What you need to know:

- Bitcoin loans mark the shift from passive holding to active deployment of $BTC, expanding access and strengthening Bitcoin’s monetary role.

- Active $BTC lending can tighten liquidity loops: more collateral, deeper markets, and stronger institutional incentives to hold $BTC.

- Bitcoin Hyper aims to make $BTC fast and programmable via SVM-based Layer 2 with ZK to Bitcoin settlement.

- $HYPER’s strong pre-sale momentum and large whale purchases fit perfectly into the current $BTC-driven cycle – one fueled by real utility rather than pure hype.

A Canadian Bitcoin-native company has just issued its first Bitcoin-backed loan.

This is not a small change to the status quo. It’s a signal that $BTC is transitioning from “digital gold” to a live financial asset, which non-crypto users can finally access through a familiar product: lending.

The company’s goal is simple: accumulate $BTC and deploy it productively, but the implications are big.

More ways to borrow and build with Bitcoin generally means stronger demand, greater liquidity, and a wider user funnel.

This design change is important because utility trumps narrative over a full cycle. Loans allow institutions to put unused $BTC to use and give businesses a way to mine $BTC without selling it.

The feedback loop is obvious: lending platforms attract borrowers, borrowers buy $BTC, hodlers see new avenues of return, and liquidity improves for everyone.

Every service that treats $BTC as collateral, rather than a speculative asset, strengthens its monetary credibility.

This provides an appropriate backdrop for Bitcoin Hyper ($HYPER)a layer 2 project focused on $BTC, designed to make Bitcoin fast, programmable and dApp ready, and which many investors are already eyeing as the next 1000x crypto.

If Bitcoin enters mainstream finance, a chain that links $BTC into high-speed smart contracts is right in the wake.

Bitcoin Hyper ($HYPER) turns $BTC into a high-speed programmable asset

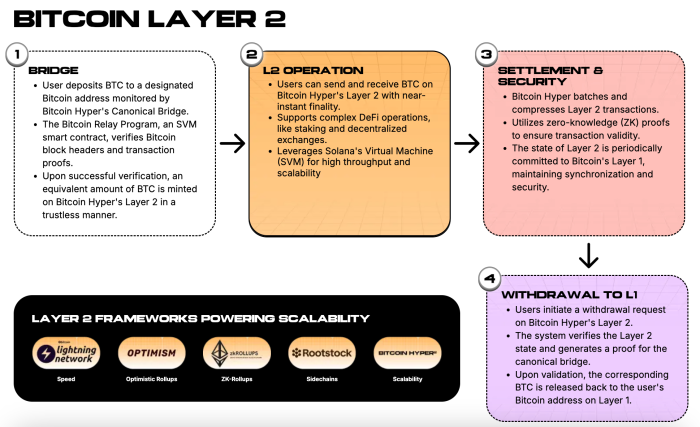

Bitcoin Hyper ($HYPER) offers a Bitcoin Layer-2 that uses an SVM-based execution environment, canonical bridging, and ZK proofs to move $BTC at near-instantaneous speed with low fees.

The goal is to maintain Bitcoin-level security while unlocking staking, DeFi, and on-chain applications for $BTC itself.

This approach directly addresses a problem that lending alone cannot solve: throughput and programmability on Bitcoin. If loans increase the demand for $BTC as collateral, a successful L2 expands what that collateral can actually do.

The flow is simple. Users link $BTC, transact on Layer 2 with high throughput, and then periodically return to Bitcoin L1 with cryptographic proofs.

In practice, this means cheaper payments, faster markets, and room for dApps that rely on programmability without compromising the trust people expect from Bitcoin.

The more services reference $BTC, such as newly launched loans, the more useful a generalized execution layer becomes for builders who prefer to stay in the Bitcoin ecosystem rather than transfer value elsewhere.

The utility also needs clear development paths. The $HYPER whitepaper focuses on developer experience, observability, and infrastructure, enabling teams to deliver quickly.

If the project can make using $BTC familiar to teams accustomed to modern virtual machine stacks, it reduces switching costs and accelerates innovation.

This is the kind of storytelling that institutions understand: faster rails, more secure regulations, and broader use cases.

Hop on the $HYPER train before it’s too late.

Pre-sale momentum meets $BTC lending tailwind

The momentum is real. Bitcoin Hyper presale has reached $26.9 million and you can buy $HYPER right now for just $0.013265.

This is a strong demonstration of demand for a BTC-first $L2 at a time when the financialization of Bitcoin is visibly accelerating. If lending adoption expands the $BTC gateway, the native $BTC infrastructure will directly benefit.

On-chain activity adds another data point. A recent transaction sent approximately 63.8 ETH, or approximately $226,000, into the presale contract, resulting in a transfer of 16.8 million HYPER.

Although a whale does not define a market, large buyers generally do their homework and often act as first liquidity. This fits the pattern of growing presale participation and the broader rotation towards $BTC-aligned narratives.

A 2026 scenario at $0.08625 would be around 6.51x if the DAO and incentive programs mature as planned.

As Bitcoin-backed loans mark a new phase in the financial integration of $BTC, Hyper Bitcoin stands out as the infrastructure built to support this momentum.

With its Layer 2 approach and growing presale, $HYPER could play a key role in transforming the latest Bitcoin lending headlines into a sustainable on-chain utility.

This article is for informational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing in crypto.

Written by Aaron Walker, NewsBTC –