(Bloomberg) — Bitcoin hit a two-week high with Vice President Kamala Harris pledging support for a regulatory framework for cryptocurrencies.

Most read on Bloomberg

The promise adds to optimism seen during Asian trading hours that a mixed reaction to China’s latest stimulus measures will encourage speculators to chase cryptocurrencies rather than the country’s stocks.

The largest digital asset rose 5.6% on Monday before paring some of the increase to change hands at $65,585 as of 2:04 p.m. in New York. Smaller tokens, including second-ranked Ether and top-10 ranked coin Solana, also advanced.

Harris’ pledge to support a framework follows years of complaints from crypto industry officials that U.S. officials have chosen the path of regulation through enforcement rather than clarity. Former President Donald Trump has actively sought out crypto voters in the current presidential race and has several crypto-related projects.

“This rise is largely due to the elections, first because of Trump’s lead in prediction markets and in polls, and later because of semi-soulful statements about him. crypto markets from the Harris campaign,” said Noelle Acheson, author of the Crypto Is Macro Now newsletter. “I haven’t seen any details yet on Harris’ crypto policy, but it seems less negative than the Biden administration’s.”

Prediction markets have reversed course in recent days, giving Trump a higher chance of victory than Harris.

Shares of Bitcoin-related companies also rebounded, with digital exchange Coinbase jumping about 9% and miner MARA Holdings gaining 5%. Bitcoin proxy MicroStrategy was little changed after rising 16% on Friday.

Meanwhile, bankrupt crypto exchange Mt. Gox last week pushed back by one year, to October 31, 2025, the deadline to repay creditors for its remaining assets, which Arkham Intelligence estimates to be around $2.9 billion. of dollars. The delay eases fears of an oversupply from creditors looking to sell the returned Bitcoin.

“The recent improvement in Trump polls will amplify the market receptivity and positive price impact of good news,” said Benjamin Celermajer, co-chief investment officer at Magnet Capital. “Good news such as Mt. Gox’s deferred repayment plan will be received more positively. »

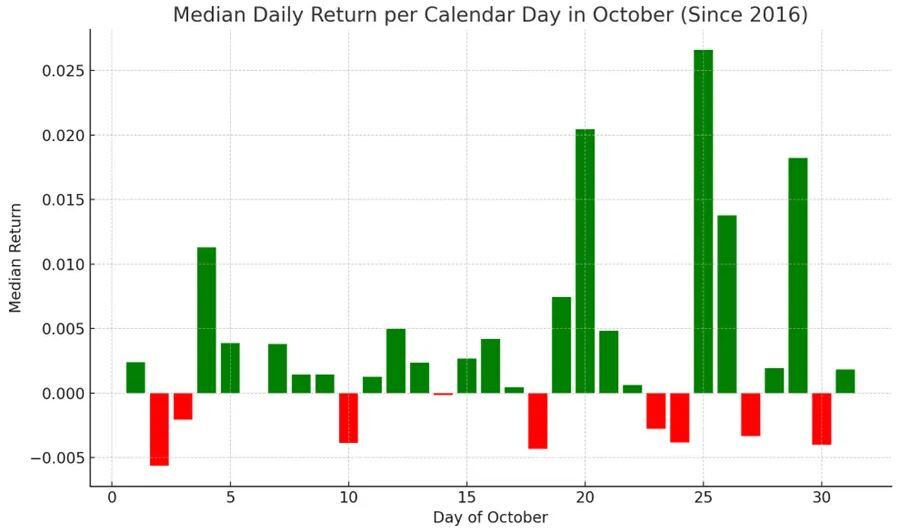

Bitcoin is now up for October after a weak start to the month that generated an average rise of 20% over the past decade, according to data compiled by Bloomberg.

“Historical data suggests that October seasonal strength in crypto markets is typically weighted toward the second half of the month,” wrote Sean Farrell, head of digital assets strategy at Fundstrat Global Advisors LLC, in a note .

China is working to revive its economy, but a highly anticipated weekend policy briefing did not spell out exactly how much fiscal stimulus the government plans to inject. Economists are not convinced that authorities are doing enough to beat deflation, and the unprecedented rally in Chinese stocks has started to unravel.

“Markets are likely viewing China’s disappointing stimulus measures as positive news for Bitcoin, as capital rotation from Bitcoin to Chinese stocks previously weighed on crypto prices,” said Caroline Mauron, co-founder of ‘Orbit Markets, a liquidity provider. for trading digital asset derivatives.

–With help from Sunil Jagtiani.

Most read from Bloomberg Businessweek

©2024 Bloomberg LP