The eminent crypto analyst Burak Kesmeci tilted Bitcoin (BTC) to achieve a price target of $ 124,000 based on the data of the gold ratio multiplier model. This upward prediction comes after a sharp increase in prices last week, suggesting that the first cryptocurrency can have more room for immediate prices growth.

Can Bitcoin go back to the target of accumulation peak of 1.6x?

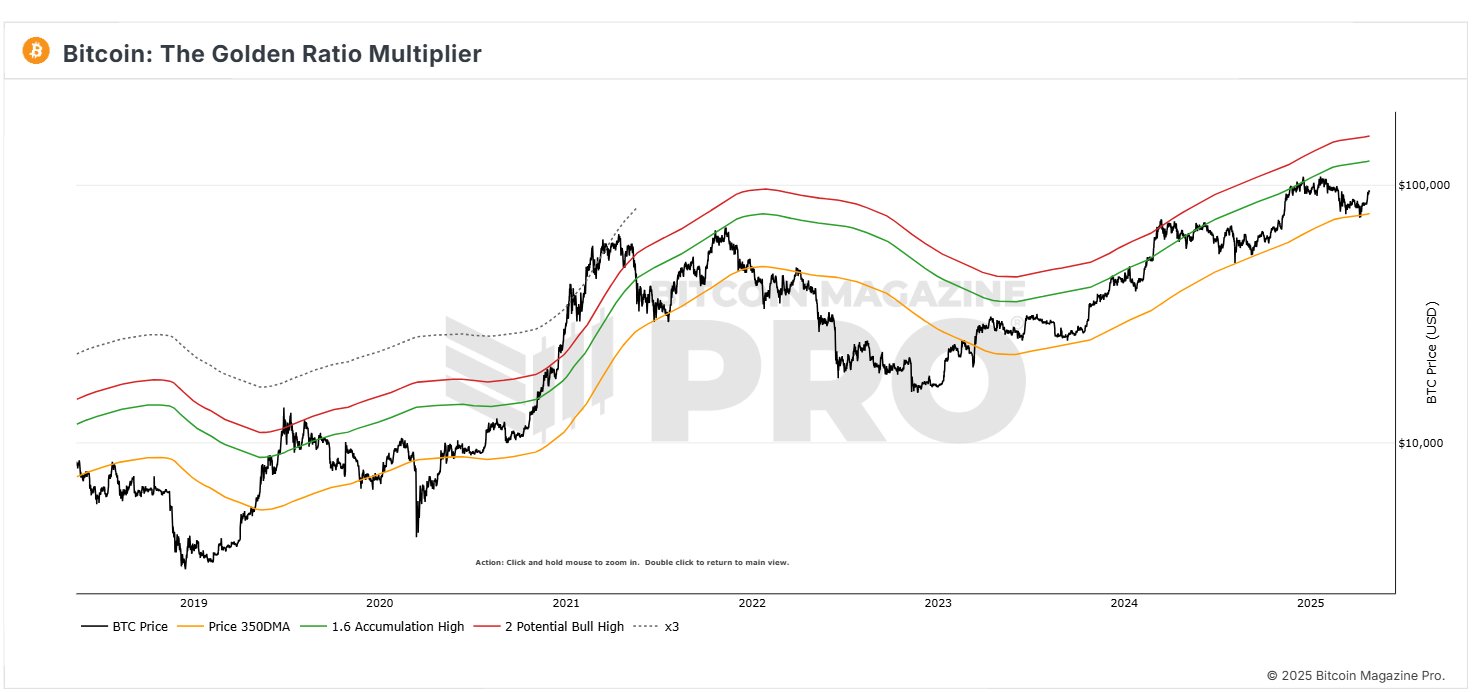

In a post X on April 26, Burak Kesmeci shared the latest updates on the Bitcoin Golden Ratio multiplier price model, referring to Bitcoin Magazine Pro data. For the context, the gold ratio multiplier model uses mobile averages and Fibonacci ratios to help identify when BTC could be overvalued or undervalued, thus signaling possible markets or good accumulation opportunities.

According to the graph below, Bitcoin recently retests the daily mobile average of 350 (350DMA) at $ 77,000. As its name suggests, the 350DMA follows the average BTC price in the last 350 days and acts as a key support area. Touching or plunging briefly below this level often indicates an opportunity for potential long -term purchase.

Bitcoin recently rebounded its 350DMA, after a price drop at $ 75,000, followed by two subsequent price rallies to exchange up to $ 96,000.

In accordance with the price strips on the Multiply Golden ratio, BTC is now heading for an accumulation of 1.6x, or 1.6 times the 350 DMA, which is currently $ 124,000. Consequently, despite the consolidation of current prices, BTC is likely to produce another price rally based on the price model of the Golden Multiplier ratio.

Interestingly, when Bitcoin moves near or above this level, it often signals the end of an accumulation phase and the beginning of a stronger upward trend. Consequently, the BTC reaching $ 124,000 would only open the way for additional price gains in accordance with the high targets of certain market analysts.

BTC minors earn $ 18.60 million in profits

In other news, another Top Crypto analyst Ali Martinez, reports that minors have recently taken advantage of the impressive Bitcoin prices rally, making nearly $ 18.60 million in profits, prices exceeding $ 94,000.

This increase made of profit emphasizes that the first minors strategically make profits at these high price levels. However, it should be noted that Bitcoin retains a strong bullish momentum despite this sales pressure, fueled by multiple factors, including high entries in punctual ETFs.

At the time of writing this document, the BTC is estimated at $ 94,393, reflecting a price drop of 0.76% in the last day.

Investopedia, tradingView graphic image

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.