Join our Telegram channel to stay up to date with the latest news

Bitcoin price broke out of a two-month consolidation to hit a high of around $97,704 on Wednesday. The world’s largest cryptocurrency rose 1.7% on the day, trading at $96,442 as of 1:13 a.m. EST, with the price at its highest level since mid-November.

The advance triggered an estimate $455.07 million in the liquidation of short crypto positions, including approximately $187.1 million tied to BTC, according to Coinglass.

The crypto space also grew by a fraction of a percentage to a market cap of $3.26 trillion, as the CMC Crypto Fear and Greed Index climbed to 54, maintaining neutral appetite in the market while investors position themselves.

CZ Predicts Bitcoin Price Could Reach $200,000

Changpeng Zhao, co-founder of Binance, has claimed that Bitcoin will reach $200,000, which he says is more about timing than probability and the more obvious bet.

This is the most obvious thing in the world to me.

(no financial advice)

– CZ 🔶BNB (@cz_binance) January 14, 2026

In an AMA, CZ noted that there is currently no indication of a spike in its value and highlighted Bitcoin’s strong growth potential.

Additionally, he mentioned that the United States Securities and Exchange Commission (SEC) will not prioritize digital assets in 2026 review efforts. Therefore, this change is expected to reduce enforcement risks and foster a more favorable environment for BTC.

This comes even as the Senate Banking Committee delayed development of a bipartisan market structure bill (CLARITY ACT), extending uncertainty around the legislation’s timeline. The bill sought to define crypto regulatory jurisdiction between the SEC and the Commodity Futures Trading Commission (CFTC).

CZ’s Bitcoin predictions are not isolated. Tom Lee of Fundstrat actions an optimistic outlook for the leading cryptocurrency in the near term. He suggests that BTC could reach around $200,000 to $250,000, thanks to supportive policies and increased institutional investment.

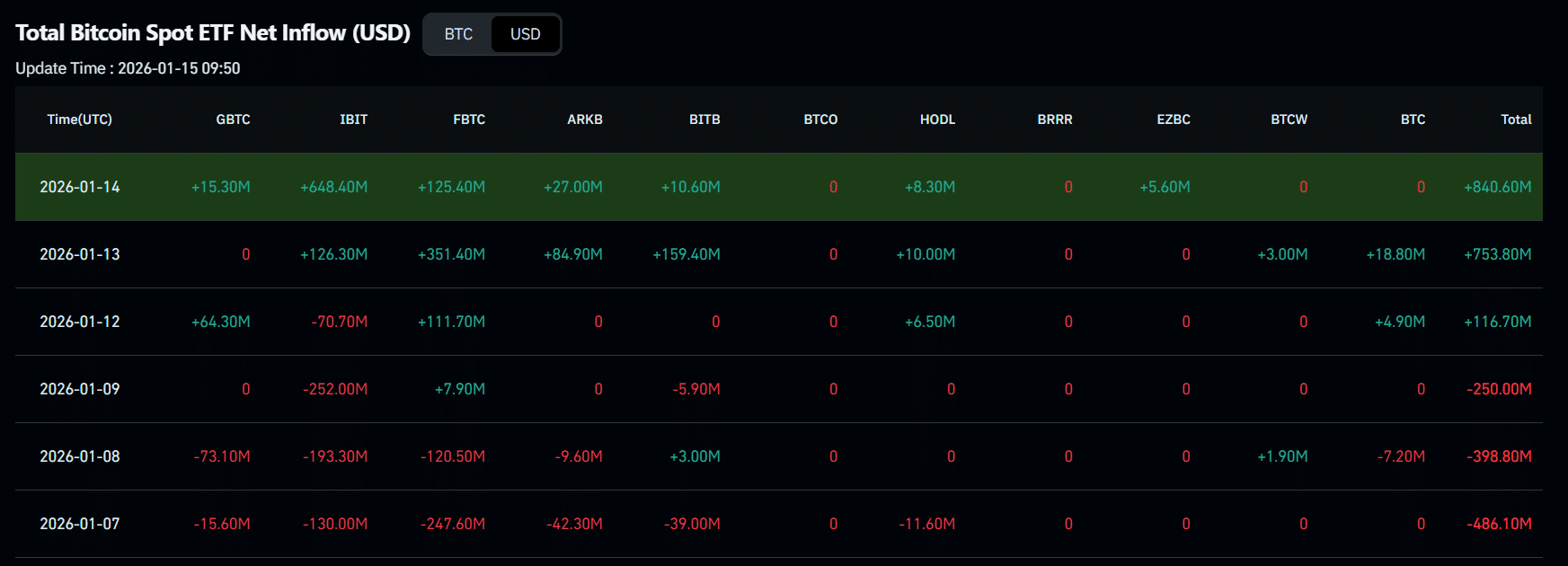

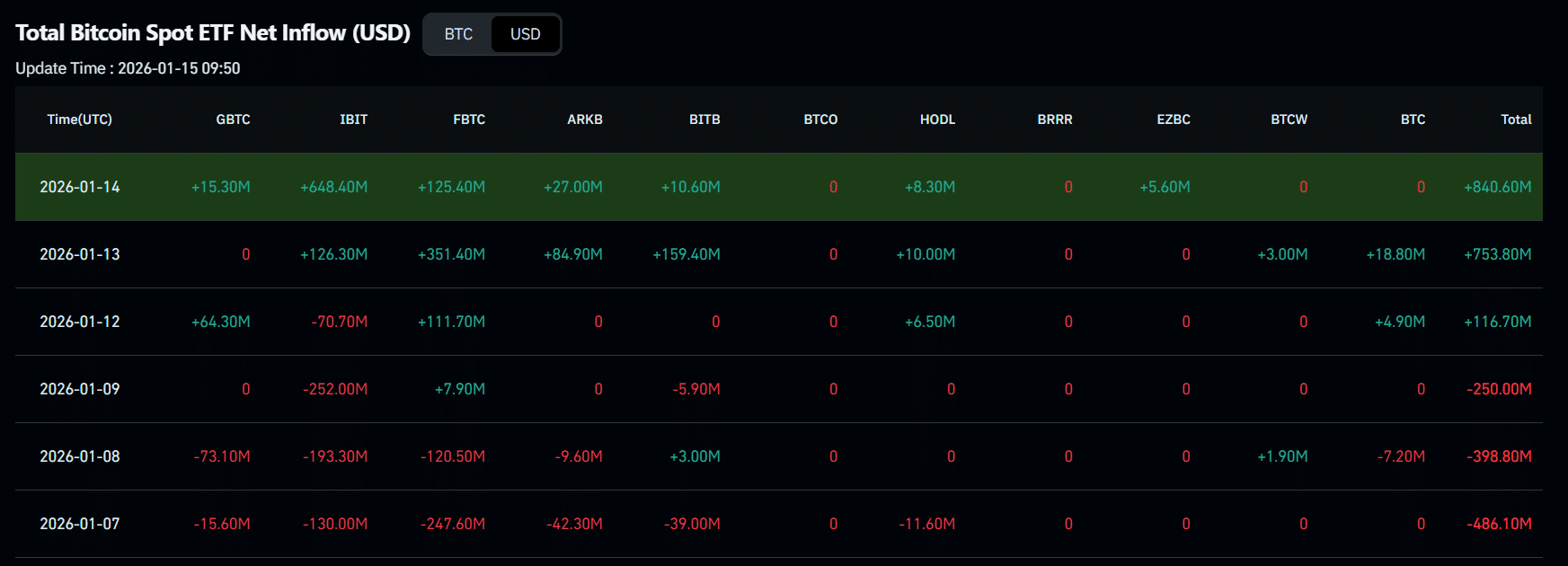

Bitcoin ETFs raise over $840 million as BTC surges

A rise in the price of Bitcoin above $96,000 triggered the largest daily inflow of U.S. spot exchange-traded funds (ETFs) in three months, with those products adding $840.6 million on Jan. 14, according to coin mechanism data. This is a third consecutive day of net collection this week.

BlackRock’s IBIT led inflows with a net flow of $648.4 million. Fidelity’s FBTC followed closely with a net flow of $125.4 million.

The buying pressure brought the total net assets of all spot BTC ETFs in the United States to approximately $122.9 billion, or approximately 6.5% of Bitcoin’s $1.89 trillion market cap.

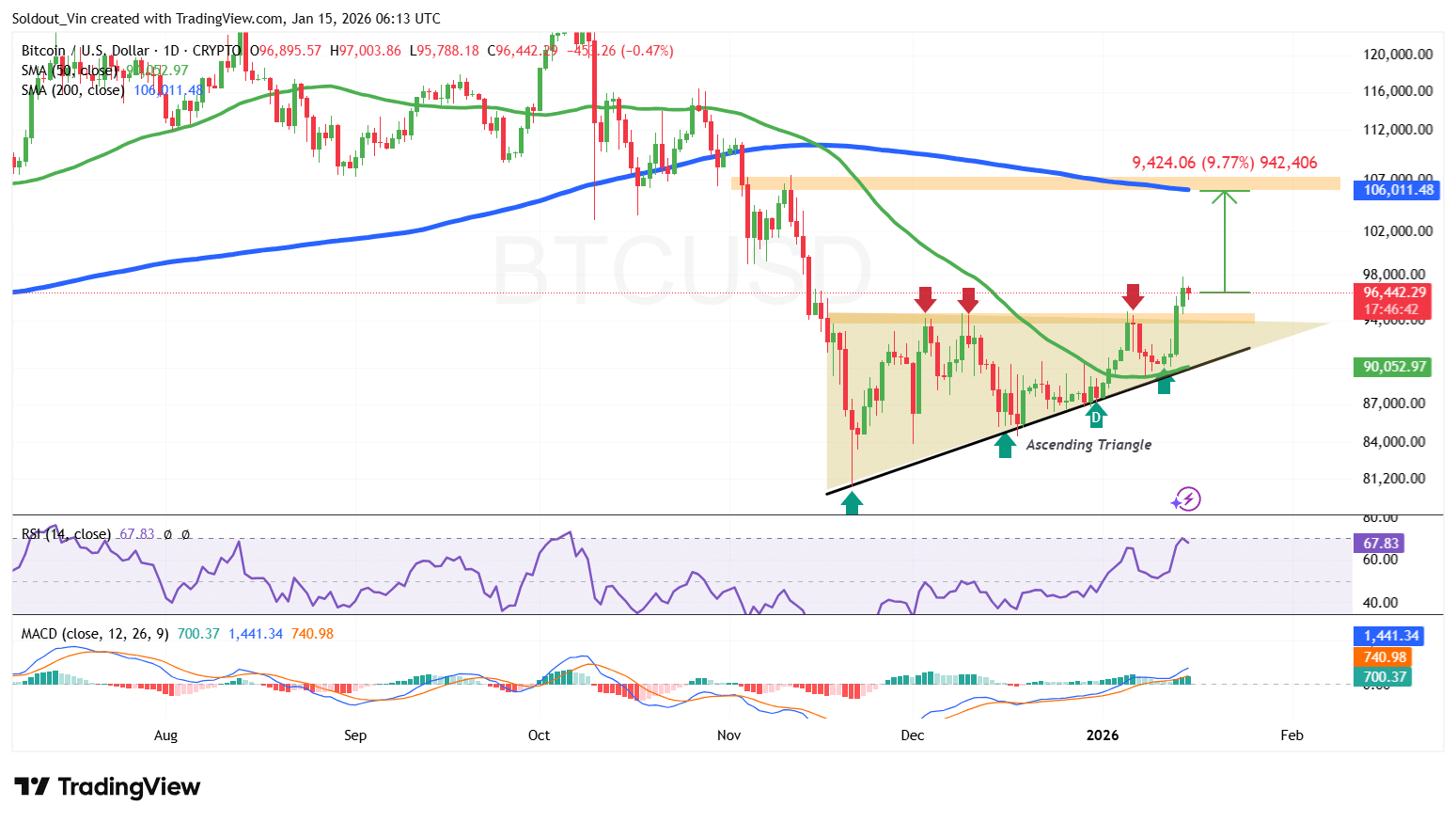

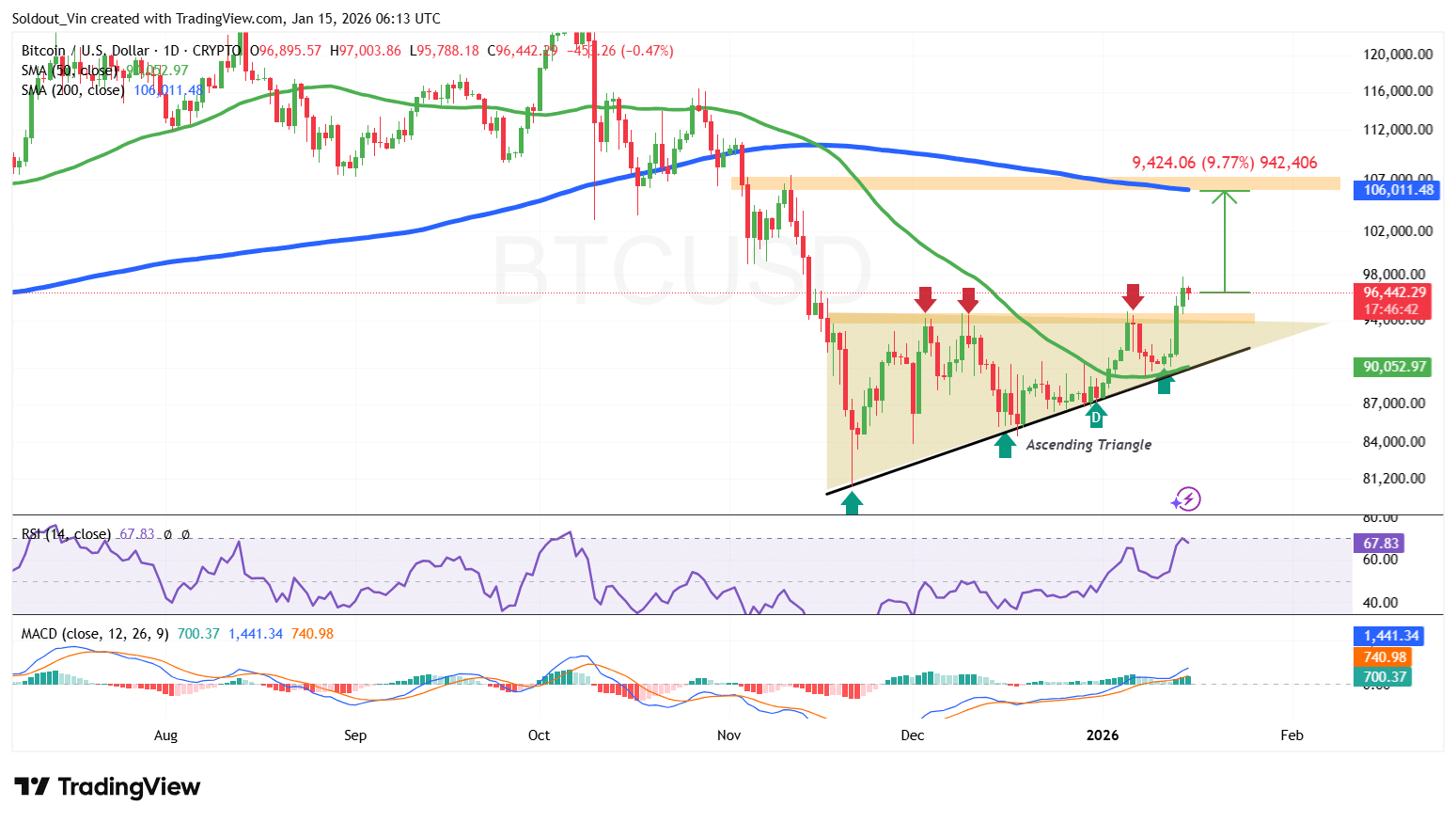

BTC breaks out of an ascending triangle

After consolidating for two months in an ascending triangle configuration, the BTC Price recently crossed $94,000 in the last 3 candles on the daily chart. Technically, this move is important because a break above this pattern often indicates a sustained bull rally.

By breaking through the resistance zone around $94,000, Bitcoin price signaled that the sideways capped price may finally be over.

The rise above the $90,000 zone has since pushed Bitcoin price above its 50-day simple moving average, signaling a near-term bullish outlook.

Bitcoin’s Relative Strength Index (RSI) is also near the overbought zone, currently at 67.83, indicating that buyers are in control without the price being overbought. This is a sign that the price still has room to rebound.

Meanwhile, the Moving Average Convergence Divergence (MACD) has also turned positive, with the blue MACD line moving above the orange signal line.

Can the momentum be maintained?

BTC/USD 1-day chart analysis shows that the breakout above the triangle could be supported. If this happens, buyers expect a 9.77% upside to the $106,011 level within the 200-day SMA.

Conversely, due to last week’s 7% rally, short-term investors could still take profits, which could push the price down to the $89,000 support.

Related news:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news