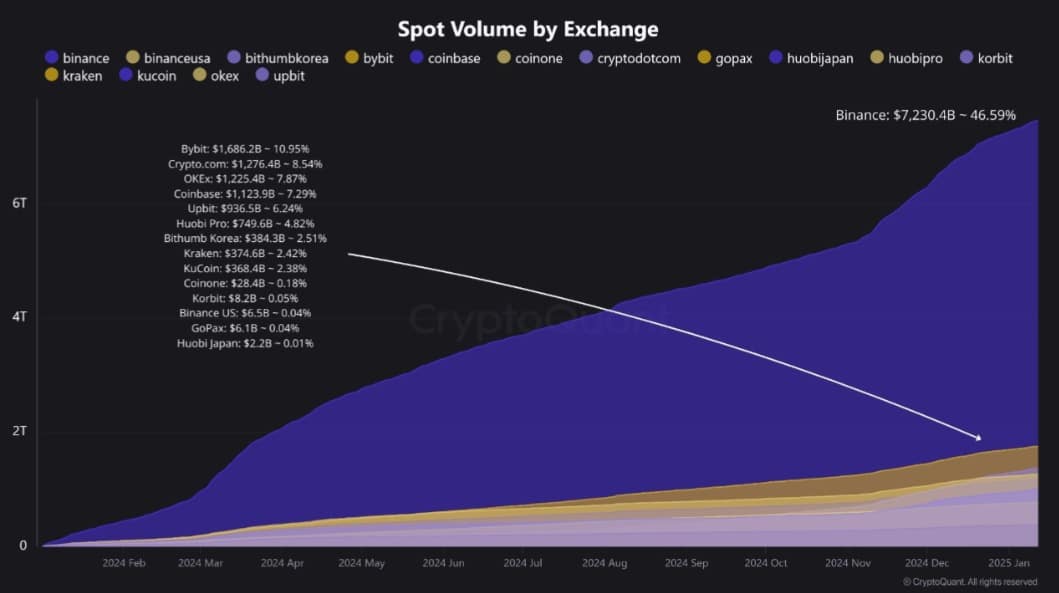

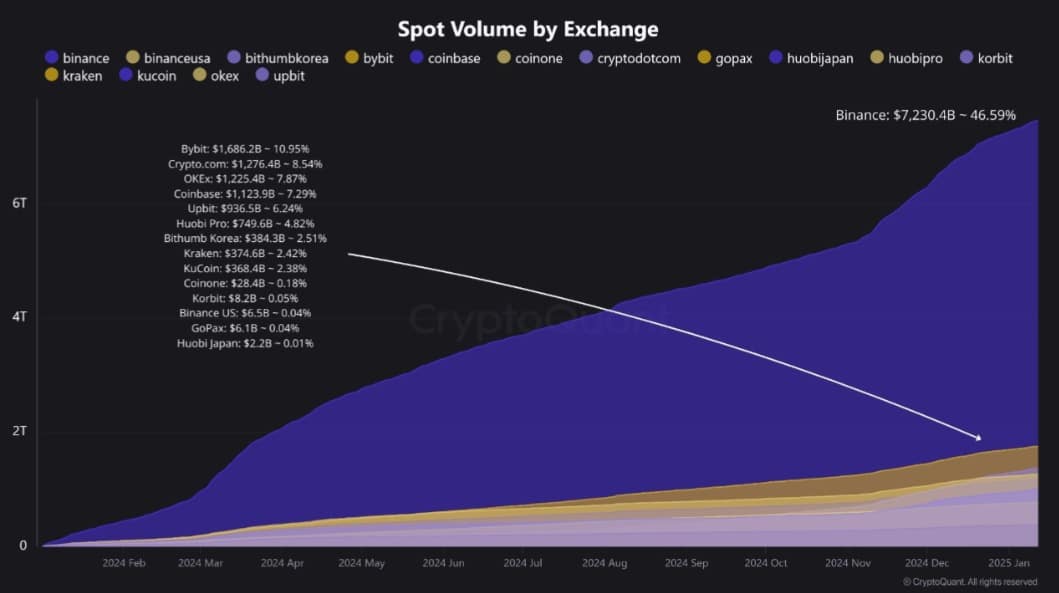

Binance’s cumulative spot volume reached $7.23 trillion in 2024, accounting for 46.59% of the total market share.

- Binance’s cumulative spot volume reached $7.23 trillion in 2024.

- BTC investors on the stock market remained bullish through 2024, pushing prices to all-time highs.

As the cryptocurrency market sees steady growth throughout 2024, Binance has become the most prominent cryptocurrency exchange.

During this period, the crypto exchange dominated the market, reflecting the market’s continued confidence in the platform.

According to CryptoQuant analysis of cumulative spot volume by exchange in 2024, exchanges have played a vital role in the continued growth and development of the market.

Binance Market Dominance

According to the CryptoQuant report, Binance has become the most dominant exchange platform.

As such, Binance recorded a cumulative spot volume of $7.23 trillion in 2024. This represented 46.59% of the total market share.

Source: CryptoQuant

Compared to other leading exchanges such as Bybit, Crypto.com, OKEx, and Coinbase, Binance accounted for 34.65% market share, reflecting an 11.94% lead over these competitors.

With the exchange’s market share increasing, this suggests that a significant portion of Bitcoin’s liquidity and price movements occur on Binance.

Therefore, Binance’s performance is directly correlated to BTC’s price movements, stability, and trends, given its high trading volume on the platform.

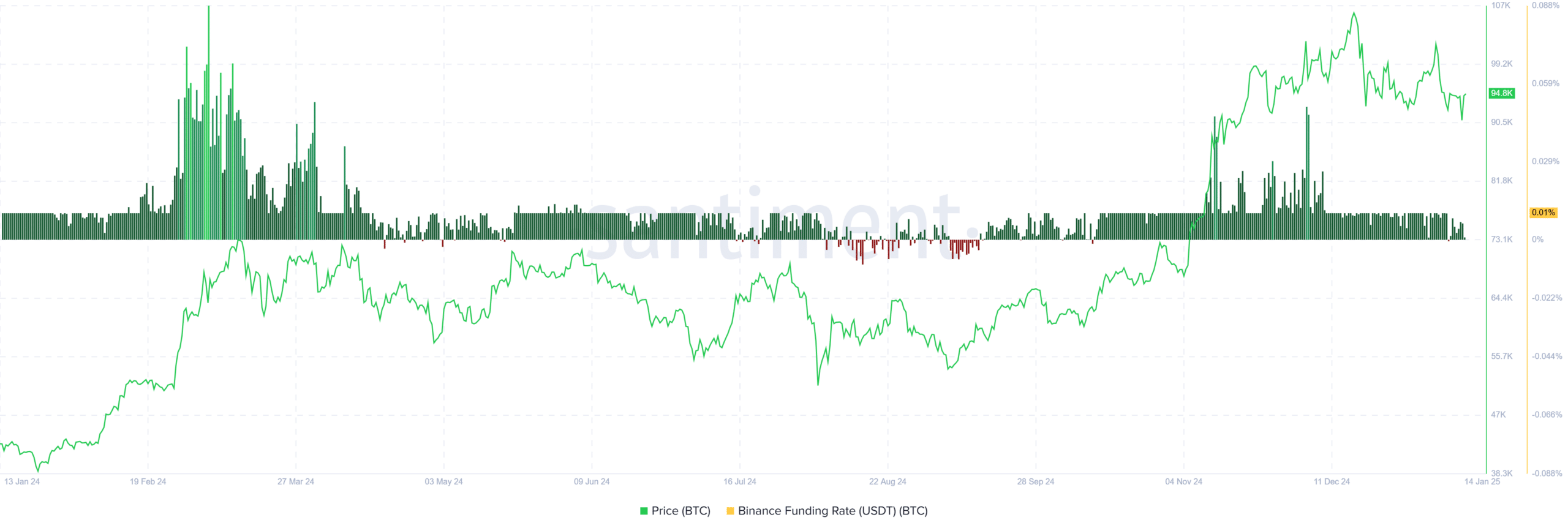

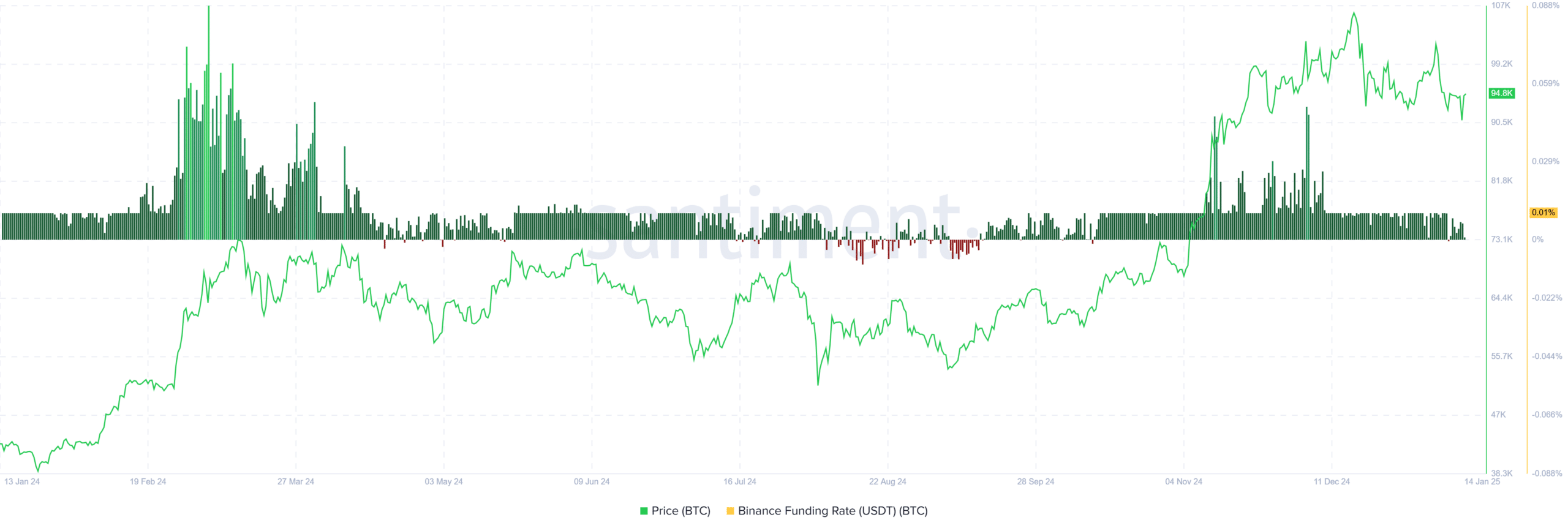

What this means for BTC

Since Binance is the dominant crypto exchange, investor sentiment on the platform reflects general market sentiment.

According to AMBCrypto’s analysis, the exchange’s market share has been growing steadily, but investors have been mostly positive towards Bitcoin.

Throughout 2024, BTC investors on Binance have shown optimism, pushing prices to all-time highs.

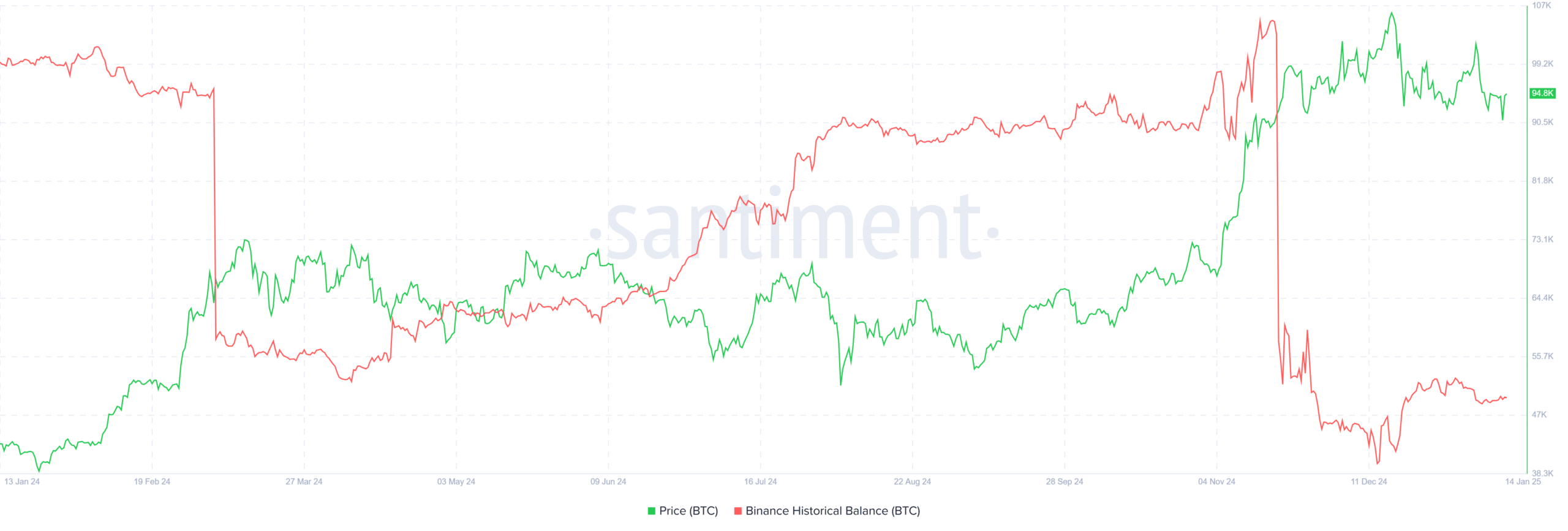

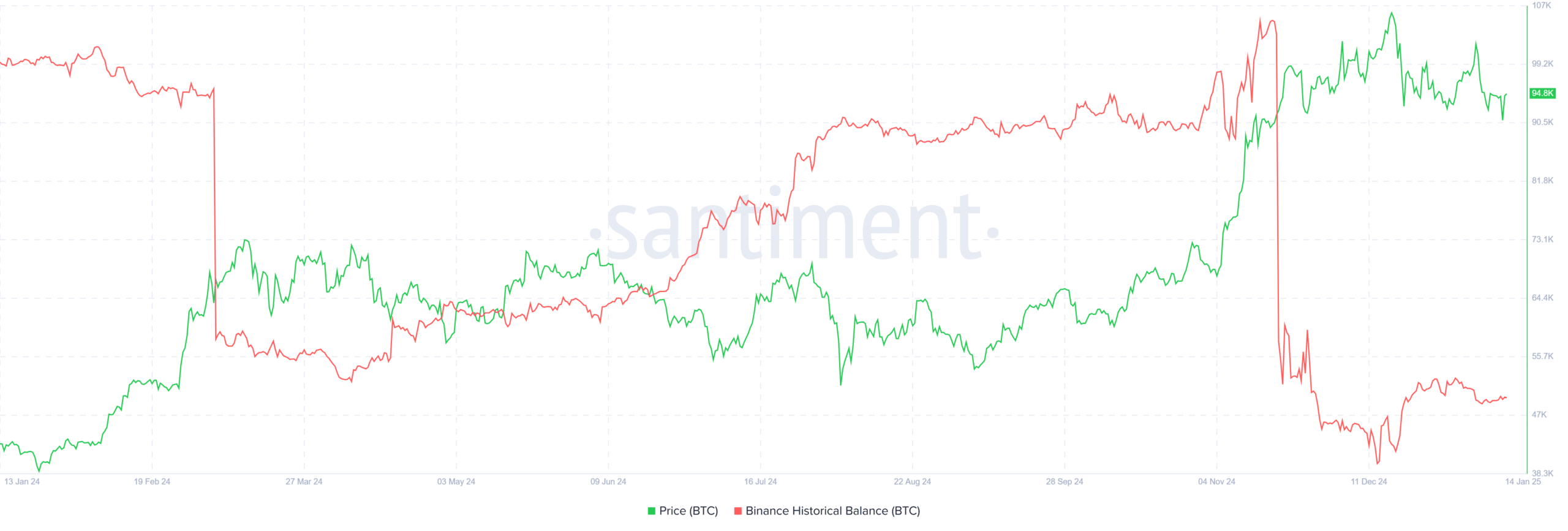

Source: Santiment

This bullish sentiment is highlighted by a positive Binance funding rate. Over the entire year 2024, 10 months recorded a positive funding rate, with the exception of October and September.

When the funding rate remains largely positive, it suggests that investors are optimistic and willing to pay a premium for long positions, reflecting their optimism about future price developments.

Source: Santiment

Additionally, Binance’s historical BTC balances saw a sharp decline through November 2024. This decline suggests that investors are accumulating BTC as they withdraw more assets from the exchange to their personal wallets.

Historically, changes in the exchange’s BTC balances have always affected prices. For example, when it fell to its yearly low, BTC reached an all-time high (ATH) of $108,000 in November 2024.

A similar trend was seen in March 2024, when BTC reached $70,000 for the first time. Conversely, an increase in Binance balances caused prices to fall, such as in August 2024 when prices fell to $49,000.

Read Bitcoin (BTC) Price Prediction 2025-26

In conclusion, Binance’s growing market dominance has had a significant impact on the crypto market. As the exchange saw massive growth, BTC investors’ optimism towards Binance pushed prices to new ATHs.

With favorable conditions, Bitcoin is well-positioned to make more gains. As such, we could see BTC reclaim $96,700 if traders remain bullish on the exchange.