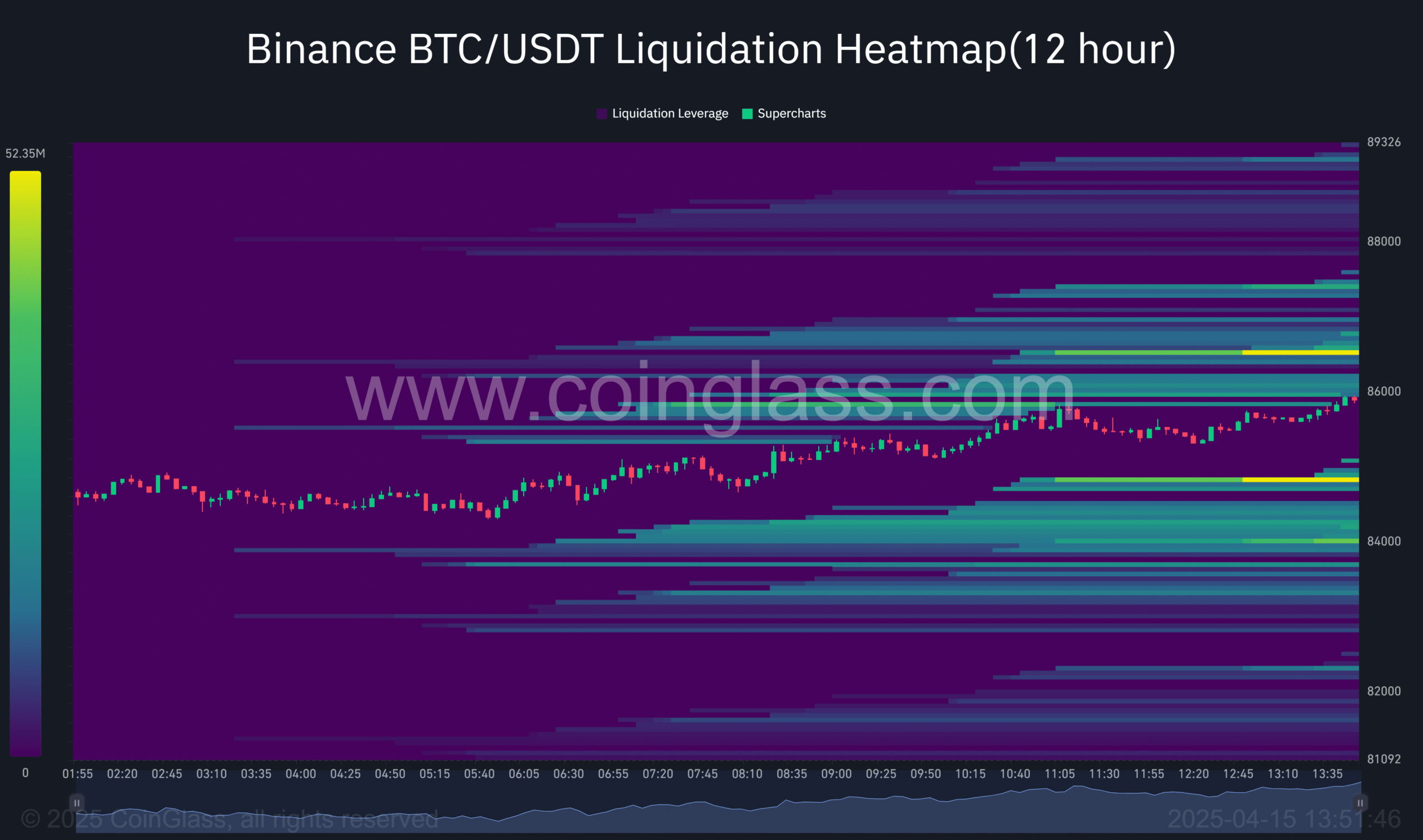

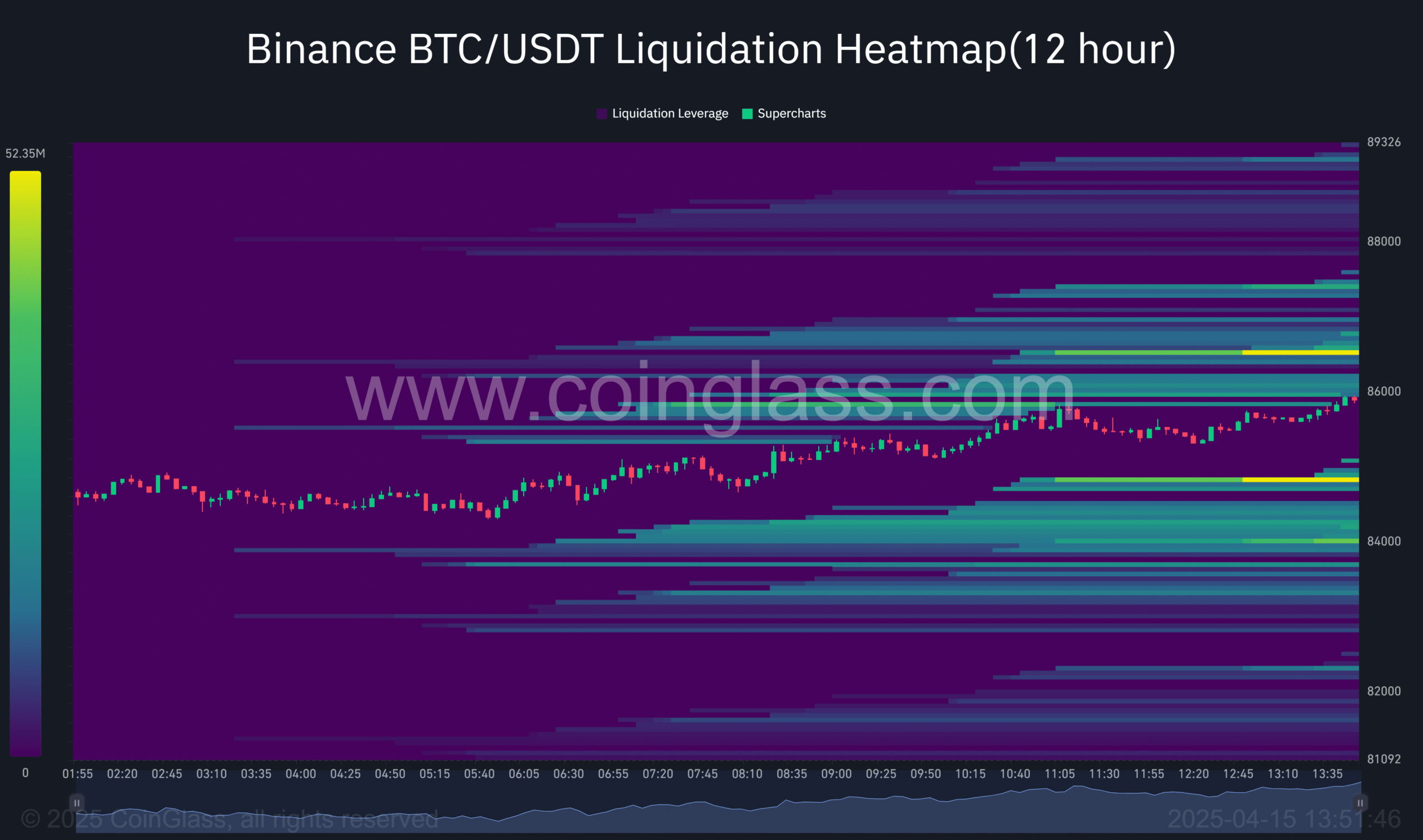

- Bitcoin could approach a key liquidity zone around $ 86,000, where 77% of liquidation levels are long

- A classic configuration could form where overcrowded positions are used before a potential reversal

Take a step back to examine the weekly Bitcoin structure. The high feeling of the PUD which has weighed on its recent price action could ensure, the BTC constantly closing daily candles to an average of $ 82.60,000 – a sign of underlying supply.

In particular, the relative force index (RSI) seemed to be below overheated levels, which suggests that the momentum always has room to develop without triggering an immediate profit.

Supporting this bullish undercover, all exchanges recorded net outings of 35,758 BTC on April 11, at the price of $ 83,403 per BTC – A signal of strategic accumulation manual.

Together, these signals refer to the emergence of potential background formation. The one where an increasingly solid demand wall can absorb the pressure of the sale and the risk of decreasing the ceiling. At least theoretically.

However, from the point of view of liquidity, the image could be less reassuring. A significant liquidity group was formed above the press prices levels. Depending on Ambcryptto’s analysis, this could create a high -risk configuration for downward liquidity scanning.

In short, does that prepare the ground for a bull trap?

Market manufacturers that exploit long overcrowded positions

At the time of the press, Bitcoin came closer to a key liquidity zone nearly $ 86.50,000. However, there seemed to be signs of weakness below.

Source: Coringlass

The positioning of the retail length has been relatively low, with Bid-Ask ratios in the negative to report the request for discoloration. In addition, the open interest (OI) indicated a lack of new capital entries to support the movement.

More crucial, 77% of the liquidation levels grouped around this liquidity zone were long positions. Consequently, this group of liquidity could act as a magnet, which potentially triggered a downward scan as market manufacturers capitalize on forced liquidations.

In fact, this level also represents the Alpha price zone, a key area which has historically acted as support and resistance. There is a risk that Bitcoin could briefly exceed this level, only to fall back – by creating a bull trap.

Bitcoin needs difficult data supported by real conviction

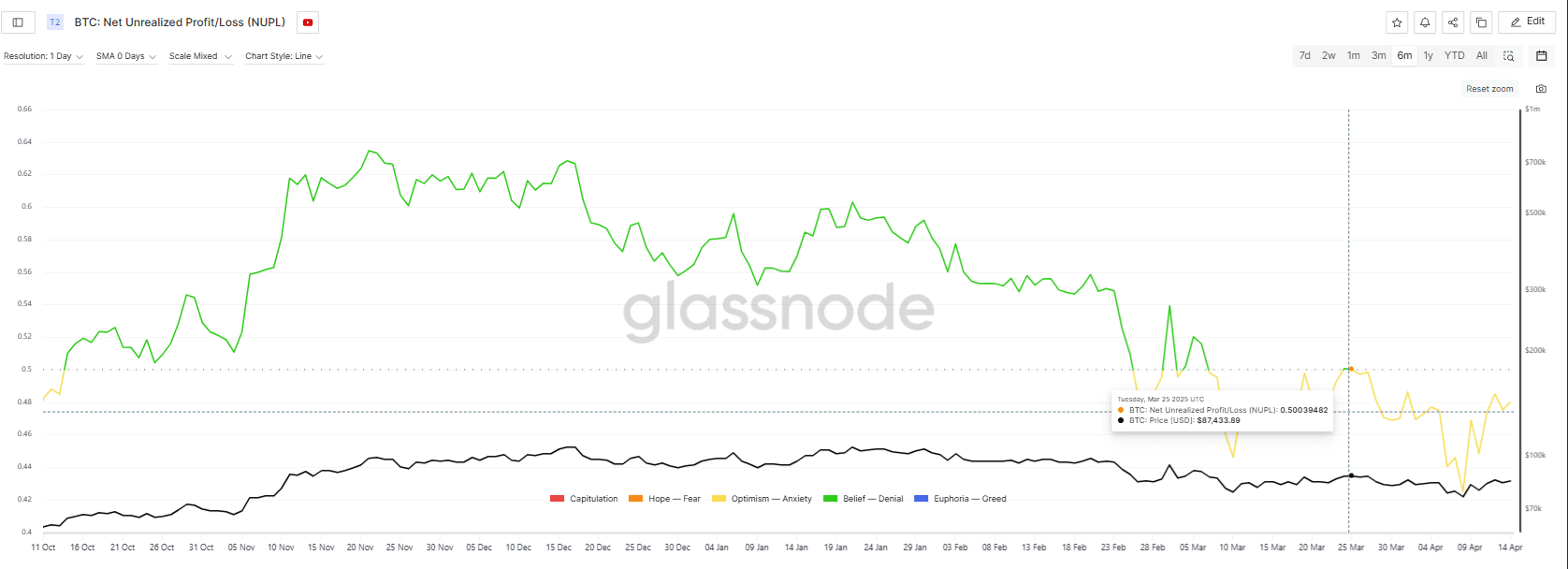

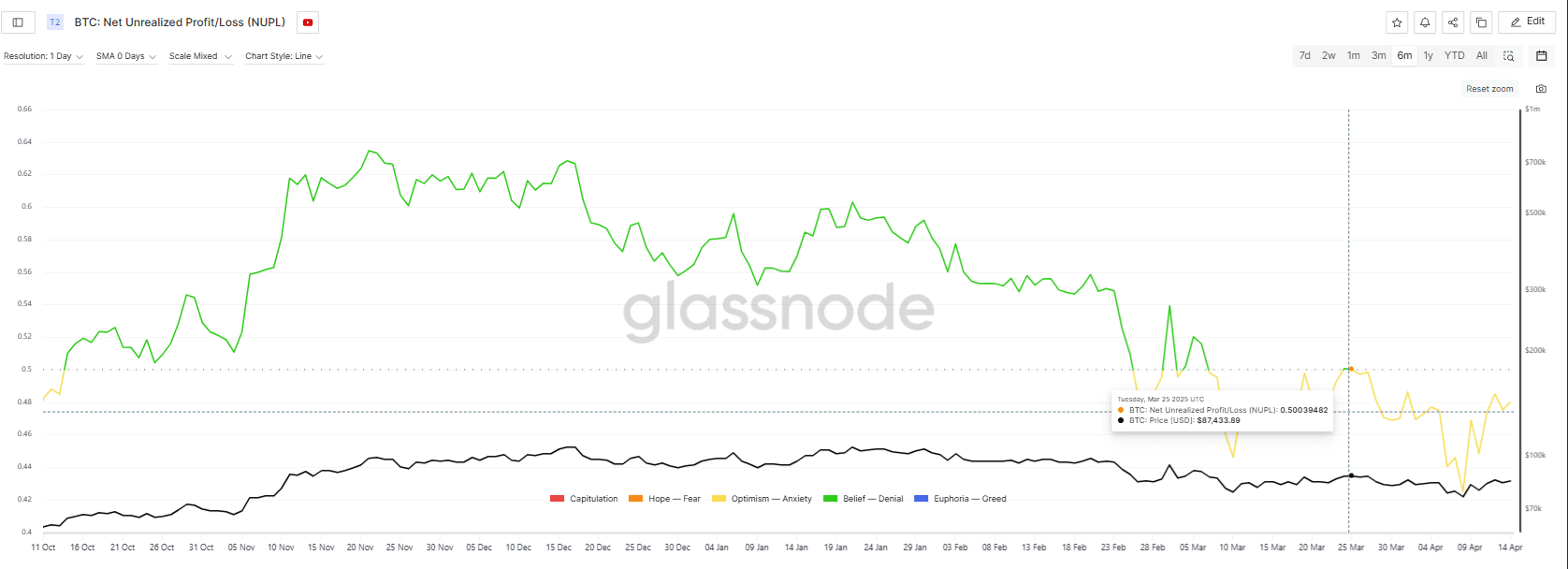

The NEPPL metric (net net not realized Brit / Persia) reveals the current erratic action of the state of the BTC.

Since March 07, he has remained in the “optimism” phase. This has suggested that a large part of the market is in unrealized profit, with major holders who are probably accumulating.

However, whenever BTC addresses the area from $ 86,000 to $ 87,000, the NUPL turns into “anxiety”, showing that an increasing number of market participants are starting to feel uncomfortable about their unrealized earnings.

This change suggests that the benefits, although not yet made, are under pressure and could soon be removed from the table.

Source: Glassnode

For example, on March 25, Bitcoin briefly recovered $ 87.5,000. However, before the Nupl could enter the belief phase, he overturned in anxiety. This pointed out that market players carried out or hid more and more against unpaid profits.

As Bitcoin revisits this area, a similar scheme could reduce the nude lower, signaling a change in feeling of the market.

Consequently, with 77% of the liquidations concentrated in long positions around this critical liquidity group, a downward sweep could be triggered. This would lead to forced liquidations, which could lead to a lower BTC.

Unless Bitcoin is decisively leaving this structure linked to the beach, the risk of additional volatility and liquidation cascades remains high. This will leave the market vulnerable to a lower leg.