Bitcoin is negotiated again above all time, after exceeding the $ 110,000 mark just hours ago. The escape signals a strong bullish momentum while BTC enters a new phase of prices. The feeling of investors remains optimistic, many analysts speculating on the extent to which this gathering could extend. While some provide an extended bull fed by macro-tendencies and institutional flows, others claim that overheated levels could trigger net withdrawals.

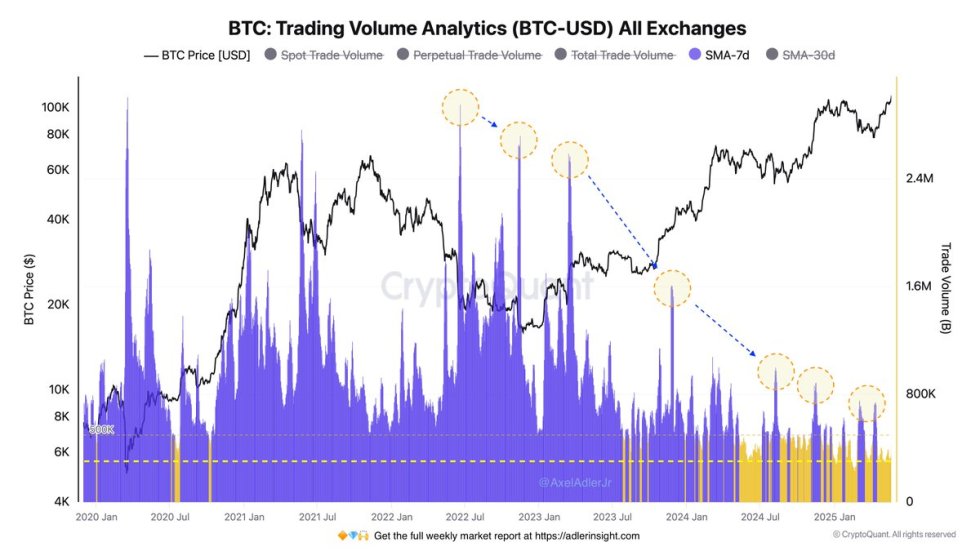

A critical element of attention of the data comes from cryptochant: since Luna’s collapse in 2022, the average weekly trading volumes for the BTC / USD pair on centralized exchanges (CEX) have greatly decreased. On a summit of 2.9 million BTC exchanged each week in July 2022, the volumes fell to only 426,000 BTC from yesterday’s session.

This drop in exchange activity suggests two key dynamics. First, a reduction in the BTC supply on exchanges is often correlated with long -term maintenance behavior, generally a bullish signal. Second, liquidity at the lower sale can increase volatility, in particular in the face of rapid price movements. While Bitcoin continues its ascending march, the absence of significant volume on the CEX could accelerate the gains or enlarge the corrections according to the reaction of the investors in the days to come.

The Low Exchange Bitcoin volume adds fuel to the upward prospects

Bitcoin shows resilience to macroeconomic opposite winds. While American shares fell yesterday due to the increase in yields in the bonds of the Treasury, Bitcoin has climbed regularly, indicating that market players can run capital in hard active ingredients in uncertainty. This relative force highlights the attraction of BTC as a hedge, especially when traditional markets vacillate.

However, despite the bullish momentum, a key obstacle remains at $ 115,000. The rupture above this resistance would confirm the next phase of the rally and would open the door to a higher price discovery. Conversely, a failure to maintain above current levels around $ 110,000 could invite a quick correction to previous support areas. Merchants are watching closely because volatility could increase quickly.

The upper analyst Axel Adler added a significant context to the broader trend. According to Adler, after Luna’s collapse in 2022, the weekly trading volumes against the BTC / USD pair on the centralized scholarships (CEX) fell, from 2.9 million BTC in July 2022 to only 426,000 BTC this week.

This long -term drop in exchange activity is considered a bullish structural change. It signals a movement towards long -term maintenance behavior and the tightening of the available supply. With fewer parts circulating on exchanges, the pressure of the sale is reduced, creating a backdrop for a continuous increase in prices.

The action of the BTC price shows a large momentum

Bitcoin is negotiated at $ 110,855 after having briefly reached $ 111,163, signaling a strong upward dynamics and a continuation of the upward trend. On the 4 -hour table, BTC has always displayed higher stockings and higher highs since the rebound in the level of support of $ 100,000 on May 15. The recent escape above the level of resistance of $ 108,000 sparked a wave of volume of purchase, pushing BTC in an unexplored territory.

Key technical indicators support the bias bias. The simple mobile average of 200 periods (SMA) at $ 98,024 and the exponential mobile average of 200 periods (EMA) at $ 98,826 tend to increase, confirming strong support for the underlying trend. The volume peaks in the last two sessions also suggest a strong conviction on the part of buyers while the BTC has entered the price discovery.

However, the price begins to show signs of potential exhaustion. The latest candles have long wicks on the upper side, referring to the sale of pressure near local vertices. If BTC fails to maintain the momentum, a retest of the level of slippage of $ 108,000 could occur. Immediate support represents about $ 103,600, with $ 100,000 as a psychological floor.

Dall-e star image, tradingview graphic

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.