- Binance volume has reached $1oo trillion.

- Market indicators showed that BNB experienced positive market sentiment.

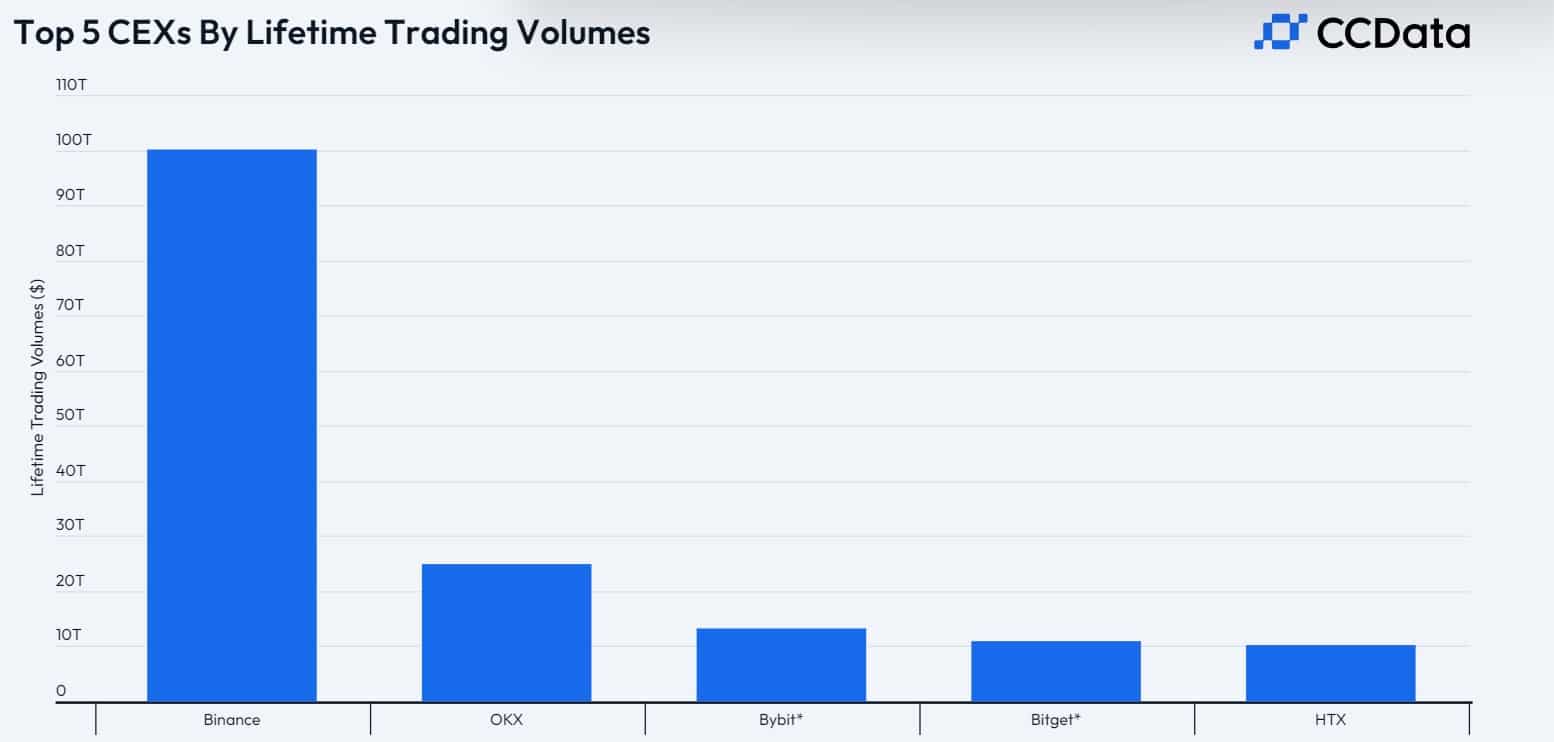

According to CCData, Binance reached historic highs by becoming the first CEX to reach $100 trillion in trading volume. This volume includes derivative markets and spots.

Source: CCData

In doing so, the stock market positioned itself at the top of all other stock exchanges. Such massive growth reflects the expanded reach of exchanges and the influx of capital into the crypto market.

Other exchanges such as OKX have also made significant gains. As such, OKX has become the second largest exchange, with a lifetime trading volume of $25 trillion.

Bybit was third on the list with $13.2 trillion, followed by Bitget with a trading volume of $10.9 trillion.

An impact on BNB?

As Binance continues to grow and dominate the markets, investor attention is turning to its native coin, BNB.

The altcoin saw a moderate decline in its price charts. At the time of writing, BNB was trading at $595, down 0.30% over the past day.

Prior to this, BNB was on an upward trajectory, increasing by 3.63% over the past week. Additionally, the altcoin gained 3.42% on the monthly charts.

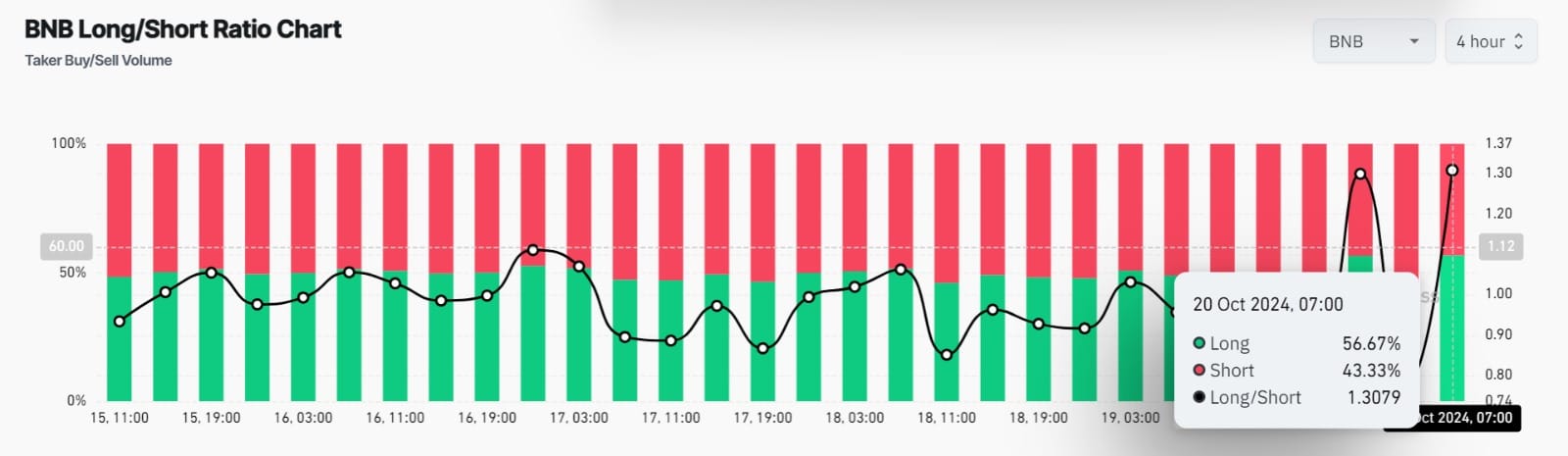

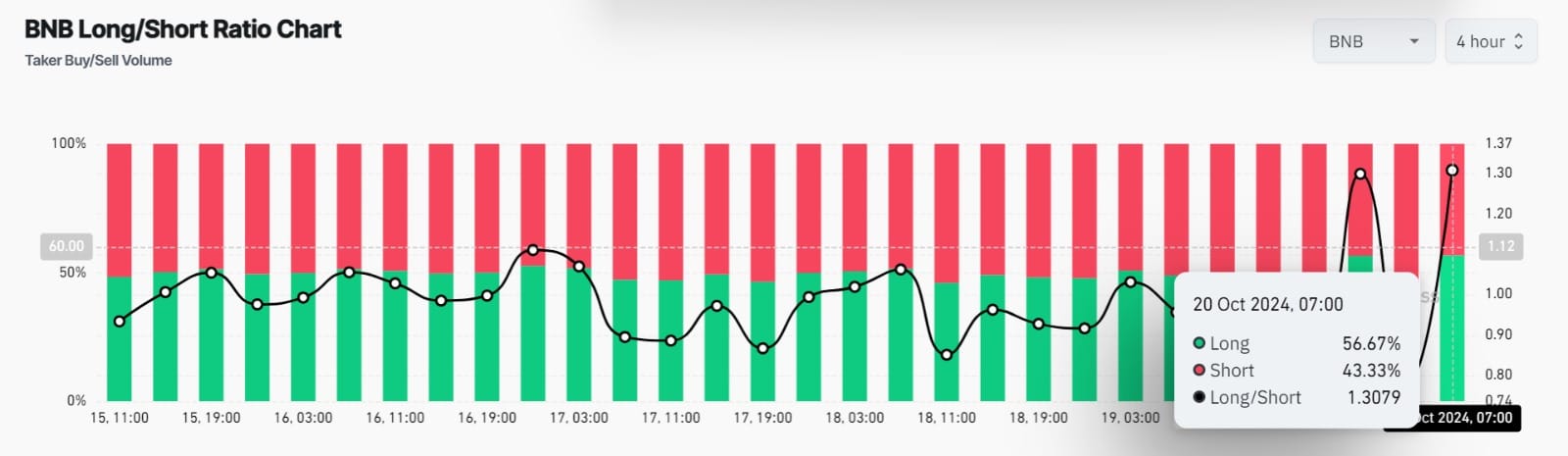

Despite the daily decline, Binance still enjoys overall positive market sentiment.

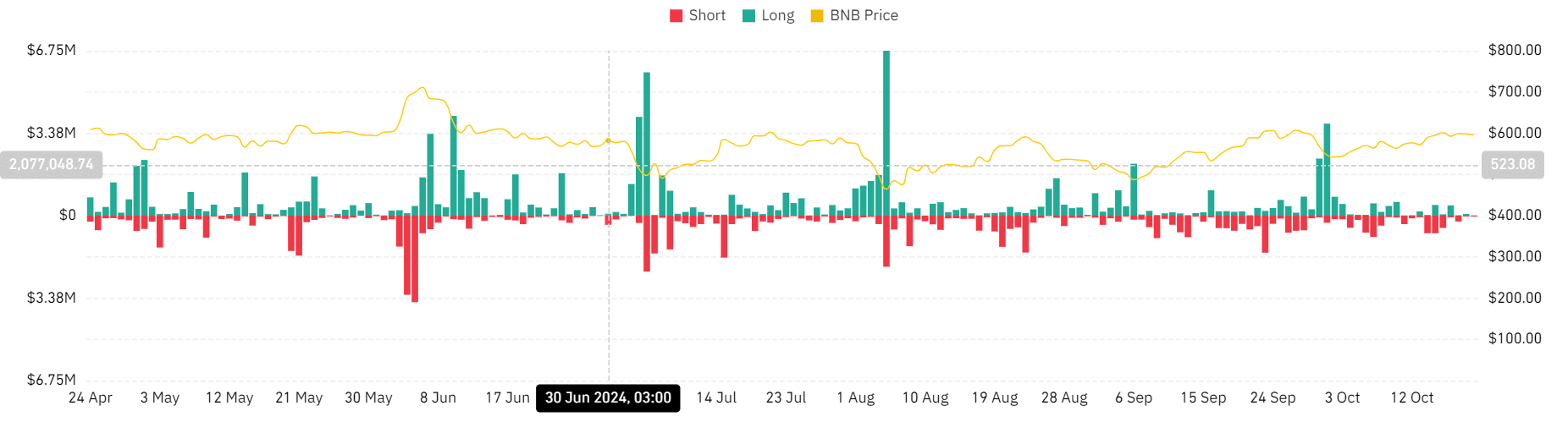

Source: Coinglass

For example, the altcoin’s Long/Short ratio was 1.3079 at press time, on a 4-hour time frame. This suggests that over the past few hours, most investors have taken long positions.

Therefore, long positions dominated the market as they anticipated a short-term price rise.

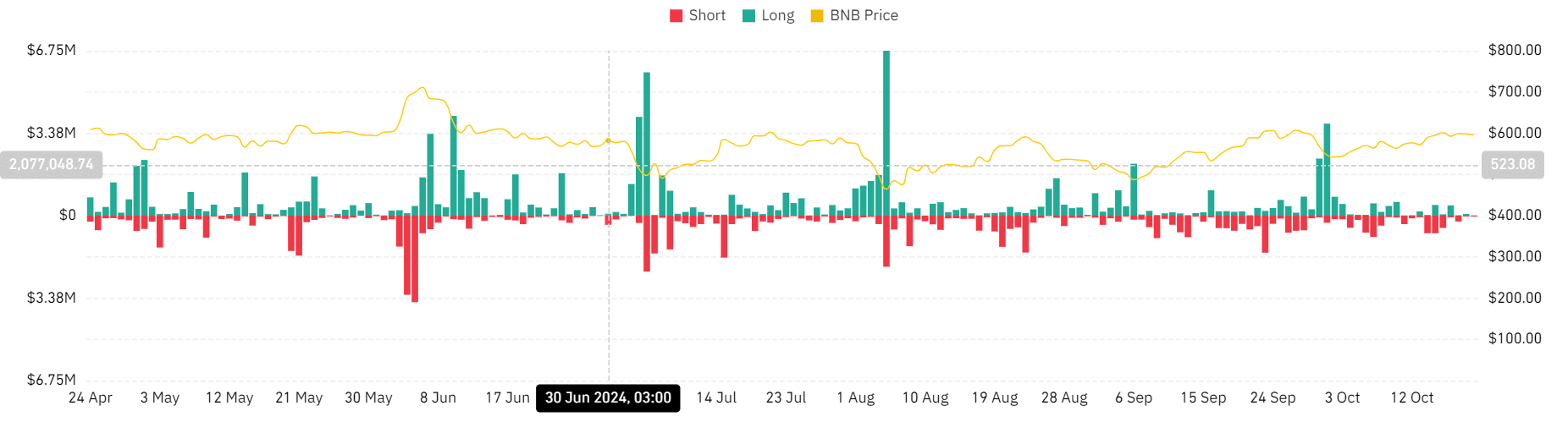

Source: Coinglass

This demand for long positions is further supported by the total number of liquidations, which have declined over the past week,

Additionally, liquidations of long positions decreased from $3.77 million to $14.37 thousand over the past three weeks. Such a drop suggests that even in a market downturn, long positions are paying short positions to maintain their trades.

Read Binance Coin (BNB) Price Prediction 2024-2025

Simply put, Binance’s volume surge to an all-time high has pushed BNB into favorable conditions. In the month that saw this rise, BNB also benefited from positive market sentiment.

If current conditions hold, BNB will attempt the next significant resistance level at $618.