Join our Telegram Channel to stay up to date on the coverage of information on the breakup

The Avalanche Foundation is in advanced talks to launch two cryptographic cash companies in the United States as part of a billion dollars fundraising.

It is according to a financial report according to which an agreement, led by Hivemind Capital with Anthony Scaramucci of Skybridge as an advisor, aims to collect up to $ 500 million through a company listed at the NASDAQ.

Another increase of $ 500 million is scheduled via a special -used acquisition vehicle supported by Dragonfly Capital, according to the report, citing two sources familiar with the issue. History said Transactions are expected to conclude in the coming weeks.

The two companies will then buy millions of Avx, which is the native token of the avalanche blockchain, at a reduced price, according to the report.

Analysts warn cryptographic cash companies are in danger

Avox Treasury’s plan comes as analysts warn that digital asset cash companies (DATS) are faced with the risks of the drop in crypto and stock prices that compress premiums and make fundraising more difficult, according to the report.

The New York Digital Investment Group (NYDIG) warned in a September 5 report that “a jumped driving can be in advance” for dats, because mergers and financing transactions risk a “substantial sales wave” of shareholders.

He noted The anxiety of investors in the face of unlocking to come and has declared that the issue of shares, taking advantage and increased limited differentiation strategies could all be the cause of bonuses.

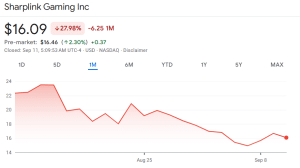

Sharplink Gaming, the second largest company holder in Ethereum (ETH) in the world, saw his The share price dropped by more than 27% in the last month, according to Google Finance data.

Sharplink gaming action price (Source: Google Finance))

Bitmin Immersion Technologies (BMNR) has tumbled more than 22%, while the strategy (MSTR) has whispered more than 18%.

Still bullish avalanche community on the plans of Avx Treasury

However, the avalanche community seems to have responded positively to the Avox Treasury plans.

In the past 24 hours, Avx’s price has climbed more than 7% to negotiate at 5:20 a.m. according to to CoinMarketCap data. This added to positive weekly crypto performance, increasing the 7 -day Altcoin gain to 16%.

Daily Graphic Avx / USD (Source: Geckoterminal))

Looking at Avox’s daily graphic, the crypto managed to get out of a medium -term consolidation channel between $ 22.92 and $ 26.05.

This opened an opportunity for the price of Avx to try a challenge at the resistance of $ 29.52. Cleaning this technical barrier could lead to a continuous rise up to $ 32.74 in the short term. Adding to upward perspectives is the potential purchase pressure of the above -mentioned dats.

Looking at the indicators of the daily graphic, Momentum always seems to be in favor of the bulls. The line of divergence of Mobile Average Convergence (MacD) stands out above the MacD signal line, which is a classic sign of strengthening upturn.

In addition to this, the shorter exponential mobile average (EMA) is positioned above the 20 EMA. The two EMAs also increase and act as dynamic support levels for the price of Avx.

Finally, the relative force index (RSI) has increased in recent days and shows that there is still room for Avx to increase before it seizes over the surachat conditions.

Related items:

Best wallet – diversify your crypto wallet

- Easy to use cryptographic wallet, easy to use

- Get early access to ICO to toys to come

- Multi-chaînes, multi-walk, non-guardians

- Now on the App Store, Google Play

- Pape to win the native token $ the best

- 250,000+ monthly active users

Join our Telegram Channel to stay up to date on the coverage of information on the breakup