Bitcoin is negotiated above the level of $ 95,000 as the bullish Momentum builds and the market seems ready for a potential break. After weeks of high prices action, the bulls are now aiming to recover the $ 100,000 mark, a key psychological and technical step that could trigger more. Analysts are increasingly optimistic, because the pressure pressure pressure and the feeling of investors becomes more constructive. However, the wider environment remains uncertain, the increase in global tensions and macroeconomic instability still throwing a shadow on the markets.

Despite the risks, the data on the chain support the upward thesis. According to Glassnode, the cost base of the short -term holder (STH) is currently at $ 93,460, a critical level which can determine the short -term management of Bitcoin. Holding above this threshold suggests that recent buyers are still in profit, which generally strengthens market confidence and reduces the probability of capitulation.

If Bitcoin maintains the force above this area, analysts think that it could open the door to a sustained rally towards peaks of all time (ATH) and beyond. On the other hand, a drop below the base of the STH cost could point out support to weaken and a potential retracement to lower demand areas. While the market enters a decisive phase, all eyes are on the break of $ 100,000.

Bitcoin takes momentum when buyers keep the level of key support

Bitcoin jumped more than 15% in less than three weeks, finding a force after an extended period of volatility and consolidation. The recent decision pushed BTC just below the highly anticipated level of $ 100,000, with prices at $ 97,900 before facing temporary resistance. The feeling of the market has moved decisively in favor of the bulls, with many analysts pointing towards continuous momentum and a potential break that could shape the next stage of the bull cycle.

High -level analyst Ali Martinez shared information on the chain highlighting the importance of the basis of the short -term holder’s cost, which is currently at $ 93,460. This level represents the average acquisition price of recent market entrants and is considered a crucial line of defense. As long as Bitcoin lies above this threshold, the structure remains optimistic. Martinez suggests that maintaining this support could ignite a rally around $ 132,330, according to a model observed in the previous bull markets when short -term holders have remained for profit.

However, the bullish scenario is prudent. A decrease below the level of $ 93,460 could report a weakening of demand, triggering a potential correction around $ 72,420 – a movement that would test the deeper liquidity zones and shake the speculative positions. For the moment, however, the path of the slightest resistance appears upwards. With the wider heating of the market and the Haussiers catalysts align, the current structure of Bitcoin suggests that the rally could be far from finished.

BTC price analysis: resistance less than $ 100,000

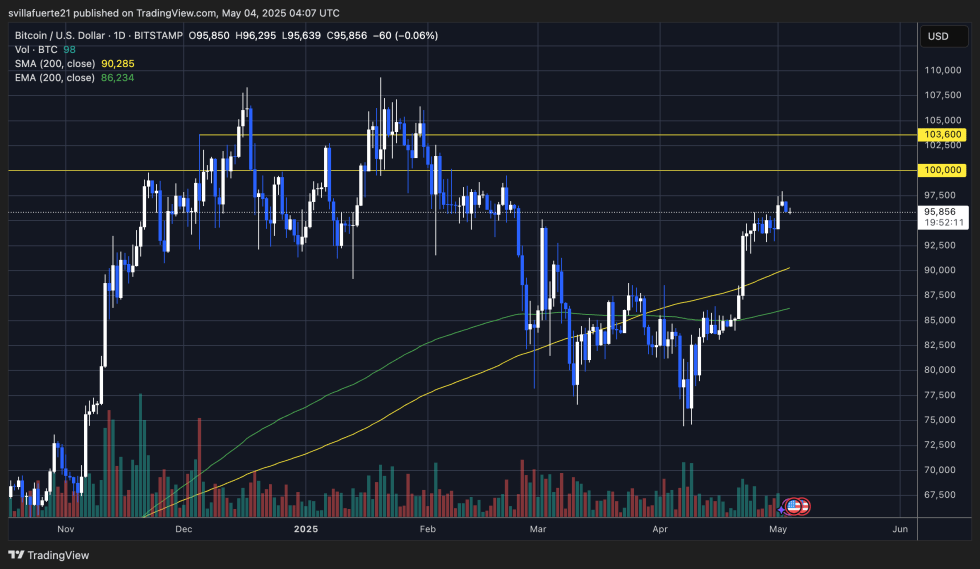

Bitcoin is negotiated at $ 95,856 after reaching a local summit nearly $ 97,900, showing signs of slowdown just below the $ 100,000 psychological level. As we can see on the daily graphic, the BTC has been in a strong upward trend since mid-April, recovering both the 200-day EMA and SMA, which is now about $ 86,200 and $ 90,200, respectively. These mobile averages are now used as key dynamic support levels.

The graph reveals a clear rejection around the resistance zone of $ 100,000, which aligns the historical supply pressure of the previous summits. Despite this, the price remains in a healthy consolidation just below the resistance, indicating that the bulls are not yet ready to abandon control. The volume has decreased slightly, suggesting a potential break or withdrawal, but the heavy lack of sale is a sign of strength.

If the Bulls manage to recover $ 97,900 and overthrow the support of $ 100,000, the following lens is about $ 103,600. However, not breaking this level could trigger a short -term retirement to the region from $ 93,000 to $ 90,000. Holding above $ 93,460, which aligns on the basis of the cost of the short-term holder, remains essential to avoid more disadvantages.

Dall-e star image, tradingview graphic

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.