Channel data suggests that Bitcoin minors have recently been the most underestimated in about a year, as daily revenues reach $ 34 million.

Bitcoin Miner Revenue observed a dive

According to data from the Cryptochent chain analysis company, the margins of bitcoin minors have recently taken a noticeable blow. Minors gain their income thanks to two sources: grant and transaction costs.

The first component, the block grant, refers to the reward that these chain validators receive in compensation to add a block to the chain. The network distributes this award as a fixed amount worded in BTC.

Due to the existence of a characteristic known as difficulty, minors can only add blocks a more or less fixed time rate, which adds another constraint to the block grant.

If the speed and the amount are fixed, this leaves only one variable linked to this reward: the price of the punctual Bitcoin. The price variations directly affect the revenues of minors from the block grant.

The other component of minor income, transaction costs, is linked to the activity level that BTC observes. Investors attach these costs to their transfers as a small payment for validators. In times when the network does not manage any notable traffic, sender is unaccviously encouraged to pay significant amounts, because there is a good chance that their transfers will pass quickly anyway.

However, when there is congestion present, transactions can be stuck in Mempool for a while. During these periods, investors who want their movements to pass quickly have no choice but to surpass other users in transfer costs. As such, total transaction costs received by minors tend to increase during periods of high activity.

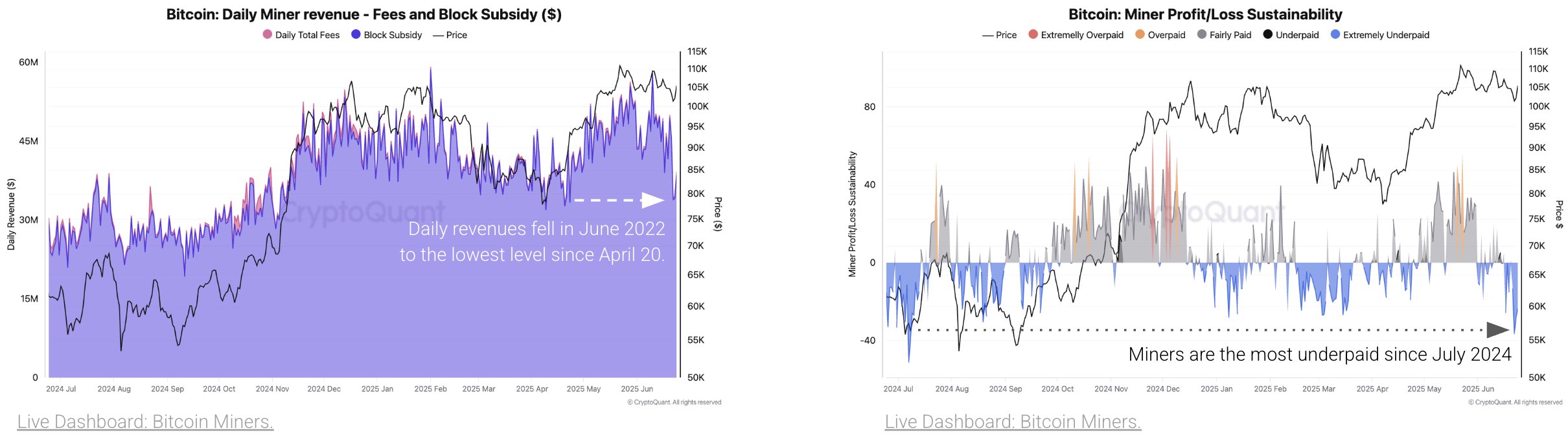

Now, here is the graphic shared by cryptocurrency which shows the trend in the two components of minor Bitcoin income in the past year:

Looks like the miner revenue has gone down in recent days | Source: CryptoQuant

As displayed in the left graphic, the daily income combined with Bitcoin minors have recently crossed a dive. “The drop in costs and the drop in bitcoin prices are overwhelming margins,” notes the analysis company.

During the price earlier, metrics reached a hollow of $ 34 million, which is the lowest that its value has been since April 10. This comparison, however, does not precisely describe how bad the current situation is for minors.

The graph on the right shows the data of the sustainability of the profit / loss of minors, a model which compares the revenues of minors in relation to the difficulty of determining how much the group is paid. According to the indicator trend, it is obvious that the recent last mining income corresponded to the most underpaid minors since July 2024.

BTC price

When writing the editorial’s time, Bitcoin floats around $ 107,000, up more than 2% in the last seven days.

The trend in the BTC price during the past five days | Source: BTCUSDT on TradingView

Dall-E, Cryptoquant.com star image, tradingView.com graphic

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.