Join our Telegram channel to stay up to date with the latest news

Bitcoin’s price fell almost $4,000 as Europe hinted at retaliatory measures against US President Donald Trump, who threatened new trade tariffs unless negotiations could begin on Greenland.

BTC’s decline came as the trade war also wiped out around $110 billion, sending BTC falling more than 2.5% to a market cap of $3.22 trillion.

Bitcoin prices fell 2.5% over the past 24 hours, falling below $92,000. BTC is now trading at $92,440 as of 1:16 a.m. EST, according to to a Coinbase chart on TradingView.

EU-US trade war shakes crypto market

Following the crypto market clearing over $110 billion in the past 24 hours, approximately $787 million in long positions were liquidated over the past day, bringing the 24-hour liquidation total to over $870 million, according to Coin Data. More than $223 million were long positions linked to BTC.

The drop comes after US President Donald Trump reignited global fears over tariffs by imposing tariffs on Greenland on several major European countries.

Trump previously threatened to impose tariffs of up to 25% on several European countries, saying the duties would remain in place until a deal to sell Greenland to the United States was reached.

🇺🇸🇬🇱 Trump threatens new tariffs on countries opposed to the takeover of Greenland.

Starting February 1, 2026, customs duties of 10% would be imposed on the following countries, increasing to 25% on June 1, 2026:

🇩🇰 Denmark

🇳🇴 Norway

🇸🇪 Sweden

🇫🇷France

🇩🇪 Germany

🇫🇷 United Kingdom

🇫🇮 Finland

🇳🇱 The… pic.twitter.com/ZbCAT3iB3A– Mario Nawfal (@MarioNawfal) January 17, 2026

However, European countries have continually rejected Trump’s demand for Danish territory, with France also preparing economic retaliatory measures against Washington.

Trump has repeatedly demanded that Greenland be ceded to the United States, saying the island is of great importance to American national security.

Following the refusal to sell Greenland, Trump declared that Denmark was unable to repel the Russian threat from Greenland.

“For 20 years, NATO has been telling Denmark that ‘you have to keep the Russian threat out of Greenland…’ Denmark has been unable to do anything about it,” Trump said. “Now it is time, and it will be done.”

“For 20 years, NATO has been telling Denmark that “the Russian threat must be removed from Greenland”. Unfortunately, Denmark could not do anything about this. Now is the time, and it will be done!!!” – President Donald J. Trump pic.twitter.com/ZyFh9OsNsn

– The White House (@WhiteHouse) January 19, 2026

Gold futures hit a record high of $4,680 an ounce as markets reacted to the renewed trade war between the United States and the European Union. according to at Google Finance. Silver futures also climbed above $93 an ounce for the first time in history.

Bitcoin Price Pulls Back as Selling Pressure Intensifies

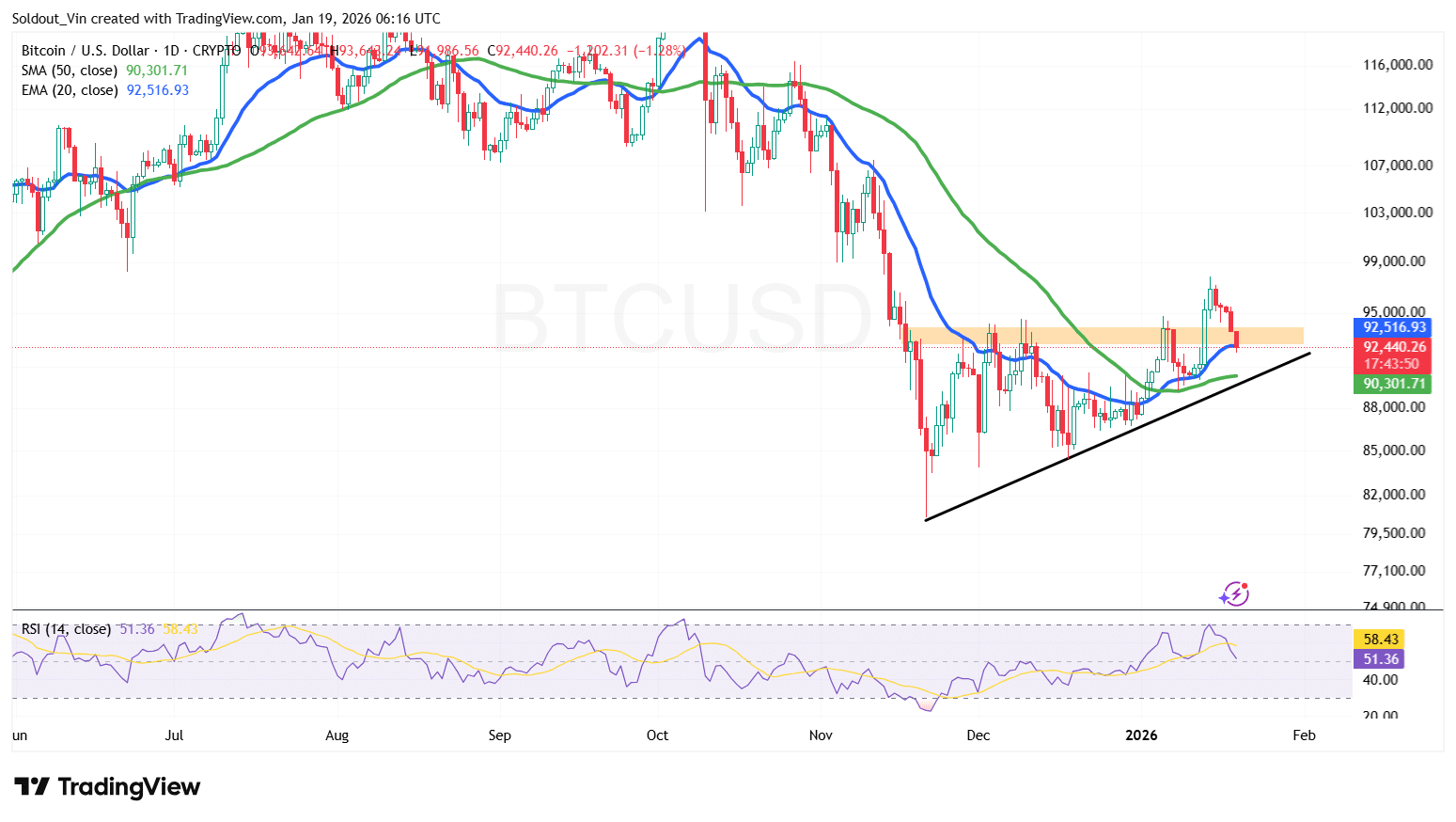

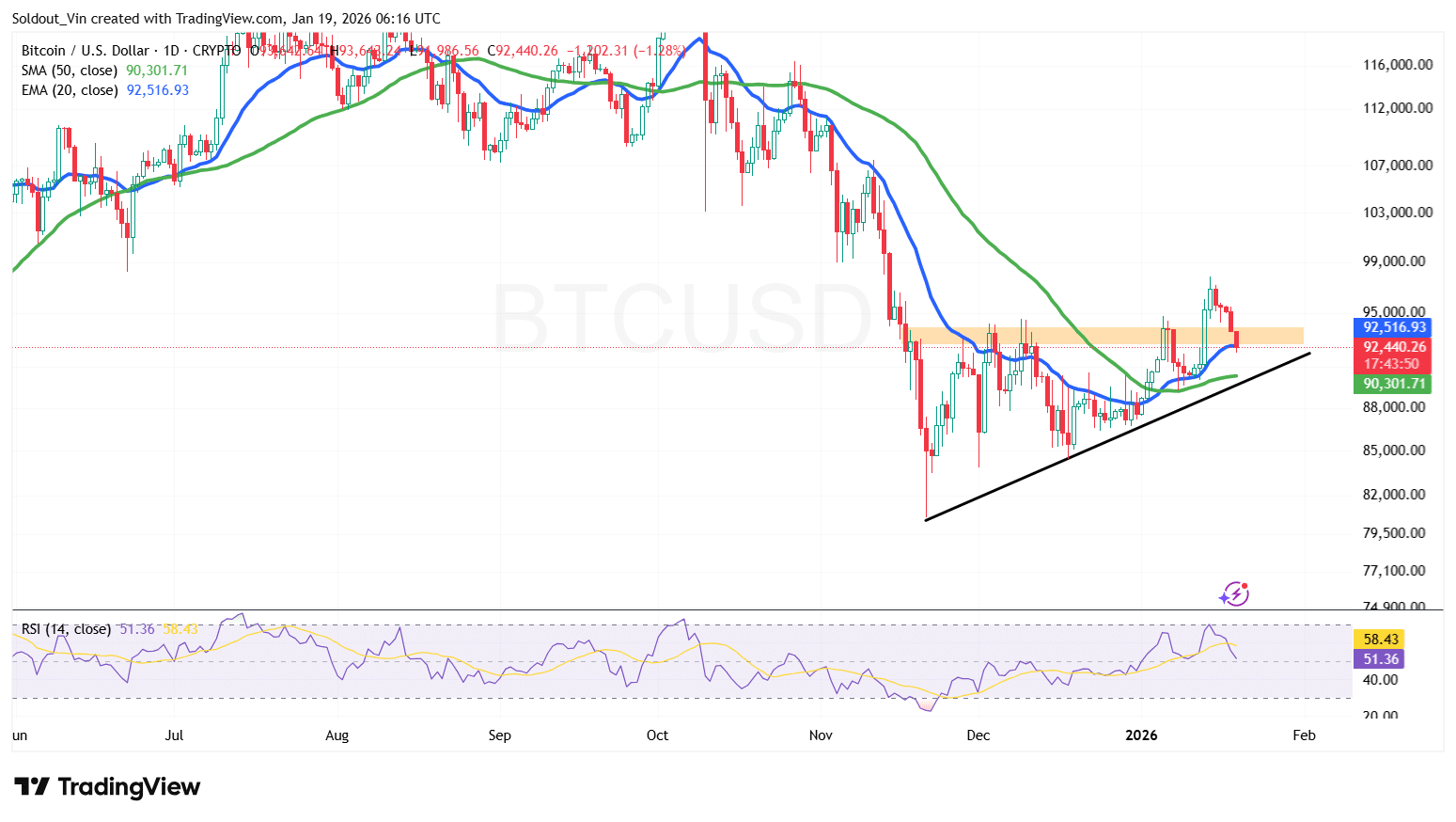

After break above the ascending triangle and rising above $97,000, BTC price has since faced selling pressure at this resistance level.

This resulted in the Bitcoin Price falling back into the triangle, now trading around the pattern’s upper boundary and the 20-day exponential moving average (EMA).

To add to the bearish pressure, the relative strength dropped from around 68 to 51.36 and continues to plunge, indicating sustained selling pressure in the Bitcoin market.

BTC Price Outlook: Is the Drop a Warning Sign?

Due to the trade war, the cryptocurrency market, particularly Bitcoin, is seeing a sustained decline as traders turn to safe-haven assets.

According to BTC/USD chart analysis, Bitcoin price is still trading above the 50-day simple moving average (SMA), which provides strong near-term support at $90,301.

With trading threats looming as BTC attempts to hold above $90,000 for the past two weeks, Bitcoin could fall even further. If Bitcoin price continues to fall and exceeds the 50-day SMA, the asset risks falling to the lower boundary around $89,000.

However, institutional buying could be a positive factor in keeping the price above this support. Michael Saylor hinted this strategy will soon make another purchase of BTC as it strives to hold more than 3% of the asset’s total supply.

Saylor posted “Bigger Orange” on X, a phrase he used before announcing new Bitcoin purchases.

₿igger Orange. pic.twitter.com/HI47hMCnui

-Michael Saylor (@saylor) January 18, 2026

After purchasing 13,627 BTC last week, Strategy now holds 687,410 BTC acquired for $51.8 billion at $75,353 per Bitcoin.

Related news:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news