- The long -term ceiling impulse of Bitcoin has approached historic support, pointing out a major market market pivot.

- The feeling remained neutral because long -term holders are faced with a key decision that could define the management of Q2.

Bitcoin (BTC) is at a central junction. While one of its most revealing long -term measures is approaching a historically significant level, the market is found to remember its breath.

The coming days can set the tone for what will happen – whether as the basis of a new gathering or the edge of a deeper slide.

What do the data say?

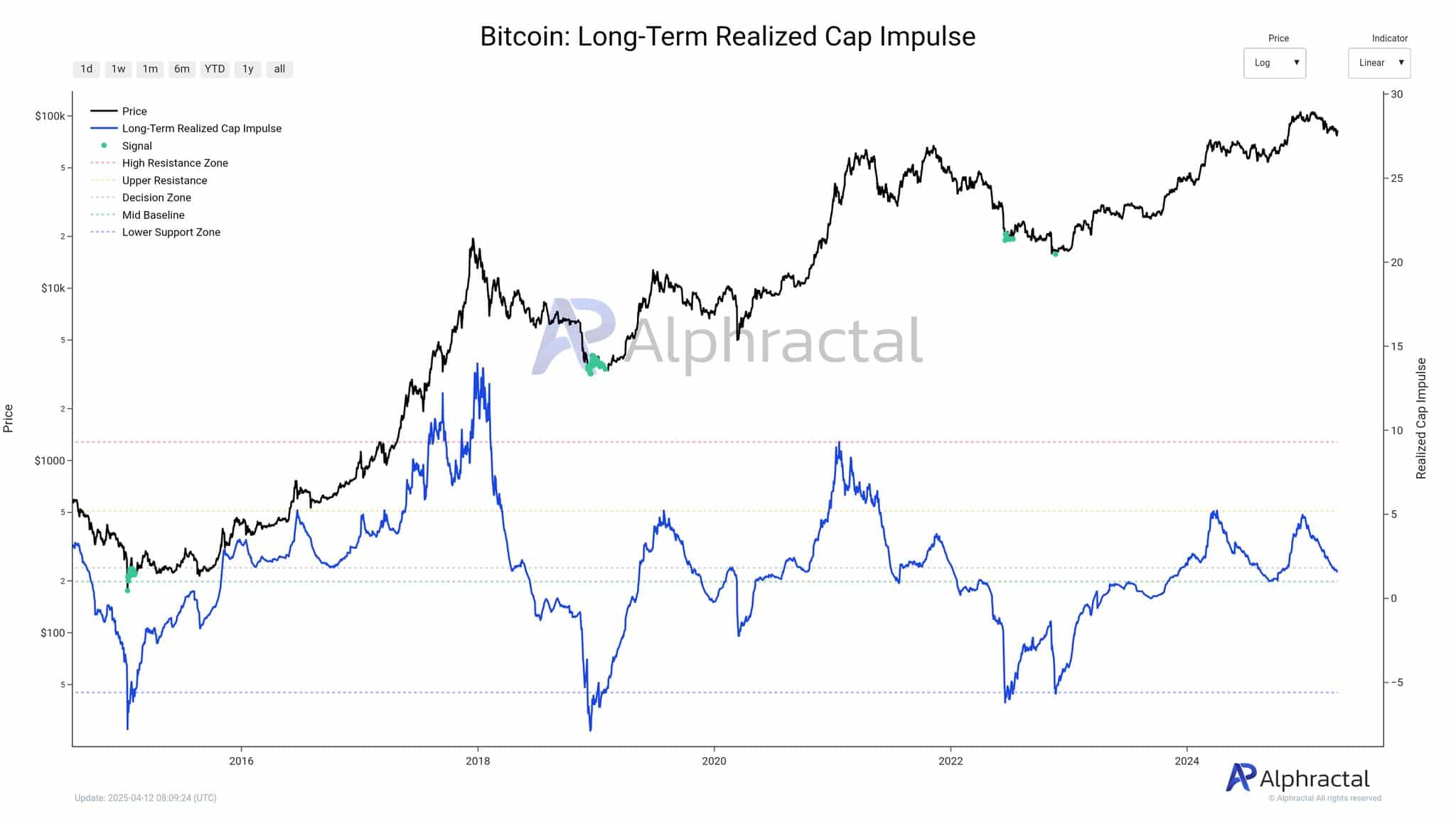

The long -term ceiling impulse is a key metric to assess the conviction of long -term bitcoin holders.

This metric assesses the momentum of the capitalization carried out, which reflects the movement of parts according to their most recent transaction price and is adjusted for long -term trends.

Historically, when this impulse reaches its lower support zone, it has aligned itself with important turning point in the Bitcoin price.

Source: Alphractal

At the time of the press, the impetus is at a level which previously preceded significant market recovery in 2019 and at the end of 2022. This model suggests that long -term holders enter a critical decision window.

Either they remain firm, or the wider story on the market can start to change.

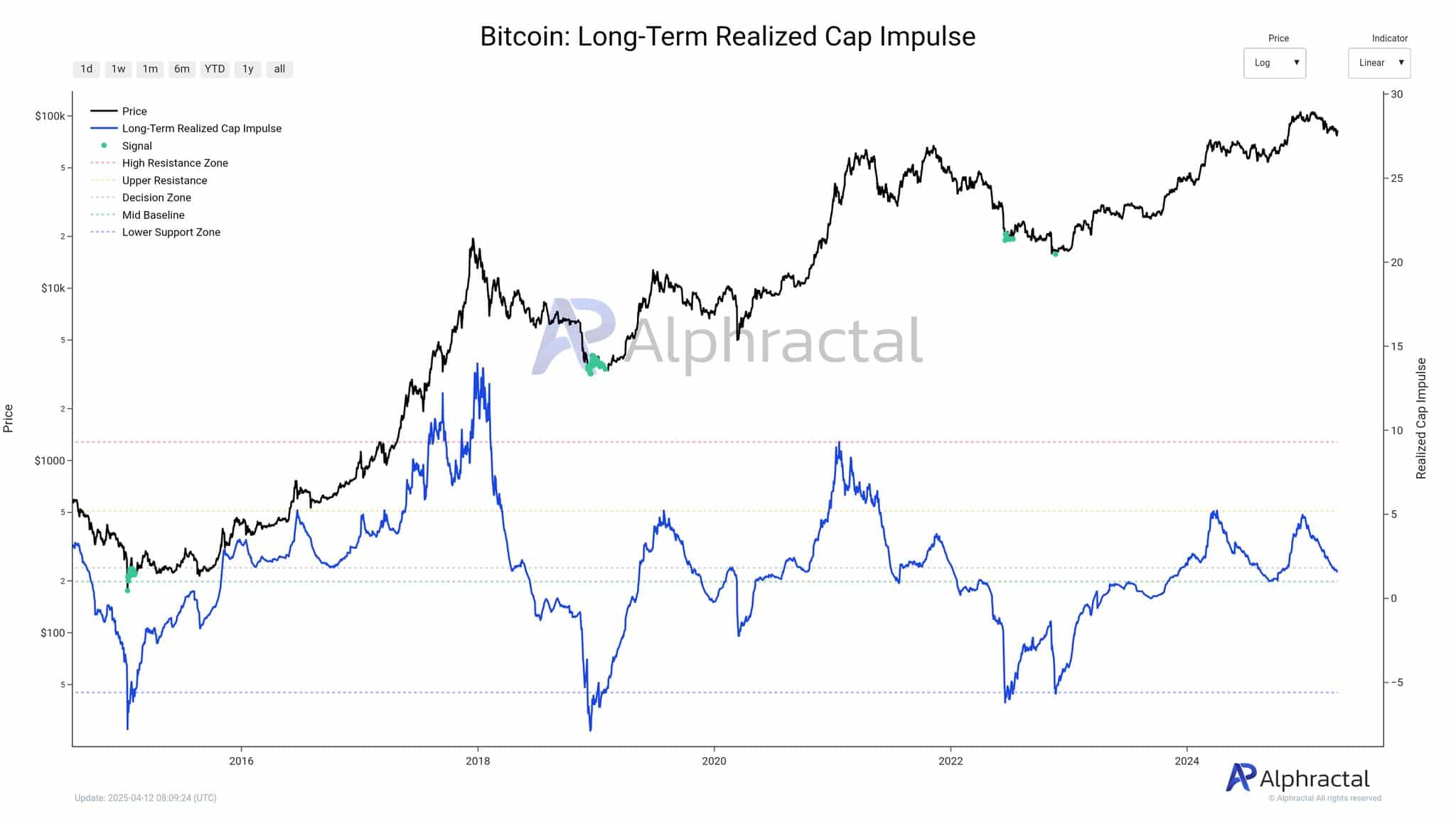

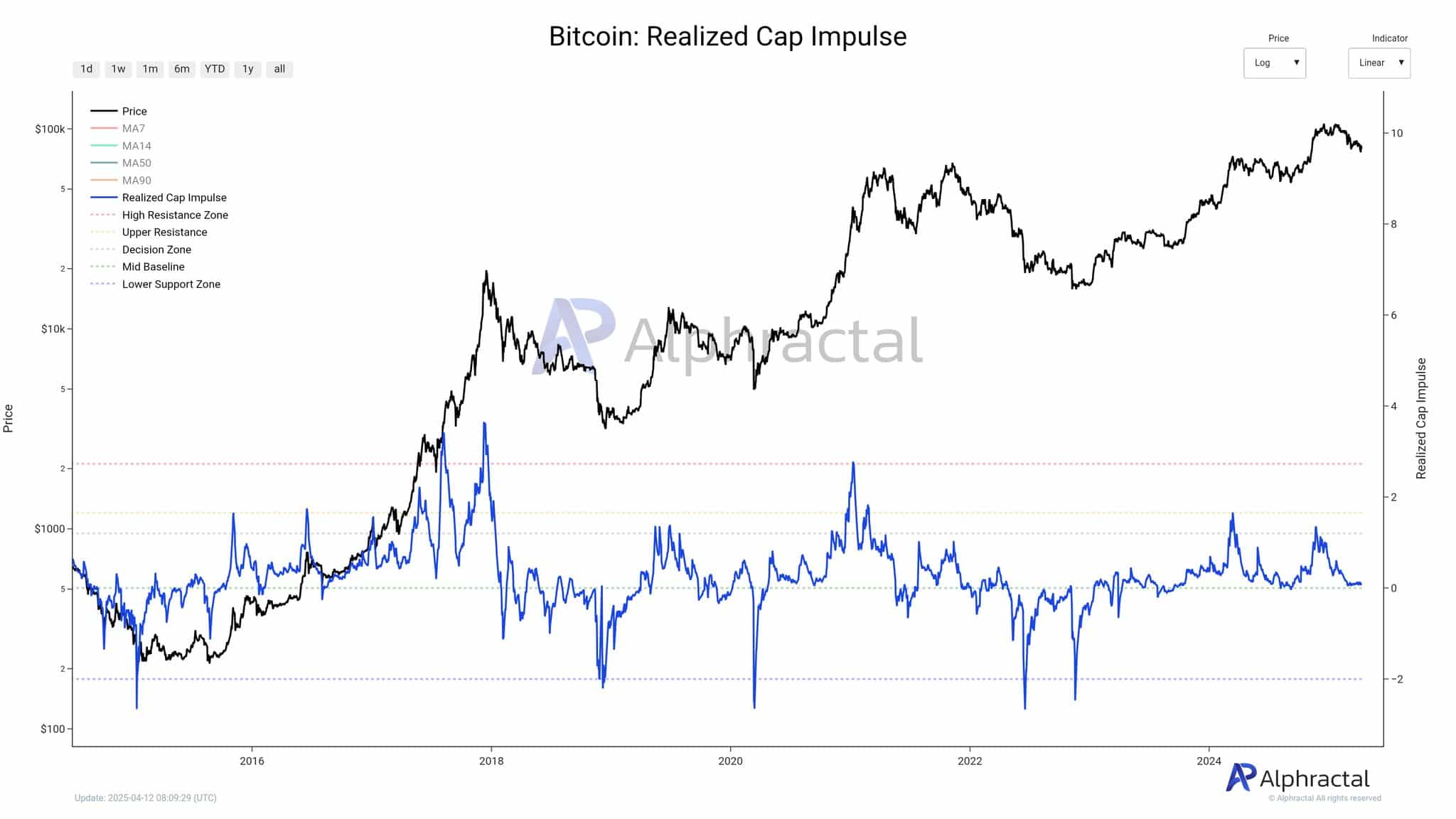

Rebound support or structural breakdown?

The current configuration has a binary result. If Bitcoin manages a positive rebound in this support area, this could point out that long -term holders maintain their positions, laying the basics of renewed accumulation and ascending momentum.

Source: Alphractal

However, Ventilation at this level could signify a loss of confidence among the most resilient participants on the market – those who generally absorb sales pressure rather than adding it. Such a shift could trigger a more pronounced correction.

Given the long -term history of the impulse of the anticipation of macro inversions, its next movement could define the trajectory of the next quarter.

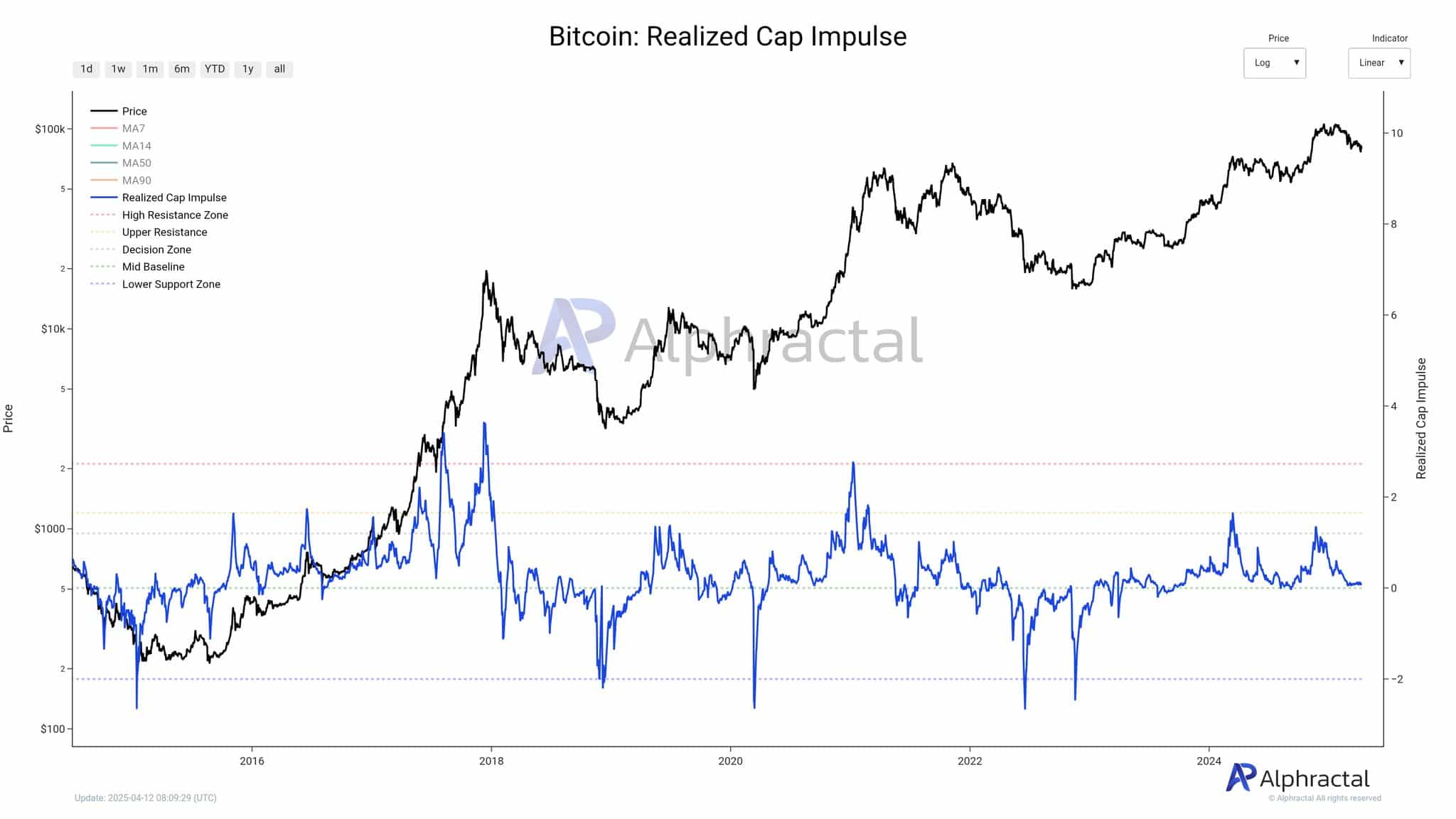

Bitcoin: feeling on the edge

At the time of the press, the index of fear and greed was 45 years, indicating a prudently neutral feeling – resembling fear but stopping in capitulation. This reflects a market characterized by uncertainty while remaining reactive to potential catalysts.

Reading the feeling reflects visible indecision on the long -term pulse table, stressing that Bitcoin approaches a critical decision point.

Historically, feeling often follows structural measures, suggesting that current calm could precede a significant directional change. Whether this change becomes optimistic or dropping it will largely depend on the behavior of long -term holders during this pivotal moment.