- Arbitrum’s DeFi TVL has been growing steadily and recently hit a one-month high of $2.45 billion.

- Despite a rise in TVL and open interest, bearish signals around ARB continue to dampen market sentiment.

Arbitrum (ARB) has remained stuck in a downtrend, with its price falling 11% in the past month. However, the downtrend is showing signs of weakness as in just four days, ARB has rebounded from $0.49 to $0.56.

ARB had lost some of those gains at press time and was trading at $0.551. On-chain data suggests that ARB is well-positioned to rebound and eventually regain its monthly highs.

Rising DeFi TVL Could Fuel ARB Rally

The arbitration was recently overturned by Base in terms of Total Value Locked (TVL) and currently ranks as the second largest Layer 2 network by this metric.

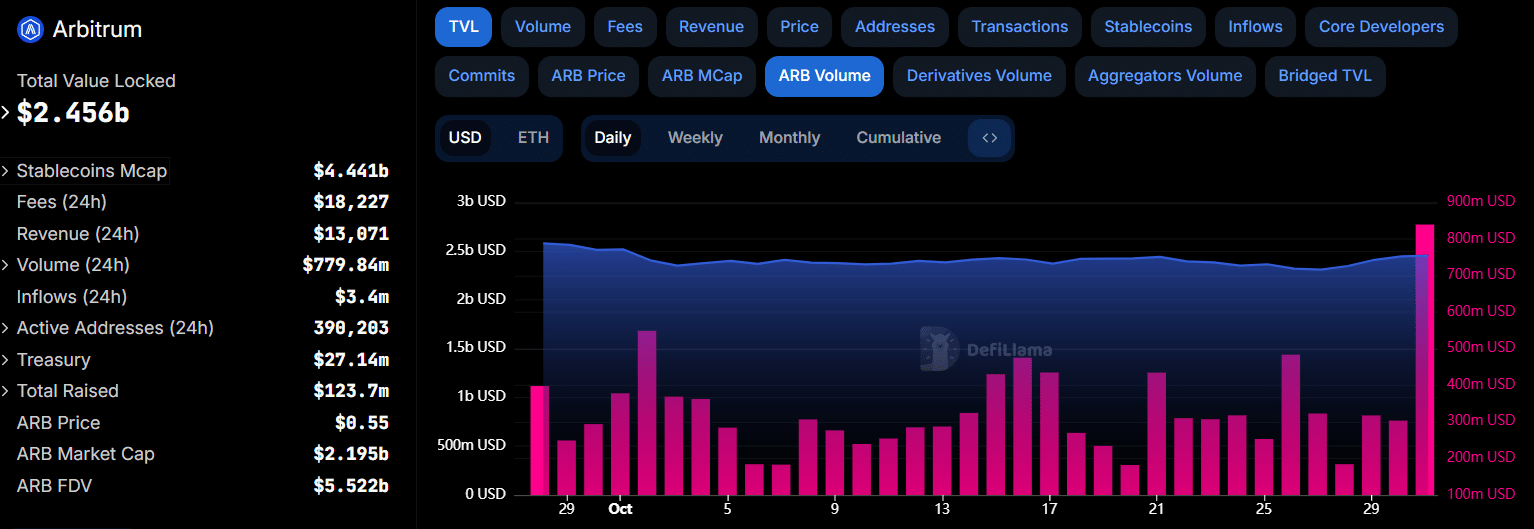

Data from DeFiLlama shows that decentralized finance (DeFi) activity on the network is on the rise again. At press time, Arbitrum’s DeFi TVL stood at $2.456 billion, its highest level in a month.

Source: DeFiLlama

In addition to the rise in TVL, ARB volumes on centralized and decentralized exchanges reached their highest level since August.

The increased TVL and rising volumes indicate growing interest in DeFi applications built on the Layer 2 network. This in turn could support ARB’s price recovery.

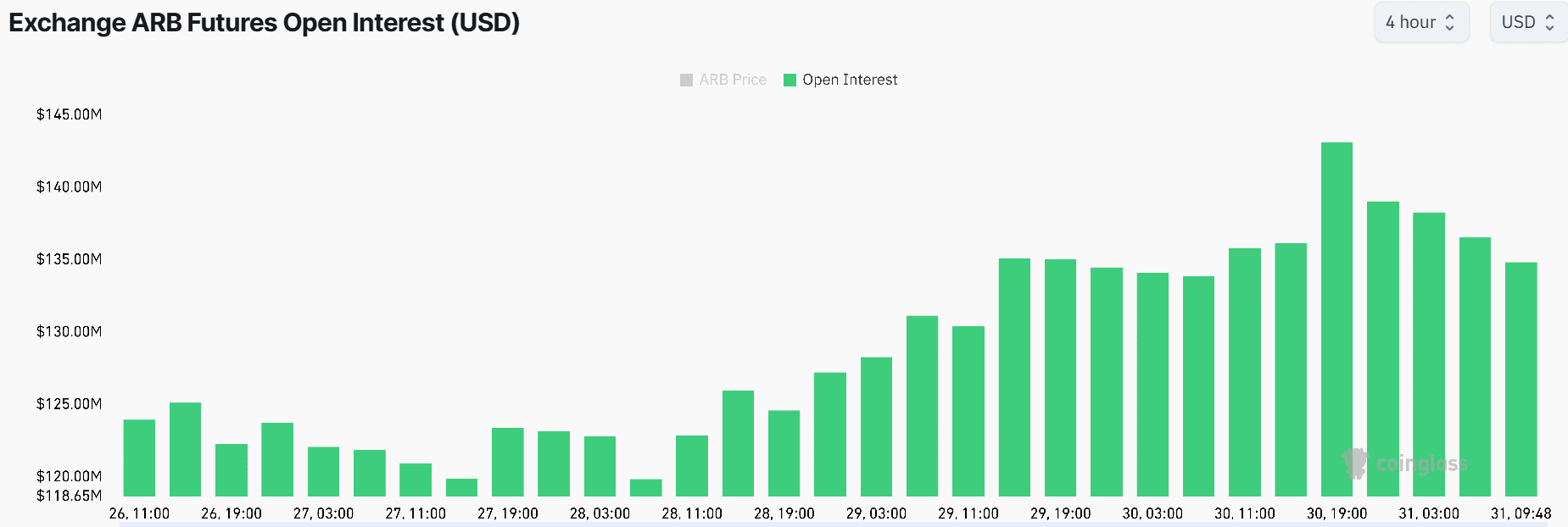

Arbitrum Open Interest Increases

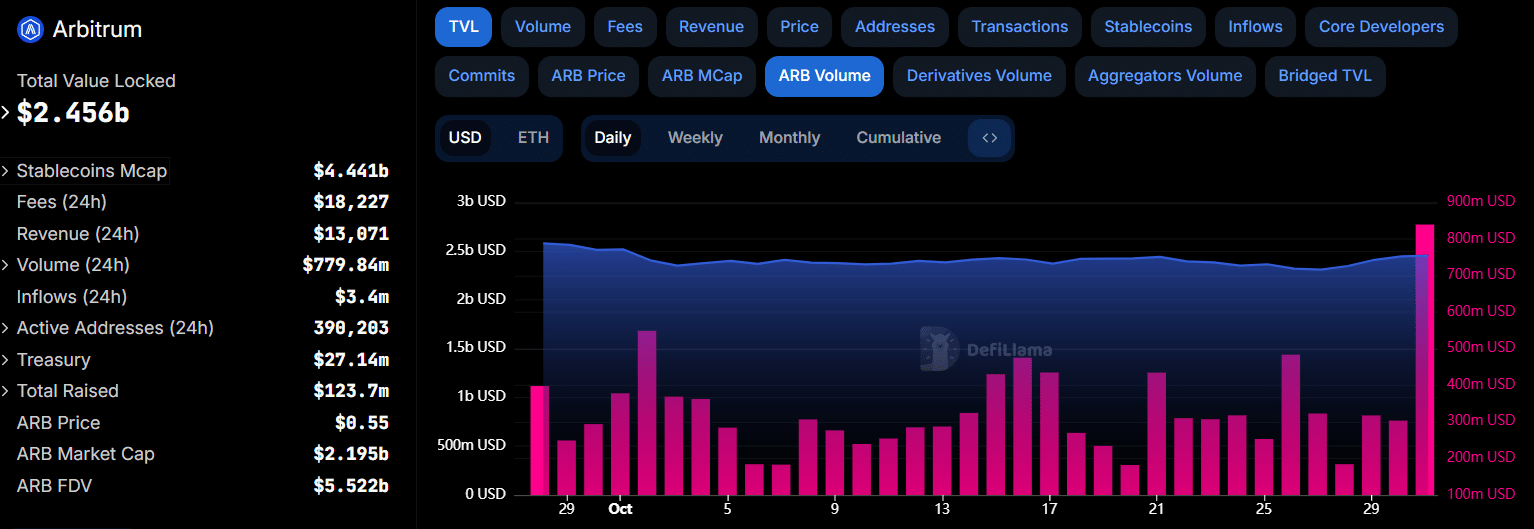

There is also an increase in speculative activity around Arbitrum. This can be seen in the skyrocketing open interest which stood at $135 million at press time.

In just three days, ARB’s OI has increased by over 10%, suggesting that derivatives traders are opening new positions in the token.

Source: Coinglass

A spike in OI that accompanies a price increase generally reflects bullish sentiment. Additionally, Arbitrum funding rates have been mostly positive since September, reinforcing the bullish thesis.

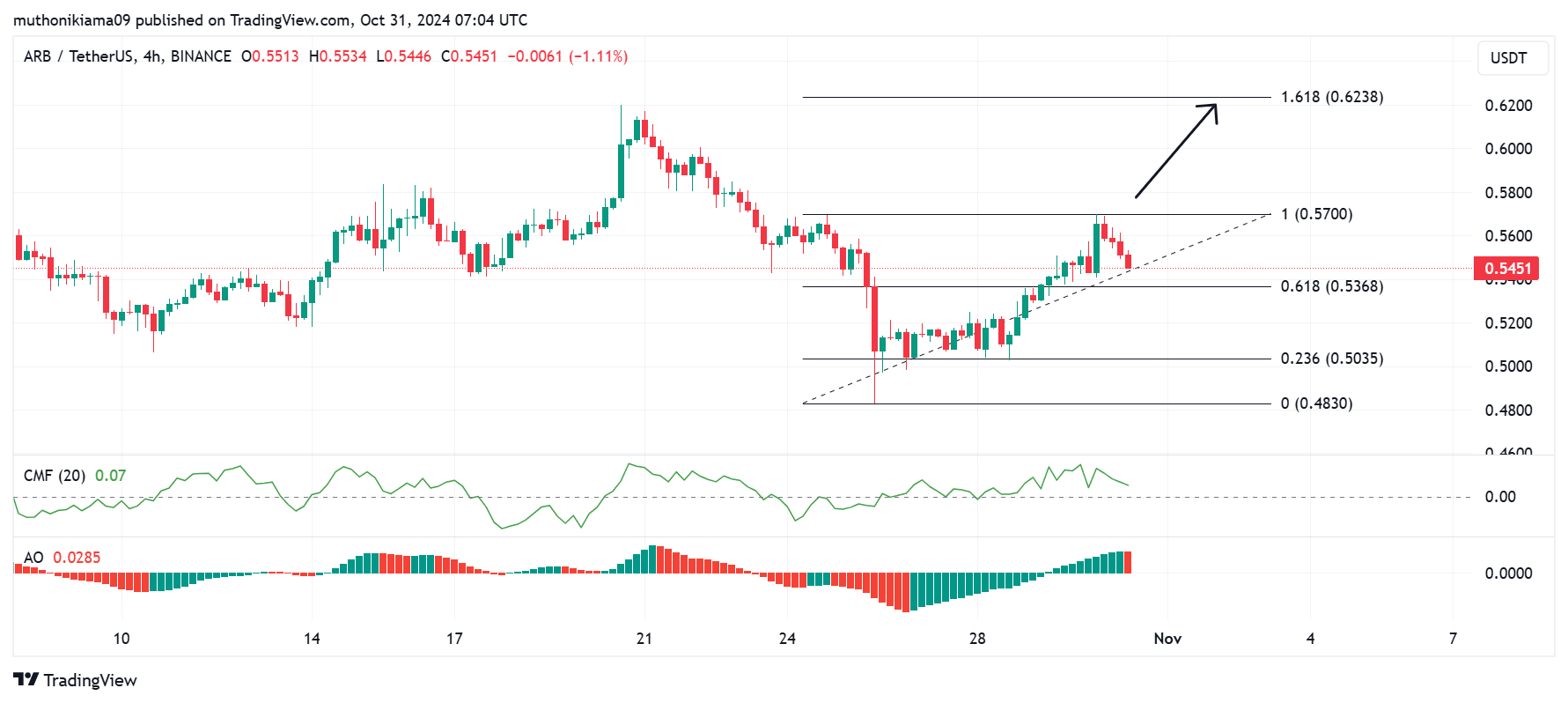

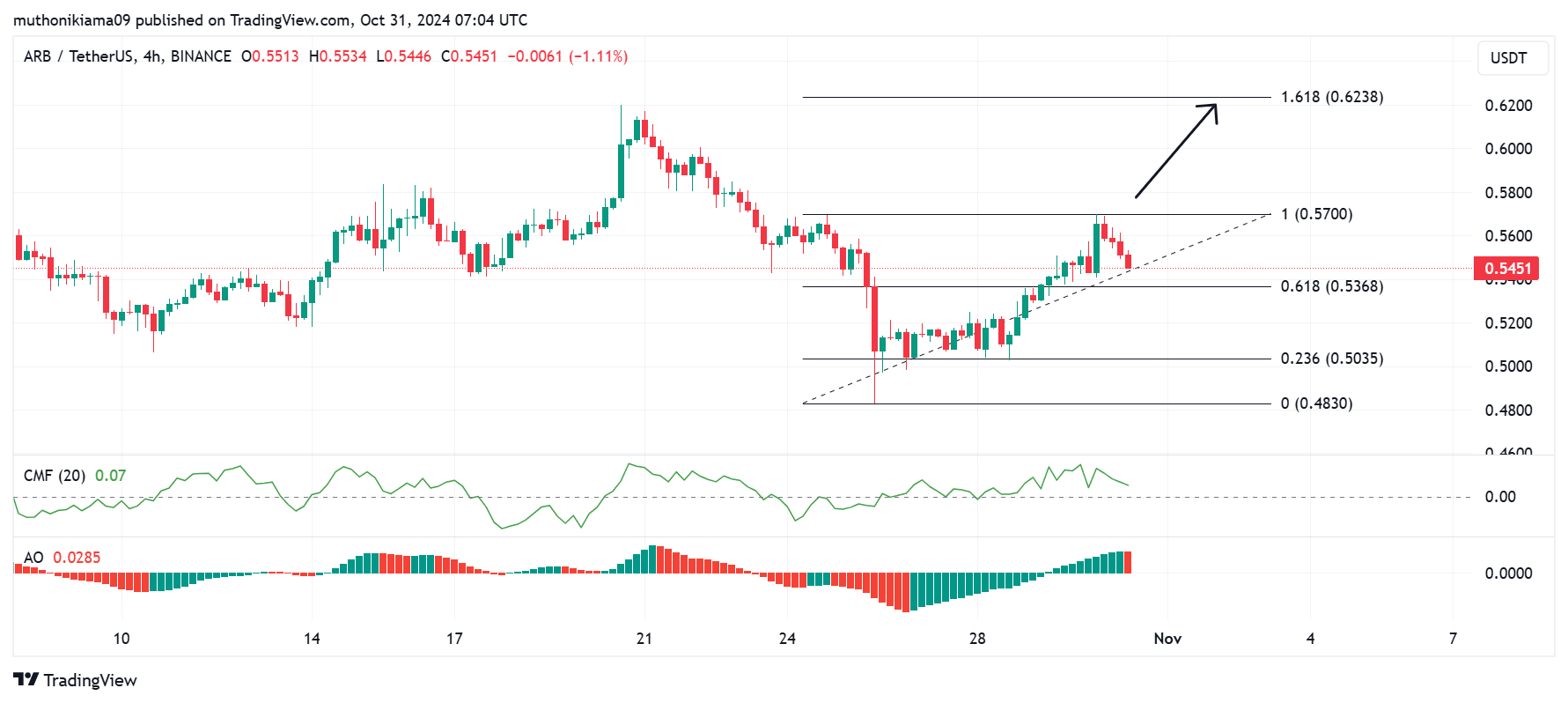

Is ARB Ready for a Breakout?

Arbitrum’s four-hour chart shows that the short-term momentum has turned bullish. The Chaikin Money Flow (CMF) indicator has a positive value of 0.07, indicating higher buying pressure than selling pressure.

The Awesome Oscillator also shows the bulls taking control of the ARB price action, with the AO bars turning positive.

However, the evolution of these indicators also calls for caution. The CMF is leaning south, suggesting buying pressure is easing. Additionally, the red AO bar shows that the bears are fighting for control.

Source: Tradingview

If new buyers enter at current prices and Arbitrum breaks the resistance at $0.57, the next target will be the 1.618 Fibonacci level ($0.62).

Realistic or not, here is the market capitalization of ARB in terms of BTC

On the other hand, if ARB succumbs to downtrends and falls below support at the 0.618 Fibonacci level ($0.53), the price could plunge to collect liquidity at $0.48.

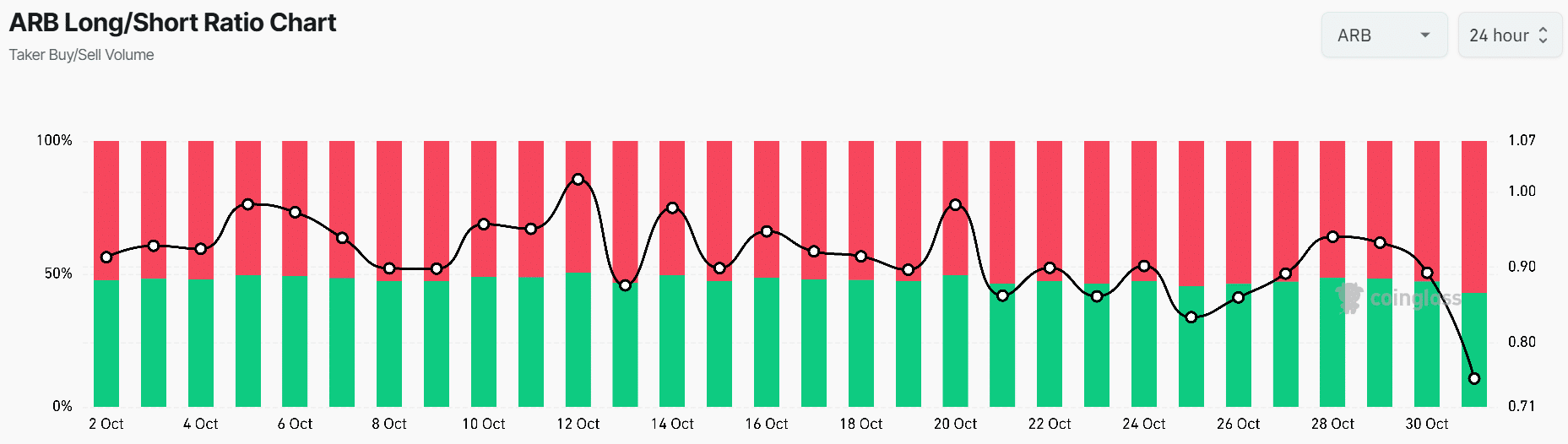

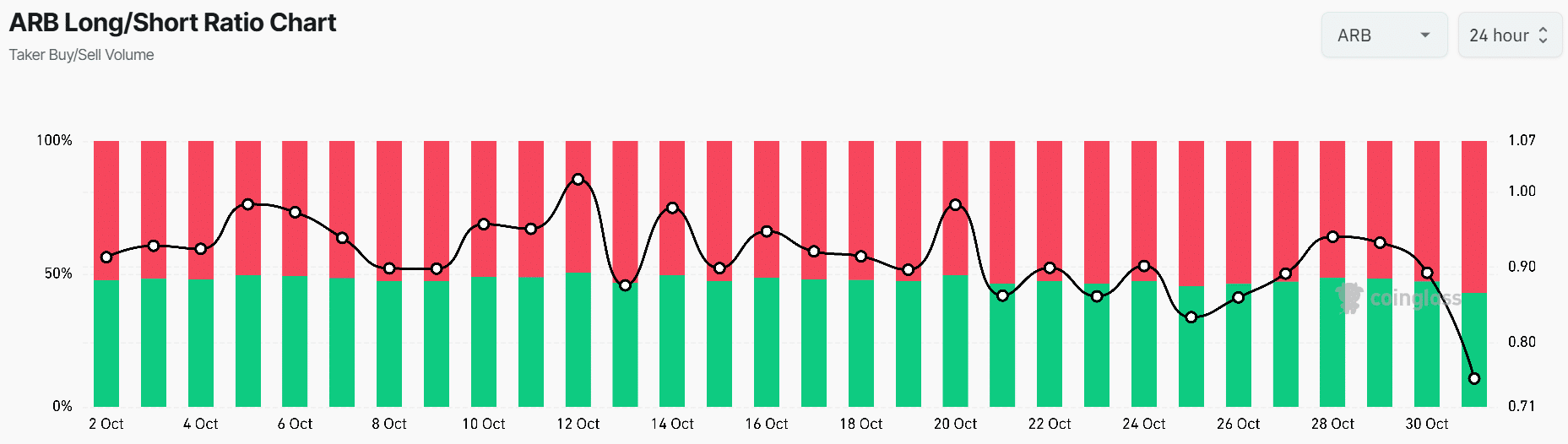

The Arbitrum long/short ratio suggests traders are leaning heavily toward further decline. This ratio fell to 0.75, with 57% of traders opening short positions. This suggests that traders are less optimistic that bullish signs around ARB will continue.

Source: Coinglass