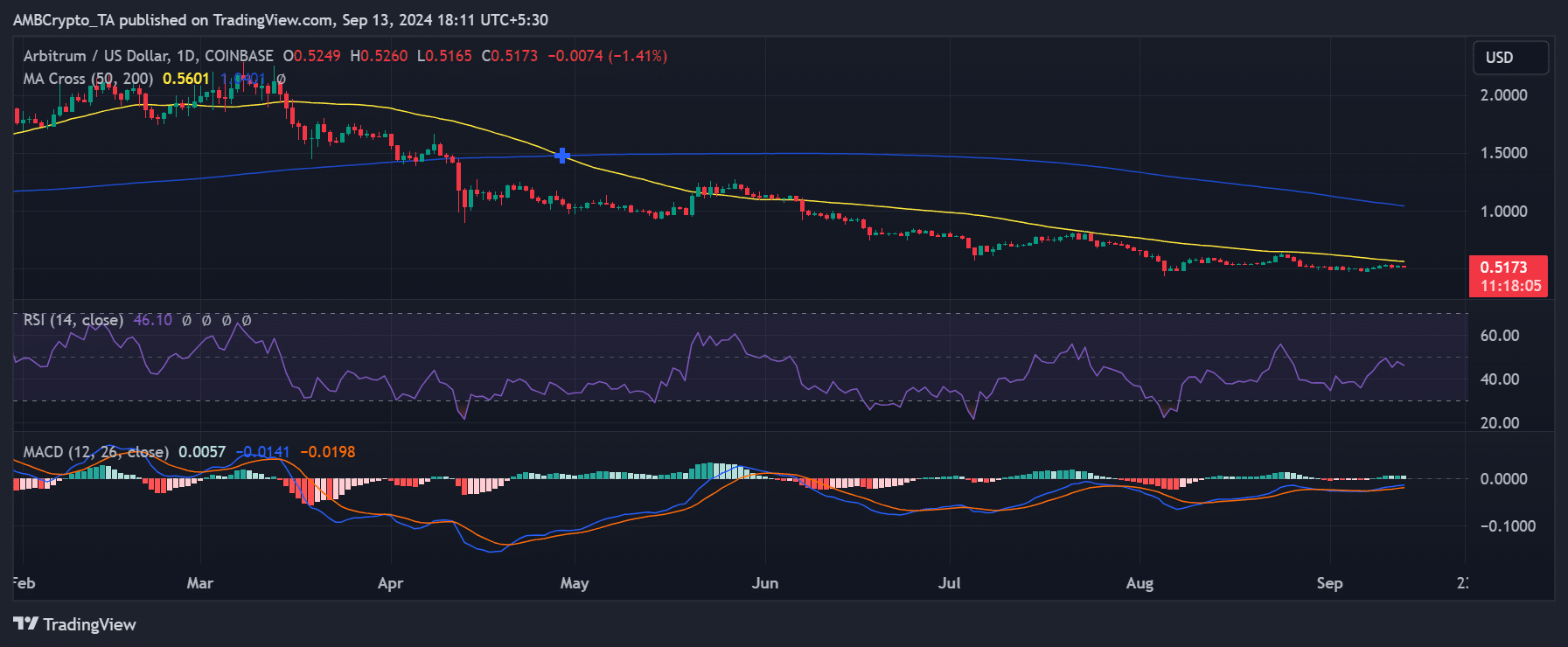

AMBCrypto’s analysis of Arbitrum on a daily chart revealed that it has seen moderate trading activity over the past few months, accompanied by a steady overall decline in its price.

The short and long moving averages (yellow and blue lines), which also function as trendlines, indicate that ARB price has been on a downtrend since May.

Source: TradingView

ARB was trading at around $0.51 at the time of writing, reflecting a decline of over 1% in the current session.

The MACD (Moving Average Convergence Divergence) further supported the bearish outlook, with signal lines below zero.

The severity of this downward trend is underscored by the fact that nearly 100% of ARB holders are now holding their positions at a loss.

More and more ARB holders are withdrawing money

The Global In/Out of the Money chart on IntoTheBlock highlighted the significant impact of Arbitrum’s price drop on its holders.

Around 1.19 million addresses were out of the money at press time, meaning over 94% of ARB holders were suffering losses.

Only about 2% of holders are profitable, which is one of the lowest profitability levels in the token’s history.

Despite this challenging pricing trend, Arbitrum’s network activity remained robust.

Data from IntoTheBlock revealed that Arbitrum ranked third among decentralized exchanges (DEXs) by volume, with over 14% market share, behind Ethereum (ETH) and Solana (SOL).

The combination of a high percentage of losing holders and the strong fundamentals of Arbitrum’s network presented a unique scenario.

This suggests that while the platform’s utility remains intact, market sentiment towards ARB may be driven more by speculative factors.

Arbitrum retains a significant share of L2

According to AMBCrypto’s analysis of Arbitrum’s dominance in the Layer 2 (L2) space, the platform has remained dominant.

L2 Beats data indicated that Arbitrum controlled over 39% of L2’s total value locked (TVL), with over $13 billion locked in the ecosystem.

Is your portfolio green? Discover the ARB Profit Calculator

However, despite this impressive performance in terms of network utilization and dominance in the L2 sector, ARB’s price has not reflected these positive metrics.

The robust platform activity has not translated into a positive price trend for the ARB token, which continues to struggle with moderate price movements and a significant percentage of holders in losses.