The cryptography market has been faced in recent months because Bitcoin and Ethereum have broken below important support levels. Bitcoin broke below $ 110,000, while Ethereum also slipped less than $ 4,000. This The slowdown has triggered billions of liquidations And pushed the index of fear and greed in territory of fear.

However, data from the Sentora chain analysis platform (formerly Intothebloc) reveals that accumulation is underway. Despite the drop in prices, the exchange exits for both assets have remained strongly negative.

Related reading

Key weekly metrics

A prolonged drop postponed from the previous week saw the price of Bitcoin fall below $ 110,000 With growing sales pressure and lever -effect position liquidations. However, despite this net movement towards the decline, data on the chain illustrate an interesting different trend occurring below the surface of volatility. According to to the figures provided by The Sentora chain analysis platform, more than $ 5.75 billion in BTC, moved away from centralized exchanges during the week.

This outing, although small compared to periods of strong increased action, shows a persistent conviction of investors, Especially among some investors who could benefit and buy the decline.

Ethereum price movement during the same period was even more pronounced than that of Bitcoin. The price accident saw the first Altcoin decompose under the level of psychologically significant support of $ 4,000 and carry out areas briefly lower than around $ 3,850. However, despite the depth of this drop, the exchange flow data clearly indicates that the lower price action has not succeeded in detering the accumulation activity through the network.

More than $ 3.08 billion ETH left the scholarships during the week, which serves as proof of continuous desire among investors to regularly accumulate Ethereum, even in the face of short -term losses and market pressure.

Despite the negative prices performance, exchange outlets have remained solid for ETH and BTC, indicating accumulation through the market pic.twitter.com/eaqztk6vof

– Sentora (previously intotheblock) (@sentorahq) September 26, 2025

Offers for driving exchange sales to multi -year stockings

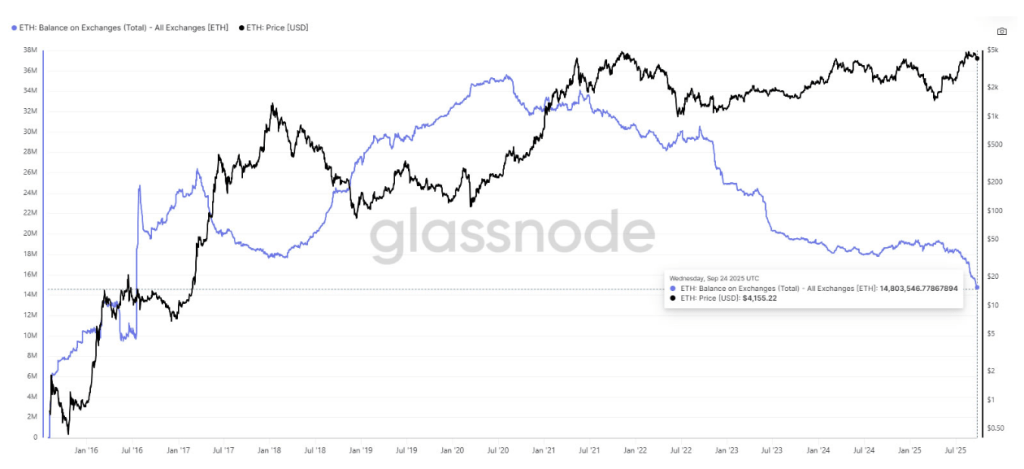

Interestingly, Ethereum, the releases of last week are linked to a notable trend that has developed in recent months. The data show that Ethereum Total supply on exchanges fell to only 14.8 million ETH, its lowest level since 2016. A large part of this supply has been redirected to stimulation, long-term storage and challenge protocols, which all caused a drastic drop in ETH on trading platforms.

ETH balance on exchanges. Source: Glassnode

The data from a Quicktake Cryptoque post by the cryptocurrency contributor add an additional weight to this trend of heavy outings. Between August and September 2025, the simple 50 -day mobile average of Ethereum (SMA) Netflow fell below -40,000 ETH per day, the lowest level seen since February 2023. This persistent negative flow shows that investors have regularly changed their long -term maintenance options. “The lower exchange balances equal to a reduction in short -term supply”, the The analyst said.

Ethereum Exchange Netflow

Related reading

At the time of writing this document, Bitcoin was negotiated at $ 109,585, while Ethereum exchanged $ 4,011.

Felash star image, tradingView graphic

(Tagstotranslate) Bitcoin

Source link