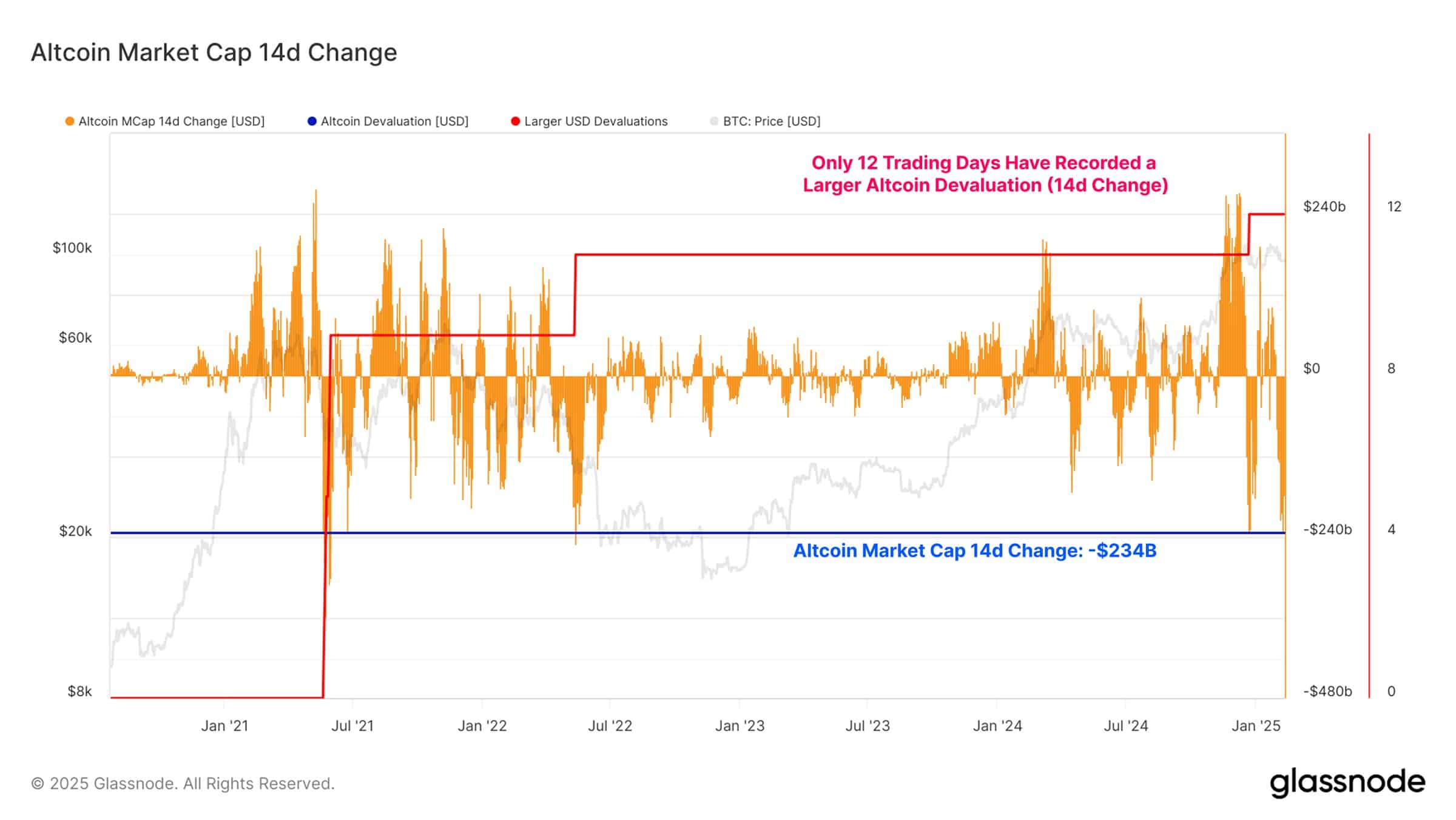

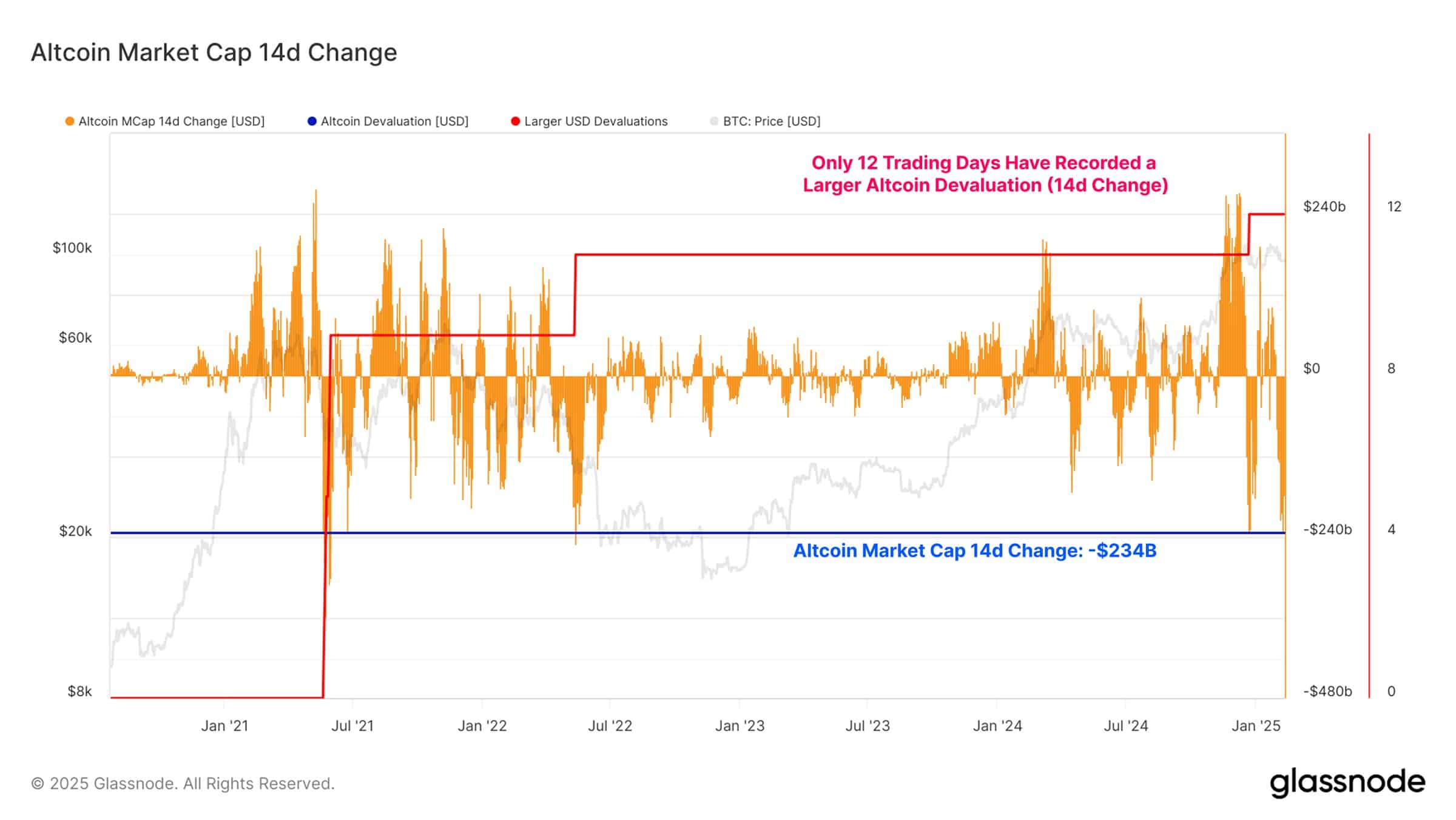

- The Bitcoin force was obvious because the ERC-20 Altcoins experienced net reductions, the sector losing $ 234 billion in just 14 days.

- Altcoin markets have been faced with a rare historical devaluation.

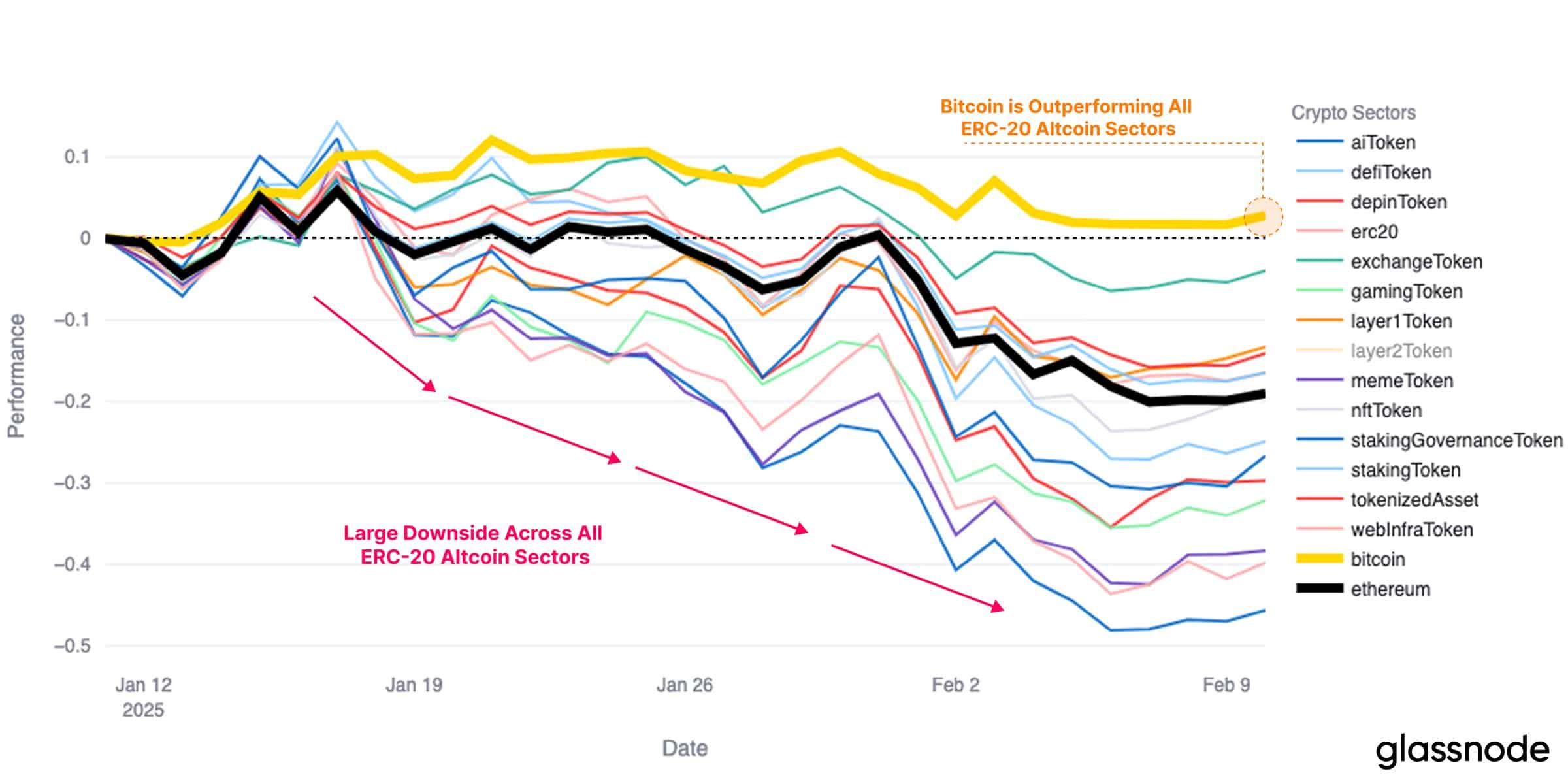

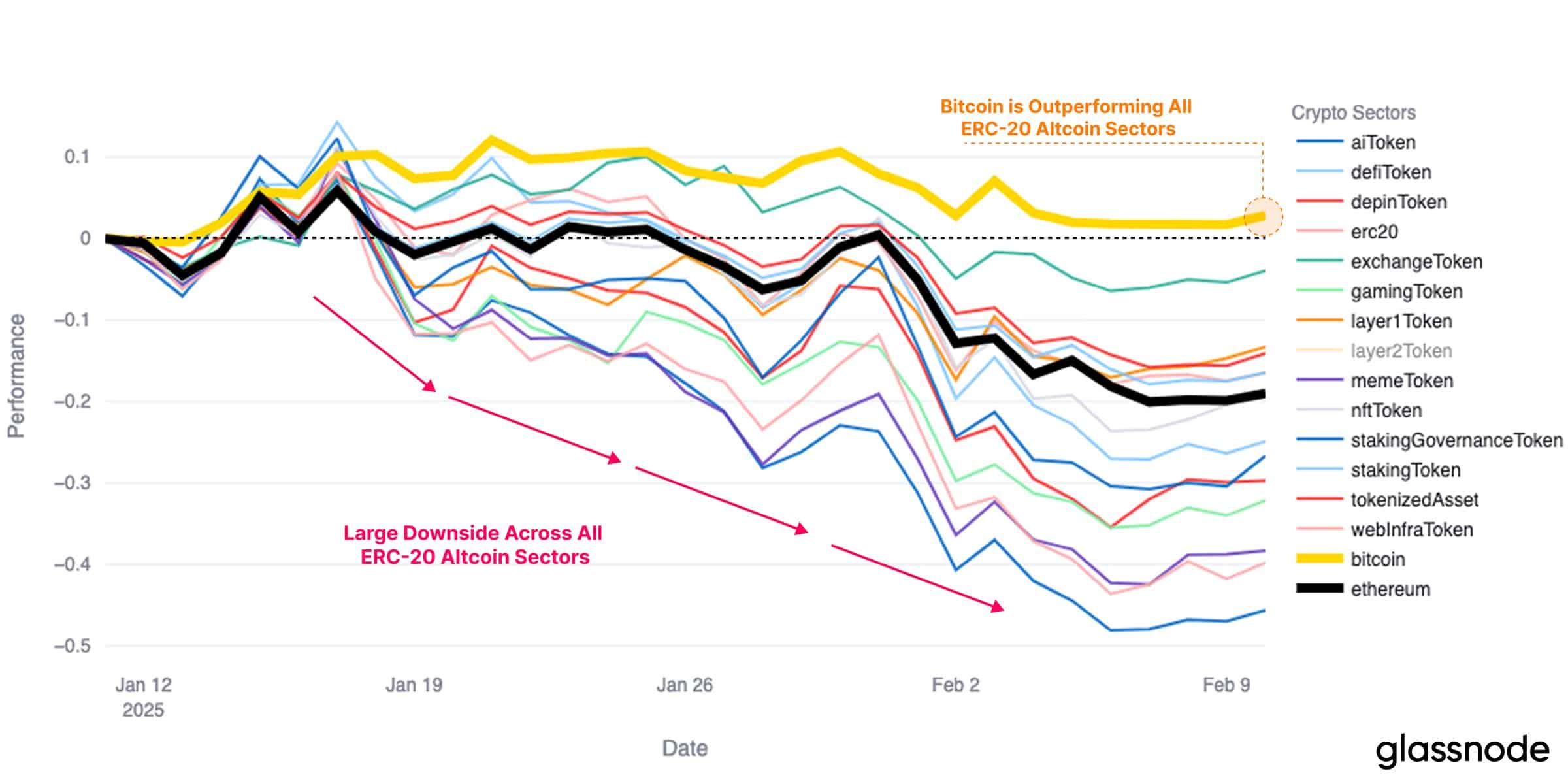

Bitcoin (BTC) continued to enhance its resilience in the middle of a larger market slowdown, considerably surpassing the ERC-20 Altcoin sectors during last week.

The latest data revealed a pronounced decline on several sub-sectors, emphasizing a striking divergence of market performance.

Altcoin assessments knowing one of their largest devaluations for years, the wider cryptography market faces increased volatility.

Bitcoin holds firm while altcoins plunge

Despite market-scale weakness, Bitcoin has maintained a stable position, surpassing all sectors of the ERC-20 Altcoin.

According to Glassnod’s performance graphic, Bitcoin (yellow line) was maintained above the neutral threshold, maintaining relative stability compared to Ethereum (ETH) (black line) and various Altcoin categories, which have undergone substantial drops.

Source: Glassnode

A great point to remember from this trend is the vast drawback visible through the ERC-20 sub-sectors, including the DEFI tokens, the playmates and the same token, which all tend to descend since mid-January.

The clear drop suggests that the confidence of decreasing investors in altcoins, the rotation of capital promoting bitcoin. This change highlights the role of BTC as a safer active in uncertain market conditions.

Altcoin Market sees one of the largest 14 -day devaluations

An overview of the Glassnod Altcoin market capitalization graph of Glassnode has strengthened this downward trend, showing an amazing drop of $ 234 billion in Altcoin market capitalization in the past two weeks.

Historically, such significant drops have been rare, with only 12 previous negotiation days testifying to a greater devaluation of the Altcoin.

This level of drawing suggests that the risk appetite in the Altcoin space has decreased sharply, traders unloading positions aggressively.

Source: Glassnode

In particular, these types of net corrections often coincide with major structural changes in the feeling of the market.

If altcoins continue to underperform while Bitcoin is stable, a new capital leak towards BTC could consolidate its domination, potentially delaying any general recovery in the Altcoin market.

What it means for the market

The current divergence between Bitcoin and Altcoins suggests that investors position themselves defensively, preferring BTC as a more stable asset.

Historically, similar periods of Altcoin sub-performance preceded market rallies led by Bitcoin, where Capital is first consolidated in BTC before turning later in more risky assets.

However, a crucial factor to watch is whether Bitcoin can maintain its strength in the midst of increasing macroeconomic uncertainty. If the BTC is starting to weaken, the wider cryptography market could face new downward pressure.

Alternatively, if Bitcoin stabilizes and starts another step, this could trigger a renewed speculative interest for altcoins.