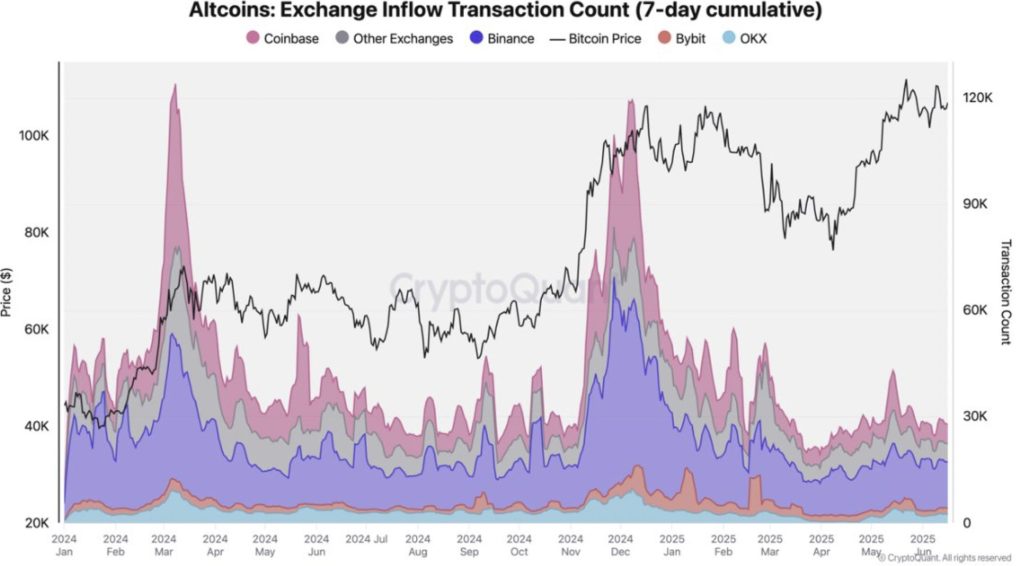

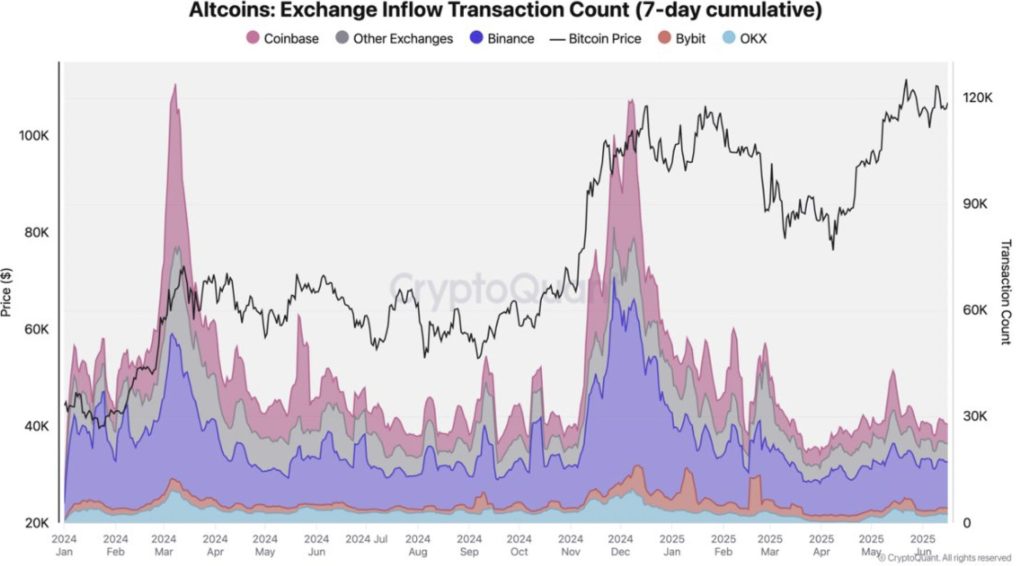

Binance continues to assert itself as the first exchange for Altcoin trading, leading the market in the Altcoin deposit activity, according to a new report by the cryptotic chain analysis company.

At the top of the Altcoin rally from November to December from last year, Binance managed up to 59,000 deposits in a single day – more double corner of 26,000 and well above the total of the other 24,000 combined exchanges.

Even in quieter market conditions, Binance maintains its advance, with an average of around 13,000 Altcoin ignition transactions per day. On the other hand, Coinbase has an average of 6,000 and other platforms on average around 10,000.

Altcoin inputs generally increase in the wake of solid market gatherings, suggesting that traders move assets on exchanges to lock profits. These peaks often coincide with local price peaks and the increase in speculative activity, reports the cryptochus.

The sustained domination of Binance’s entries is due to its large Altcoin and deep liquidity offers, which makes it the favorite destination for retail and institutional traders during increased market dynamics.

Stablecoin activity on Ethereum Favors Binance

Binance also has a dominant position in Stablecoin inputs on the Ethereum network, in particular in transactions involving USDT and USDC, reports cryptocurrency.

During a recently observed period, Binance received around 53,000 stablecoin transactions based on Ethereum, compared to 42,000 for Coinbase, 28,000 for Bybit and only 11,000 for OKX. This trend demonstrates binance status as the main entry point for the capital labeled in dollars entering the cryptography market via Ethereum.

Stablecoin entries are often considered as a precursor to the increase in commercial activity, as they represent the capital stationed on scholarships against a potential deployment.

The domination of Binance in this segment indicates a strong confidence of traders and investors, further strengthening its essential platform position for liquidity and execution.

TRON network data also confirms Binance’s Edge

The trend extends to the Tron network, where binance systematically receives the highest volume of USDT deposits. In the last seven days only, Binance recorded around 384,000 USDT entry transactions, exceeding the use of 321,000 and HTX with 163,000.

With its low costs and rapid transaction times, Tron has become the essential rail for moving stablescoins. Most of this traffic is found in Binance, showing how firmly the exchange has positioned in the trading of the Stablescoin.

Cryptochant notes that exchanges with the dominant stable entries are often positioned to benefit from an increase in the volume of negotiation and user confidence.

Binance’s coherent advance in Ethereum and Tron networks confirms its central role in the world liquidity of cryptography and capital allowance.

The post-binance binance leads in the Altcoin and Stablecoin deposits through ETH and Tron: Crypttoier appeared first on Cryptonews.