Nasdaq and NYSE have reportedly scrapped their plans for Bitcoin ETF options, which is a huge turnoff for any investors looking for more accessible cryptocurrency trading.

This comes as both exchanges have recalled their applications intended to list and trade options based on Bitcoin ETFs. In a move that, one might say, is not what most people expected, a debate over whether options trading on this terrain is a possibility has been sparked in the crypto community.

Regulatory obstacles

The regulatory landscape has remained relatively constant in terms of the challenge for crypto innovation. It took the industry nearly a decade of effort to get Bitcoin spot ETFs approved, and the road to options trading is still fraught with obstacles.

The US Securities and Exchange Commission has been very cautious, and the recent delistings of the Nasdaq and NYSE only underscore the difficulties of the process. Industry players had previously estimated that options could be available as early as late 2024, but recent events suggest otherwise.

NASDAQ and NYSE have joined the CBOE in withdrawing their applications to authorize trading of Bitcoin ETF options. I expect them to refile in the coming days or weeks, as we have seen from the CBOE. pic.twitter.com/YC1U2SgAVA

— James Seyffart (@JSeyff) August 15, 2024

James Seyffart, an ETF analyst at Bloomberg, is among the optimists who believe options trading could resume soon. He said the SEC has set a deadline to make decisions on several applications, including those regarding options on Bitcoin ETFs.

But recent pullbacks following these announcements have revealed that exchanges are increasingly risk-averse in a still-developing regulatory environment. That represents a layer of uncertainty for investors considering options as a trading strategy.

Market reactions

The market reacted cautiously but with some vigor to this news. Notably, Bitcoin price recently rebounded above the $70,000 level after earlier selling pressure attributed to ETF-related capital outflows.

Analysts noted that this could impact trading dynamics, particularly the price of Bitcoin. According to investors and analysts, the recent surge in Bitcoin’s value, attributed to lower ETF outflows and a favorable macroeconomic environment, may ultimately prove insufficient to maintain investor confidence if options trading fails to resume.

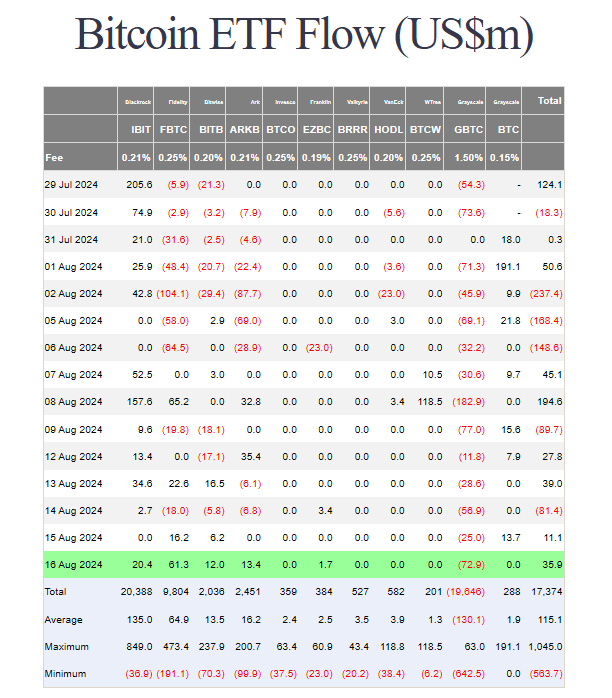

Source: Farside Investors

Bitcoin ETF flows were positive on Thursday after net outflows the day before, according to data from Farside Investors. Outflows from the Grayscale Bitcoin Trust slowed to $25 million, while Grayscale’s BTC Bitcoin Mini Trust hit $13.7 million after two days of steady flows.

According to Swan Bitcoin analysts, the SEC may well wait for the market to stabilize before launching new products. The analysts believe that the agency is cautious about the current fluctuations in Bitcoin price, which could make trading options slightly complex.

Looking to the future

Bitcoin ETF options are growing, but their future is uncertain. In fact, some have even said that by the end of 2024, the issue will be resolved. However, on the other hand, it is believed that the regulation is much more complex than it seems at first glance and that by 2025, a clearer guideline can be developed.

Featured image from Pexels, chart from TradingView