Bitcoin finally broke through its overhead resistance in the predicted pennant formation, moving closer to testing its all-time high. This breakout matches expectations for such formations and reinforces the broader bullish narrative despite the CME’s impending gap to $77,000. Encouragingly, the daily TBO Slow line remains trending upward, signaling that the macroeconomic trend is still intact. Volume has also increased over the past three days, a welcome change from last week’s consolidation period.

Ethereum Overtakes Bitcoin With Strong Weekly Indicators

Ethereum has outperformed Bitcoin, gaining 6% today and solidifying its upward trajectory with a TBO Breakout cluster. On the weekly chart, Ethereum is approaching the TBO resistance level at $3,887, with the RSI in overbought territory and the OBV above its moving average.

While the ETH/BTC ratio remains bearish, signs of a reversal are emerging, suggesting that Ethereum could maintain its momentum.

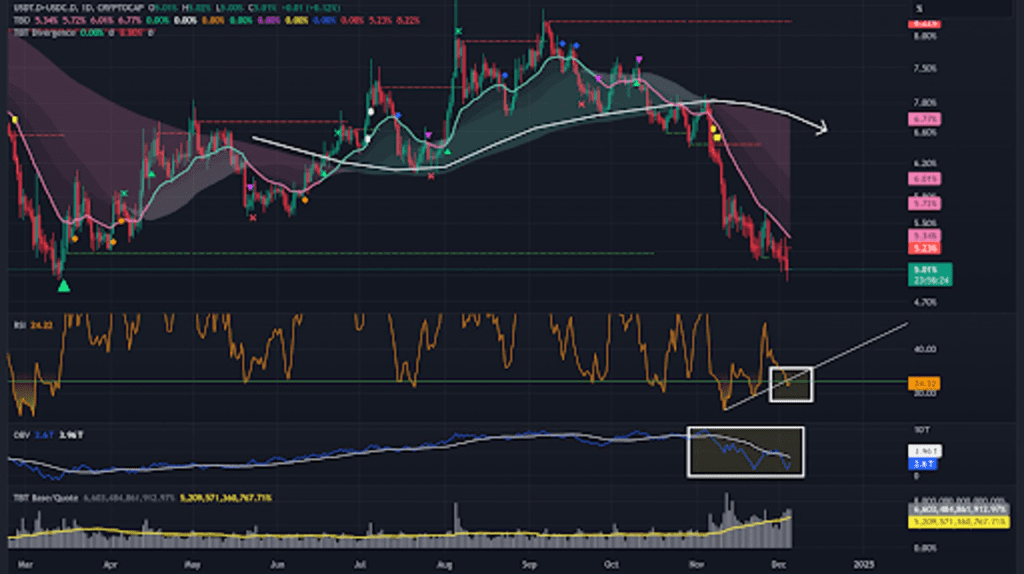

Changes in market dominance signal broader opportunities

Stablecoin dominance continues to decline, approaching the critical level of 5%, indicating a shift from fear to greed within the market. The TBO Slow daily line for stablecoins is now strongly trending downward, further confirming this trend.

Meanwhile, Bitcoin dominance is showing signs of temporary stabilization, although it remains overextended compared to the TBO Fast line. This opens the door for altcoins to attract attention, especially since OTHERS.D exhibits strong bullish characteristics, including a TBO Breakout cluster and uptrend indicators.

Navigating Market Narratives and Staying Patient

As Bitcoin approaches the psychologically significant $100,000 level, attention should also focus on identifying changes in market narratives. Whether it’s the return of old coins or new utility tokens preparing to hit the scene, traders need to keep a close eye on the ecosystems driving the action. Patience remains a crucial virtue during this phase of the market cycle, as some coins may not experience parabolic movements until much later. By staying tuned to market rotations and aligning with emerging trends, traders can position themselves to maximize gains in this evolving bull market.

Disclaimer: The opinions expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure the accuracy of the information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is for informational purposes only. This is not a solicitation to trade any commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article accept no liability for loss and/or damage arising from the use of this publication.