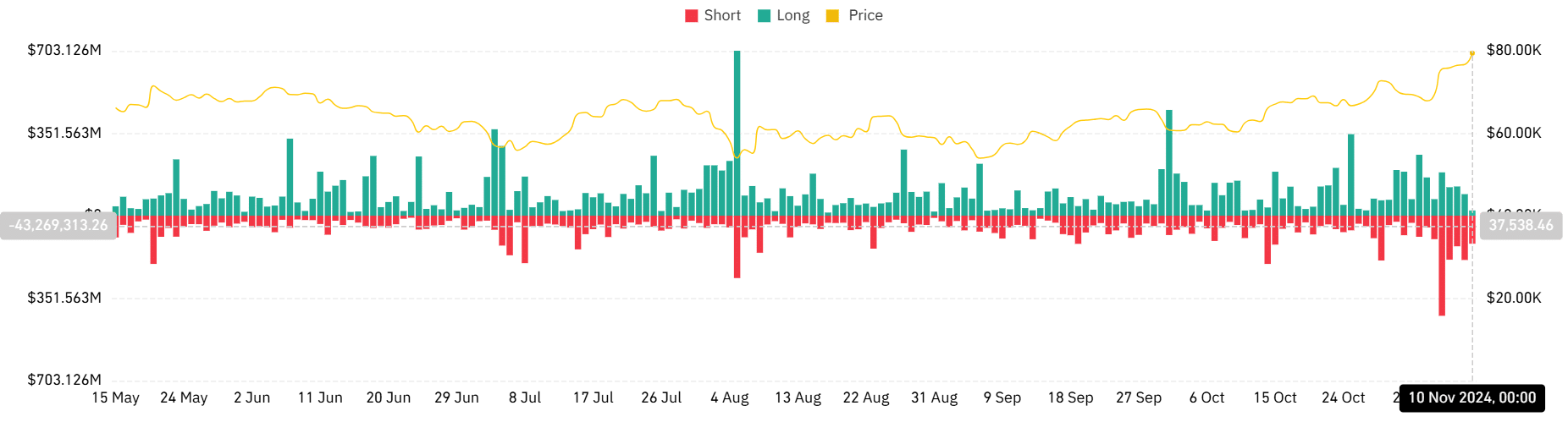

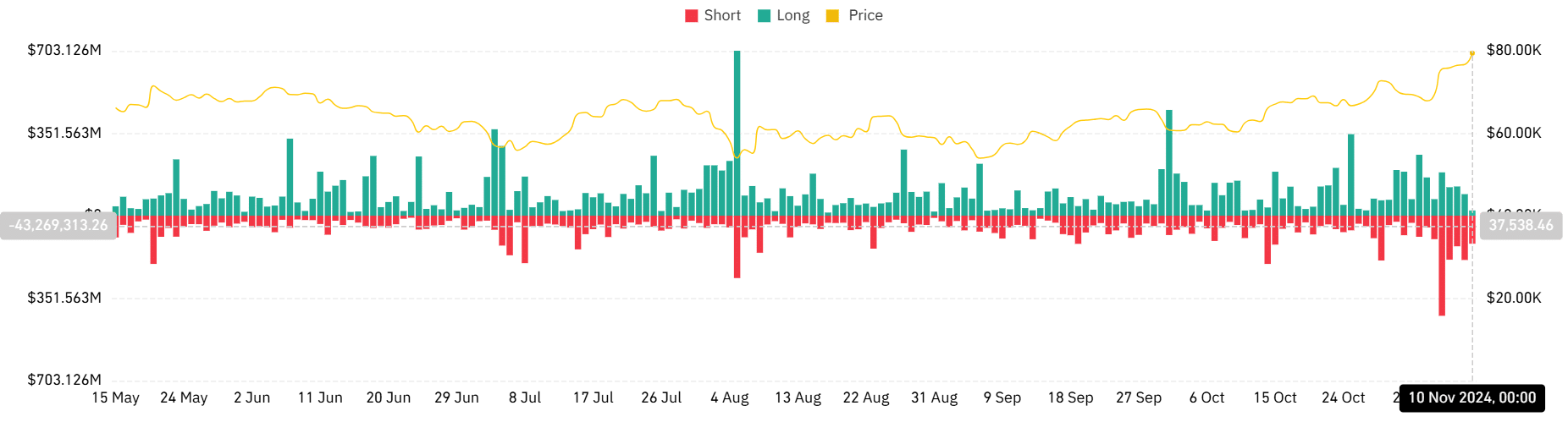

- In recent days, short positions have suffered consecutive blows.

- The market could see more liquidations as more assets reach new price levels.

The crypto market saw another round of significant selloffs during the last trading session on November 9, driven by the movements of major coins like Bitcoin (BTC) and Ethereum (ETH).

The market reacted strongly when these assets reached new price levels, leading to significant liquidations, especially for short positions.

As indicators such as the Fear and Greed Index approach extreme levels, market observers are bracing for possible further selloffs.

Stock market liquidations exceed $280 million

On November 6, as Bitcoin hit a new all-time high of $76,000, market liquidations increased, reaching over $600 million.

This included nearly $427 million in short liquidations, representing the highest level of short liquidations in more than six months. Long liquidations totaled approximately $184 million.

Most recently, on November 9, stock market liquidations remained high, exceeding $280 million.

According to Coinglass data, short positions continued to bear the brunt, accounting for approximately $189 million of the total liquidation volume.

Source: Coinglass

In comparison, long liquidations were around $92 million. At the last update, the short-term liquidation volume was close to $120 million, and the long-term liquidation volume was around $22 million.

This trend suggests that short traders face significant losses when betting against the upward movement of major crypto assets.

Major assets affected by the stock market liquidation

Over the past 24 hours, the price of Bitcoin has increased by more than 3%, closing in on the $80,000 mark, a new all-time high.

Data from Coinglass shows that Bitcoin dominated liquidation volumes, with over $100 million in total liquidations over the past day.

Short liquidations for Bitcoin alone reached $87 million, while long liquidations totaled around $13 million.

Ethereum also saw significant liquidation volumes, ranking second after Bitcoin. Ethereum saw over $56 million in short liquidations and another $13 million in long liquidations.

Other assets affected by significant liquidation volumes include Dogecoin, which saw approximately $16.7 million in short liquidations and $4 million in long liquidations.

Solana (SOL) and Sui (SUI) also faced significant liquidation volumes, with short positions of $13 million and almost $13 million, respectively, while long liquidations were $3.7 million. of dollars and 1.3 million dollars.

What’s next for the market?

Current market liquidation levels are influenced by increased investor sentiment, as indicated by the Fear and Greed crypto index. At the time of writing, the index stands at 78, reflecting a state of “extreme greed.”

This increased positive sentiment, coupled with fear of missing out (FOMO), pushes more traders into active positions, which, in turn, could lead to additional market sell-offs.

As the market shows signs of overheating, traders and investors should remain cautious.

The increased activity could push prices higher, but it also increases the likelihood of further liquidations if the market corrects or reverses.

As Bitcoin nears record highs and other major assets follow suit, the potential for volatility remains high.

If the Fear and Greed Index continues to rise, the crypto market could see even larger selloffs in the coming days, especially among leveraged positions.