Join our Telegram channel to stay up to date with the latest news

Bitcoin (BTC), Ethereum (ETH), and

Over the past trading day, the total crypto market cap also plunged more than 5% to below $3 trillion, according to CoinMarketCap. data.

The largest cryptos by market cap all plunged. Bitcoin slipped more than 5% in the past 24 hours, as did the king of altcoin Ethereum.

Smaller chips were more affected. Ranked fourth in terms of market capitalization, XRP saw its price drop by over 6%, enough to push its 7-day performance into the red.

Meanwhile, Binance’s BNB, Solana (SOL), and TRON (TRX) fell by over 5%, 7%, and 1%, respectively. Dogecoin (DOGE) and Cardano’s ADA token suffered the largest price drops among the top ten cryptos, with both tokens seeing declines of over 8%.

Liquidations skyrocket

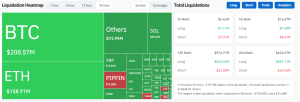

After the market plunge, 24-hour liquidations in the crypto space exceeded $636 million, according to Coinglass data.

Crypto Market Liquidation Data (Source: coin mechanism)

Long trades, which involve betting that cryptocurrency prices will rise, accounted for the majority of the capital that was wiped out in the past 24 hours. Some $567 million was liquidated through these trades, while only $69.46 million was cleared from bearish short positions.

BTC and ETH transactions accounted for the lion’s share of liquidated positions. Over $358 million has been wiped from long trades for the two crypto market leaders.

“Extreme fear” continues to grip the market as traders anticipate lower interest rates

The recent crypto price drop comes as the market remains in a fragile state following the record $19 billion liquidation on October 10.

THE Crypto Fear and Greed Indexa popular measure of market sentiment, fell four points over the past day and nine points from a month ago to 24, signaling “extreme fear.”

But while investor sentiment remains cautious, analysts and traders are increasingly optimistic about the Fed’s announcement of an interest rate cut this month.

In a Polymarket contract Asking what the Fed’s decision will be in December, users of the decentralized market prediction platform put the probability of a 25 basis point cut at 89%, up 1% in the past 24 hours. Only 11% of traders think there will be no change in rates this month.

Low liquidity and high leverage are holding back the crypto market

Several analysts have attributed the October 10 crash to extreme levels of debt. In crypto, it is not uncommon for traders to trade with up to 50X leverage. While this can lead to parabolic gains on small price movements, it also magnifies losses in the event of a correction.

Commenting on the continued fragility of the market, Kobeissi Letter told his more than 1.1 million followers on X that the market was grappling with a liquidity problem.

Crypto’s Liquidity Problem:

As we’ve seen countless times this year, Friday night and Sunday night often bring BIG crypto moves.

Just now we saw Bitcoin drop -$4,000 in a few minutes without any news.

For what? Liquidity is thin.

Then add this to the fact that…

– Kobeissi Letter (@KobeissiLetter) December 1, 2025

In addition to the “low” liquidity of the market, debt on the market “is currently reaching record levels”, indicates the Kobeissi Letter in its article.

“As a result, the sudden increase in sales volume leads to a domino effect, which is only amplified by the historical amounts of leveraged positions liquidated,” he adds.

He said the current bear market “is structural in nature” and that he does not view the recent price decline as a “fundamental decline.”

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news