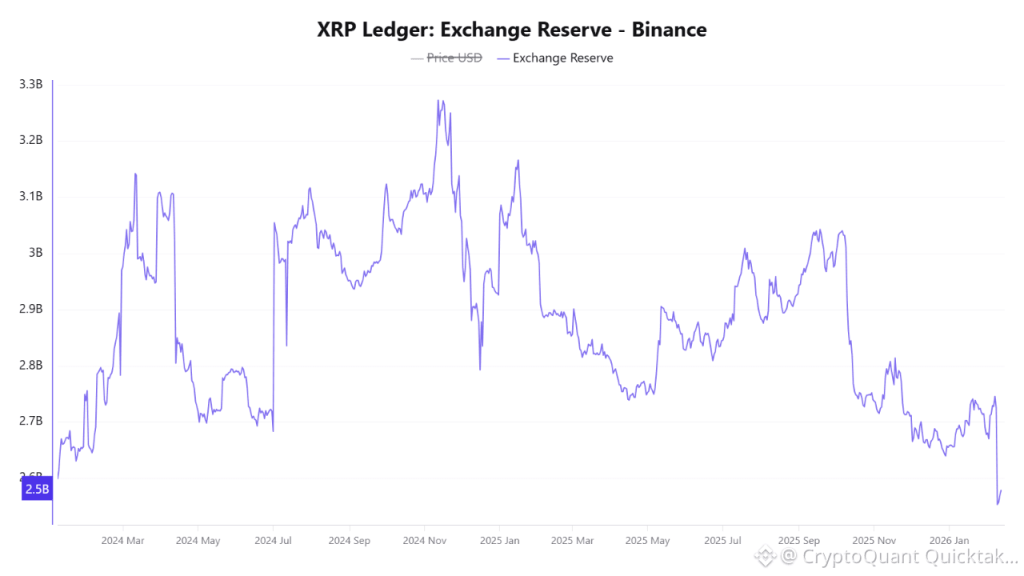

Binance reserves have fallen to levels not seen since early 2024, and the timing is interesting. As liquidity dwindles, the price climbed 4.5% to $1.50. This is not a coincidence that the market can ignore.

On-chain data is displayed Binance now only holds around 2.5 billion XRP. This is a notable pressure on the sales side. Less supply on exchanges generally means less immediate selling pressure.

And as sentiment slowly turns bullish again, this type of liquidity flight can quickly add fuel. When supply tightens and demand wakes up at the same time, things can move faster than expected.

- Binance XRP reserves have fallen to around 2.5 billion, the lowest point since early 2024.

- Nearly 700 million coins have left the exchange since November 2024, signaling a potential shift to cold storage.

- Analysts interpret the contraction in exchange rate balances as a classic accumulation signal which reduces selling pressure.

Is a supply shock imminent?

The change is not small. As of November 2024, Binance held approximately 3.2 billion XRP. This figure is now closer to 2.5 billion. That’s about 700 million tokens gone, or about 22% of the pile wiped from exchange wallets in just over a year.

Analysts say this type of decline usually signals tightening liquidity on the sell side. When coins leave exchanges, they are often placed in their own custody. This is generally a longer-term play, something that institutions and whales tend to do when positioning and not when trading.

What makes it more interesting is the timing. This reserve leak occurred just after Binance rolled out full XRPL support for RLUSD. Many expected a higher chain speed. Instead, XRP itself began circulating.

Less offer on exchanges. Stronger price reaction. This combination becomes difficult to ignore.

The short squeeze scenario

What happens next depends on financing rates. XRP funding recently hit a 10-month low, and historically, this type of reset has often occurred before strong rallies.

If shorts become crowded as FX supply continues to decline, a sharp break above $1.55 could trigger a sharp squeeze toward $1.80.

The setup also benefits from support from improving regulatory sentiment, particularly with Ripple’s leadership gaining visibility in Washington.

For now, $1.45 is the key level to watch. If the price holds while reserves continue to fall, that’s the kind of confirmation bulls want before aiming for new highs.

Post Binance XRP Reserves Fall to 2024 Lows as Traders Eye Accumulation Signal appeared first on Cryptonews.