The idea that Bitcoin reaches $ 1 million, once no, noisy discussions of the fringes of the market, are now quietly modeled in the corner offices of Wall Street. It is not a question of media threshing; It is a model.

Analysts envisage the curve S, the same adoption path which took current gold in the 1970s and the Internet in the 90s. With the launch of Bitcoin Etf spot, valves for institutional money finally opened, potentially restarting the future of Bitcoin.

World chaos pushing Wall Street pimples

Big Money is not piled up by Bitcoin out of curiosity. It is a defensive decision. Governments drown in debt, money printers make overtime and global tensions are high. This environment increases managers for an asset which is outside the control of a single country.

The Bitcoin hard ceiling of 21 million pieces is its entire sale argument.

This simple fact seems more and more attractive compared to the endless creation of traditional currencies. The story of “digital gold” is quickly rejected in serious financial circles. In a world, this tremor, adding a decentralized and inacroped asset to a wallet begins to look less like a suggestion and more to a necessity.

ETF – Official Welcome Tat of Wall Street

For a long time, large financial companies have watched since cheap seats, frightened by troubled regulations and headache to really hold crypto. Approval by the US FNB Bitcoin SPOT FNB in early 2024 has changed everything. This gave them a familiar, regulated and easy way to buy.

Source: Coringlass

Suddenly, giants like Blackrock and Fidelity were not only curious. They were a party hosts who saw their products and inflate with money. The Ishares Bitcoin Trust of BlackRock (Ibit) alone now manages $ 83 billion. This new plumbing adapted to institutions, completes with regulated future and guaranteed guard, has made Bitcoin feel safe for great players.

This flood of money has made an allowance of 1 to 5% Bitcoin is less like a wild bet and more as a standard procedure. Especially since he does not dance on the same song as shares and obligations.

The Crunch offer responds to a demand fire pipe

The most aggressive price forecasts come down to simple mathematics – a fixed supply respects an explosion of new buyers. The Bitcoin code has an “half division” integrated approximately every four years, which automatically reduces the creation of new coins in two. This foreseeable compression of the offer is now at first head in a request shock for business balance sheets and massive funds.

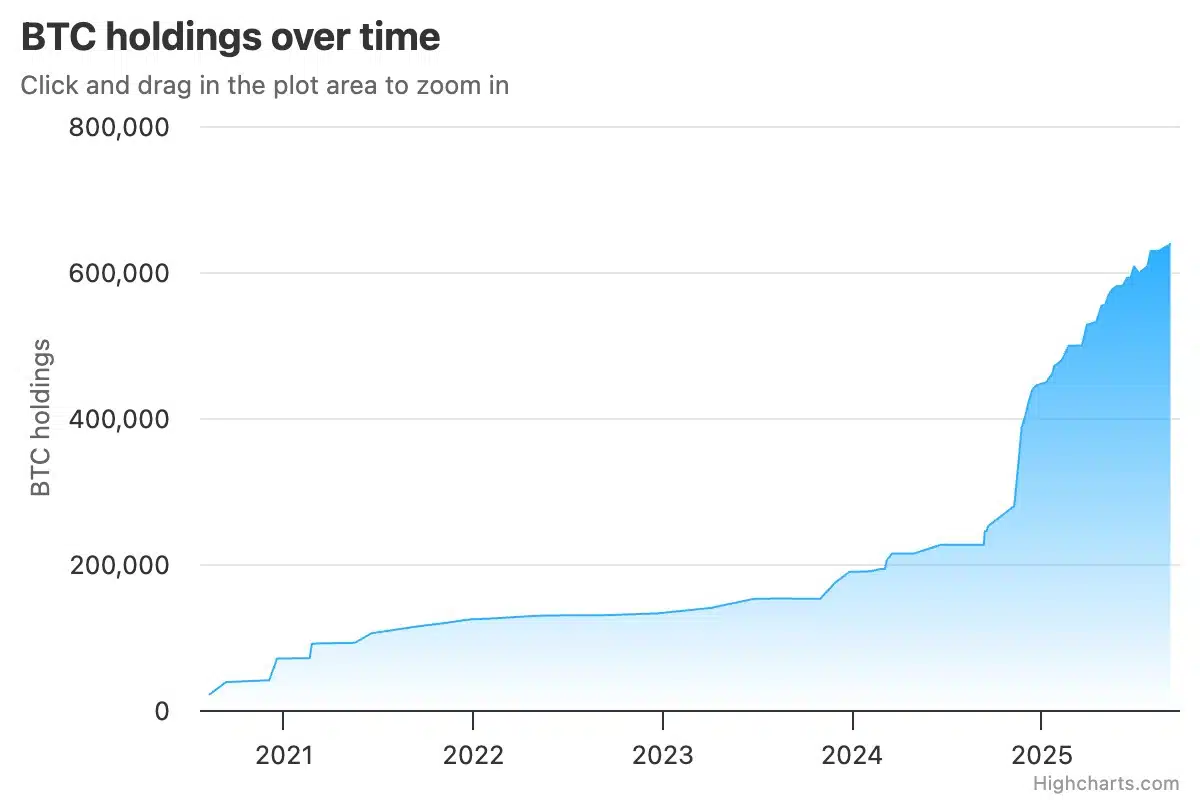

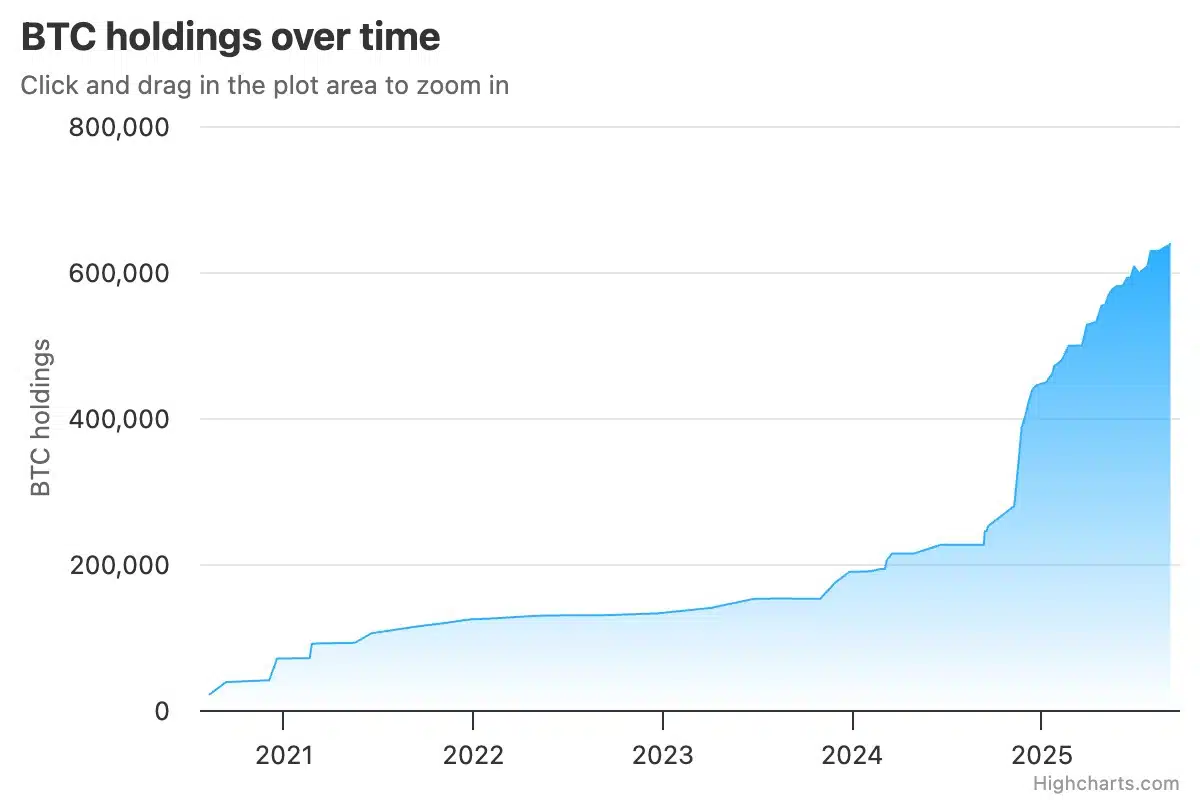

Microstrategy, now renamed as a Strategy Inc., has gone all-in, hoarding more than 632,000 BTC by August 2025. Their bet, combined with billions of dollars in ETFs, gives life to models that see an almost vertical price climb.

Source: Bitcoin Holdings of Microstrategy / Bitbo

Former flux stock models were often criticized to be too simple, but their basic idea – this rarity and demand equivalent to a higher price – takes place in real time. Ark Invest by Cathie Wood passed this logic to its extreme, floating a potential price of $ 2.4 million by 2030, with institutional money as the main fuel of rocket.

Source: S2F / Bitno graphics

Final boss – Governments and sovereign wealth

The last piece of the puzzle could themselves be the nations. To get out of the thumb of the US dollar and protect against political benefits, some countries are starting to buy bitcoin.

The law on the call for legal tenders of El Salvador and the secret mining farms of Bhutan were the Canaries of the coal mine. The real news is quieter – massive sovereign funds in places like Norway and Abu Dhabi now plunge their toes, buying a bitcoin directly or through other companies and ETF.

It starts a dangerous game. As more and more countries are joining, the risk of not having a bitcoin increases, which potentially gives a world race.

What could kill the dream of a million dollars?

However, this climb is a minefield. The path to a Bitcoin of a million dollars is not guaranteed.

- Governments could still spoil the party – Although rules like European Mica and American friendly invoices like The Genius Act are positive, the danger of coordinated global repression has not disappeared. If the main powers of the world decide to become hostile, they could stop this cold trend.

- Coupies on the crowded field and the central bank – Bitcoin is not alone. He competes with thousands of other digital assets. More importantly, digital currencies of the central bank (CBDC) could steal the show for daily payments, leaving Bitcoin as a simple digital collection for the rich.

- Ghost in the machine and a dirty imprint – The massive energy appetite for Bitcoin remains a nightmare for public relations for investors who care about ESG standards. In addition to that, there is the imminent and long -term threat of quantum computers which could one day be powerful enough to break the whole system, a fear even the vitalik buterin of Ethereum has stressed.

However, the conversation has fundamentally changed. Bitcoin’s institutional era is there. The confluence of its rigid supply, a ramp approved by Wall Street and a chaotic world economy made the impossible to feel plausible. The curve is in motion, and a seven -digit price no longer looks like a fantasy, but at an end point.