Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Morbi Pretium Leo and Nisl Aliquam Mollis. Quisque Arcu Lorem, quis pellentesque nec, ultlamcorper eu odio.

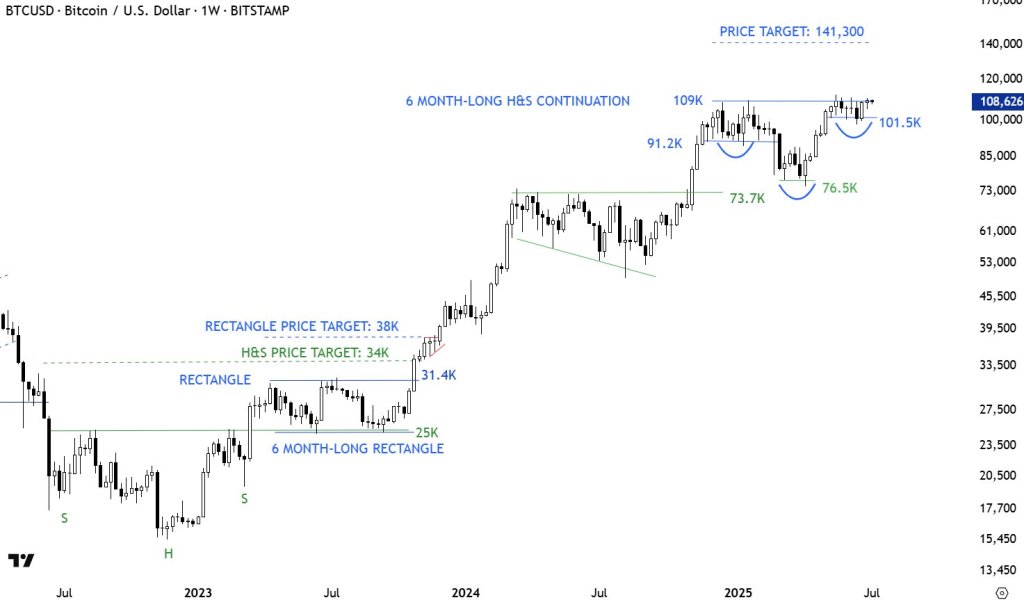

Upper analyst Aksel Kibar (CMT) thinks that Bitcoin approaches a decisive moment on the weekly graph. In a position shared on July 9, 2025, the veteran technician noted that BTC / USD “is the right to the limit of the model”. The annotated graph that he published – on the coverage of the weekly bitstamp prices in mid -2010 – compression of the cryptocurrency directly under a strip of horizontal resistance at $ 109,000, the neckline of what it develops a continuation of continuation of the head and shoulders (H&S) of six months.

Bitcoin loan for $ 141,300

Kibar’s graphic first revisits the basic sequence that reversed the 2022 bear cycle. A reverse manual of the head and shoulders finished at the beginning of 2023, with hollows at around $ 17,600 (left shoulder), $ 15,500 (head) and $ 19,500 (right shoulder). The escape above the neck was bitcoin at $ 31,400.

Related reading

Immediately afterwards, the price is dead in a six -month rectangle delimited by a support of $ 25,000 and a resistance of $ 31,400. The possible resolution of Topside propelled the market to the implicit objective of the rectangle of $ 38,000, validating two consecutive conventional projections in less than a year. Subsequently, the price of the BTC has grown more. Below $ 73,700, BTC was decreasing, ending with an escape around $ 109,000.

From this moment, the initial withdrawal has the bottom at $ 91,200, creating what Kibar designates as the left shoulder. A deeper descent at $ 76,500 has cut the head. Then, the price of Bitcoin formed the right shoulder at $ 101,500, resolved by the blue bowl arc on the graph.

Throughout this structure, the neck at $ 109,000 has remained intact, acting as a clear demarcation between consolidation and fresh summits. The opposite model of the head and shoulders extends over about half a year, corresponding to the “6-month” annotation of the analyst.

Related reading

Using the H&S Orthodox continuation rule – adding the vertical distance of the head ($ 73,700) to the neckline ($ 109,000) at the rupture level – Kibar draws a price target of $ 141,300. He notes in an answer X that this target is distinct from the previous objective of $ 137,000, which came from a greater cut with a round at the monthly scale. In other words, the short -term weekly model is now changing modestly higher than the longer -term structure.

At the time of the Bitcoin press, Bitcoin exchanged nearly $ 111,000, exceeding the neckline. However, from a technician’s point of view, the break must still confirm with the weekly fence. Confirmation requires a decisive weekly colony north of the neck of $ 109,000. As Kibar notes: “Breakout must take place with a long white candle, similar to the complements of the previous patterns. There should be no hesitation. ”

The invalidation would emerge on a weekly closure below the last Swing-Bas support at $ 101,500; A deeper failure under $ 91,200,000 would completely unravel the diagram.

For the moment, Bitcoin is on the support point of its six -month balance. A weekly candle or two should reveal whether the largest digital asset can convert another formation of conventional graphics into a measured movement – this time towards a half -plates territory.

Star image created with dall.e, tradingView.com graphic