Bitcoin mining stocks jumped after Riot Platforms signed a long-term deal with chip giant AMD, while Galaxy Digital continued a massive expansion in Texas. Stocks moved as investors linked these trades to more stable earnings at a time when Bitcoin USD is trading in a tight range. The context is important: competition from record networks is putting miners under pressure, forcing them to rethink how they make money.

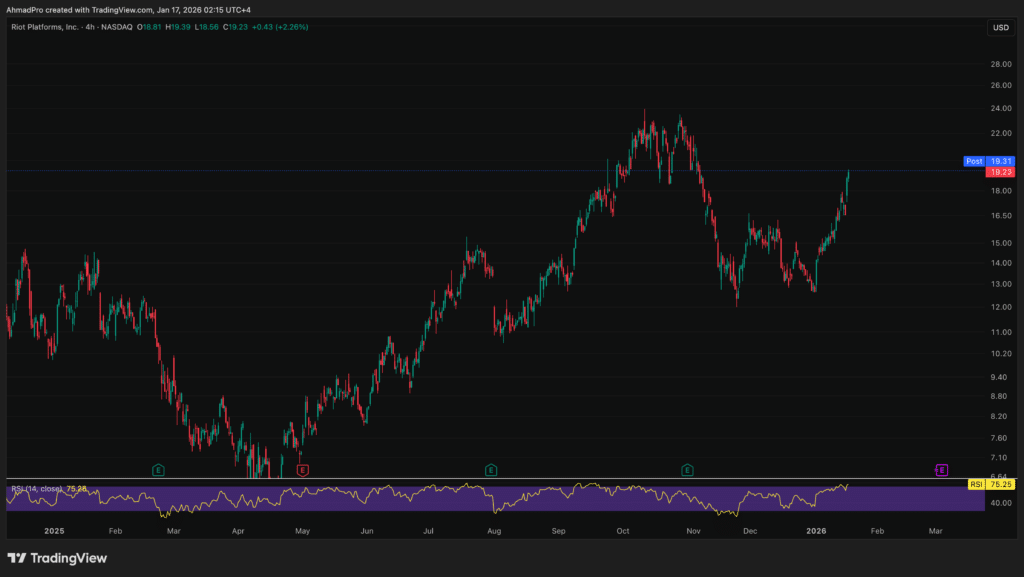

(Source: RIOT Stock Price / TradingView)

DISCOVER: The Best Ethereum Meme Coins to Buy in 2026

What happened with Riot, Galaxy and AMD?

Riot Platforms has entered into a 10-year lease with AMD at its Rockdale, Texas, facility worth $311 million, with expansion options that could bring the total to $1 billion. Think of it like renting unused warehouse space to a reliable tenant company instead of leaving it empty. According to Riot, the deal could reach 200 megawatts.

We are excited to share a series of transformative transactions that firmly establish our growing data center business, including the fee simple acquisition of our Rockdale facility and the signing of our first data center lease with AMD.

Read the full press release here:…

– Riot Platforms, Inc. (@RiotPlatforms) January 16, 2026

Galaxy Digital is taking a similar path. The company raised $460 million in new financing, on top of an earlier $1.4 billion loan, to expand its Helios campus in Texas by up to 3.5 gigawatts. Around 800 megawatts are already committed to AI company CoreWeave.

Why should a beginner care? Because mining companies earn less when competition increases. Renting electricity and data centers to AI customers creates revenue that is not dependent on daily Bitcoin price fluctuations.

Why It Matters for Bitcoin Investors

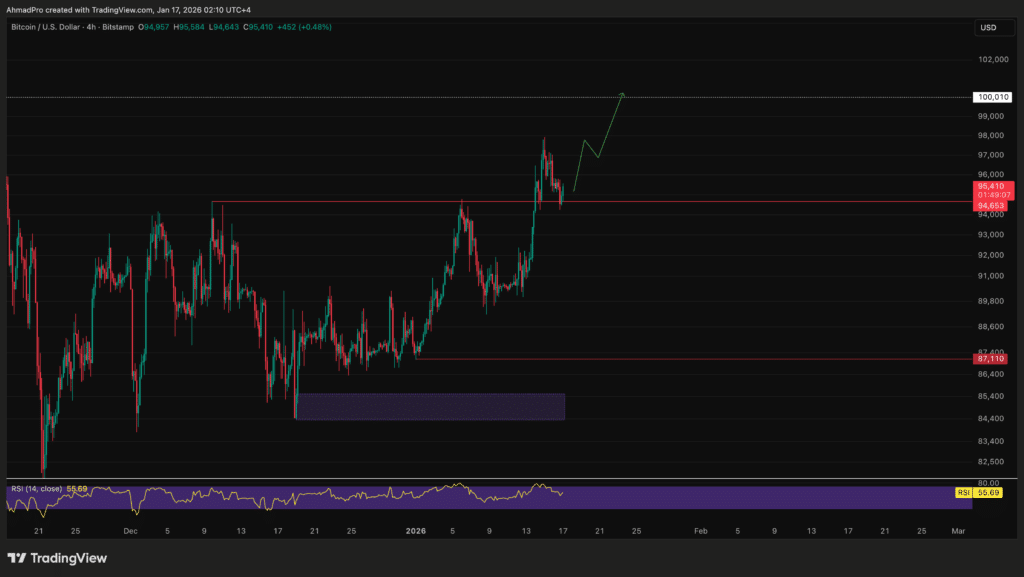

Bitcoin mining works like a lottery where everyone buys more tickets every year. Total computing power, known as hashrate, continues to set records. This means that each miner earns less Bitcoin unless the price rises quickly.

Bitcoin Mining Update:

At $90,436 per BTC, my 27 machines now earn $4,800 per month (0.053019 BTC)

It costs me $3,752 per month to run them (hosting/electricity), for a profit of $1,048/month.

To date, I have stacked 3.84 BTC worth $348,462 and will continue to stack. pic.twitter.com/7mvRaHFh3K

– Your Friend Andy (@YourFriendAndy) January 10, 2026

By turning to AI and high-performance computing, miners are making Texas’ cheap electricity a second business. According to MarketChameleon, Riot now controls approximately 1.7 gigawatts of electricity across Texas after selling approximately 1,080 BTC to fund its expansion. To shareholders, it looks more like a utility company with long-term contracts.

This change also ties into the broader Bitcoin story. When mining companies remain solvent during periods of Bitcoin stagnation against the US dollar, they throw fewer coins into the market. This can ease selling pressure over time.

DISCOVER: Top 20 cryptocurrencies to buy in 2026

Where the risks still lie

This is not a free victory. Building AI data centers is expensive upfront, and delays can affect cash flow. If demand for AI declines, these long-term projects lose their luster.

Mining stocks are also moving faster than Bitcoin itself. A 5% drop in Bitcoin often turns into a double-digit stock market swing. If you’re new, think of mining stocks as high-volatility bets, not savings accounts.

(Source: BTCUSD/TradingView)

For readers following the big picture, this fits with themes around Bitcoin price predictions and the growth of institutional Bitcoin investment. Stronger miners tend to support a healthier network.

Going forward, watch the actual revenue generated from these AI leases. If cash flows turn out as promised, mining stocks could trade less like pure Bitcoin bets and more like energy-backed infrastructure plays.

DISCOVER: The Best Solana Meme Coins to Buy in 2026

Follow 99Bitcoins on X for the latest market updates and subscribe on YouTube for daily market analysis from experts

The post Bitcoin Mining Stocks Jump as Riot Taps AMD, Texas Builds Grow appeared first on 99Bitcoins.