Key Notes

- Singapore-based Canaan must maintain its share price above $1 for 10 consecutive sessions by July 13, 2026, or face potential delisting.

- The Company may receive an additional 180-day extension if the initial compliance period fails, subject to Nasdaq approval and fees.

- Canaan stock continues to trade at $0.798, reflecting weak demand amid broader crypto market conditions and operational challenges.

Canaan Inc. (NasdaqGM:CAN) received a new warning from Nasdaq regarding its stock price below $1. The company has retained its listing for now and can avoid being delisted, while its shares trade below the threshold in Friday’s session.

Singapore-based crypto mining hardware maker Canaan Inc. said it received a written notice from Nasdaq on January 14, 2026. The notice stated that its American depositary shares (ADS) no longer met the minimum offering requirement under Listing Rule 5550(a)(2).

The company’s ADSs have closed below $1 for 30 consecutive business days, triggering the deficiency notification, according to their press release.

Canaan gets a second chance to avoid delisting

Based on Nasdaq Listing Rule 5810(c)(3)(A), Canaan now has 180 calendar days, until July 13, 2026, to return to compliance. The company must increase its closing ADS offering to at least $1 for 10 consecutive trading sessions. The notice does not immediately affect the listing or trading of Canaan’s securities on Nasdaq. The shares will continue to trade under the symbol CAN during the grace period.

If the company fails to reach the $1 level by July 13, it could still benefit from a second 180-day compliance window, subject to review by Nasdaq staff. To obtain this extension, the company will have to request a transfer and pay a fee of $5,000. It must also meet other initial listing standards beyond the bid price and confirm its intention to resolve the issue, including through a possible reverse stock split.

Canaan states that it will monitor the performance of its shares and take steps to restore compliance with the offering rule.

Canaan Stock Continues to Trade Below Threshold After Notice

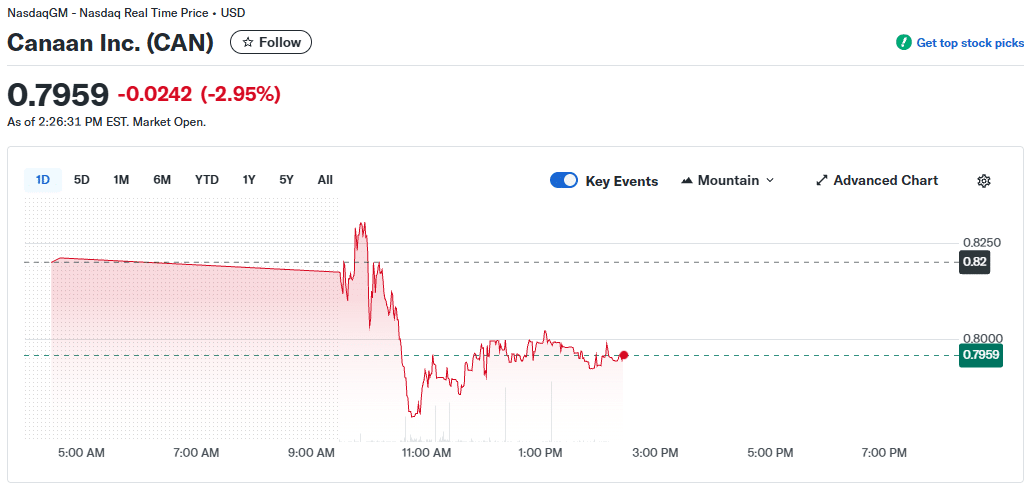

Canaan shares continued to trade below the dollar on Friday, despite the publication of the notification, and even fell 3%. ADSs changed hands around $0.80. The last listed price was $0.798 in the early afternoon of January 16, 2026. This shows that supply remains well below the required level, according to Yahoo! Finance.

Canaan Inc. Stock Price | Source: Yahoo! Finance

Data shows the stock has remained below $1 in recent days, matching the 30-day period mentioned in Nasdaq’s notice. The last time it was above $1 was in October 2025, when the company announced a 4.5 MW contract to connect its Bitcoin.

BTC

$95,179

24h volatility:

0.5%

Market capitalization:

$1.90 T

Flight. 24h:

$31.62 billion

minors in Japan.

The average analyst price target for CAN remains in the multi-dollar zone, but this does not affect Nasdaq’s minimum bid rule. The target may reflect Canaan’s Bitcoin Treasury, ranked 38th on BitcoinTreasuries, and its strong correlation with Bitcoin prices.

Canaan’s results remain tied to demand for bitcoin mining machines and broader market conditions in the crypto industry. The company re-emphasized these factors in the forward-looking statements section of its latest announcement. Their executives also highlighted macroeconomic and regulatory risks that could influence its ability to execute its strategy as it works to resolve the listing problem.

following

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article is intended to provide accurate and current information, but should not be considered financial or investment advice. Because market conditions can change quickly, we encourage you to verify the information for yourself and consult a professional before making any decisions based on this content.

José Rafael Peña Gholam is a cryptocurrency journalist and editor with 9 years of experience in the industry. He has written in leading media outlets like CriptoNoticias, BeInCrypto and CoinDesk. Specializing in Bitcoin, blockchain and Web3, he creates news, analysis and educational content for global audiences in Spanish and English.

José Rafael Peña Gholam on LinkedIn