Join our Telegram channel to stay up to date with the latest news

The price of Bitcoin fell 7% over the past 24 hours to $83,237, with JPMorgan analysts explaining that the cryptocurrency’s latest weakness is more due to short-term market sentiment and liquidity conditions than the recent decline in the US dollar.

Despite the greenback losing ground, Bitcoin failed to stage its usual reverse rally, underscoring its current behavior as a risk-sensitive asset rather than a traditional hedge against currency weakness.

JPMorgan analysts note that the recent decline in the U.S. dollar is primarily due to short-term capital flows, tariffs and changes in investor sentiment, rather than a significant change in the Federal Reserve’s growth outlook or policy outlook.

Although the dollar index (DXY) has fallen about 10% over the past year, strategists point out that interest rate differentials have actually moved in favor of the United States since the start of the year. This shows that the dollar’s weakness could be temporary, similar to the brief decline seen last April, with stabilization expected as the US economy demonstrates resilience.

Dollar weakness fails to boost Bitcoin’s gains, but there’s a reason for that, according to JPMorgan.

Dollar down but Bitcoin stagnates: JPMorgan identifies structural change in crypto correlations. The historical narrative of “digital gold” is challenged when traditional safe haven behavior disappears.…

– Dr Efi Pylarinou (@efipm) January 29, 2026

Bitcoin remains linked to risk sentiment

JPMorgan further claims that Bitcoin’s underperformance highlights how investors currently view the asset. Instead of functioning as a store of value like gold, Bitcoin continues to trade based on broader risk sentiment and global liquidity trends.

This became evident after the Federal Reserve kept interest rates unchanged and Chairman Jerome Powell maintained a hawkish stance, which weighed on risk assets, including cryptocurrencies. In contrast, gold and other hard assets have rebounded strongly amid dollar weakness, benefiting from their established macroeconomic hedging role.

JPMORGAN: #BITCOIN FAILS TO RALLY DESPITE THE 10% FALL IN THE DOLLAR INDEX

JPMorgan Private Bank notes that although the U.S. dollar index has fallen 10% over the past year, #Bitcoin is down 13%, shattering its #usual inverse correlation with dollar weakness. Analysts say the dollar… pic.twitter.com/yfmQU6uiEv

– CryptOpus (@ImCryptOpus) January 29, 2026

Looking ahead, JPMorgan expects Bitcoin to lag traditional inflation and currency hedges until macroeconomic fundamentals, such as changes in growth expectations or interest rate dynamics, take over. For now, low trading volumes and the upcoming expiration of crypto options continue to limit BTC’s bullish momentum.

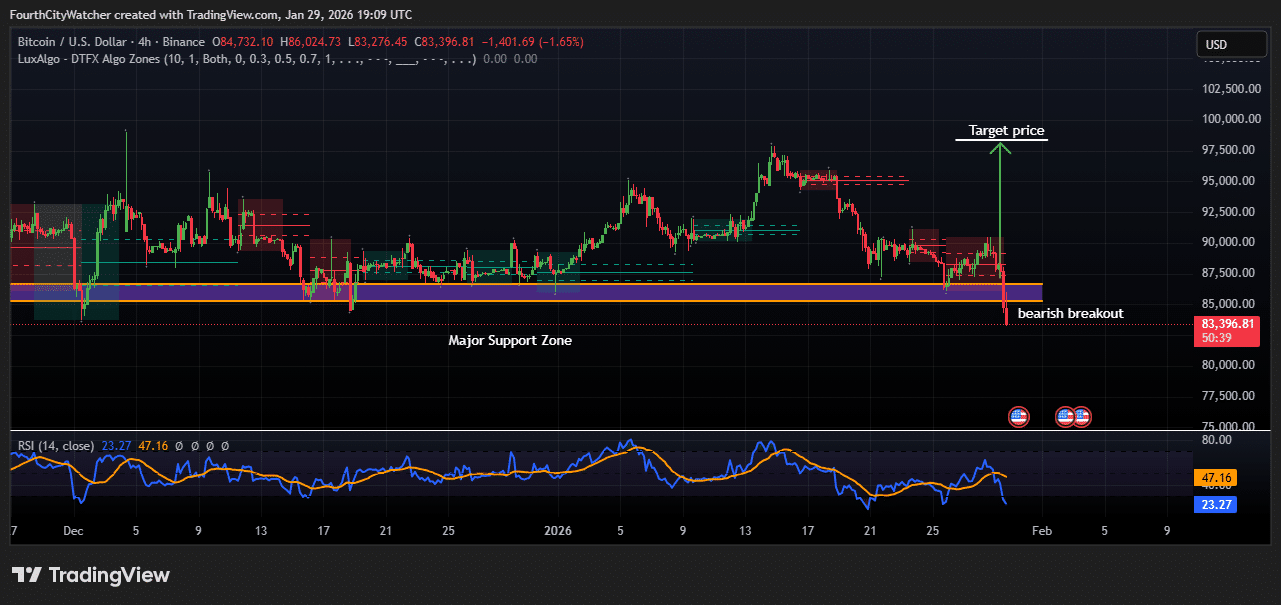

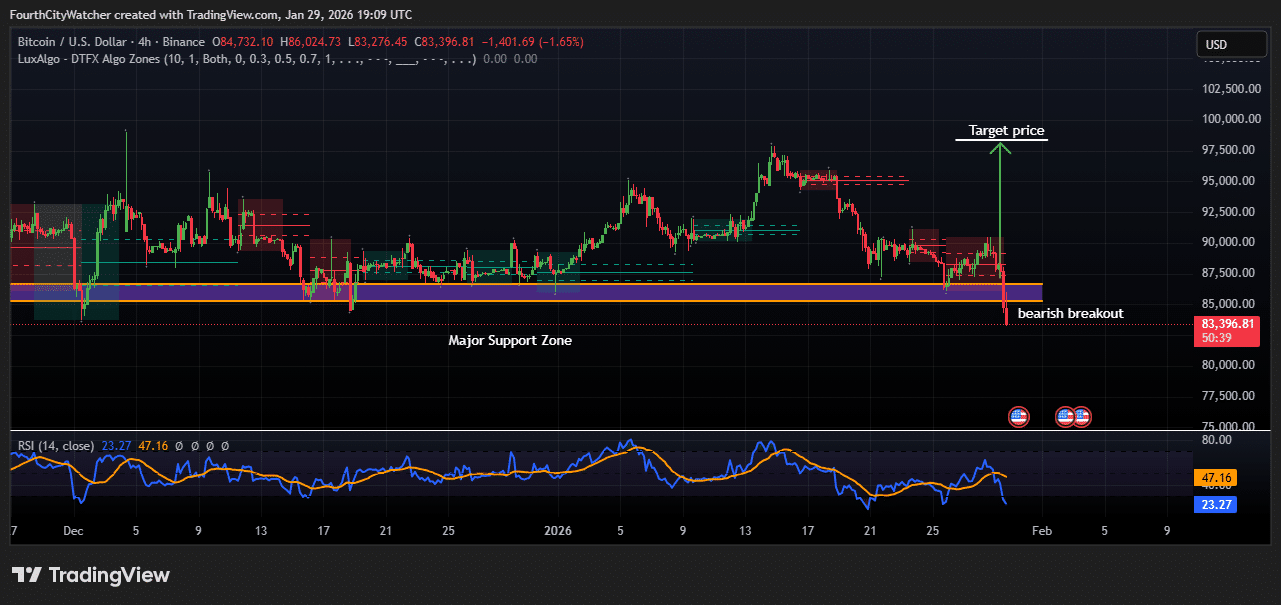

Bitcoin Breaks Key Support at $85,000 as RSI Signals Oversold Levels

Bitcoin price fell below a key support zone around $85,000, signaling a bearish breakout on the 4-hour chart. The move comes after a period of sideways consolidation within this major support zone, indicating that the previous level of buyer interest has failed to hold. The breakout comes with a sharp price decline to $83,397, highlighting increased selling pressure in the near term.

The relative strength index (RSI) fell to 23.27, entering deeply oversold territory. This suggests that even if sellers dominate, the market could experience a temporary rebound or consolidation, although the prevailing trend remains bearish until support levels are regained. Historically, similar breaks below major support areas have often led to accelerated bearish moves, meaning traders should be wary of further declines.

BTCUSD chart analysis. Source: Tradingview

Bitcoin faces short-term downside

Resistance to prior price congestion appears near $87,500-$88,000, which could serve as a near-term ceiling in the event of a corrective rebound. The chart also indicates a long-term target price above $95,000, but reaching this level would require a significant reversal in momentum and reclamation of previously lost support.

For now, the combination of a bearish breakout, an oversold RSI, and failure to hold the support zone positions Bitcoin as vulnerable to further declines in the near term, while highlighting that any rebound could be met with strong selling pressure.

Overall, the technical picture favors sellers, with the main support zone now acting as a potential reference point to monitor market reaction. Traders should monitor RSI recovery signals and price action around broken support to identify potential reversal opportunities or continuation of the downtrend.

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news