NEW YORK (AP) — As money continues to flow into crypto following Donald Trump’s re-election last week, bitcoin has hit a new record high.

The world’s largest cryptocurrency topped $89,000 for the first time, briefly peaking at $89,995 early Tuesday, according to CoinDesk. The price of Bitcoin has been oscillating throughout the day, but is still up more than 27% over the past week, settling at around $88,288 as of 5 p.m. ET.

It’s part of a rally in cryptocurrencies and crypto-related investments since Trump won the US presidential election. Analysts attribute much of the recent gains to the “crypto-friendly” nature of the new administration, which could translate into more regulatory clarity, but also greater room for maneuver.

However, as for everything in the volatile cryptoversethe future is difficult to predict. And while some are optimistic, others continue to warn of investment risks.

Here’s what you need to know.

Backup. What is cryptocurrency anyway?

Cryptocurrency has been around for a while now, but it has come into the spotlight in recent years.

In fundamental terms, cryptocurrency is digital money. This type of currency is designed to operate through an online network without a central authority – meaning it is generally not backed by any government or banking institution – and transactions are recorded using a technology called blockchain .

Bitcoin is the largest and oldest cryptocurrency, although other assets like Ethereum, Tether, and Dogecoin have gained popularity over the years. Some investors view cryptocurrency as a “digital alternative” to traditional money, but it can be very volatile and dependent on broader market conditions.

Why are Bitcoin and other crypto assets skyrocketing now?

Much of the recent action is tied to the outcome of last week’s election.

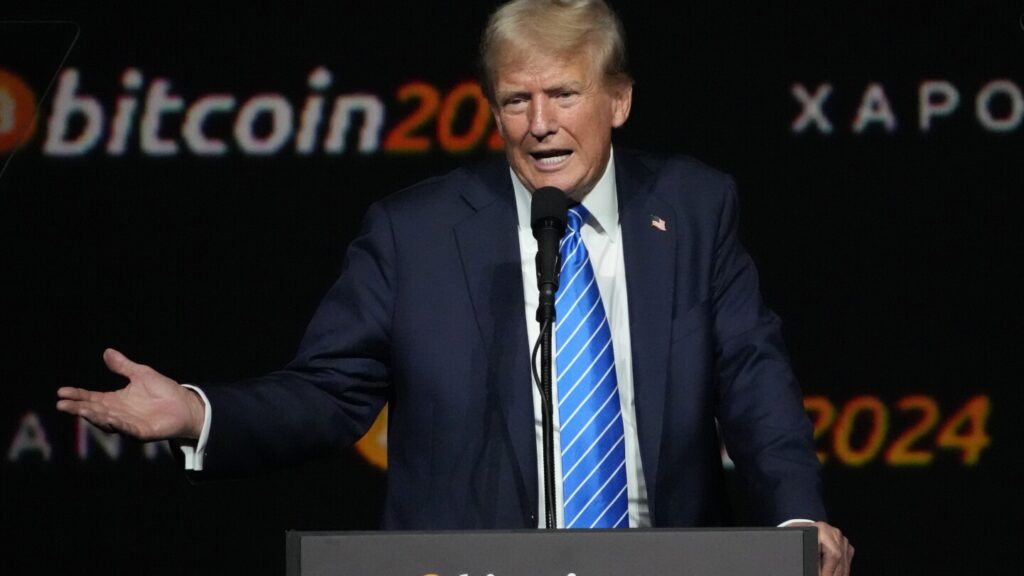

Trump was previously a crypto-skeptic, but changed his mind and kissed cryptocurrencies in this year’s presidential race. He pledged to make the United States “the crypto capital of the planet” and create a “strategic reserve” of bitcoin. His campaign accepted cryptocurrency donations, and he courted fans at a Bitcoin conference in July. He also launched World Liberty Financial, a new business with family members to trade cryptocurrencies.

Crypto industry players welcomed Trump’s victory, hoping that he will be able to push through the legislative and regulatory changes they have long called for. And Trump previously promised that, if elected, he would remove Securities and Exchange Commission Chairman Gary Gensler, who led the US government’s crackdown on the crypto industry and repeatedly. called for more monitoring.

“Crypto rallied as Election Day progressed into the night and it became increasingly clear that Trump would emerge victorious,” Citi analysts David Glass and Alex Saunders wrote in a note research on Friday, highlighting broader industry sentiment around Trump being “crypto-friendly.” and a potential shift in regulatory support.

But even before the post-election rally, assets like bitcoin saw notable gains over the past year. Much of the credit goes to the early success of a new way of investing in the asset: Bitcoin Spot ETFwhich were approved by US regulators in January.

Entries in Spot ETFor exchange-traded funds, “have been the primary driver of Bitcoin returns for some time, and we expect this relationship to continue in the near term,” Glass and Saunders noted. They added that spot crypto ETFs saw some of their largest inflows on record in the days following the election.

In April, Bitcoin also saw its fourth “halving” – a pre-programmed event that impacts production by halving the reward for mining or creating new bitcoins. When this reward decreases, the number of new bitcoins entering the market also decreases. And if demand remains strong, some analysts say this “supply shock” can also help propel prices in the long term.

What are the risks?

Crypto assets like Bitcoin have a history of drastic fluctuations in value – which can come on suddenly and occur over the weekend or overnight in trades that continue at all hours, every day.

In short, history shows that you can lose money as quickly as you make it. Long-term price behavior is based on broader market conditions.

At the start of the COVID-19 pandemic, bitcoin stood at just over $5,000. Its price soared to nearly $69,000 in November 2021, at a time of high demand for tech assets, but then collapsed during an aggressive round of Federal Reserve rate hikes aimed at to curb inflation. Then came 2022 FTX collapsewhich has significantly undermined trust in crypto as a whole.

Early last year, a single bitcoin could be had for less than $17,000. Investors, however, have started return in large numbers as inflation began to cool – and gains soared thanks to the anticipation and then early success of spot ETFs. While some crypto proponents see the potential for record-breaking days, experts still stress caution, especially for investors with smaller pockets.

“Investors should only get into crypto with money they can be prepared to lose,” Susannah Streeter, head of currency and markets at Hargreaves Lansdown, said last week. “Because we have witnessed these crazy fluctuations in the past.”

What about the climate impact?

Assets like bitcoin are produced through a process called “mining,” which consumes a lot of energy. And operations relying on polluting sources have caused particular concern over the years.

A recent study published by the United Nations University and the journal Earth’s Future found that the carbon footprint of bitcoin mining in 2020-2021 in 76 countries was equivalent to emissions from burning 84 billion pounds coal or the operation of 190 natural gas power plants. Coal met the bulk of bitcoin’s electricity demand (45%), followed by natural gas (21%) and hydropower (16%).

In the United States, the Energy Information Administration Remarks that cryptocurrency mining across the country “has grown very rapidly over the past few years,” adding that grid planners have begun to express concerns over the associated increase in electricity demand. Preliminary estimates released by the EIA in February suggest that annual electricity consumption from crypto mining likely represents between 0.6% and 2.3% of U.S. electricity consumption.

Environmental Impacts of Bitcoin Mining largely comes down to the energy source used. Industry analysts argue that the use of clean energy has increased in recent years, coinciding with growing calls from regulators around the world for climate protection.

_________

AP Business Writer Kelvin Chan contributed to this report from London.