Main to remember

- Bitcoin shows a stronger correlation with technological stocks rather than gold.

- Bitcoin correlation with the Nasdaq has reached 0.7 in the past three years.

Share this article

Bitcoin shows a stronger correlation with technological stocks than gold, according to the new report by Franklin Templeton Digital Assets, “when Gold Zigged, Bitcoin Moonwalked”, discusses the common narrative that Bitcoin is “digital gold”.

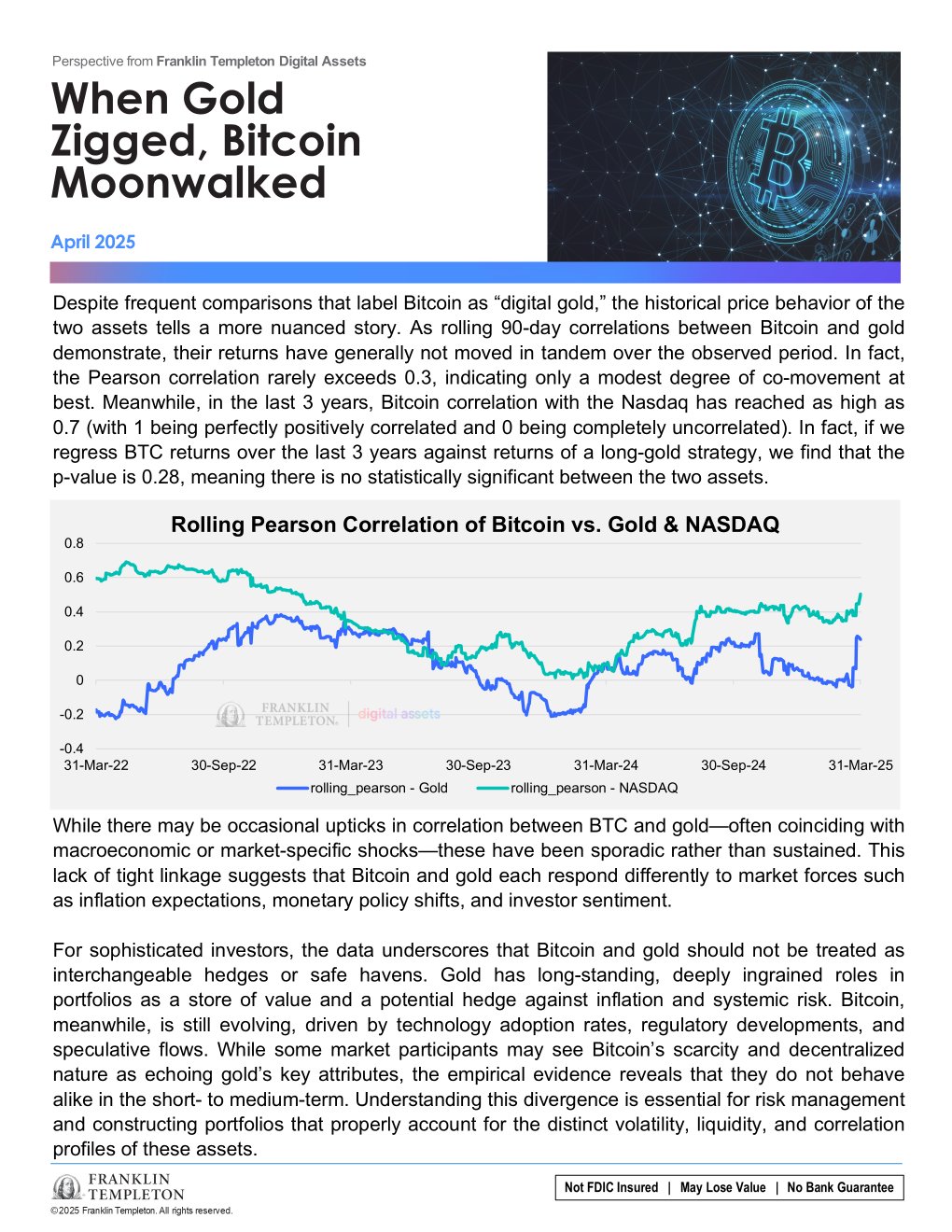

Franklin’s digital asset team has analyzed three years of data and found that the correlation of prices between bitcoin and gold is low. Research shows that the correlation of bitcoin with gold rarely exceeds 0.3 over 90 days periods, which means that the two active people generally move independently.

Although they can occasionally display some cooperation, they do not behave in a consistent manner in tandem.

Instead, Bitcoin has shown a much stronger and growing correlation with the Nasdaq stock market index, reaching 0.7 in the past three years. This suggests that Bitcoin behavior follows technological actions more closely than traditional shelters.

“In fact, if we regress BTC yields in the past 3 years against long -standing strategy, we find that the P value is 0.28, which means that there is no statistically significant between the two assets,” said the report.

According to digital assets by Franklin Templeton, several key factors are the source of the divergence. Gold has a long -standing institutional adoption, deep liquidity and a robust market structure developed over the centuries.

Bitcoin, on the other hand, has recently seized institutional portfolios and remains influenced by emerging dynamics such as regulatory changes, technological innovation and speculative flows.

Although there were brief periods when bitcoin and gold moved to tandem, generally during macroeconomic shocks, these episodes were more exception than the rule.

The report argues that the intrinsically volatile nature and focused on Bitcoin limits its usefulness as a gold substitute in diversified wallets.

“The disparity in maturity, combined with intrinsically more volatile nature and focused on bitcoin, continues to limit its correlation with gold, which means that the nickname” digital gold “can be more ambitious than the reflection of the real behavior of the market – at least for the moment,” notes the report.

Gold prices rise on fresh summits as American-Chinese trade tensions increase

Bitcoin climbed over $ 83,000 early Friday, while American data index (PPI) has declared lower than 2.7% compared to a 3.3% forecast, according to tradingView data.

The decrease in the PPI, as well as a drop in the US dollar index below the key level of the 100, fueled optimism among crypto traders on the potential bruise market for bitcoin.

However, despite these ostensibly positive inflation figures, the main American stock market indices such as the S&P 500 and the NASDAQ showed a minimum change, reflecting current concerns concerning the American trade war.

Bitcoin experienced high volatility in last week, largely in response to the announcement of President Trump’s tariff, who rocked the world’s stock markets.

Despite the first signs of decoupling, Bitcoin continues to negotiate with technological actions. After having briefly fell below $ 80,000 on Thursday as the United States-China trade conflict intensified, the asset Crypto rebounded above $ 83,000 today on PPI data.

At the time of publication, Bitcoin changed hands at around $ 82,600, up almost 4% in the last 24 hours.

Gold reached new record heights on Friday while investors clashed towards security assets in the midst of growing trade in American China. Gold at point has climbed more than $ 3,207 per ounce, while term contracts have reached $ 3,236.

Precious metal is now up by around 20% for the year, surpassing most of the large asset classes.

Share this article