The data show that the expansion of the market capitalization of the stable reserve recently slowed down to only $ 1.1 billion, signaling a weakening of liquidity for bitcoin and other parts.

The growth of the market capitalization of stablescoin is considerably decreasing compared to previous summits

According to data from the Cryptochent chain analysis company, the growth of stablescoin has recently cooled. The “stablecoins” refer to cryptocurrencies which have their price linked to a fiduciary currency, the US dollars being the most popular option.

Investors generally store their capital in the form of these tokens when they want to avoid volatility which is accompanied by parts like Bitcoin. Many holders who buy stables, however, finally plan to venture into the volatile side of the market. Since stablecoins can potentially be exchanged in the BTC and other assets, their diet can be considered as a kind of “dry powder” available for the cryptocurrency sector. As such, extensions in this offer can prove to be a bullish sign.

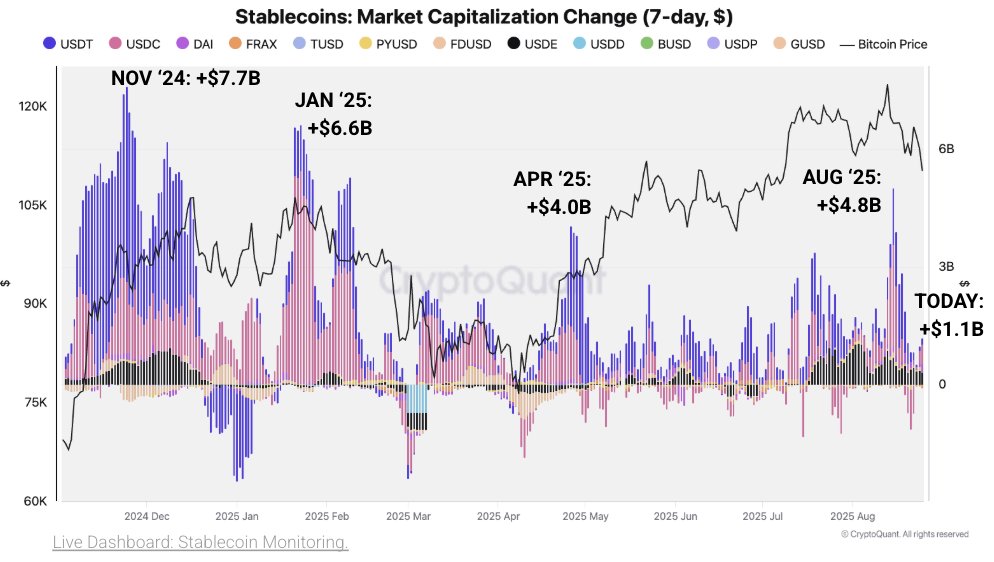

Now, here is the graph shared by cryptocurrency which shows the trend of the change of 7 days in the market capitalization of the main stables based on the USD in the past year:

Looks like the stables have been observing a positive change in their market cap in recent days | Source: CryptoQuant on X

As displayed in the above graph, the end of 2024 Bull Run was accompanied by a positive net change in the market capitalization of Stablecoins. At the top, these assets observed weekly net inputs of around 7.7 billion dollars. Another wave of entrances occurred in January of this year, the metrics culminating at $ 6.6 billion. Since then, the market has experienced a recharge time of interest, the entries in the stables remaining far from the previous summits.

From the table, it is visible that the net breakdown of capital flows earlier this month could only manage $ 4.8 billion. The interest also lasted quite briefly and the entries disappeared shortly after. Currently, metric is at $ 1.1 billion, which implies that the market capitalization of stablecoins increases, but clearly, the speed at which it occurs is not close to the previous rally of bulls.

“The rear liquidity winds are lower, limiting the momentum upwards,” explains the analysis company. It now remains to be seen how long the stable admissions in eyebrows would last and if a pivot for outings would follow.

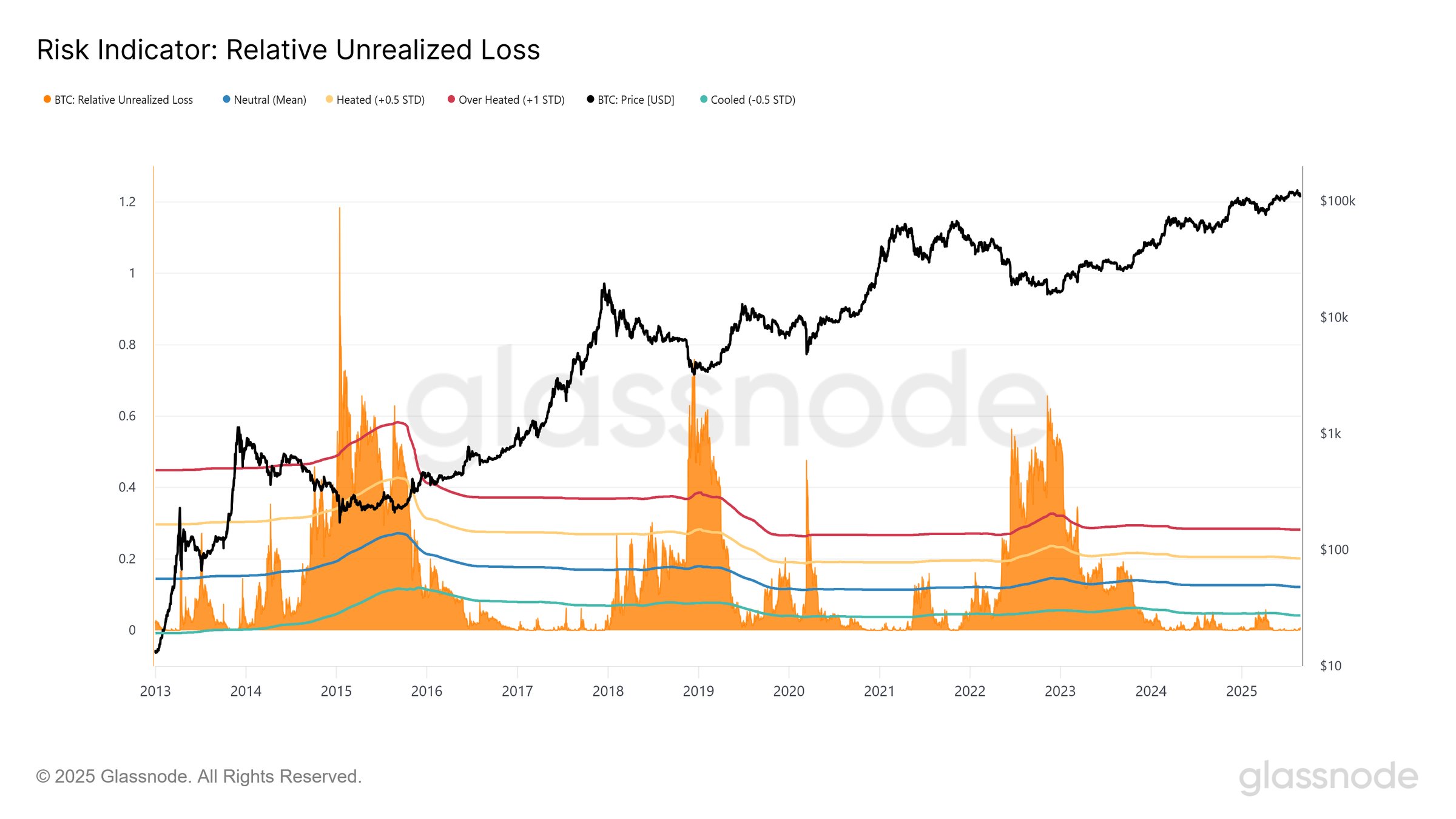

In some other news, the relative losses not made held by Bitcoin investors are still quite low even after the last drop in prices, as pointed out in the chain analysis company, Glassnode in a post X.

How the Relative Unrealized Loss has changed for the BTC network over history | Source: Glassnode on X

The relative loss not carried out is a measure of the unrealized total loss owned by Bitcoin investors represented as a percentage of market capitalization. Currently, the value of the metric is only 0.5%, which is quite low compared to the markets of previous bears.

BTC price

At the time of writing the editorial staff, Bitcoin floats around $ 113,400, up almost 2% over the 24 hours.

The trend in the BTC price over the past five days | Source: BTCUSDT on TradingView

Star image of Dall-E, Glassnode.com, cryptotics.com, tradingView.com graphic

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.