Bitcoin’s recent rise above $90,000 has pushed its market capitalization to $1.805 billion, making it the seventh-largest asset in the world – and positioning the cryptocurrency on the cusp of surpassing the 2,200 valuation billion dollars from Google’s parent company, Alphabet.

The meteoric rise of the digital currency has already caused it to overtake Saudi Aramco, the world’s largest oil producer, in terms of market capitalization. Trading data shows that Bitcoin reached a new all-time high of $93,434.36 on November 13, 2024, with daily trading volumes reaching $118.32 billion.

The broader cryptocurrency market has also seen substantial growth, with its total value reaching $3.02 trillion. This places the crypto market as the eighth largest economy by GDP, behind the United States, China, Germany, Japan, India, the United Kingdom and France, according to Fund data international monetary policy.

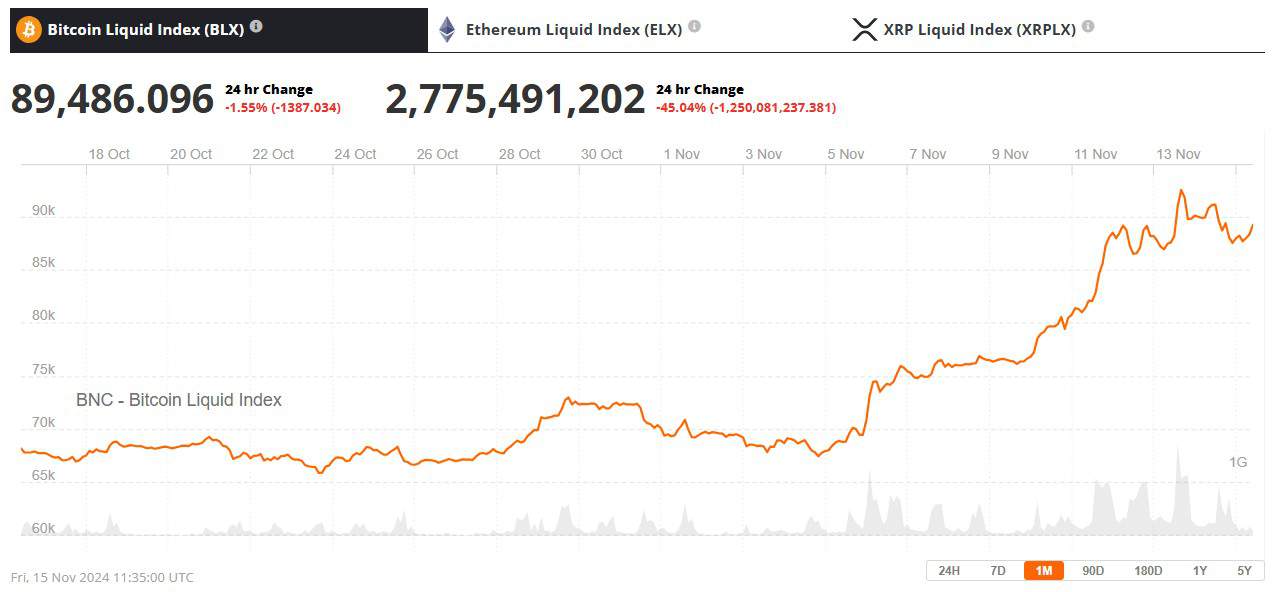

The price of Bitcoin and most other large-cap digital assets soared in November following Donald Trump’s election victory. Source: Brave New Coin Bitcoin Liquid Index.

The rise of Bitcoin has coincided with significant institutional trading activity. Binance, the largest cryptocurrency exchange, recorded over $7.4 billion in Bitcoin/USDT trading volume in 24 hours, while Coinbase, a major US exchange, processed over $3.4 billion. dollars of Bitcoin transactions.

Investment bank Standard Chartered has made a bold prediction about the future of the cryptocurrency market in light of recent political developments. The bank predicts that the total market capitalization of cryptocurrencies could reach $10 trillion by the end of 2026, following the Republican victory in the United States.

“With a Republican victory in the US election now looking likely, we believe we have entered the summer of crypto,” said Geoff Kendrick, head of digital assets research at Standard Chartered. The bank suggests government support measures could quadruple the market value over the next few years.

If Bitcoin reaches these projected levels, its total value could exceed $4.3 trillion, surpassing the entire British pound money supply. Currently, Bitcoin ranks behind gold ($17.1 trillion), Nvidia ($3.5 trillion), Apple ($3.4 trillion), Microsoft ($3.1 trillion), and Amazon ($2.25 trillion). dollars) in terms of market capitalization.

Cryptocurrency market metrics show a circulating supply of 19.78 million BTC, closing in on its maximum cap of 21 million coins. Market data indicates strong liquidity on major exchanges, with significant trading depth on both sides of the market.

Donald Trump, recently elected the 47th President of the United States, emerged as a strong supporter of cryptocurrencies during his campaign, promising to create a “strategic national stockpile of Bitcoin.” This marks a significant shift from his previous stance on digital assets, with Trump warning that “if we don’t adopt crypto and Bitcoin technology, China will, other countries will, they will dominate, and we won’t We can’t let China dominate.

The total cryptocurrency market has already gained more than $650 billion after the election, reaching $3.2 trillion, as investors respond to expectations for more favorable crypto policies under the new administration.