Key points:

-

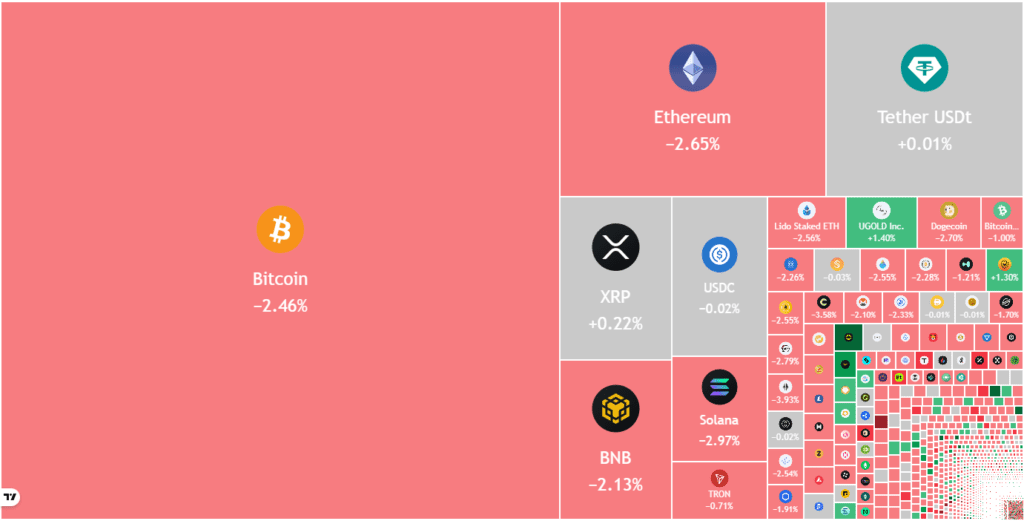

Bitcoin’s relief rally is expected to sell off near $72,000, but a positive sign is that the bulls have not ceded much ground to the bears.

-

Several major altcoins are likely to sell off at higher levels, indicating that sentiment remains negative.

Bitcoin (BTC) moved closer to $69,500, indicating that bears are selling in rallies. Several analysts say that the bottom of BTC has still not been reached. Trader BitBull said in an article on

A different view was put forward by crypto sentiment platform Santiment. In a report released Saturday, the Santiment team said data suggests the drop to $60,000 may have been a real bottom. However, for a sustainable recovery, the market must hold above the key support level and whales must continue their tentative accumulation.

Another positive for bulls is that the BTC Sharpe ratio has fallen to -10, which historically indicates the final stages of bear markets, according to CryptoQuant analyst Darkfost. While the numbers do not confirm that the bear market is over, they do indicate that the risk-reward profile could reach extreme levels.

Could BTC and major altcoins begin a strong recovery, or will the downtrend resume? Let’s analyze the charts of the top 10 cryptocurrencies to find out.

S&P 500 Index Price Prediction

The S&P 500 Index (SPX) fell below the ascending channel pattern on Thursday, but the bulls were unable to hold the lower levels.

The index came back strongly on Friday and surged above the moving averages. This shows that the break below the channel may have been a bear trap. The bulls will attempt to push the price towards the resistance line, where the bears are expected to intervene.

The 20-day exponential moving average (EMA) (6,917) is flattening and the relative strength index (RSI) is just above the midpoint, signaling a balance between supply and demand. A close above the resistance line could trigger the next leg of the uptrend towards 7,290.

US Dollar Index Price Prediction

The US Dollar Index (DXY) broke above the 20-day EMA (97.67) on Thursday, but the bulls were unable to sustain the higher levels.

The price fell below the 20-day EMA on Monday, signaling that the bears are trying to take control. There is strong support at the 96.21 to 95.51 support zone, but if the bears prevail, the index could collapse to 91.88.

Instead, if the price rises sharply from the current level or support zone and breaks above the moving averages, it indicates that the index could extend its stay in the 96.21 to 100.54 range for some more time.

Bitcoin Price Prediction

BTC’s rally is stalling just below the $74,508 breakout level, indicating that bears are trying to tip the level towards resistance.

The falling 20-day EMA ($78,142) and RSI in negative territory indicate advantage for sellers. If the price declines from $74,508 or the 20-day EMA, the bears will once again strive to pull the BTC/USDT pair towards $60,000.

This negative view will be invalidated in the short term if the Bitcoin price rises above the 20-day EMA. This suggests solid buying at lower levels. The pair could then bounce towards the 50-day simple moving average (SMA) ($86,636).

Ether Price Prediction

Ether’s (ETH) relief rally risks selling off at the $2,111 level, but a positive sign is that the bulls have not ceded much ground to the bears.

If the price closes decisively above the $2,111 level, the ETH/USDT pair could rise to the 20-day EMA ($2,447). This is a crucial resistance to watch, as a break above suggests that bearish momentum has weakened. The Ether price could then increase to the 50-day SMA ($2,877).

Sellers will need to aggressively defend the $2,111 level to maintain their advantage. If they do, the $1,750 level is likely to collapse. The pair could then fall to $1,537.

BNB Price Prediction

BNB’s (BNB) relief rally is facing a selloff near the 50% Fibonacci retracement level of $676, indicating negative sentiment.

If the price falls below $602, the bears will attempt to push the BNB/USDT pair below the $570 support. If they succeed, the pair could drop to $500.

Conversely, if the bulls push the BNB price above $676, the pair could reach the breakout level of $730. Sellers should defend the $730-$790 zone as a break above suggests the bulls are back in the game. The pair could then reach the 50-day SMA ($849).

XRP Price Prediction

Buyers held XRP (XRP) above the support line of the descending channel pattern but are struggling to push the price up to the 20-day EMA ($1.63).

If the price declines and crosses below the support line, it indicates that the bears remain in control. The XRP/USDT pair could then retest the $1.11 level. Buyers should defend the $1.11 level with all their might, as a break below could send the pair tumbling to $1 and then to $0.75.

Buyers will need to propel XRP price above the 20-day EMA to gain the upper hand in the near term. The pair could then move towards the downtrend line. A close above the downtrend line suggests the start of a new upward move.

Solana Price Prediction

The Solana (SOL) relief rally is likely to sell off just below the $95 breakout level, indicating that the bears are attempting to tip the level into resistance.

If Solana price continues to decline and breaks below $77, it suggests that the bears remain in charge. The SOL/USDT pair could then retest the $67 level, which is likely to provide strong support.

Sellers should defend the area between the 20-day EMA ($104) and the $95 level, as a close above indicates that the bulls are back in control. The pair could then walk towards the 50-day SMA ($123).

Related: Bitcoin whales took advantage of $60,000 price drop, harvesting 40,000 BTC

Dogecoin Price Prediction

Sellers are trying to stop Dogecoin’s (DOGE) relief rally at the psychological $0.10 level.

If Dogecoin price declines from the current level, it increases the possibility of a breakout below the $0.08 level. The DOGE/USDT pair could then resume its downtrend and fall to $0.06.

Time is running out for the bulls. They will need to push the price above the 20-day EMA ($0.11) to suggest that the bearish momentum is weakening. The pair could then move towards the $0.13 level.

Cardano Price Prediction

Cardano’s (ADA) shallow bounce off the support line of the descending channel pattern indicates that bears are selling in rallies.

If Cardano price declines from the current level, the bears will once again attempt to pull the ADA/USDT pair below the support line. If they succeed, the pair could collapse to the next support at $0.20.

Conversely, a break above the 20-day EMA ($0.30) suggests that the pair could remain inside the channel for some more time. Buyers will gain the upper hand in the event of a close above the downtrend line. The pair could then rise to the $0.50 split level.

Bitcoin Cash Price Prediction

Bitcoin Cash’s (BCH) relief rally faces resistance at the 20-day EMA ($543), indicating bearish sentiment.

If the price continues to decline and breaks below $497, it suggests that the bears remain in control. The BCH/USDT pair could then fall towards the crucial support at $443, where buyers should step in.

On the upside, the bulls will need to push and sustain the price above the 20-day EMA to negate the bearish view. If they do, Bitcoin Cash price could rise to the 50-day SMA ($585).

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research before making a decision. Although we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness or reliability of the information contained in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on such information.