After an in -depth correction of prices in the past three months, the bitcoin bull market continues to stay in the balance. Despite a modest price rebound in April, the first cryptocurrency has not yet displayed a strong intention to resume its bull rally in the middle of a lack of positive market factors. However, the Crypto Axel Adler Jr. analyst has highlighted a promising development which could point out a major uproar of Bitcoin.

Long -term bitcoin holders seek to stop the sale pressure

In a recent article on X, Adler Jr. shared an important update of the activity of long -term Bitcoin holders (LTH), which could be significantly positive for the wider BTC market.

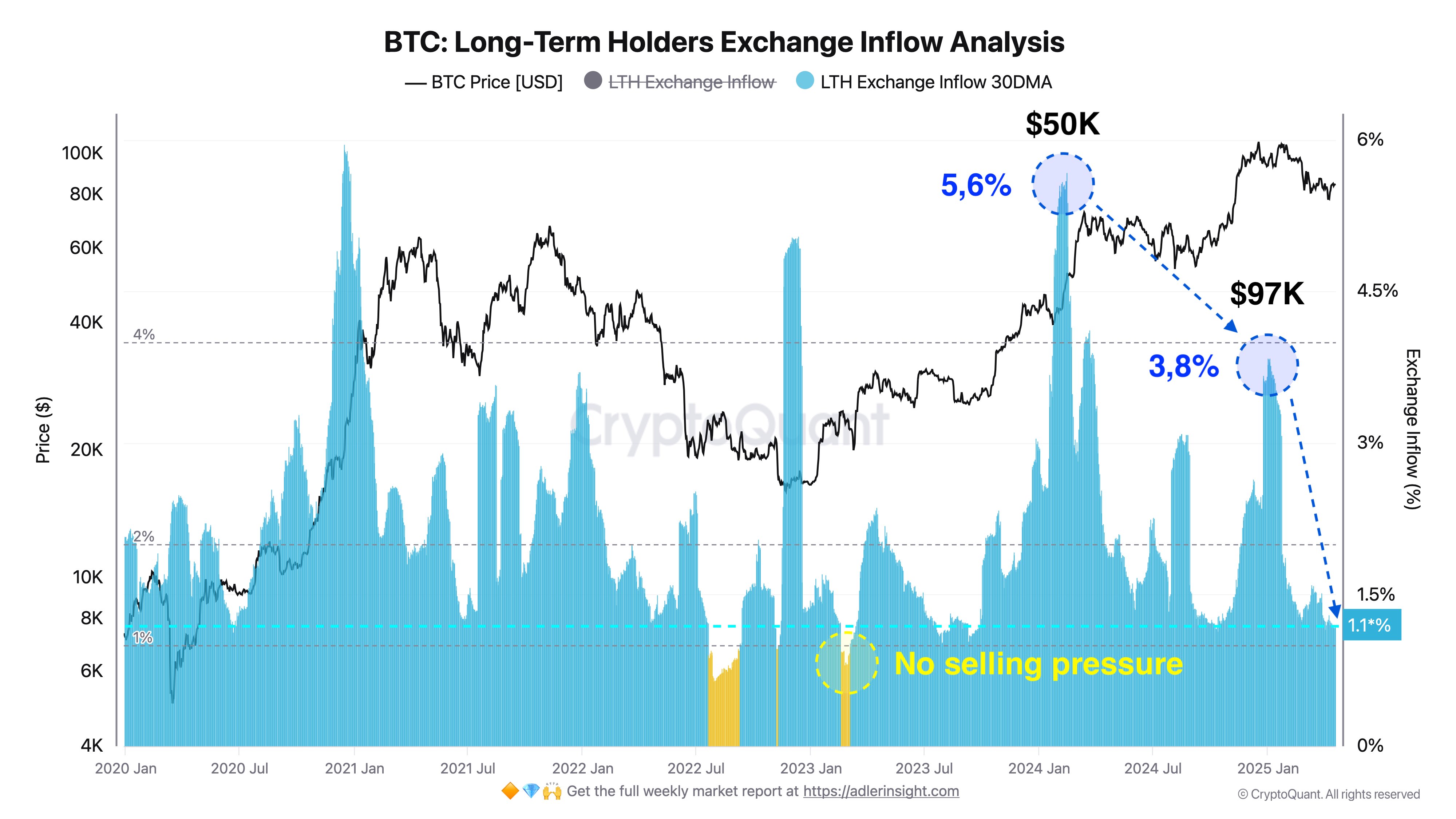

Using data on the cryptochant chain, the renowned analyst reports that pressure pressure by long-term holders, that is to say an amount of LTH on trade, has now reached its lowest point at 1.1% in the past year. This evolution indicates that Bitcoin LTH now chooses to keep their assets rather than taking profits.

Adler explains that a new drop in these LTH Exchange assets to 1.0% would point out the total absence of sales pressure. In particular, this development could encourage a new market entry and a sustained accumulation, creating a strong bruise dynamic on the BTC market.

Above all, Alder points out that the majority of Bitcoin LTH has entered the market at an average price of $ 25,000, since then, Cryptoant recorded the highest sales pressure of $ 5.6% at the start of 2024 and 3.8% at $ 97,000 at the start of 2025.

According to Adler, these two cases probably represent the main for -profit phases for long -term holders who intended to leave the market. Consequently, a resurgence of the pressure of the sale of this cohort of BTC investors is unlikely in the short term, which supports an optimistic case of construction, as long -term holders currently control 77.5% of the bitcoin in circulation.

Overview of BTC prices

At the time of writing this document, Bitcoin was negotiated at $ 85,226 after a gain of 0.36% in the last day and a loss of 0.02% last week. The two measures only reflect the consolidation of the current market while the BTC continues to fight to reach a convincing price escape beyond $ 86,000.

Meanwhile, the performance of the monthly cat assets now reflect a 1.97%gain, indicating a potential tendency inversion as market correction ceases. However, BTC needs a solid market catalyst to light any sustainable price rally. With a market capitalization of $ 1.67 Billion, Bitcoin is classified as the largest digital asset, controlling 62.9% of the cryptography market.

Adobe Stock star image, tradingview graphic

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.