Bitcoin has seen increased institutional demand since the start of the year, according to Ki Young Ju, CEO of CryptoQuant.

According to Young Ju’s post

However, whale addresses holding at least 1,000 BTC – excluding crypto exchanges and mining pools – saw an inflow of 670,000 BTC over the past year.

The CEO of CryptoQuant, a leading market analysis platform, said that “institutional demand is twice that of retail” for self-custodial wallets.

Whales control the majority

According to data provided by IntoTheBlock, almost 40% of Bitcoin’s supply is in whale addresses holding at least 1,000 BTC.

The latest company to join the list is Japanese investment firm Metaplanet. According to a report from crypto.news, Metaplanet increased its Bitcoin holdings by 156.7 BTC on October 28 – the total amount reached 1,018 BTC, worth over $70 million at the time of reporting.

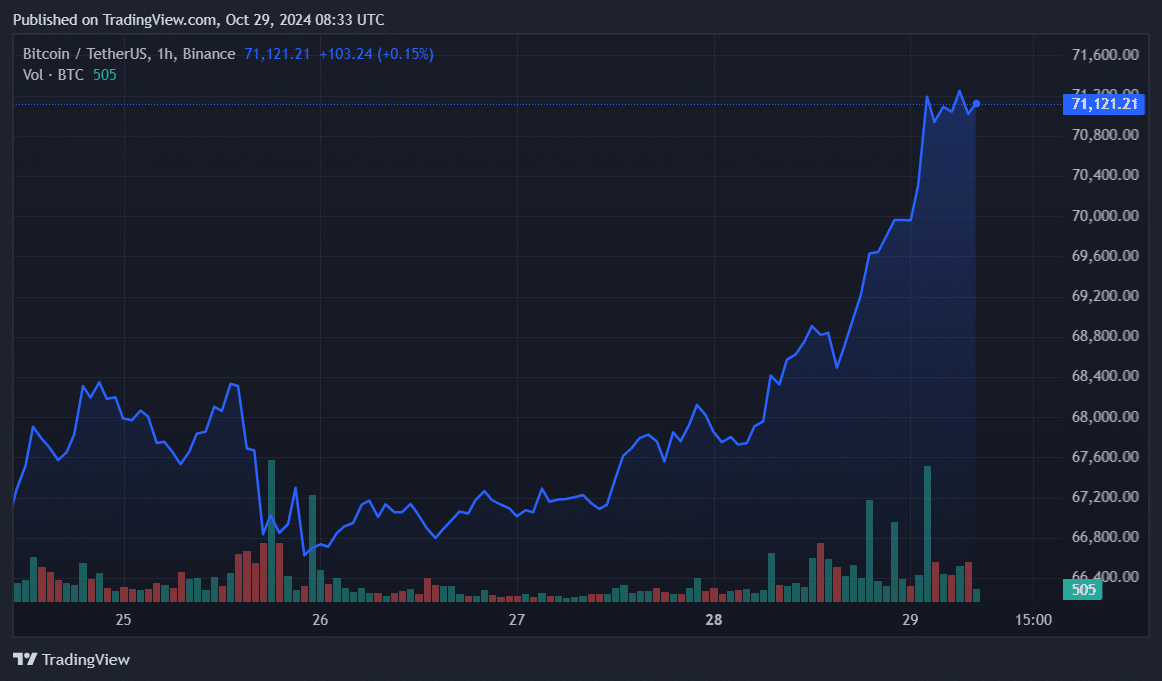

Bitcoin has gained 4% in the last 24 hours and is trading at $70,950 at the time of writing. The asset briefly hit a five-month high of $71,475 earlier today. Currently, BTC is only 3.5% away from its all-time high of $73,750.

The flagship cryptocurrency saw its daily trading volume increase by 123%, reaching $47 billion. Bitcoin’s market capitalization has surpassed the $1.4 trillion mark following the recent price rally.

According to ITB, over 99% of Bitcoin holders are currently profitable. This could hint at short-term profit-taking, which could indicate a potential price correction.