- BTC jumped 4.16% in the last 24 hours.

- Rising open interest and falling funding rate suggest strong demand for Bitcoin short trades.

Over the past 24 hours, Bitcoin (BTC) has seen slight gains as markets get into the Christmas spirit. At the time of writing, Bitcoin was trading at $98,056. This represents an increase of 4.16% compared to the last day.

On Christmas Eve, Bitcoin rose from a low of $93,461 to a high of $99,419. This slight rise over the past day has analysts discussing BTC’s post-Christmas performance.

As Cryptoquant analyst Traders Oasis suggested that BTC would move sideways during the Christmas week and then the distribution move would follow as demand for short positions increases.

Bitcoin Demand for Short Positions Soars

According to Trader Oasis, Bitcoin has seen a correction in recent weeks due to the lack of institutional demand.

Source: Cryptoquant

In his analysis, he posited that the Coinbase premium index did not accompany the price rise, thus leading to a retracement. However, the analyst expects the market to continue its rise as the index has entered negative territory.

Source: Cryptoquant

According to him, the further potential rise is supported by financing rates and open interest.

As such, the funding rate has decreased, which is a positive sign for a bull market, while open interest has increased over the past few days.

Source: Cryptoquant

When the funding rate decreases while open interest increases, it indicates that investors are opening short trades. Since investors are opening short trades, this suggests that they are expecting prices to fall.

However, increased demand for short trades could lead to a squeeze on short positions as buying pressure increases. This spike attracts more buyers, creating a self-reinforcing rally.

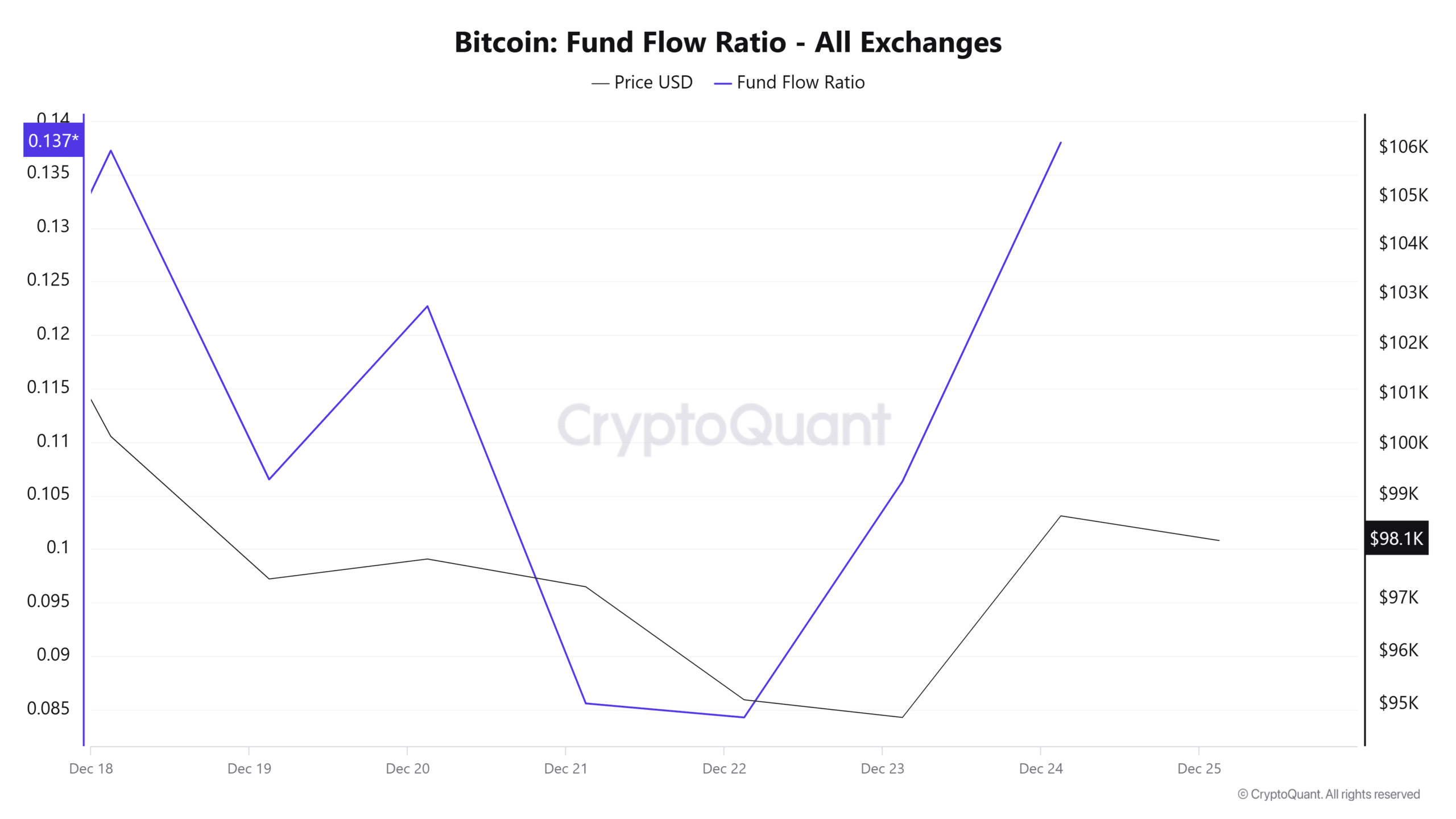

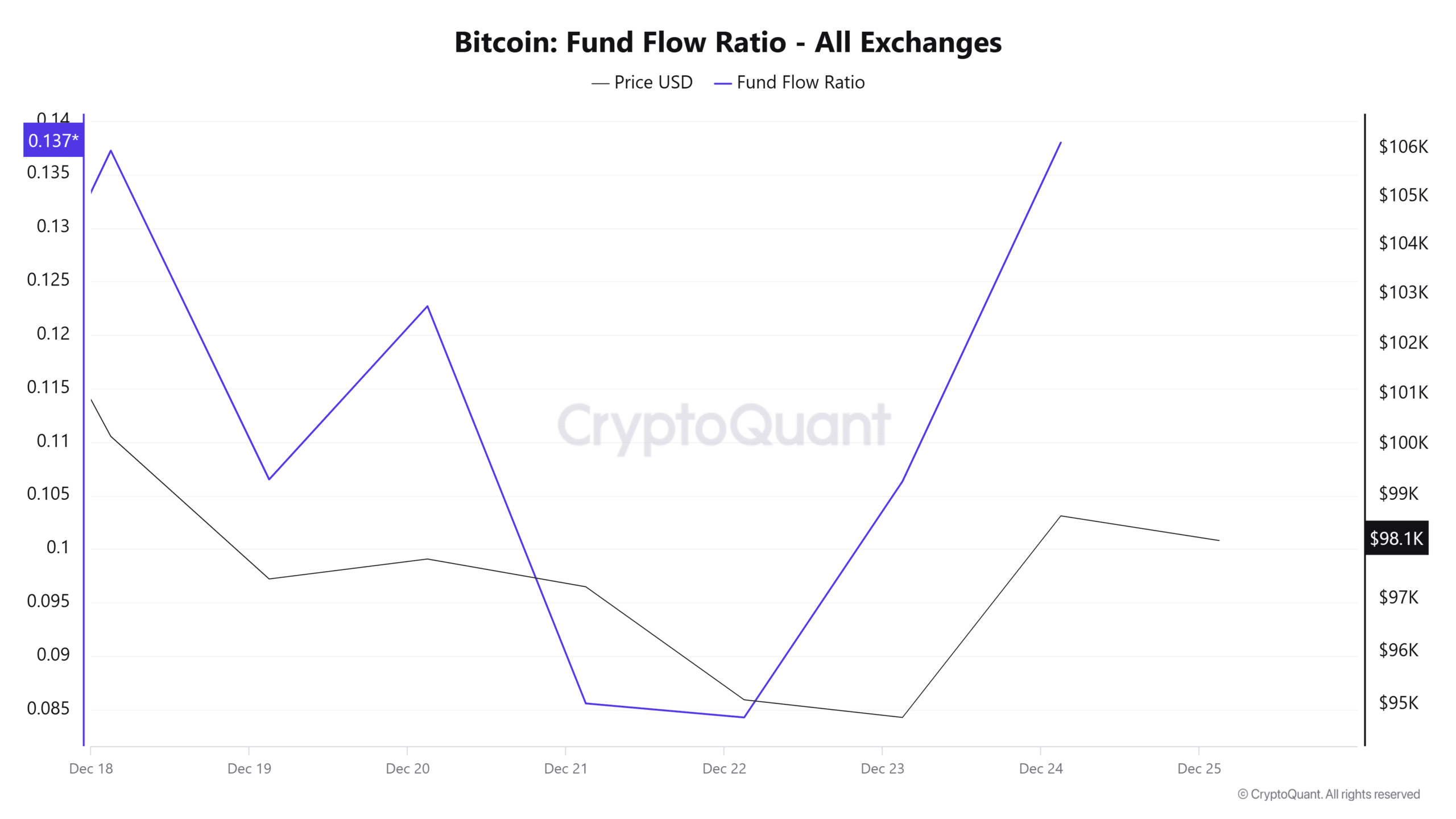

We can see this demand for Bitcoin over the last three days. During this period, the BTC funds flow ratio increased from 0.084 to 0.137.

Source: Cryptoquant

When the fund flow ratio increases, it implies that more money is invested in Bitcoin. Such a trend is a bullish signal suggesting that investors are ready to allocate more capital to BTC. This leads to rising prices due to increased buying pressure.

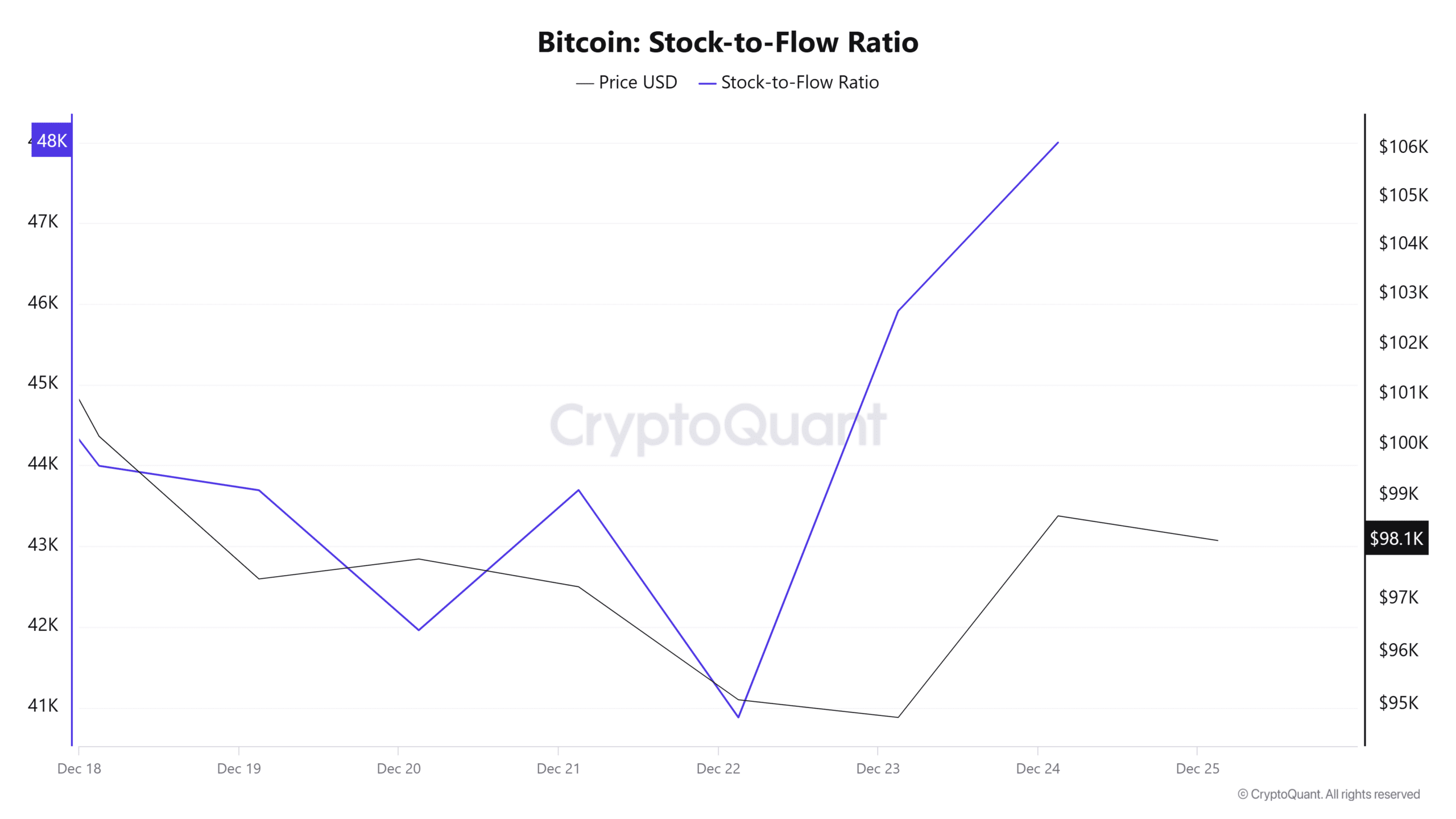

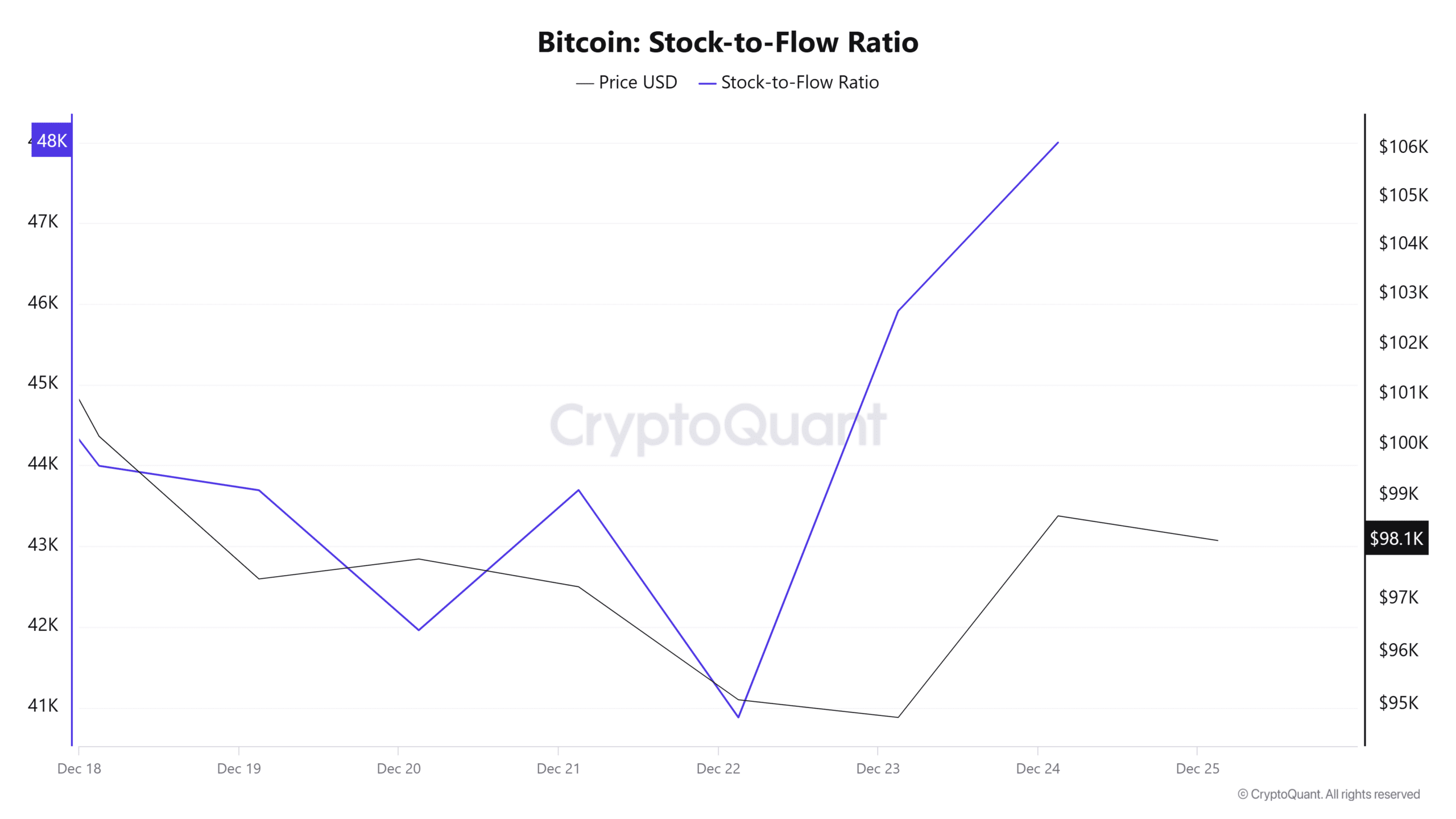

Source: Cryptoquant

Additionally, increased flows mean more BTC leaves exchanges, increasing scarcity. As more traders turn to buying crypto, it is now becoming scarce, as evidenced by the increasing stock-to-flow ratio.

When Bitcoin becomes more scarce, its prices rise because higher demand and low supply lead to higher prices.

Read Bitcoin (BTC) Price Prediction 2024-25

What’s next for BTC?

With increasing investor demand for short trades, it appears these traders could be suffering from a short squeeze. This is when the demand for those taking short positions causes the opposite market reaction which drives prices up.

Therefore, if demand remains constant while supply declines as observed, we could see Bitcoin reclaim the $100,000 resistance after Christmas. However, if the crypto continues to trade sideways, it could drop to $96,600.