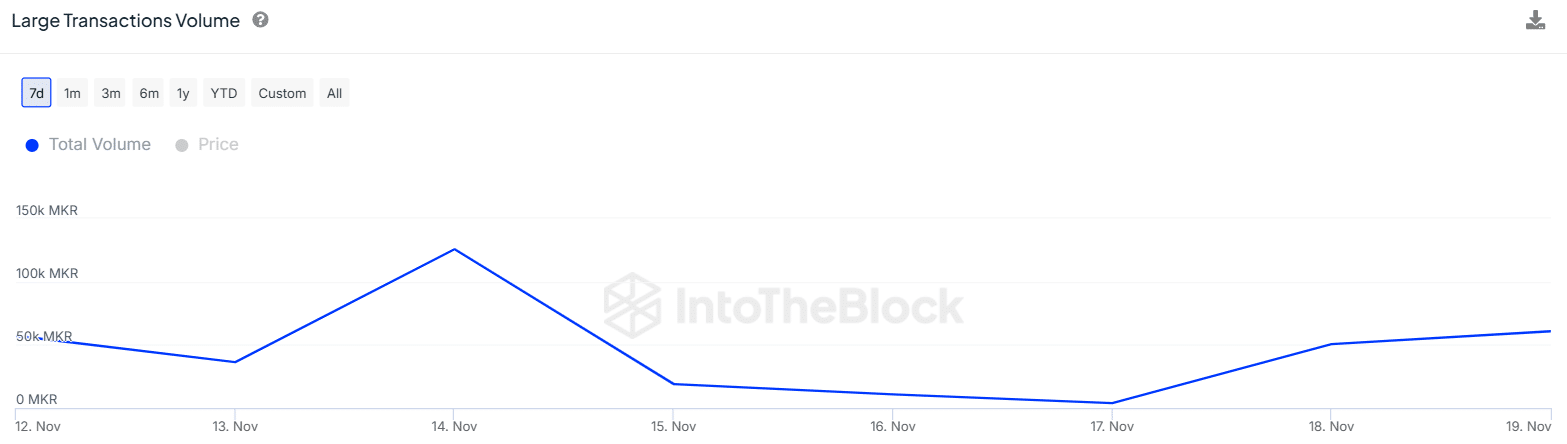

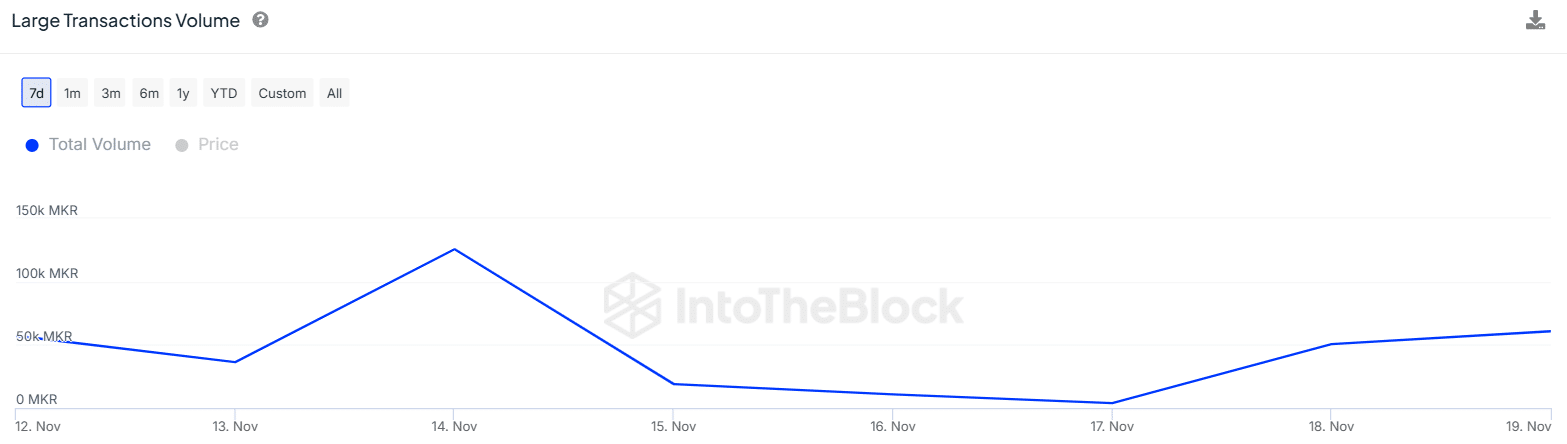

- Large trading volumes for Maker increased by over 1,400% in just two days

- Despite increasing whale activity, technical indicators and on-chain metrics have given mixed signals for MKR

Manufacturer (MKR), at press time, was valued at $1,513 after rising just under 2% in the past 24 hours. Here, it is worth noting that the token’s performance mirrored that of the broader cryptocurrency market with gains of 24% over the month.

Despite these gains, Maker has remained stuck in the $1,419 to $1,550 range for the past two weeks. A slight increase in whale activity, however, could help exceed these levels.

In fact, data from IntoTheBlock revealed that large MKR transactions exceeding $100,000 increased by 1,400%, from 3,840 to 60,730 in just two days.

(Source: In the block)

51% of the total MKR supply is held by whales. Therefore, if trading activity from this cohort increases, MKR could move above or below the consolidation range depending on whether these traders are buying or selling.

Key levels to watch

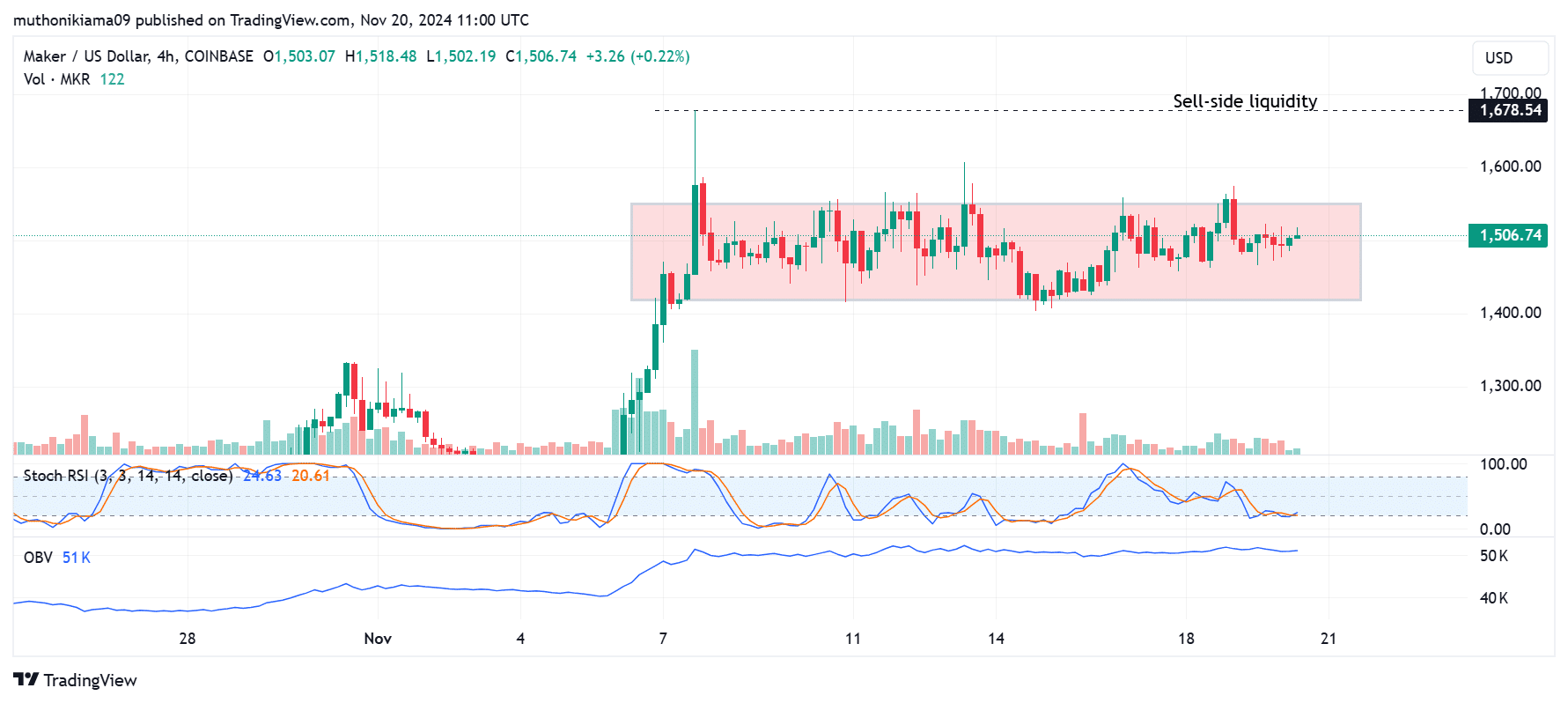

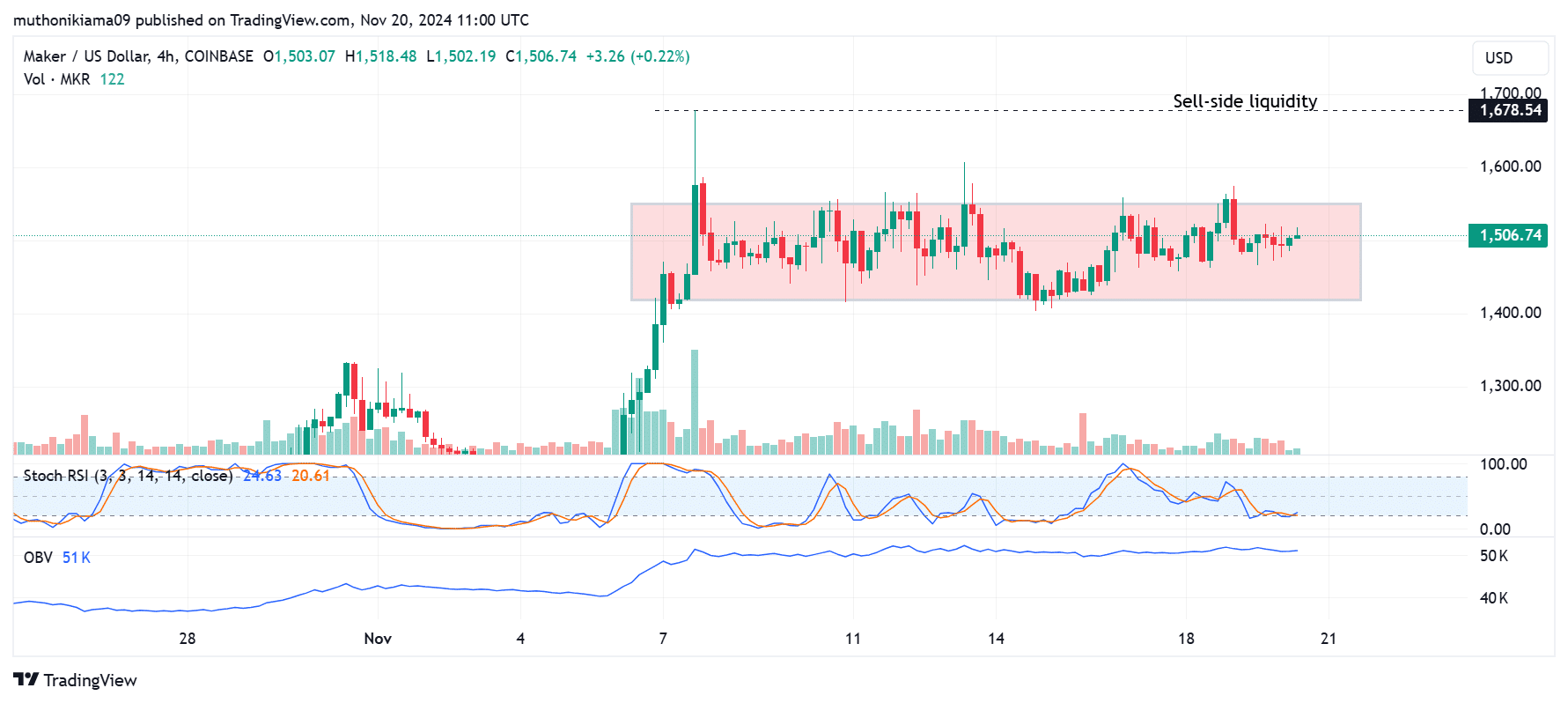

For Maker to confirm a bullish breakout of the consolidation range seen on the four-hour chart, it must break above resistance at $1,550 with high buying volumes.

The short bars on the volume histogram highlighted the lack of buyer interest in pushing the price above this resistance. Additionally, the Balance Volume indicator appears to have flattened, indicating that buying and selling pressures may be balanced.

Traders should watch out for sell-side liquidity at $1,678. Maker could rise to withdraw this liquidity and if buyers step in during this rally, it could lead to a lasting rally. Conversely, if such a move fails to attract buyers, MKR could return to the consolidation range or trend down.

(Source: Tradingview)

At the time of writing, the Stochastic Relative Strength Index (RSI) with a reading of 24 showed MKR to be oversold. This could also lead to an upward correction in the short term.

At the same time, traders should pay attention to the support level at $1,419. A fall below this support could result in a bearish breakout of the consolidation and cause MKR to enter a downtrend.

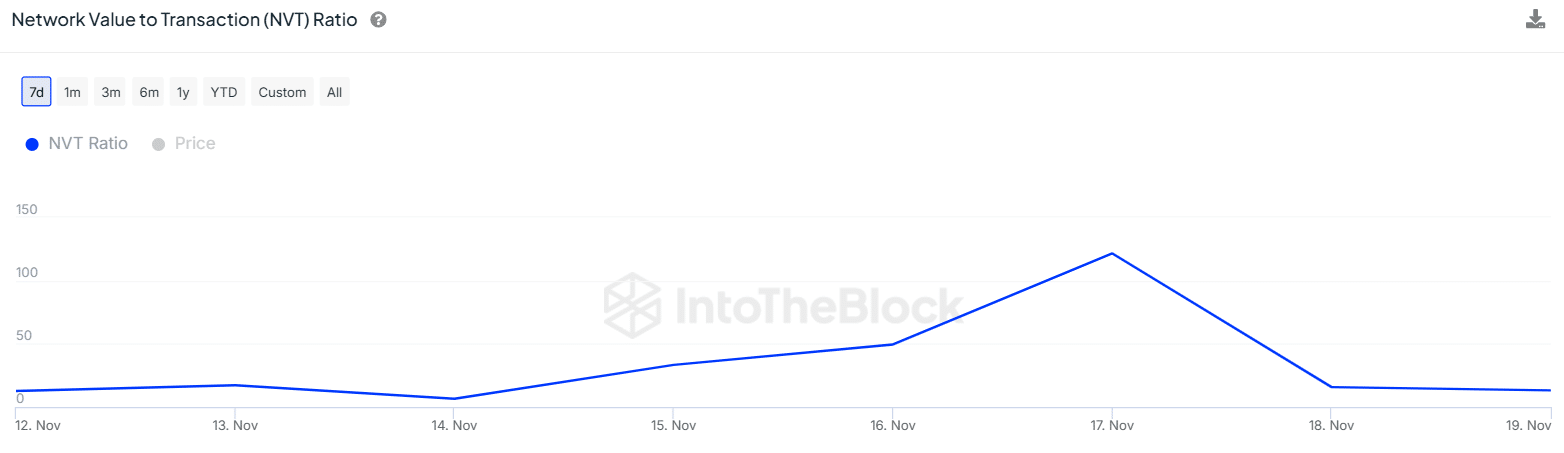

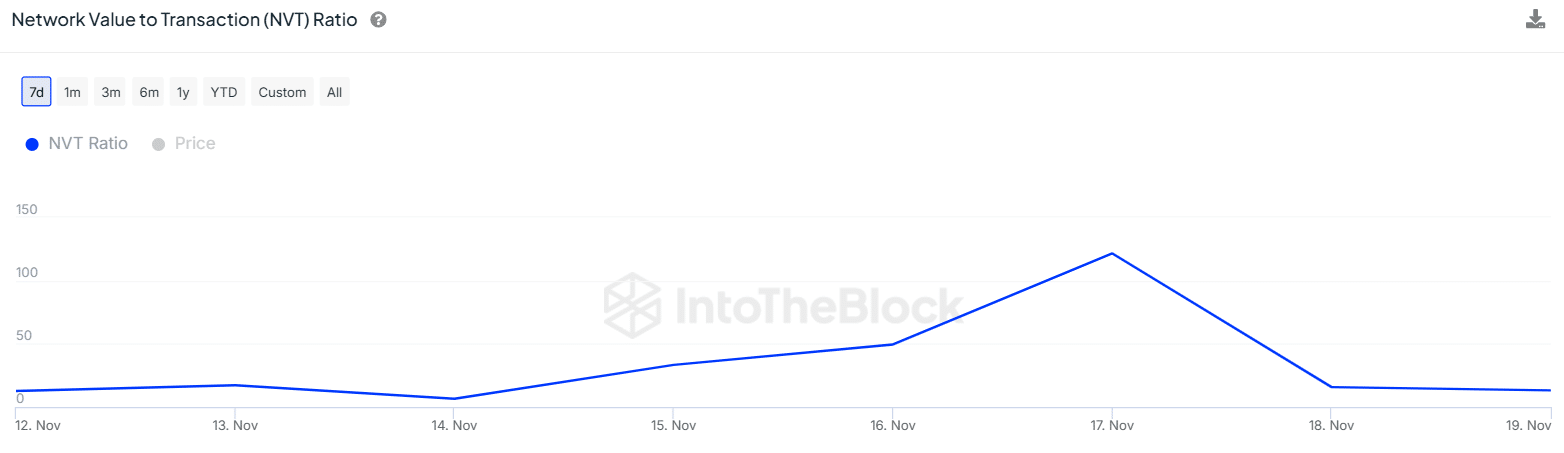

The decline in the NVT ratio shows THIS

Maker’s network value-to-transaction (NVT) ratio has decreased from 121.47 to 13.17 over the past two days, indicating that there has been an increase in transactions on the network.

(Source: In the block)

Whenever the NVT ratio drops, it means that a token may be undervalued. However, a look at the market value to realized value ratio (MVRV), which increased from 0.84 to 0.87 during the aforementioned period, suggests that this may not be the case.

This discrepancy could indicate that the high transactions are due to the profit-making activities of the whales. This could fuel a downward trajectory on the charts.

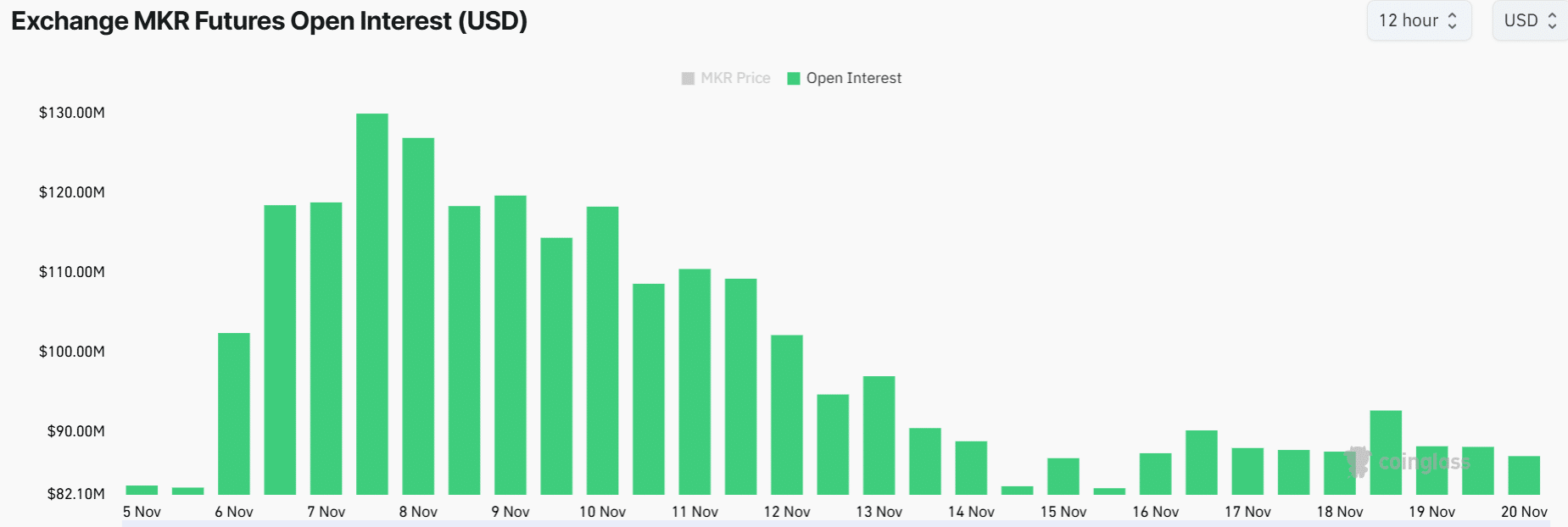

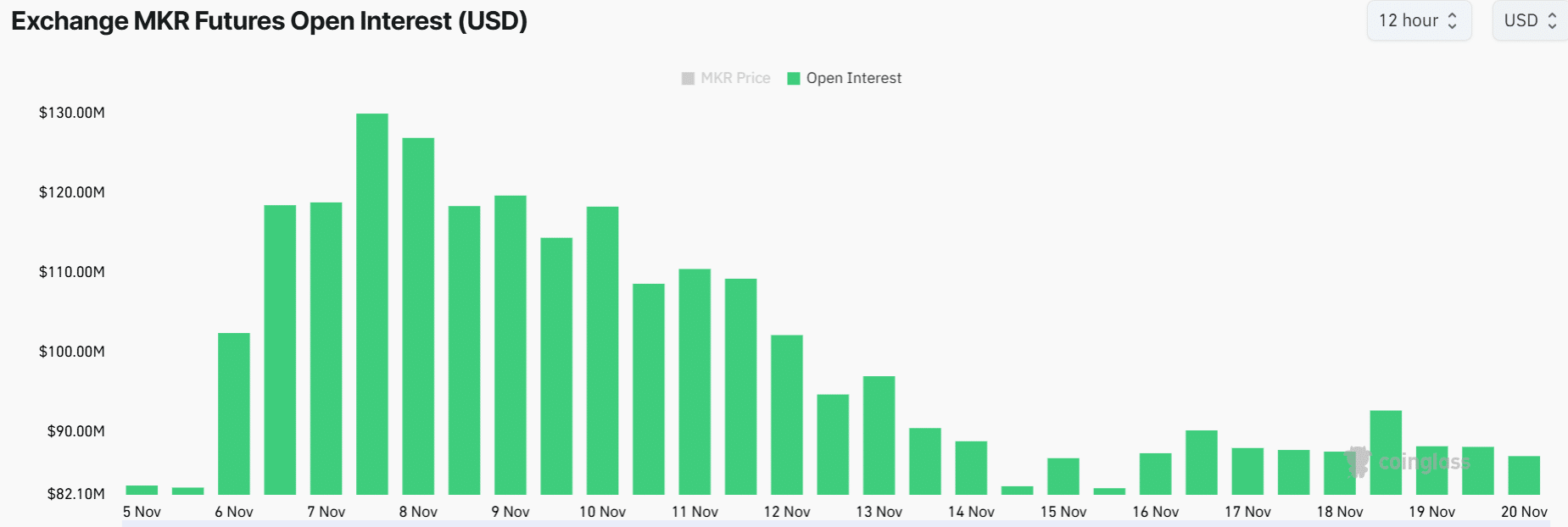

Derivatives market reflects uncertainty

In the derivatives market, traders have been uncertain about Maker. This, after open interest dropped from $129 million to $86 million in just two weeks.

(Source: Coinglass)

When Open Interest falls, it shows that traders are closing their positions on a token due to uncertainty over future price performance.

This drop in speculative activity could also be one of the key factors leading to Maker being stuck in a consolidation phase.