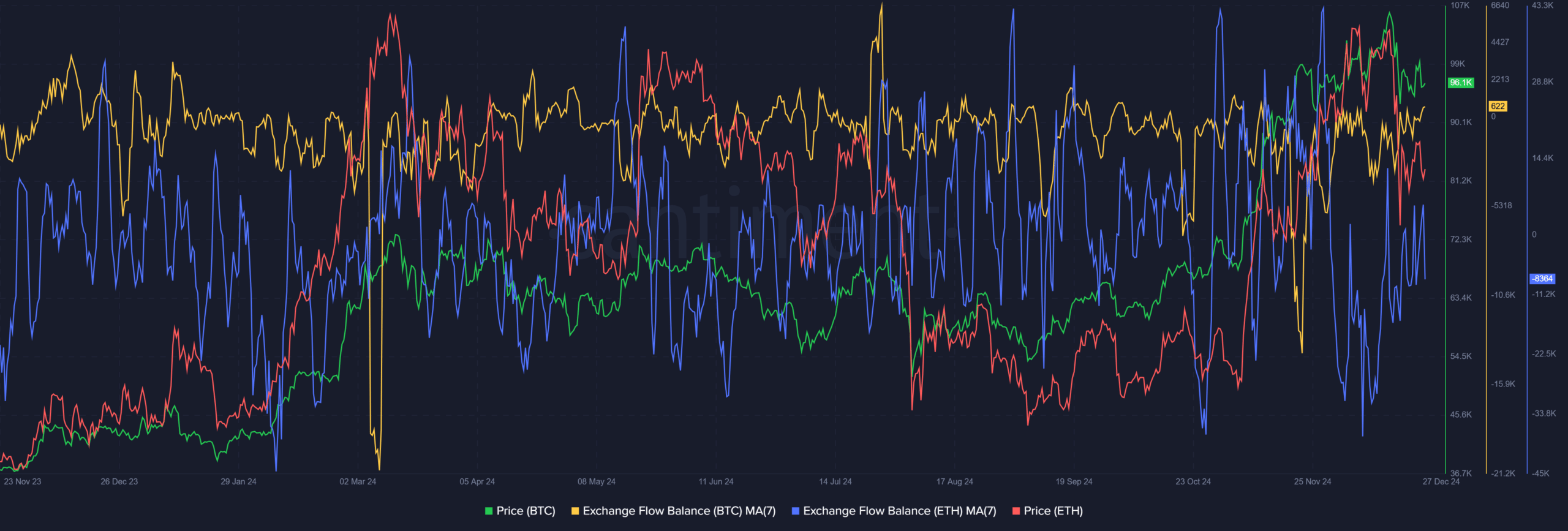

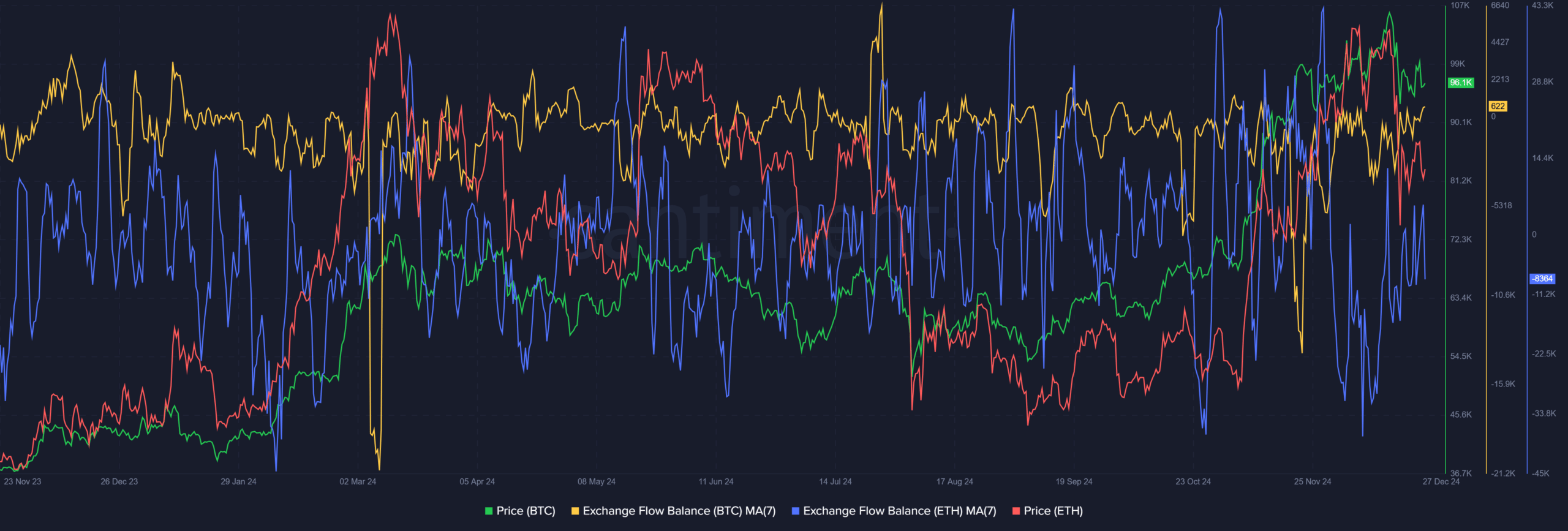

- Bitcoin and Ethereum net flows showed similar patterns around Christmas

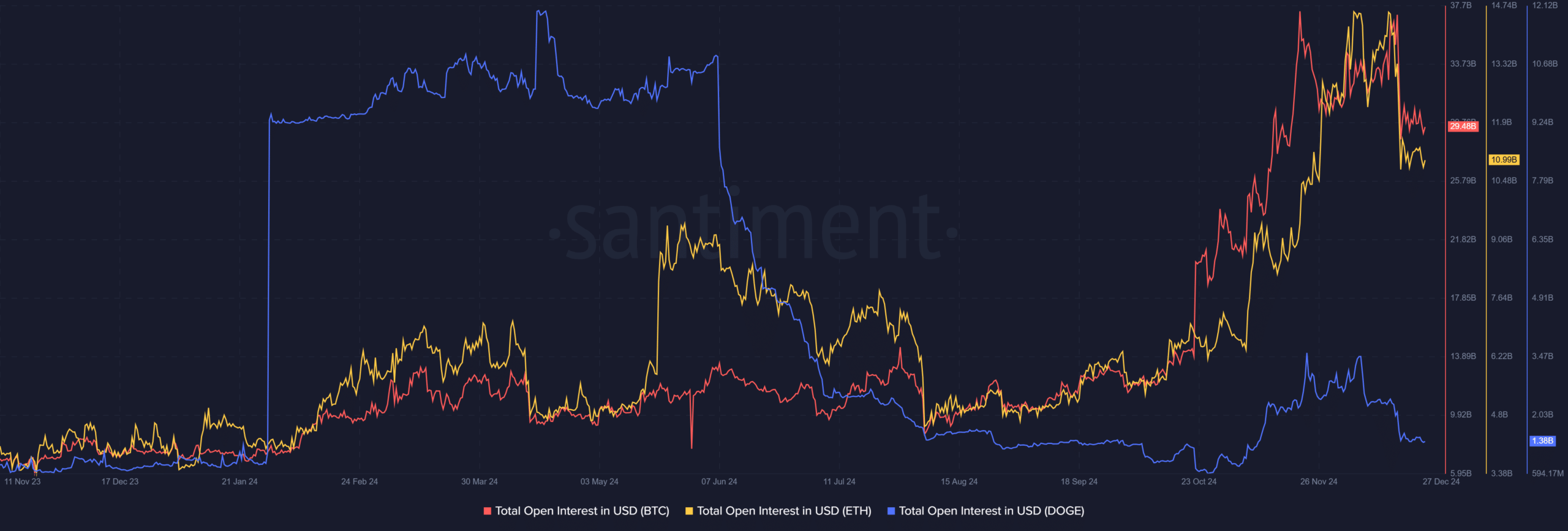

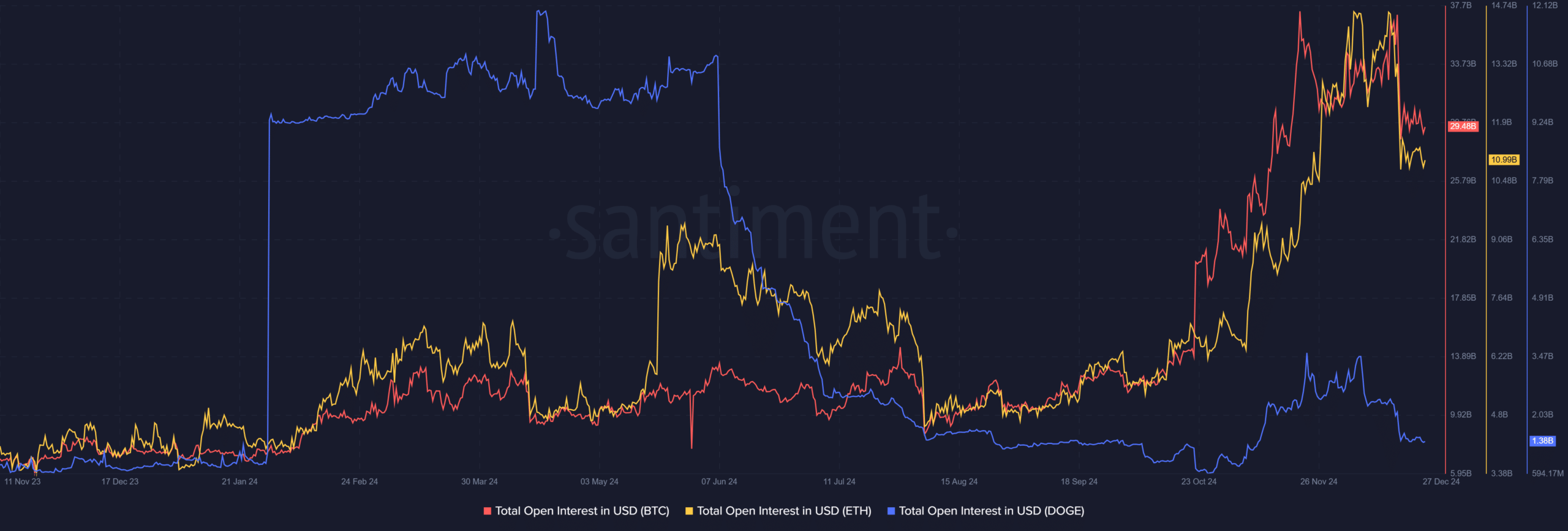

- Open Interest Trends Revealed Sense of Distrust Among Traders

Bitcoin (BTC) tends to see a Santa rally in the week leading up to Christmas, before giving up those gains the following week. This has been the trend in recent years, starting in 2021. The previous year it did not match this trend.

This means that alongside Bitcoin, other major altcoins such as Ethereum (ETH) and Dogecoin (DOGE) tended to see their prices drop in the week following Christmas. Will this trend continue in 2024?

Top Asset Trading Flows and Price Correlation

Source: Santiment

AMBCrypto looked at the flow of BTC and ETH to and from exchanges around Christmas. A 7-day moving average was used to smooth the readings. In 2023, BTC saw the 7-day MA reach 1,481 BTC on December 22, and the 7-day ETH inflow was 32,805. A few days later, they took the opposite path.

The moving averages of net exchange flows for BTC and ETH reached -5,915 and -9,626 for BTC and ETH respectively on December 26 and 27 – A sign of accumulation.

Meanwhile, token price trends were sideways for BTC and up 10% for ETH, leading into the final week of the year. Together, the measurements revealed that participants preferred to send tokens to exchanges to make profits and accumulated more the following week.

2024 brought a Santa Claus rally to crypto, taking BTC to $99.6k, ETH to $3,560, and DOGE to $0.342 – a 6-9% gain in three days before Christmas.

At press time, net FX flows were trending higher, showing that selling pressure was likely imminent. Meanwhile, the prices of BTC and ETH have already fallen by 5% and 6%, respectively. Dogecoin moved closer to 9%.

Open Interest showed low-key sentiment ahead of holiday week

Source: Santiment

The open interest of Dogecoin, Ethereum and Bitcoin can also be compared. In 2023, the OI fell sharply from December 22 to 25, before recovering quickly in the first half of January.

Read Bitcoin (BTC) Price Prediction 2025-26

In 2024, December 17 saw a sharp decline in OI. This can be attributed to the decline in the overall market, following bearish news from the Federal Reserve that sent the Dow down 1,250 points last Wednesday.

IO continued to meander sideways, clearly suggesting that market participants stayed on the sidelines. Traders might look for long entries. And an increase in OI and volume in the coming days could see gains from early 2024 repeated in January 2025.