Binance, the largest crypto exchange in the world, decided to reject a trial of $ 1.76 billion filed by the succession of the FTX of the succession.

In the court documents filed on Friday May 16, Binance maintains that the complaint lacks merit and indicates that the court does not have jurisdiction over the case.

Binance believes that the FTX legal team is trying to divert responsibility for the founder of the FTX, Sam Bankman Fried

In last week’s judicial files, Binance declares that the legal team representing FTX wrongly depicts Binance and its co -founder, Changpeng Zhao, such as the brains of a program aimed at undermining the now disappeared exchange.

Binance filed the court documents with a Delaware judge at the end of last week. In them, the exchange says that FTX simply tries to pass responsibility for its collapse on another part.

Binance believes that the FTX legal team takes this path to avoid holding the former CEO Sam Bankman Frit responsible as a chief conspirator. Bankman Fried was sentenced to 25 years in federal prison last year during a long -standing case that prosecutors have described as “one of the biggest business fraud in history”.

The $ 1.76 billion clawback dispute has a lot of history behind. It started with a transaction in 2021 in which FTX bought a 20% stake that Binance owned in the company.

This acquisition was complex because it involved a mixture of digital assets, including BNB, Busd and native token of FTX, FTT. Around November 2022, with swirling rumors of financial instability within the FTX at that time, CZ went to X, declaring that Binance would unload his FTT assets.

Discover: Top 20 crypto to buy in May 2025

FTX Estate thinks that CZ’s public comments caused its fall

It is there that the FTX domain says that Binance and CZ played a decisive role in the collapse of the FTX, because they maintain that the public comments of the CZ caused a cascade of withdrawals which put the nail in the coffin for the exchange.

Binance’s reconvention request indicates that FTX continued to operate for more than 16 months after this takeover transaction in 2021, and the trial has not proven that the declarations made by CZ were false.

As a last point, the Binance legal team argues that the court lacks personal jurisdiction, declaring that Binance has its registered office outside the United States and that the CZ was not directly involved in the sale of buyout.

This long -standing legal battle is part of the broader efforts in the FTX domain to recover funds for its creditors. More than $ 11 billion is due to the victims of the collapse of the FTX. There are strong reports that the recovery succession plan will start significant distributions from creditors on May 30.

The entire cryptographic community will monitor market reaction on May 30. After a multi -year legal debacle, many investors will finally be reimbursed, which could lead to the reintegration of billions of fresh liquidity on the markets.

Many creditors reimbursed in June are experienced merchants and unlucky investors so that their funds are taken in the collapse of the FTX.

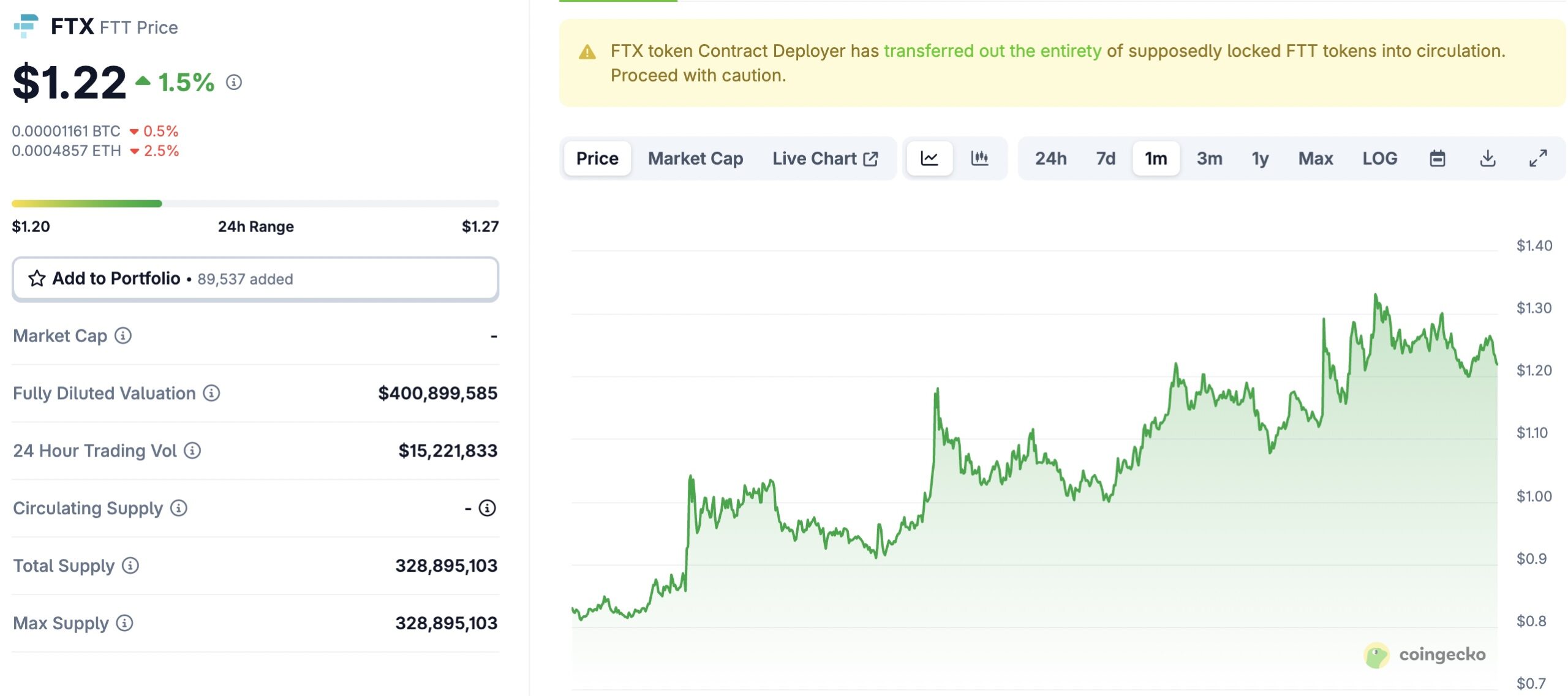

Surprisingly, the FTT token increased 1.5% per day, currently negotiating $ 1.22. According to Coingecko, it still has a market capitalization of $ 400 million while having no use. More surprising is its volume of negotiation, dealing with more than $ 15 million in the last 24 hours.

(Coingecko)

Explore: Top Solana Same Coins to Buy in 2025

Join the 99Bitcoins News Discord here for the latest market updates

The post-binance binance post was the drop in the trial of $ 1.76 billion in FTX appeared first on 99Bitcoins.