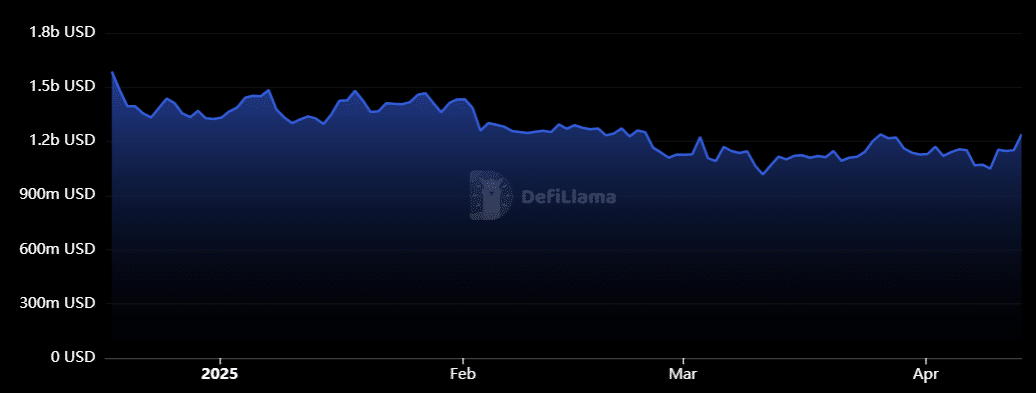

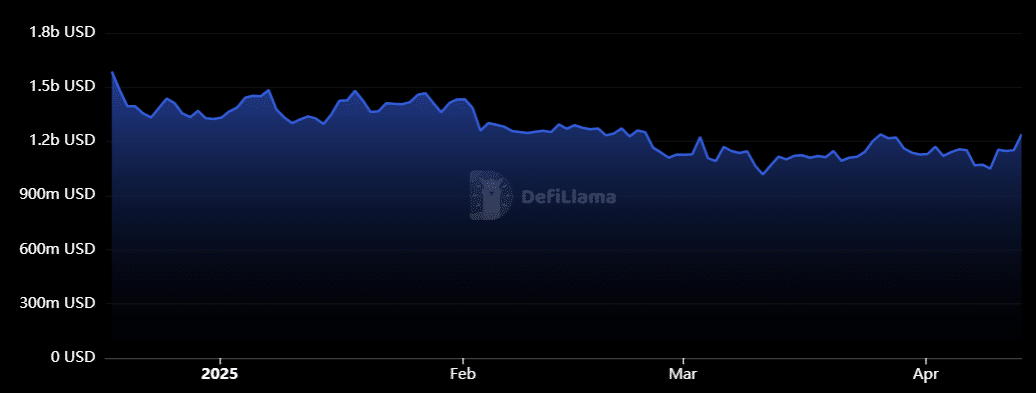

TVL rebounds after a decrease of three months

The avalanche TV showed a notable rebound in April, backing over $ 1.2 billion after a persistent decrease trend since early January.

The graph reflects a clear drop of more than $ 1.5 billion at the beginning of 2025 to less than $ 1.1 billion by the end of March, reflecting the broader feeling of risks on cryptographic markets.

Source: Defillama

However, the recent increase suggests a change in momentum – probably pulled by the increase in AVAX prices, user incentives and protocol reactivations.

Although still below the levels of T4 2024, this rebound marks the first sign of sustained recovery and could point out a turning point.

Avax Eyes $ 30, but the resistance is looming

At the time of the press, Avax was negotiated at around $ 20, recovering from the bottom of March nearly $ 16.

Technically, the level of $ 30 remains a key psychological and structural resistance – tested for the last time in early February 2025 and again during multiple refusals in mid -2024.

Source: tradingView

The graph indicates that Avax is emerging from its short -term trend. However, for a decisive movement towards the $ 30 mark, the bulls must erase the resistance area between $ 24 and $ 26.

If Momentum holds and Avox firmly recovers the level of $ 26, a thrust around $ 30 becomes feasible. That said, a short -term consolidation period is likely before any potential break.