Bitcoin prices only earned 0.95% in last week in the middle of intense market consolidation. The first cryptocurrency is struggling to get out of the price range from $ 85,000 to $ 86,000 following an impressive price rally during the second week of April. However, the popular analyst of Crypto Ali Martinez identified the main price resistance for the current trend of the Bitcoin rise.

Bitcoin STH produced the price at $ 91,000 has a major moment

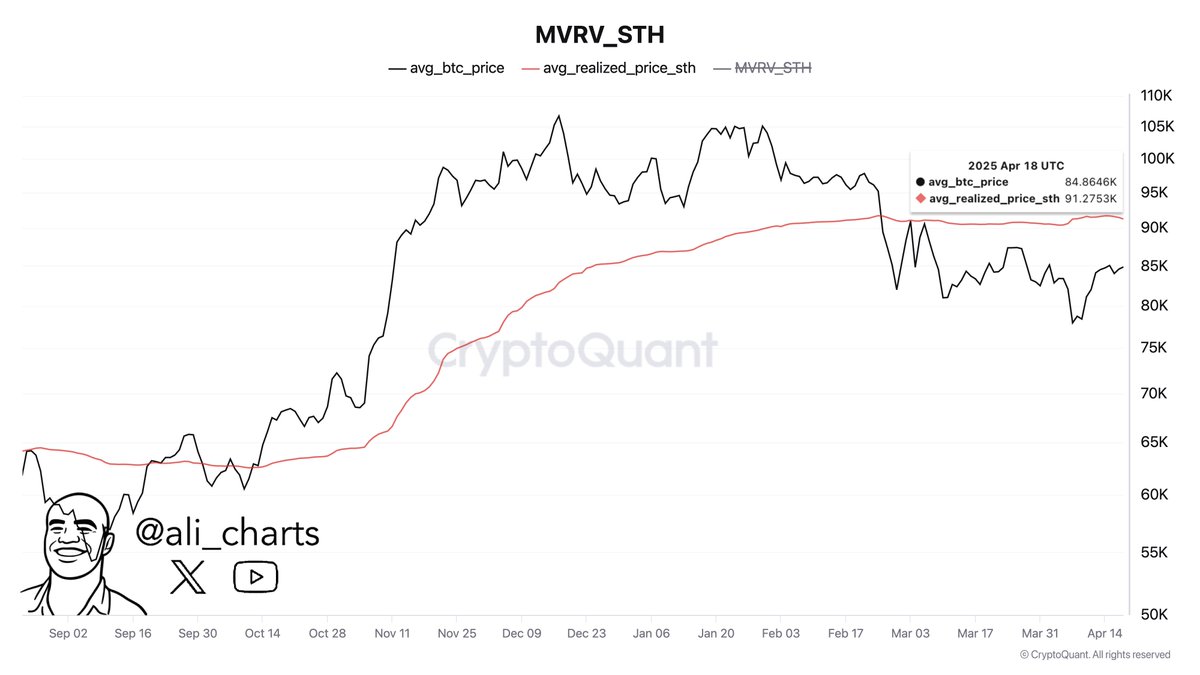

In a recent article on X, Martinez declares that Bitcoin faces a level of key resistance at $ 91,275 after a price rebound in early April. In particular, the asset jumped 17.33% after reaching a price of $ 75,000 on April 9. However, BTC has since entered into a consolidation after this feat, producing no significant price movement in both directions.

During last week, the cryptography market leader intervened between $ 84,000 and $ 86,000, forming a tight market at the beach. However, in the midst of these difficulties, Martinez declares that Bitcoin holders in the short term realized that the price is at $ 91,275, which indicates the pivot resistance to the recent market resurgence.

For the context, the price made of short-term holders is the average price at which new buyers (that is to say, new Bitcoin investors in the last 155 days) have acquired their BTC. This is an important technical indicator used to assess the feeling and market behavior in the short term.

When a market price is higher than the price made STH, it indicates a bullish momentum because recent buyers are in profit and are likely to hold. In this case, the price made STH serves as a high level of support, the new entrants of the market often defending their entrance area.

However, when the price of bitcoin is lower than the price made STH as currently shows on the market, the price made is an important resistance to psychological prices. Indeed, many short -term holders can choose to leave once the market breaks, increasing the sale pressure around this area.

Consequently, Bitcoin recovery $ 91,275 is essential to validate sufficient bullish potential to feed a complete price reversal.

Bitcoin price preview

At the time of writing this document, Bitcoin is negotiated at $ 84,872, reflecting prices growth of 0.14% on the last day. Meanwhile, the first cryptocurrency is down 1.34% on its monthly table while the downward pressure continues to decline.

While a major market resistance is $ 91,000, Bitcoin faces immediate opposition in the price area of $ 86,000, moving that could stimulate a high price increase to $ 91,000. However, a drop in price below the support at $ 84,500 could lead to a new price task at $ 84,000 with the potential to negotiate as low as $ 83,300.