Join our Telegram channel to stay up to date with the latest news

Bitcoin plunged below $90,000 for the first time since April and Ethereum and XRP slipped as “extreme fear” gripped the crypto market.

BTC is trading at $89,730.57 as of 3:12 a.m. EST after sliding more than 5% in the past 24 hours. It has now fallen more than 14% over the past week.

Other major cryptocurrencies also fell, with the altcoin king ETH fell 6%, dragging it below the psychological $3,000 level. XRP lost more than 5%, moving closer to the $2 mark.

Crypto market cap nears $3 trillion in top 10 bleeds

Most of the other ten largest cryptocurrencies by market capitalization also buckled under the wave of selling pressure. Cardano (ADA) lost 6%, BNB and Solana (SOL) fell more than 3%, while Tron (TRX) and meme coin leader Dogecoin (DOGE) fell 1% and 4%, respectively.

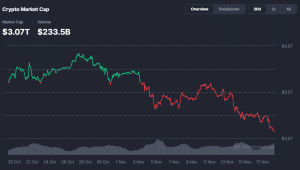

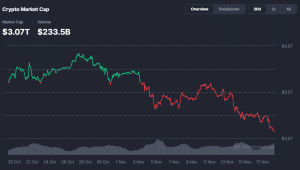

Crypto’s overall market cap plunged 5% to $3.07 trillion, according to to CoinMarketCap data.

Crypto market capitalization continues to decline (Source: CoinMarketCap)

“Extreme fear” reigns as liquidations exceed $1 billion

Amid the broader market decline, investor sentiment has become even more bearish, with the Crypto Fear and Greed Indexa popular tool for gauging market sentiment, fell three points to an “extreme fear” level of 11. It also lost 18 points over the past month.

Data from CoinGlass shows that liquidations exceeded $1.02 billion over the past day, with long positions accounting for $724.2 million..

The short-to-long liquidation ratio hit a high over the past four hours, with $100.74 million cleared from long positions and only $17.90 million liquidated from short positions during that time.

Before the latest sell-off, The Kobeissi Letter told its over 1.1 million followers on

In the last 16 days alone, we have seen 3 days of liquidations exceeding $1 billion.

Daily liquidations of more than $500 million have become commonplace.

Particularly in times of low volume, this leads to violent crypto fluctuations.

And it goes both ways. pic.twitter.com/yGMQG4VEMC

– Kobeissi Letter (@KobeissiLetter) November 16, 2025

He added that liquidations of more than $500 million had also become a “normal phenomenon” and blamed excessive debt levels. He said hHigh leverage combined with low volumes have been the cause of “violent crypto fluctuations.”

Bitwise and BitMine executives see bottom this week

Bitwise CIO Matt Hougan and BitMine President Tom Lee say the market could bottom this week.

Speaking in a interview With CNBC yesterday, Lee said the crypto has been suffering since the October 10 liquidation event and added that traders are still unsure if there will be an interest rate cut in December.

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news