Key notes

- Bitfarms have reached one -year heights at $ 3.20 after ten days of consecutive gains negotiations and an increase in the volume of shares.

- Cipher Mining reached 52 -week peaks to $ 12.66 while providing 313% of yields over six months thanks to an AI diversification strategy.

- Mining companies rotate towards artificial intelligence and high performance IT as the difficulty of Bitcoin increases and that the transaction costs decrease.

Bitfarms and Cipher Mining have become artists out of competition in the overvoltage of Bitcoin Mining actions in September, the two companies displaying remarkable gains while the sector has exceeded Bitcoin itself by significant margins.

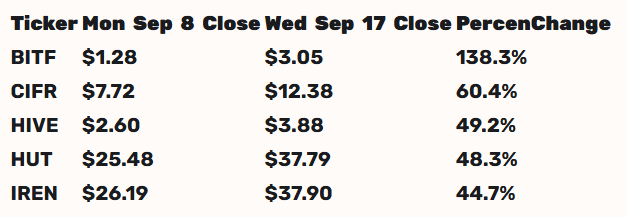

Bitcoin extraction actions experienced exceptional momentum throughout September 2025, the main players displaying gains between 44% and 138% while Bitcoin decreased by more than 3% during the same period. Bitfarms (Nasdaq: BitF) and Cipher Mining (Nasdaq: CIFR) led this rally, showing a strong appetite for investors for Bitcoin extraction companies.

Change table in the share of the Bitcoin operating companies in September | Source: BlockSpace

Bitfarms stock activity shows a large momentum

The Bitfarms action reached a one -year summit of $ 3.20 on September 18, marking ten consecutive days of earnings and more than double the value in last week. The action closed at $ 3.19, the volume of negotiations reaching nearly 174 million shares, against the average of three months of approximately 37.2 million shares, according to Yahoo! Finance.

September’s commercial data show that Bitfarms won more than 132% compared to its monthly opening price of $ 1.34 at its current level around $ 3.18. The company’s market capitalization increased to around $ 1.769 billion, which represents an increase of more than 94% compared to its closing value at the end of 2024.

This year, they sold a mining site from the BTC to Paraguay in Hive Digital, and they declared that they had sold 1,052 BTC in August 2025, which means that they currently have a substantial amount of liquid assets. According to BlockSpace, he recently reassessed his production of Panther Creek site, and the company recently agreed to advance the development of the campus with T5 data centers. This announcement could be part of this positive activity in its actions.

Cipher Mining demonstrates operational growth

Cipher Mining increased by around 40% in September, the stock reaching new heights of 52 weeks to $ 12.66. The company’s shares have provided an impressive yield of 313% in the last six months, positioning it as a key beneficiary of the trend of the IA infrastructure, according to Yahoo! Finance.

Recent negotiation data shows that CIFR’s daily volume with an average of 35.4 million shares throughout September. The action closed $ 11.85 with a market capitalization of $ 4.66 billion, reflecting a strong institutional interest in its double mining and high performance computer strategy.

In the case of Cipher, they presented an operational update on September 4, where they declared the addition of new production capacities. In addition, their CEO, Tyler Pager, maintained market expectations for a significant agreement by the end of 2025, probably linked to bitcoin extraction or a pivot at AI.

The industry pivot stimulates market performance, despite growing mining difficulties

The outperformance of the mining sector stems from the diversification of businesses beyond the traditional Bitcoin exploitation in high performance artificial and informational intelligence services. Hive Digital accelerates its transition to IA data center infrastructure, while Iris Energy increases operations with Blackwell GPUs.

Despite the high performance of the sector, the fundamentals of Bitcoin exploitation remain under pressure. The difficulty adjustment of the Bitcoin network should increase between 0.2% and 7.24%, marking the first era with an average hashrate above the Zetahash brand. Transaction costs have slipped under 0.8% of monthly awards, indicating lower activity on the chain. Over time, it will become more and more complex to acquire more BTC, which is the main reason why these companies diversify their investments.

following

Non-liability clause: Coinspeaker undertakes to provide impartial and transparent reports. This article aims to provide precise and timely information, but should not be considered as financial or investment advice. Since market conditions can change quickly, we encourage you to check the information for yourself and consult a professional before making decisions according to this content.

José Rafael Peña Gholam is a cryptocurrency journalist and publisher with 9 years of experience in the industry. He wrote in the best outlets like Criponotias, Beincrypto and Coindesk. Specializing in bitcoin, blockchain and web3, he creates news, analyzes and educational content for the world public in Spanish and English.

José Rafael Peña Gholam on Linkedin