- AVAX surged 100% after the breakout, with analysts eyeing $60.

- On-chain growth accelerated as AVAX hit $43.03, with support at $38.57 critical for December gains.

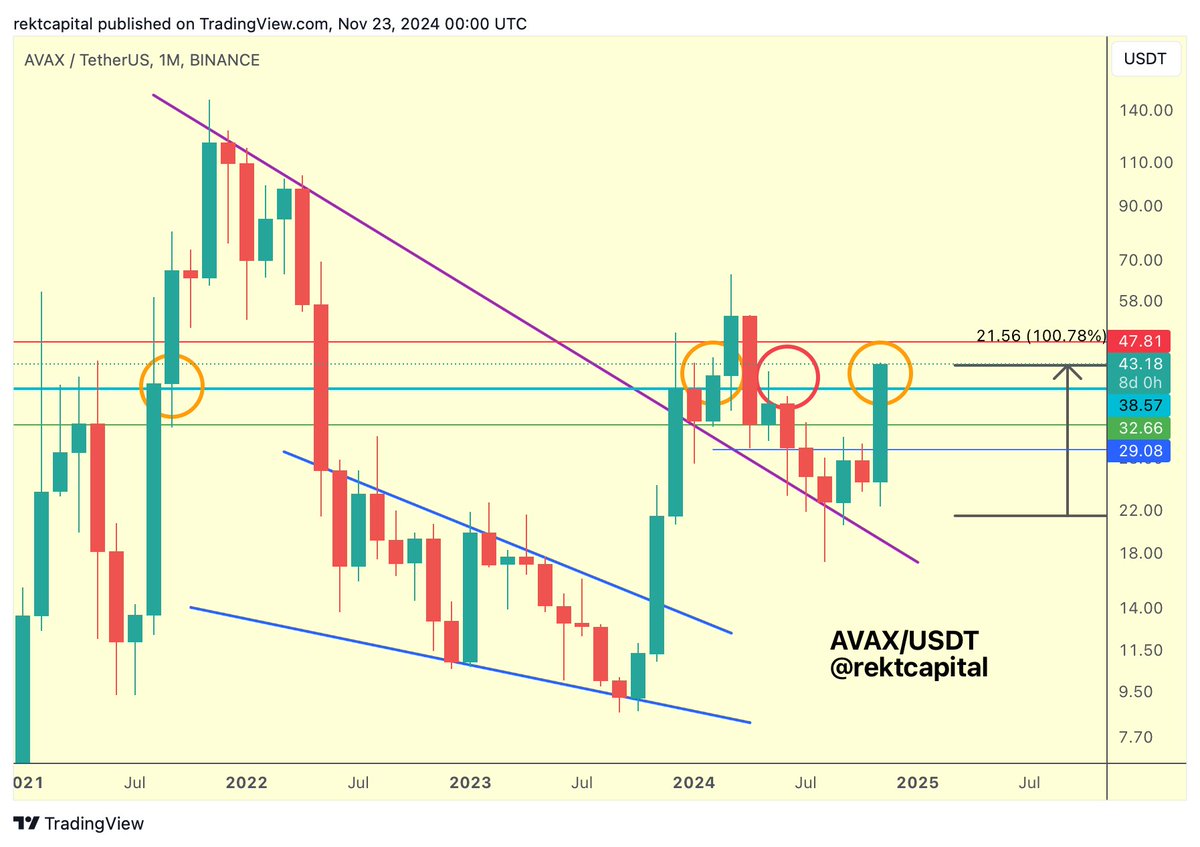

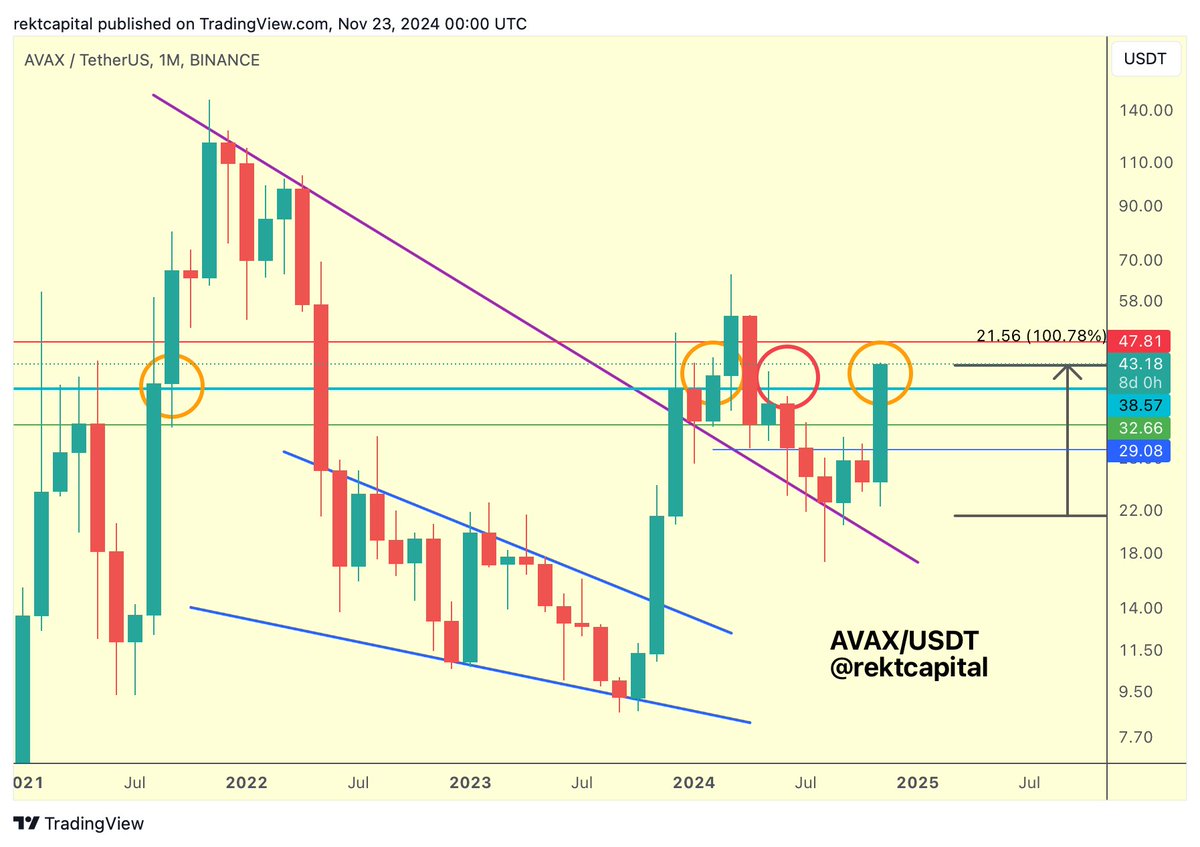

Avalanche (AVAX) gained momentum, doubling its price after a critical breakout of its long-term macro downtrend.

As the market looks for signals of continued growth or potential pullback, traders closely monitor key levels to determine the coin’s next move.

AVAX double fortune

Avalanche price rose from around $21.56 to a recent high of $47.81 after successfully breaking through a downtrend macro trendline and retesting it as support.

The breakout was followed by strong bullish momentum, allowing the cryptocurrency to double in value in a few weeks.

The November monthly candle closed above a critical support level of $38.57, reinforcing buyers’ control at this price level.

Analyst Rekt Capital has identified this level is a key area to maintain bullish momentum, suggesting that holding above $38.57 through December could pave the way for further price increases.

Support at $38.57 and resistance at $47.81

Market participants are monitoring the $38.57 support level, considered the basis for continued price growth.

The resistance levels at $43.18 and $47.81, however, presented challenges to buyers as the latter aligned with historical price rejection zones.

Source:

If AVAX manages to maintain its position above $42.81 in the near term and clear $47.81, analysts believe the next major upside target of $60 could come into play.

This level has psychological significance and reflects the continuation of the upward trend observed in recent weeks.

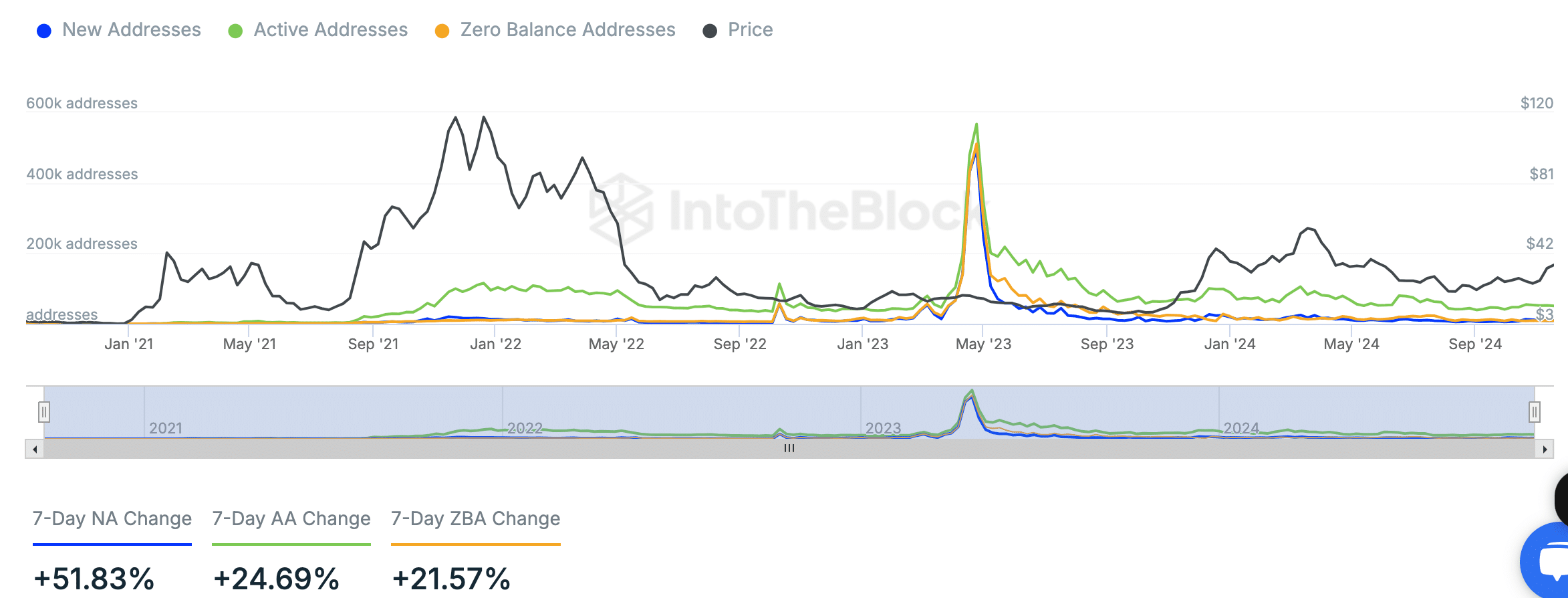

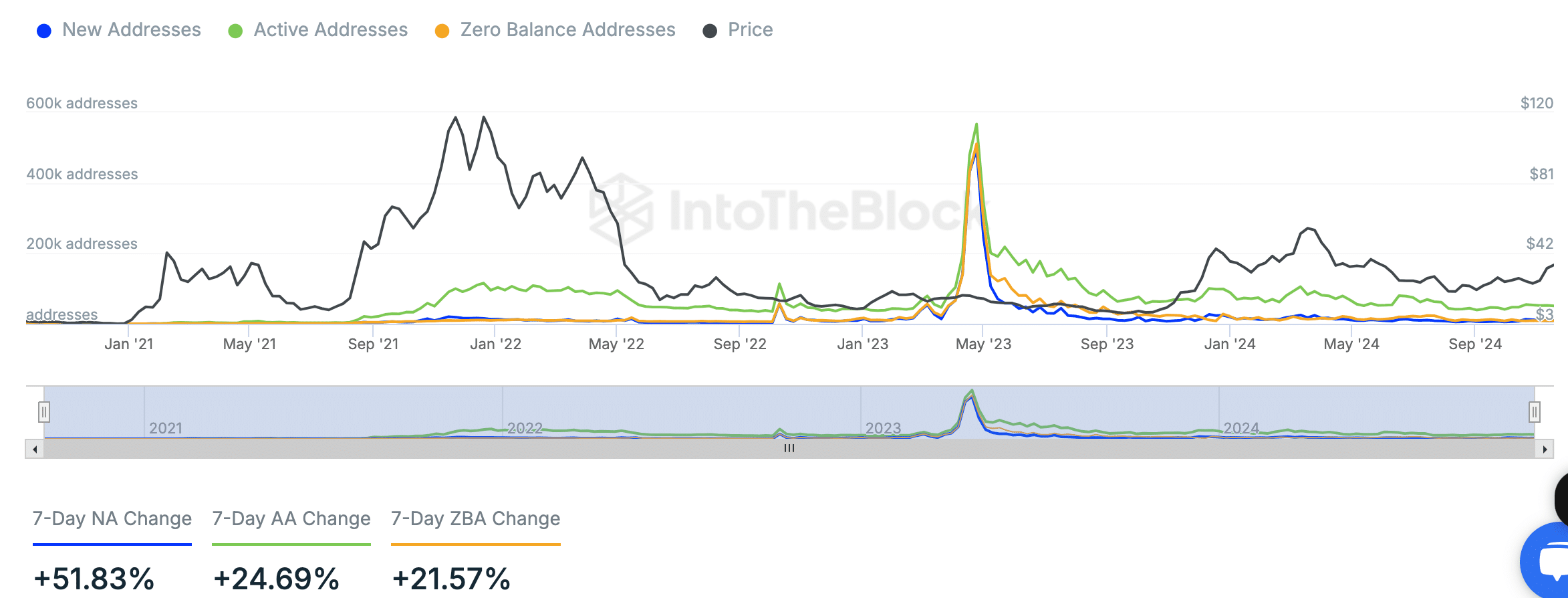

On-Chain Metrics and DeFi Activity

On-chain data showed a sharp increase in user activity on the Avalanche network. Over the past seven days, new addresses increased by 51.83%, while active addresses increased by 24.69%.

Additionally, zero balance addresses saw an increase of 21.57%, indicating growing adoption.

Source: In the block

Avalanche’s total value locked (TVL) also saw a 9.09% increase over the past 24 hours, now sitting at $1.443 billion, according to DeFiLlama.

Stablecoin’s market capitalization was $1.955 billion and the platform recorded $75,998 in daily fees and revenue.

This suggests increased ecosystem engagement alongside rising prices.

Withdrawal remains possible

Technical indicators, such as Bollinger Bands, showed AVAX trading above the upper band, indicating increased volatility and overbought conditions.

A pullback towards the 20-day SMA at $32.70 could occur if the upward momentum slows.

Source: TradingView

Read Avalanche (AVAX) Price Prediction 2024-2025

The MACD confirmed positive momentum, with the MACD line moving away from the signal line and the green histograms extending.

However, traders are wary of over-extension, as histogram spikes often precede consolidations or short-term corrections.