- The graphics of mana, sand and axes revealed notable supply clusters

- Analysis of the basis of costs highlighted the key accumulation zones which could define the next trend for the main metavese tokens

The metavese was once the next great innovation in digital ecosystems, with projects like decentraland (Mana), the sandbox (sand) and Axie Infinity (AXS) leading the charge.

However, the media threshing around the metavese has cooled considerably in recent years. In fact, the prices of the main metavese tokens have also undergone serious slowdowns, the interests of investors decreasing in a coherent manner.

Now, with signs of renewed engagement and price activity, the key question are: do Metaversse tokens put a return?

Cost base analysis – signs of accumulation or distribution for metavese tokens?

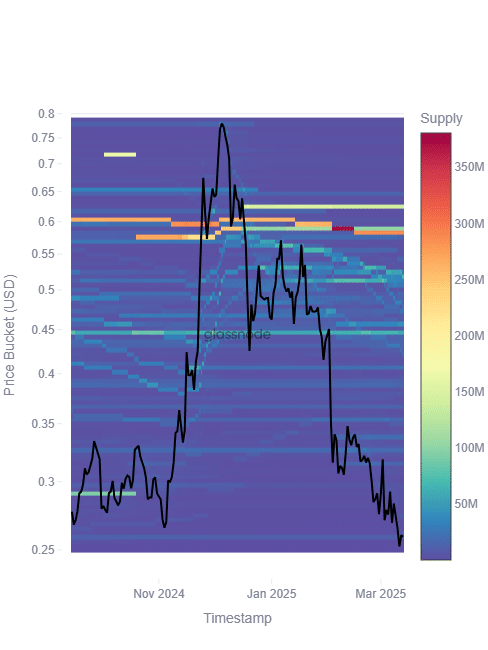

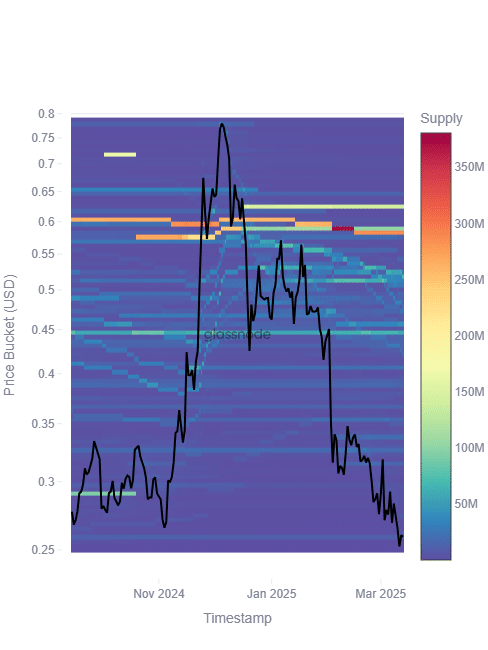

Examination of basic cost distribution metrics for mana, sand and axes revealed some crucial information on the behavior of investors. The graphics have experienced significant supply clusters at higher price levels, with a clear tendency for clear prices since the beginning of 2025. A major concern is the offer of persistent general costs, which suggests that many holders have bought at higher price levels and can always be at a loss.

- Mana – The price has regularly decreased on graphics, from around $ 8.50 at the end of 2024 to around $ 3 by March 2025. The basic cost of cost indicated that a large part of the offer remains concentrated between $ 6.50 and $ 8.00, potentially acting as a resistance zone.

Source: Glassnode

- Sand: a similar scheme can be observed, with a price drop from $ 0.90 to around $ 0.25 over the same period. The largest accumulation area was around the $ 0.60 brand, indicating a potential challenge for bullish attempts to recover the lost terrain.

Source: Glassnode

- AxS: Previously, one of the hottest play tokens, AxS reflected the downward trend. Its offer gathered heavily from $ 0.55 to $ 0.70, while its price oscillated around $ 0.30 on graphics.

Source: Glassnode

Feeling of investors – still cautious?

These graphs also suggested that the metavese tokens have not yet emerged from their prolonged decline. Despite small signs of purchasing activity at lower price levels, the supply pressure has remained high.

This could mean that all short -term price overvoltages can face high sales pressure of holders who seek to break.

In addition, chain activity has not indicated a major influx of new users. A real metavese resurgence would require both institutional interest and a broader adoption of the platforms linked to the metavers – factors that are still lacking.

Can metovense tokens recover?

To make metovense tokens gain momentum, several conditions must be met,

- Higher negotiation volumes and a greater demand for metovense platforms – the current price action remains speculative without substantial use of users.

- Reduction in air supply – an escape higher than the main levels of resistance could point out that long -term holders reduce sales pressure.

- The interest of investors relaunched in web development and Metaversse – if large companies announce renewed investments in space, tokens like mana, sand and axes could benefit.

In the current state of things, the metavese tokens are trying to stabilize. However, their recovery is far from guaranteed. While the graphics have alluded to accumulation at lower levels, a significant break has not yet taken place.

Consequently, investors should remain cautious and monitor key resistance zones before expecting a full -fledged metailing resurgence.