Key takeaways

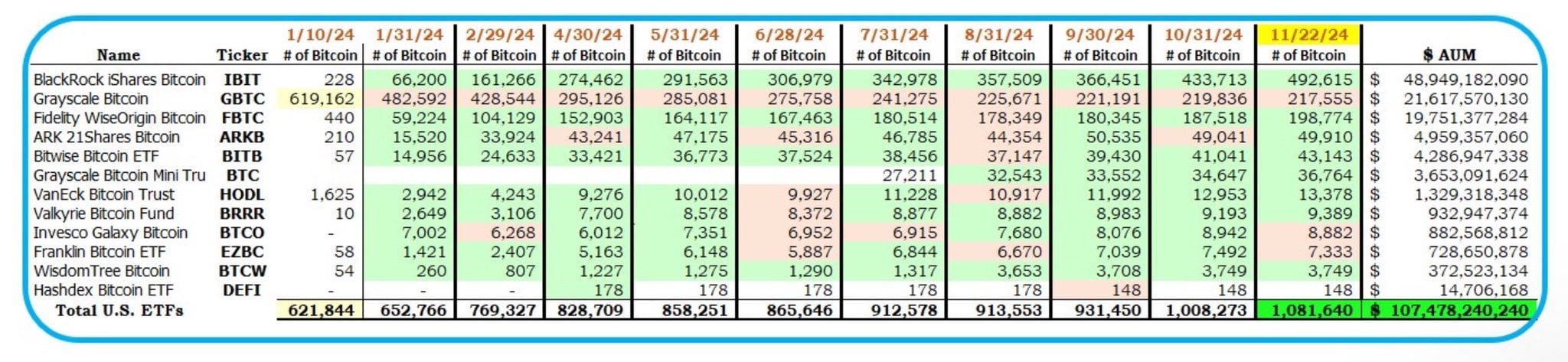

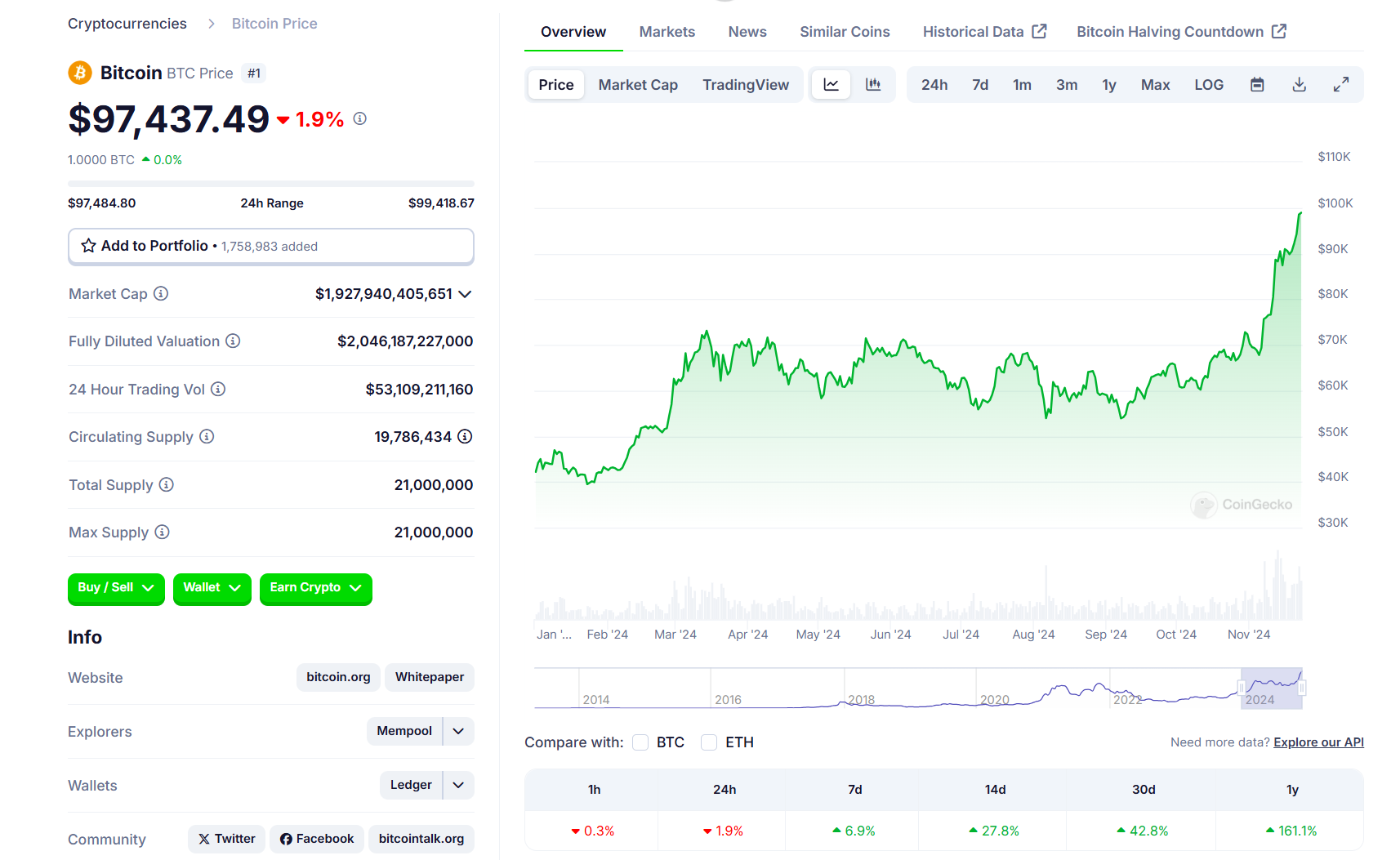

- US Bitcoin ETFs are expected to overtake gold ETFs in size by Christmas, with current assets of $107 billion.

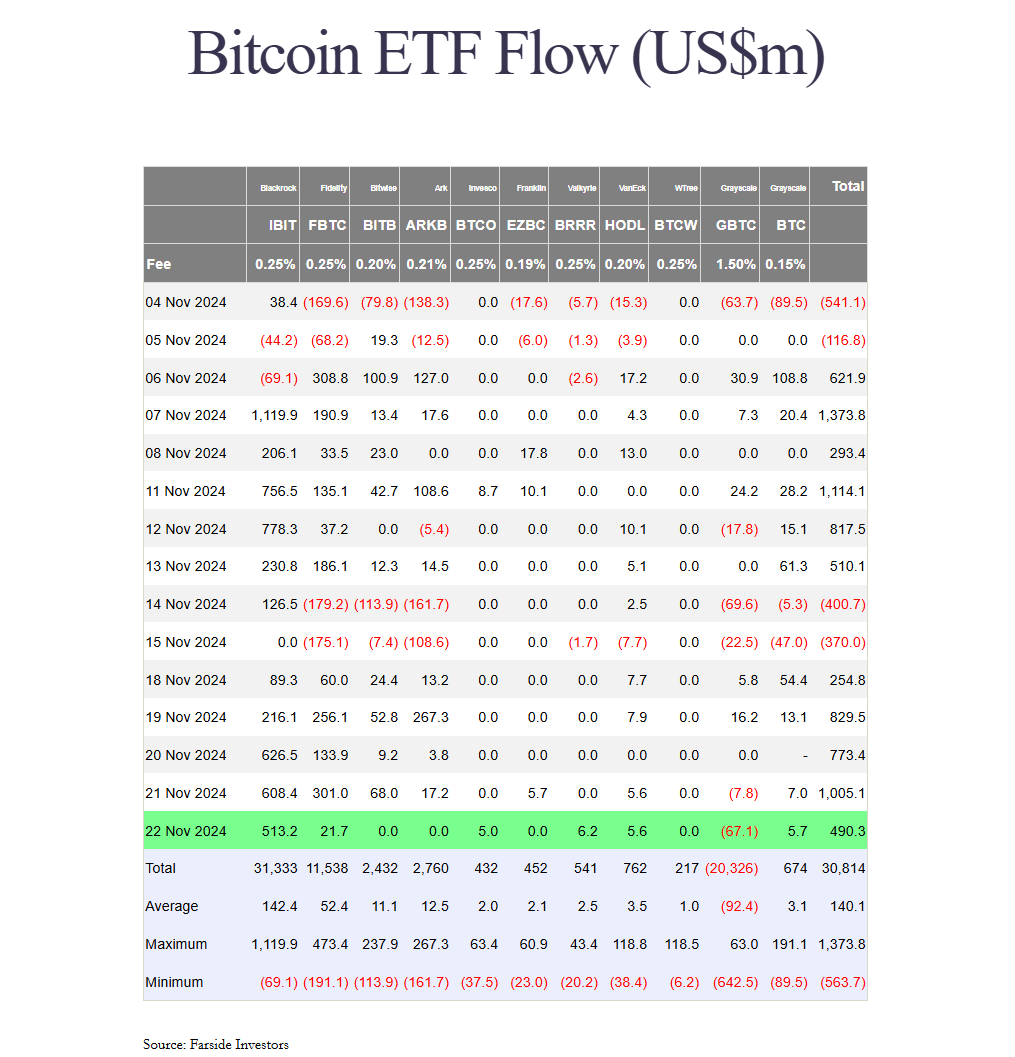

- BlackRock’s iShares Bitcoin Trust remains a key player this week, capturing 73% of net inflows into Bitcoin ETFs.

Share this article

US Bitcoin ETFs will soon catch up with gold ETFs if they maintain their current accumulation rate. Bloomberg ETF analyst Eric Balchunas suggests these funds could eclipse gold ETFs by Christmas.

As of November 23, Bitcoin ETFs in the United States reached $107 billion in assets, representing approximately 86% of total gold ETF net assets, according to combined data from Balchunas and HODL15Capital.

“They are only $23 billion behind gold ETFs, a good chance of outperforming them by Christmas,” Balchunas said.

Bitcoin ETFs are closing the gap with Satoshi Nakamoto. These funds currently hold around 98% of Satoshi’s estimated Bitcoin reserve, with a strong chance of overtaking Bitcoin’s creator to become the world’s largest Bitcoin holder next week.

This week alone, U.S. spot Bitcoin ETFs generated about $3.3 billion in net inflows, with BlackRock’s iShares Bitcoin Trust (IBIT) capturing about 62% of the total, according to data from Farside Investors.

IBIT continues to widen the gap with BlackRock’s iShares Gold Trust (IAU) in terms of net assets. As of November 22, IBIT held $48.4 worth of Bitcoin while AIU’s assets were valued at approximately $34 billion.

Bitcoin’s Rise Raises Concerns About Its Stability Compared to Gold

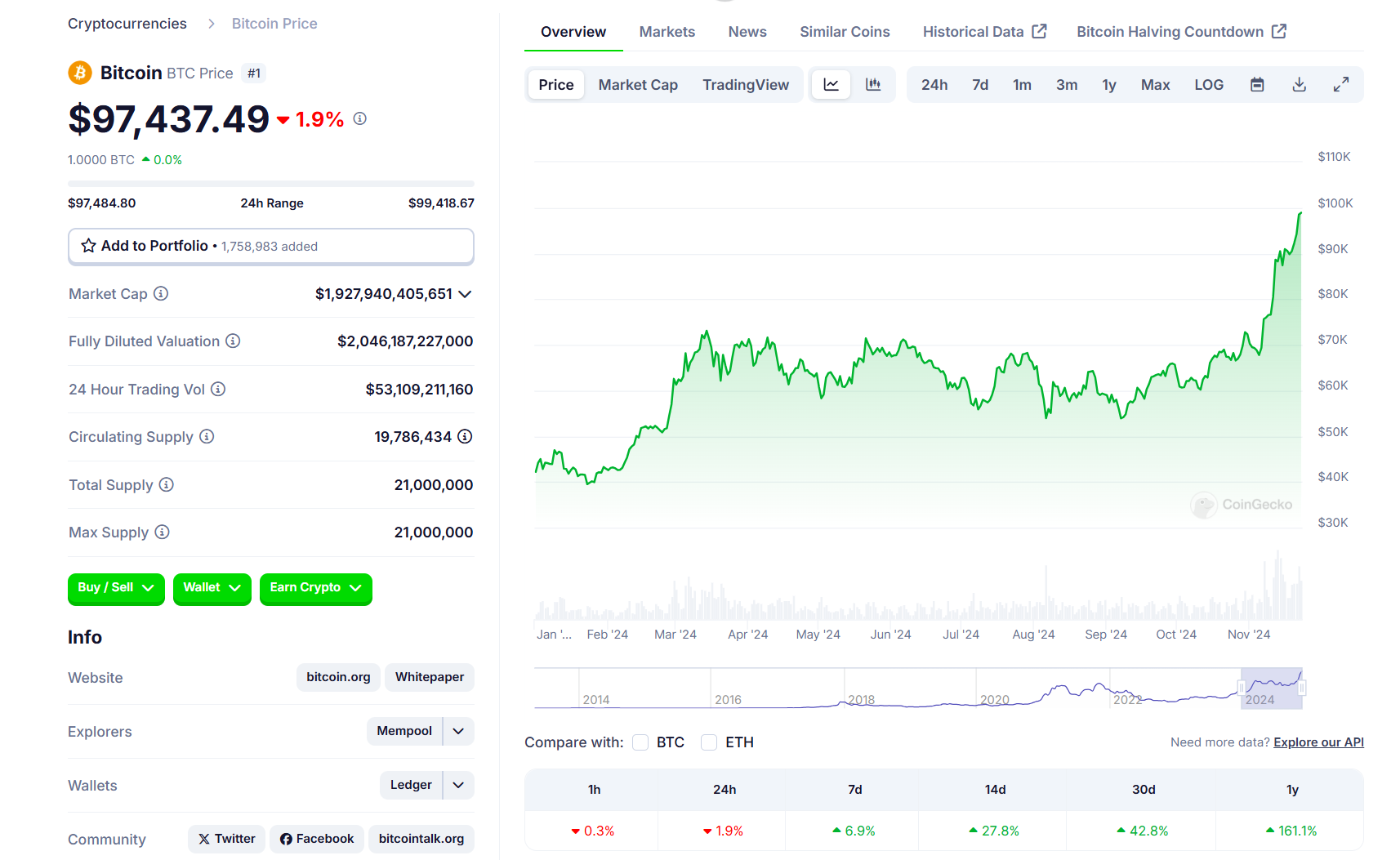

The world’s largest crypto asset hit a new all-time high of $99,500 on Friday, closing in on the six-figure mark. For Bitcoin supporters, the bull market is still in its early stages.

VanEck’s target for Bitcoin this cycle is $180,000. The asset manager reiterated its projection in a recent report, supported by bullish indicators such as funding rates, relative unrealized profit (RUP) and retail interest.

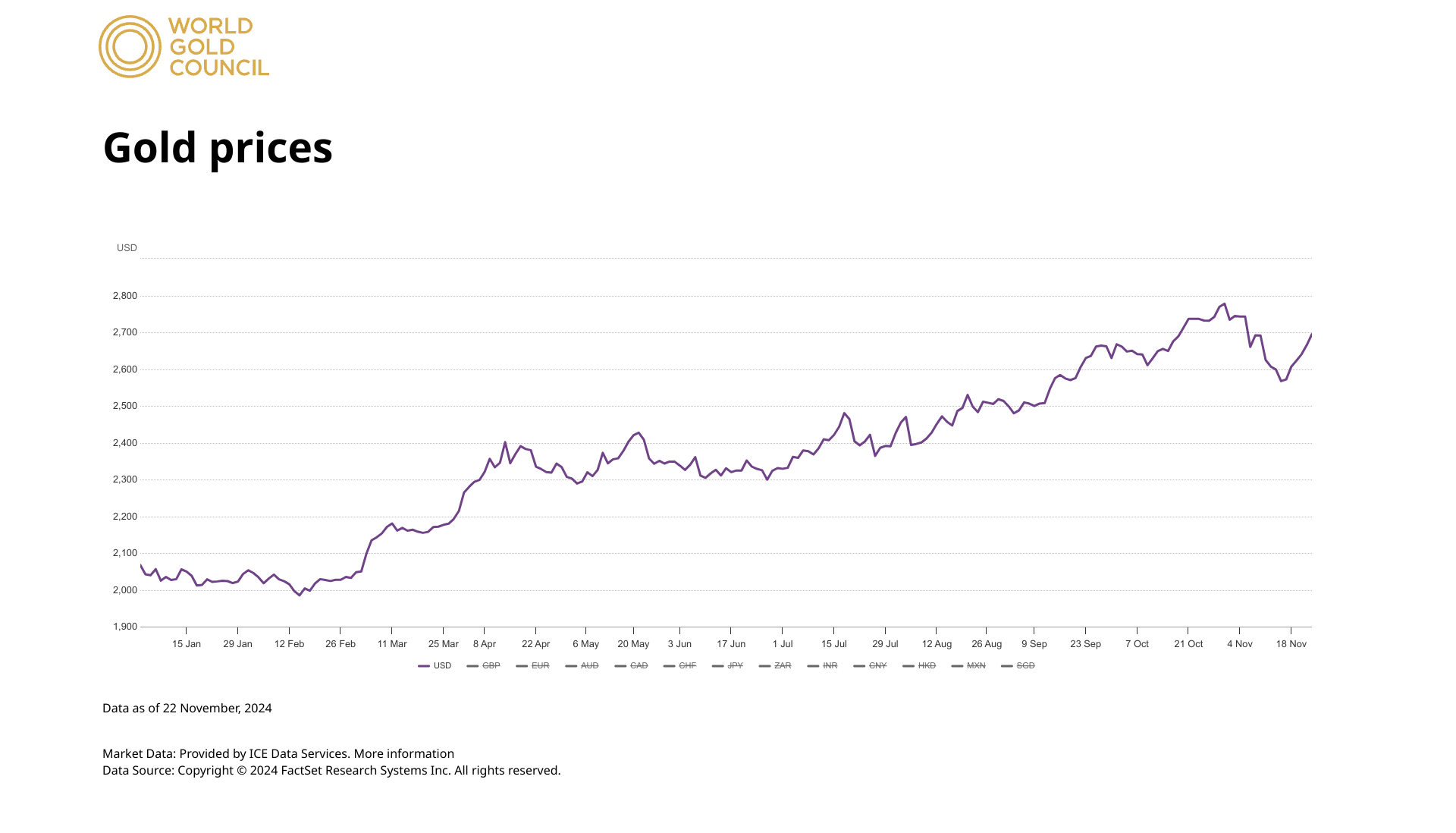

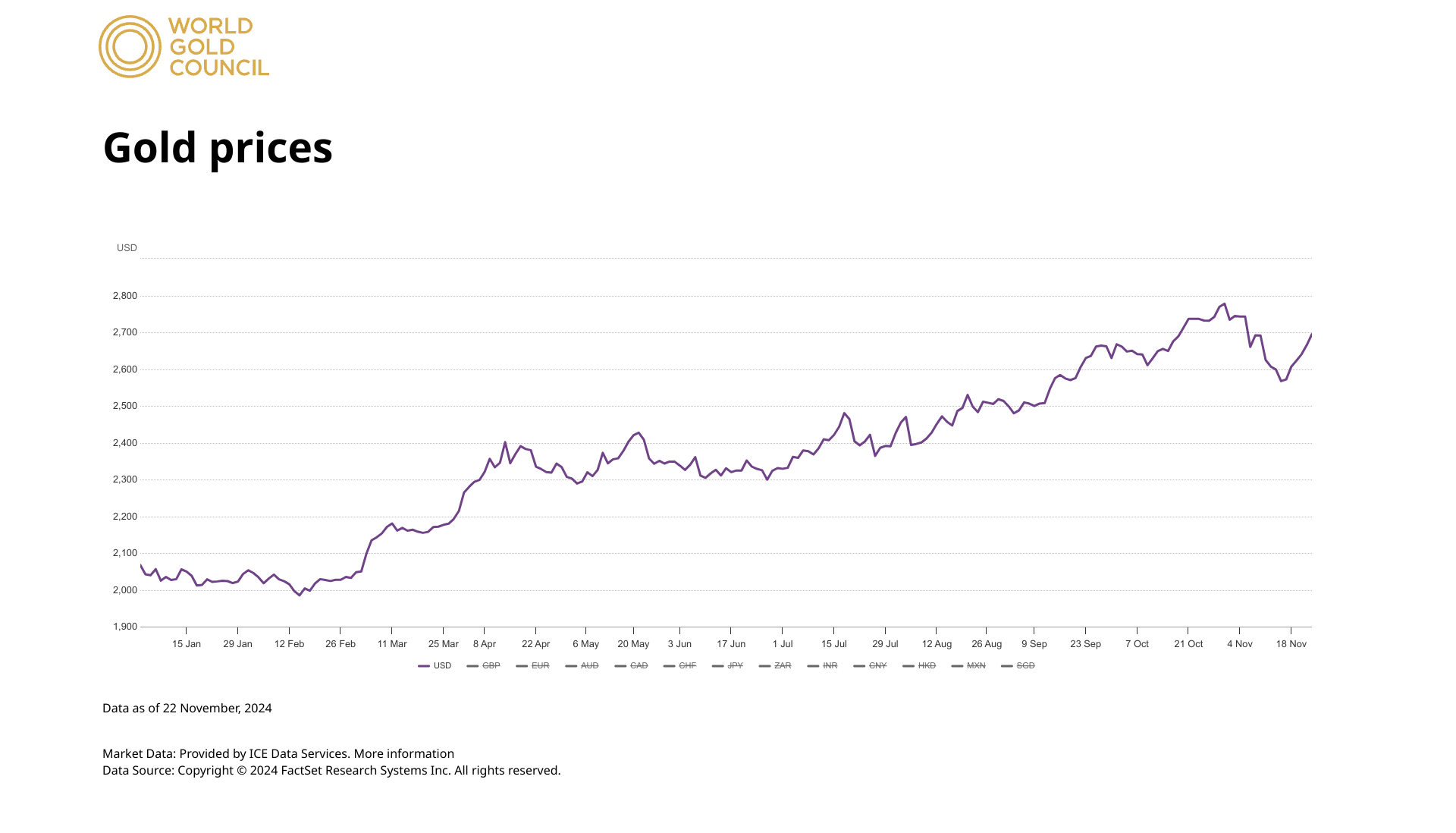

However, State Street, which manages more than $4 trillion in assets, believes investors are becoming too optimistic about Bitcoin’s potential and overlooking the stability and long-term value that gold offers.

George Milling-Stanley, chief gold strategist at State Street Global Advisors, warns that Bitcoin’s current rally could create a misleading sense of security among investors. Unlike gold, which has long been a reliable store of value, Bitcoin’s future is uncertain, according to the analyst.

“Bitcoin, pure and simple, is a comeback play, and I think people have jumped on the comeback plays,” Milling-Stanley told CNBC.

Milling-Stanley points out that Bitcoin proponents, who often compare Bitcoin mining to gold mining, create a false sense of sameness that mimics the appeal of gold.

“There is no mining involved. This is a pure and simple computer operation. But they called it mining because they wanted to look like gold – maybe take away some of the aura of gold,” he added.

While gold has enjoyed a 30% year-to-date return, Bitcoin has stolen the show with a staggering 160% rise. Its market capitalization now eclipses that of silver and Saudi Aramco.

Share this article