Join our Telegram channel to stay up to date with the latest news

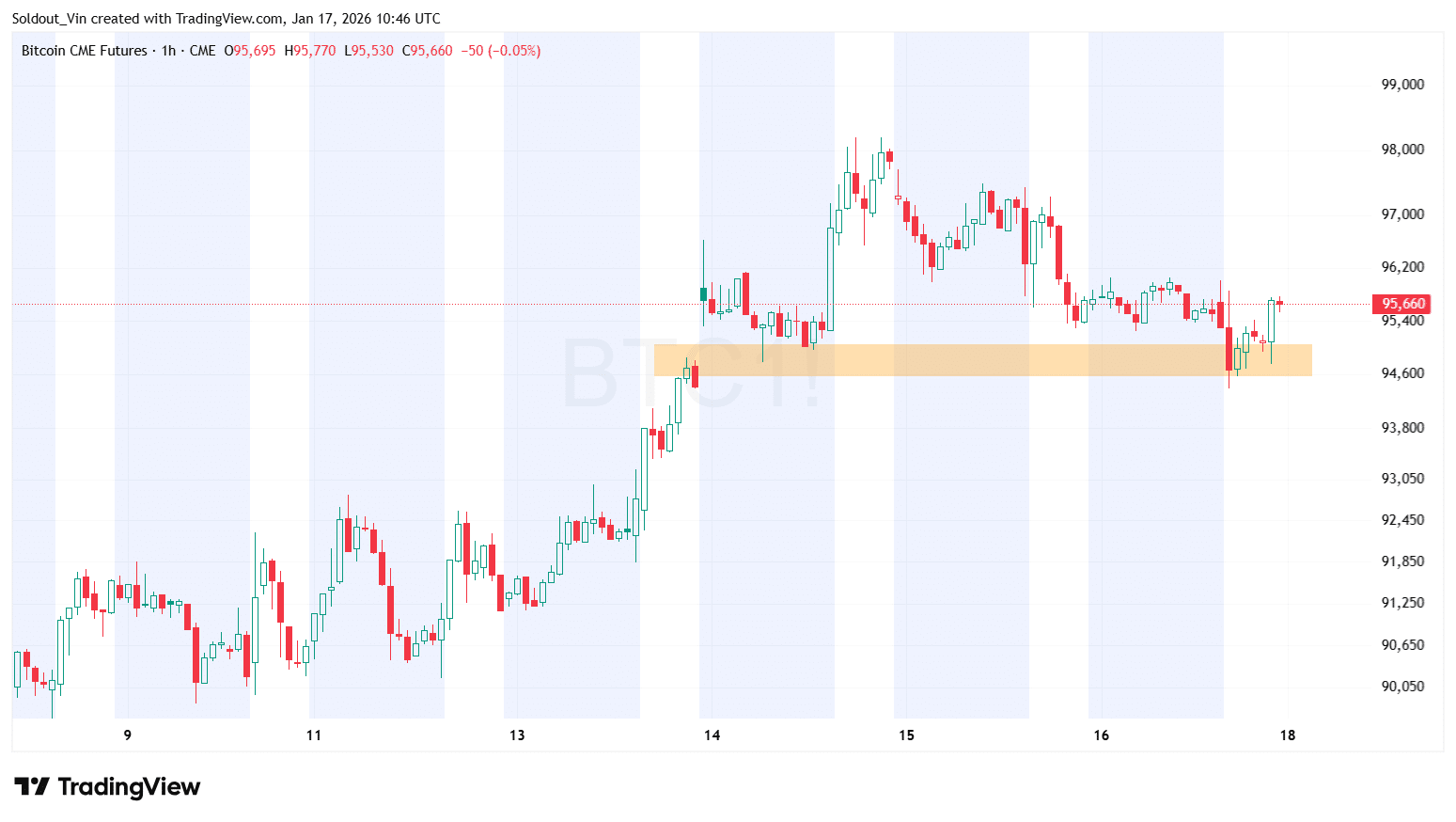

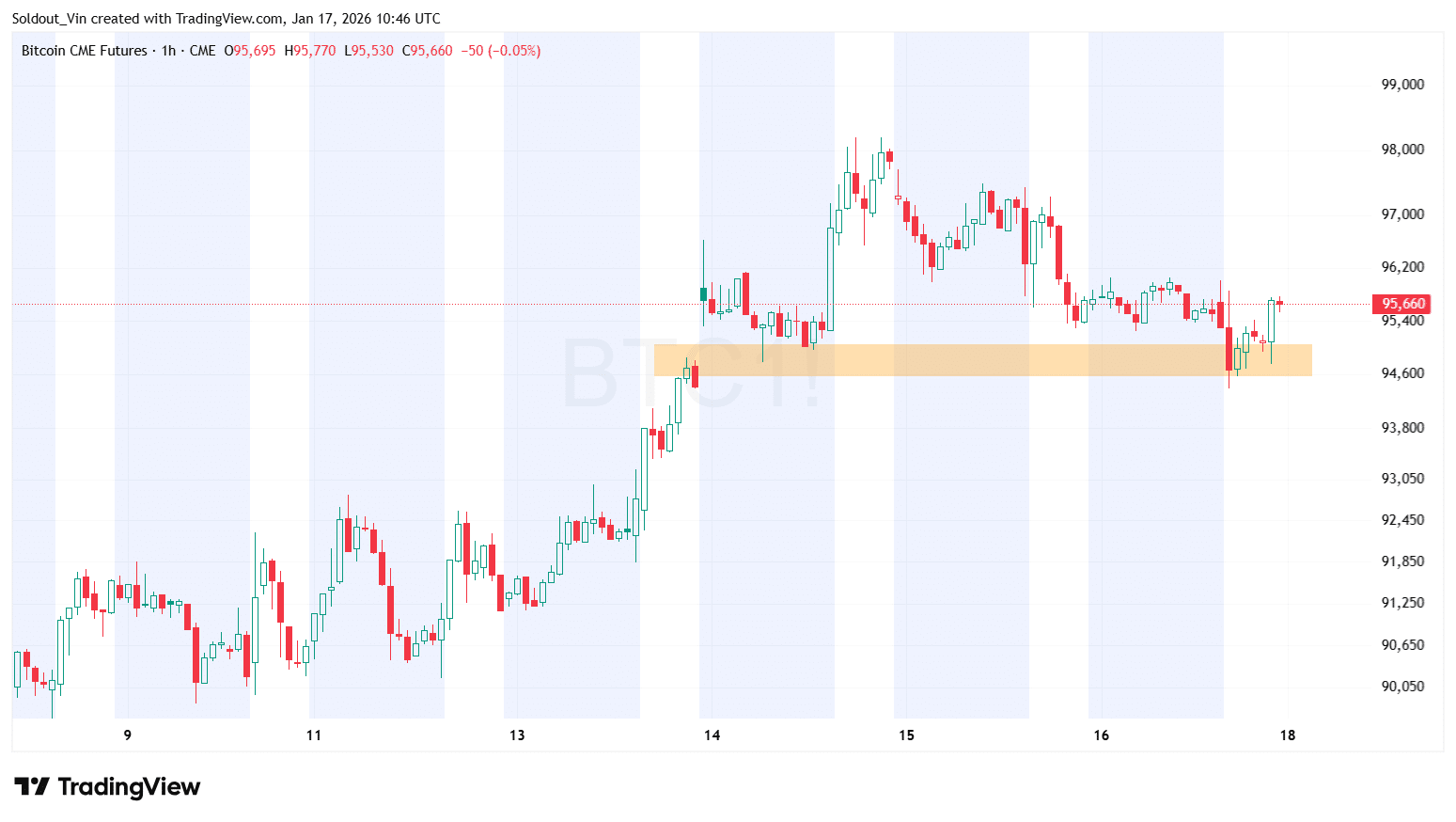

Bitcoin closed the CME futures gap near $94,800, a technical milestone that analysts view as a bullish signal.

CME gaps form when weekend Bitcoin price movements in 24/7 spot markets create unfilled price ranges on the CME futures chart, which does not trade on weekends.

Historically, while these gaps provide focal points for technical traders, they tend to be revisited and filled by subsequent price action.

Based on the CME BTC futures chart, the gap near $94,800 has now been closed, a condition for further upside. Therefore, a weekly close above the $94,000 level could open the door for BTC to extend its rally towards the $100,000 threshold.

The CME gap constitutes an important level amid recent price resilience above $90,000, where bulls have defended support zones before staging rebounds. BTC fell below $94,000 and has since moved towards $95,000, closing the gap.

Bitcoin heads for weekly gain after another muted year

Bitcoin is up 5% this week as it also benefited from some bargain buying after a quiet start to the year.

Much of the coin’s gains this week came after major corporate holder Strategy revealed a purchase of over $1 billion of BTC, raising hopes that corporate demand for the crypto king would improve.

Strategy acquired 13,627 BTC for approximately $1.25 billion at approximately $91,519 per bitcoin. As of 01/11/2026, we are hosting 687,410 $BTC acquired for ~$51.80 billion at ~$75,353 per bitcoin. $MSTR $STRC $STRK $STRF $STRD $STRE

– Strategy (@Strategy) January 12, 2026

However, retail demand remained under pressure as general sentiment towards the crypto space remained nervous. Bitcoin price continued to trade at a discount, indicating that retail sentiment remains weak.

It comes as US lawmakers said earlier this week delayed a key discussion on a planned regulatory framework for crypto, after Coinbase opposed the bill in its current version.

BTC is now down only a fraction of a percentage to trade at $95,100 as of 6:26 a.m. EST, according to Coingecko data.

Related news:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news